MH Daily Bulletin: November 29

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices increased about 1% Monday, rising from their lowest levels in nearly a year. Prices have fallen 35% since June.

- Oil futures rose in mid-day trading today on hopes that China would relax its COVID-19 controls, with WTI up 2.47% at $79.15/bbl, Brent up 2.88% at $85.59/bbl, and U.S. natural gas up 1.64% at $7.31/MMBtu.

- Traders and analysts are worrying about a potentially oversupplied global crude market in the coming months.

- Falling global oil demand could spur OPEC to cut output at the group’s next meeting on Sunday, Dec. 4.

- The UAE’s national oil company will cut 5% of December crude shipments to Asia on fears of an oversupply. At the same time, the nation is moving up short-term plans for boosting oil production.

- The average U.S. gasoline price is now $3.52 per gallon according to AAA. Some traders say prices could fall below $3 per gallon by Christmas.

- New York City electricity prices could be up to 30% higher this winter than last year, the state’s grid operator said.

- The U.S. will offer over 950,000 acres of Alaskan land for new oil and gas drilling next month.

- More oil news related to the war in Europe:

- EU ministers continue to disagree over the terms of a G7 cap on the price of Russian crude with just a week left to implement the plan. Russia’s flagship oil is already trading well below rumored targets of $65-$70 per barrel.

- Tanker rates, already in one of their longest-ever stretches of ultra-high prices, will likely keep rising as sanctions on Russia force ships to take longer routes to new trading partners.

- Russian crude shipments to China, India and Turkey were 3.5 times higher than pre-invasion levels in November.

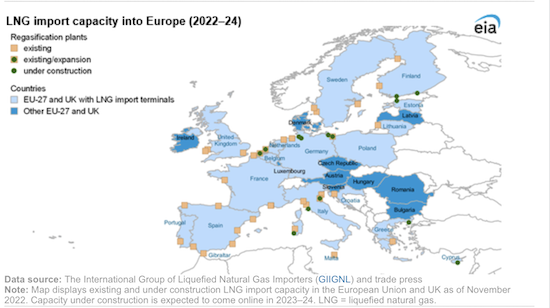

- The EU and the U.K. are set to raise their combined LNG import capacity by 34% by 2024.

- Ukraine resumed regular blackouts across the country Monday as it continues repairing infrastructure damaged by Russia.

- Saudi Aramco refining unit Luberef is pushing forward with an initial public offering in Riyadh that could raise around $1 billion.

- Italian lawmakers are working on a 50% one-off windfall tax on surplus income of energy companies next year.

- Shell will buy Denmark’s Nature Energy Biogas for $2 billion, marking the latest renewables push by a major oil company.

- BP may scrap its 70-year-old Statistical Review of World Energy, a benchmark publication of global oil, gas and coal use, as the firm pushes further into renewables.

- Britain’s Rolls-Royce says it successfully tested the world’s first aircraft engine running on hydrogen.

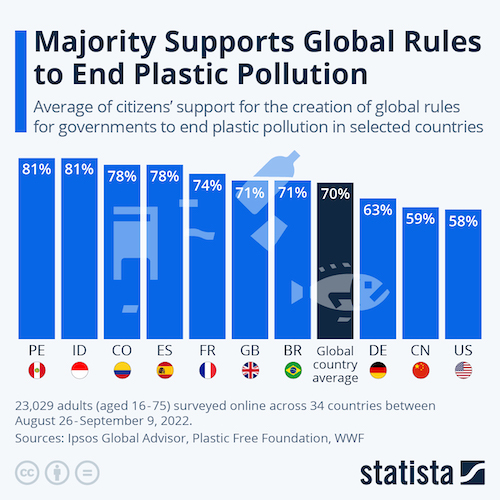

- The Intergovernmental Negotiating Committee, comprising representatives of governments, businesses and civic organizations, began developing a binding international instrument to end plastics pollution.

Supply Chain

- In the latest labor action news:

- The U.S. president and over 400 trade groups say Congress should pass legislation to end an ongoing labor standoff between rail workers and freight railroads.

- South Korea took the unprecedented step of ordering thousands of striking truckers in the cement industry to return to work as daily losses from the trucker strikes top $220 million, officials say.

- Austrian rail traffic ground to a halt Monday as workers held a 24-hour strike in a dispute over pay.

- Construction was temporarily halted on a $900 million port being built in southern India by Adani Group after community protests turned violent.

- Workers at Chile’s Escondida mine, home to the largest copper deposit in the world, accepted a new offer from BHP Group and will not move forward with a strike.

- Apple could lose production of over 6 million iPhone Pro units this year due to COVID-19 disruption at the world’s biggest iPhone factory in Zhengzhou.

- The pace of global shipping activity will lose steam next year as trade weakens, the United Nations says. Xeneta warns that shippers could idle as much as 1 million TEUs of capacity across the world.

- The American Trucking Association’s for-hire truck tonnage index fell 2.3% from September to October, the largest monthly decline since the start of the pandemic.

- Package carriers say they have enough capacity to handle this year’s holiday shipping.

- Major shipping lines plan to pass along to customers the costs of complying with Europe’s new emissions trading system.

- Freight forwarder DB Schenker is reducing its chartered flights amid declining airfreight demand.

- Airbus is expected to miss its 2022 delivery goals.

- A record 689.4 million square feet of U.S. industrial space is in the pipeline, largely motivated by retailers’ need for more space to house inventory.

