MH Daily Bulletin: November 22

News relevant to the plastics industry:

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 24 and Friday, Nov. 25 in observance of the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil futures plunged early Monday, then recovered and ended slightly down after Saudi Arabia denied a report that it may increase production. Futures were down for their fourth straight session, with WTI settling below $80/bbl.

- In mid-morning trading today, WTI futures were up 2.3% at $81.85/bbl, Brent was up 2.3% at $89.42/bbl, and U.S. natural gas was down 0.5% at $6.74/MMBtu.

- Goldman Sachs, among the more bullish forecasters, cut its 2023 oil price projection by $10/bbl to $100/bbl over concerns that lockdowns in China will dampen global demand.

- Almost every region on the planet could face a diesel shortage within the next few months, experts warn.

- California’s PG&E will get $1.1 billion from the federal government to help keep the state’s last two nuclear reactors online.

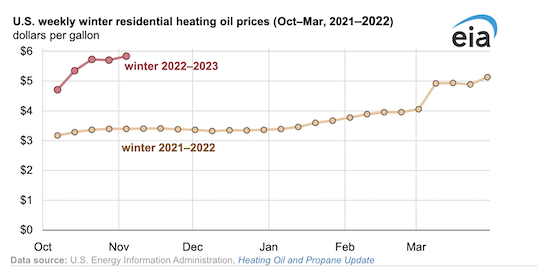

- U.S. heating oil prices started the winter heating season roughly 65% higher than a year ago, new data shows:

- Japan says little new LNG supply will come online before 2026 due to global underinvestment in capacity.

- Pemex expects to boost supply at a key offshore natural gas field in the Gulf of Mexico as part of a push to reduce imports.

- Europe’s largest battery storage system officially came online in Britain Monday, marking a new era of power diversification in the U.K.

- The U.S. administration is warning of “significant” cybersecurity risks to critical offshore oil and gas infrastructure.

- More oil news related to the war in Europe:

- Russian oil exports to Europe have plunged 90% from historical levels with just two weeks left until Europe’s complete ban on seaborne crude deliveries from Russia. Russian diesel exports to the bloc, meanwhile, are surging.

- India’s oil refiners are ramping up last-minute purchases of Russian crude just weeks before new Western sanctions take effect.

- Russia says it will not ship oil to countries that impose a price cap and could also cut production.

- Europe’s leading energy exchanges say a cap on natural-gas prices could backfire on the continent by pushing traders to less secure transactions in private markets.

- Ukrainians will see power blackouts until the end of March, officials say, as half the nation’s infrastructure has been damaged by Russian attacks. The country is raising transit fees for Russian oil in a bid to raise funds to restore its power supplies.

Supply Chain

- Spot prices for bulk shipping’s largest vessels plummeted 27% last week amid uncertainty about China’s economy.

- Freight forwarders say ocean carriers are in “panic mode” as bookings from China and North Europe to the U.S. West Coast plummet.

- Global container import bookings are now only about 6% higher than in November 2019 after averaging 80% above pre-pandemic levels through most of 2021, FreightWaves estimates.

- Maersk and MSC suspended a joint service from Asia to the U.S. East Coast, as freight rates and volumes continue to slump.

- South Korea is promising to support state shipping lines if plummeting freight rates hit financial results.

- The U.S. Postal Service says it is well-equipped to handle peak season volumes that will likely be unchanged from last year.

- Pitney Bowes will raise rates for its e-commerce services by 6.5%, adding to the list of delivery providers rolling out larger rate hikes than in years past.

- A unionization effort has begun among cargo handlers at Amazon’s national air hub at Cincinnati/Northern Kentucky International Airport.

- A lack of charging infrastructure could inhibit California’s plan to phase out diesel-powered trucks from servicing its ports by 2035.

- Amazon is testing Sparrow, an artificial-intelligence-driven robotic arm capable of handling objects of varying shapes, that promises to streamline picking and packing operations at the heart of its distribution centers.

- One of Germany’s main industry lobby groups is calling for more support for industry to diversify trade beyond China.

- In the latest news from the auto industry:

- South Korea’s LG Chem plans to build a $3 billion battery-cathode plant in Tennessee to help meet rising demand for U.S. electric-vehicle components.