- In the latest news from the auto industry:

- Volkswagen’s plant in Chengdu, China, halted production due to rising COVID-19 cases.

- Toyota posted a 23% rise in October output across the globe, beating its own target for a third month as chip shortages ease.

- Five years in the making, Tesla’s Class 8 electric truck completed its first 500-mile trip with a load weighing 81,000 pounds.

- U.S. truck-trailer orders soared 171% in October despite worries of a weak economy.

- Japanese chip equipment supplier Ferrotec is reconfiguring its supply chain to access both the U.S. and China markets.

- Indian exporters say a new tax on freight charges is starting to affect outbound business.

- By 2030, Amazon aims to deliver 500 million urban packages a year by drone.

- PepsiCo U.K. will start using fuel derived from cooking oil to power its trucks.

- Supply-chain disruptions continue to push up global food prices even as inflation shows signs of cooling.

- Prices for chicken breasts in the U.S. have plunged about 70% since June after poultry companies boosted production.

Domestic Markets

- The U.S. reported 59,717 new COVID-19 infections and 280 virus fatalities Monday.

- “BQ” subvariants of Omicron now account for the majority of U.S. cases, posing greater risks to people with compromised immune systems.

- Only 1 in 20 Americans have completely dodged COVID-19 infection during the pandemic, new research shows.

- U.S. life insurers paid a record $100 billion in death benefits in 2021 due largely to COVID-19 fatalities, an industry group said.

- The New York Fed suggested the central bank could start lowering interest rates as soon as 2024.

- The inverted yield curve between long-term interest rates and short-term rates, often a sign of impending recession, reached the largest spread since 1981.

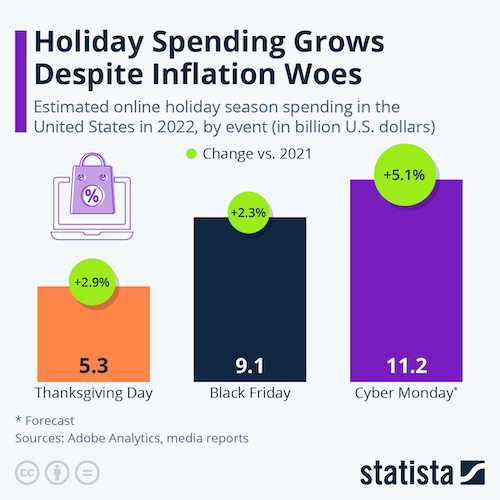

- Spending on Cyber Monday, the biggest U.S. online shopping day, is expected to top $11 billion, a record, according to Adobe Analytics.

- U.S. orders for durable goods jumped 1% in October.

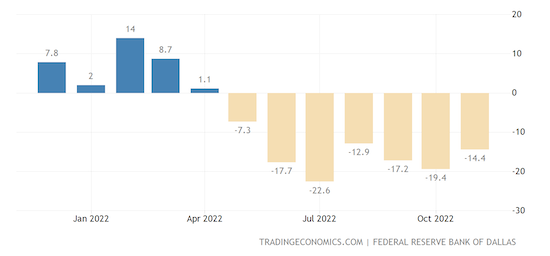

- The Dallas Fed’s index of Texas manufacturing activity remained well inside contraction territory in November:

- Dollar Tree’s quarterly comparable-store sales at its namesake stores grew 8.6%.

- Urban Outfitters’ quarterly net sales rose 3.9%, with a decline in sales for its Urban Outfitters brand offset by solid growth at its Anthropologie and Free People business units.

- Embattled Bed Bath & Beyond is struggling to keep its stores stocked for the holiday season with over 40% of its SKUs out of stock in October.

- Home-furnishings seller United Furniture Industries abruptly laid off all its employees and ordered all its over-the-road truck drivers back immediately as part of a shutdown.

- U.S. airports saw over 2.56 million travelers Sunday, surpassing pre-pandemic levels.

- Existing U.S. home sales have fallen for nine straight months as mortgage rates near 7%. Home prices could soon start to plunge as inventory builds, experts say.

International Markets

- China is boosting its police response to growing civil unrest over the nation’s strict COVID-zero policies. Nationwide infections hit a record 40,052 on Monday, roiling global commodities and equity markets.

- Bharat Biotech received approval in India for its nasal COVID-19 vaccine spray.

- Global trade growth is set to slow in the closing months of 2022 and into 2023, according to the World Trade Organization. Emerging economies could see the harshest impacts, S&P Global says.

- The European Central Bank says inflation in the 19-country euro zone has not peaked and may exceed current expectations, raising the case for a series of interest-rate hikes ahead.

- Euro-area economic sentiment rose in November for the first time in nine months:

- German inflation dipped across five states in November, suggesting cost pressures eased in Europe’s largest economy.

- Nearly all retailers surveyed in Germany plan to raise their prices ahead of the Christmas shopping season.

- Spain’s annual inflation rate fell to 6.8% in November, the lowest since January.

- South Korean exports will likely hit a record decline this month on a downcycle in the global tech industry. For the same reason, Taiwan has cut its GDP growth forecast for this year and next.

- Vietnamese smartphone production slumped 9.3% in November, a new sign that the country’s largest manufacturer, Samsung Electronics, is adapting to falling global demand.

- Analysts and policymakers say India is emerging as an alternative production base to China as U.S. companies diversify production.

- Moscow is asking India to consider shipping hundreds of products, including parts for cars, aircraft and trains, as sanctions squeeze Russia’s ability to keep vital industries running.

Some sources linked are subscription services.