- Nissan lowered its global sales forecast as chip shortages and lockdowns in China hit production more than expected.

- GM’s electric-vehicle subsidiary BrightDrop says it has tens of thousands of reservations from major logistics providers for its electric delivery van.

- Easing supply-chain issues are boosting sales of new U.S. class 8 trucks and accompanying trailers.

- Affordable China-made electric vehicles are growing in popularity in Europe.

- Domino’s Pizza ordered hundreds of Chevrolet Bolt electric vehicles for its delivery services.

- Luxury electric-vehicle startup Faraday Future cast doubt on its ability to bring its first car to market.

Domestic Markets

- The U.S. reported 42,557 new COVID-19 infections and 194 virus fatalities Monday. The nation’s fatality toll is higher than 20 of its peer countries, new data shows.

- Just over 10% of qualifying Americans have received an updated COVID-19 booster tailored to Omicron, according to the CDC. Florida, Louisiana, Mississippi and Alabama have the lowest vaccination levels.

- Rising U.S. cases of various respiratory viruses, including COVID-19, are putting strain back on hospitals after pressures eased over the summer and early fall.

- Over two-thirds of non-hospitalized patients infected with COVID-19 in the first wave of the pandemic developed long-COVID, new research shows.

- Texas is attempting to ban all COVID-19 vaccine mandates for public school students.

- The Conference Board’s index of leading economic indicators contracted in October for the eighth straight month.

- The Federal Reserve will likely stop raising borrowing rates when they reach 5%, up from the current 3.75%-4%, according to the San Francisco Fed.

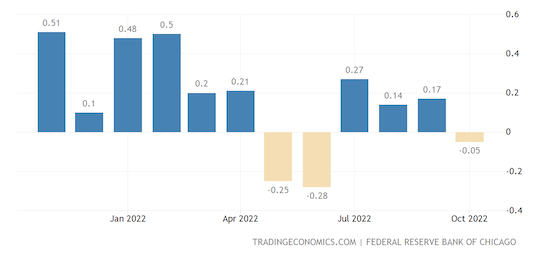

- The Chicago Fed’s index of national economic activity fell to -.05 in October, the weakest reading in four months:

- Deutsche Bank predicts default rates on U.S. leveraged loans will hit a near-record 11.3% by 2024 as the global economic outlook deteriorates.

- Americans’ financial fragility was little changed from 2021 to 2022, according to the New York Fed.

- U.S. company borrowing for equipment investments rose 6% in October from a year ago, according to the Equipment Leasing and Finance Association.

- Massive layoffs in U.S. big tech have left hundreds of workers living in the U.S. on temporary visas with little time to find another job.

- Dell posted a 68% rise in quarterly operating profit as strong demand for servers and network equipment offset weak PC sales.

- Zoom lowered its annual revenue forecast as the video-conferencing platform expects a hit from declining online business conferencing.

- Customer satisfaction in Amazon fell to a near-record low last year, according to independent surveys.

- Pending U.S. home sales dropped 32.1% annually in October, the largest decline since at least 2013, according to online home seller Redfin.

- Investor buying of homes tumbled 30% in the third quarter in a sign that rising borrowing rates and high home prices that pushed traditional buyers to the side are causing firms to pull back, too.

- U.S. airports are preparing for a three-year high in travel volume this Thanksgiving holiday. On Sunday, the more than 2.3 million people screened by the TSA topped the total for the same day in 2019.

- U.S. air regulators are proposing new rules that would help pave the way for commercial air taxi operations by 2025.

- After California’s waste recycling level shrank in 2021, the state led the country in passing new recycling legislation in 2022.

International Markets

- China imposed fresh lockdowns in major cities including Beijing and Guangzhou, as the nation’s daily case count remains at levels not seen since April. Over 28,000 national infections were reported Monday, leading Beijing to tighten rules on entry.

- COVID-19 cases in Japan are up 16.6% week over week.

- Canada’s British Columbia will no longer require COVID-infected people to self-isolate.

- Sudden jumps in borrowing costs will put more emerging-market economies into default next year, according to Fitch ratings agency.

- Financing conditions and rising energy costs have turned the outlook negative for non-financial companies in Europe, the Middle East and Africa, according to Moody’s.

- Mexico’s economy likely grew by 5% year over year in October, government officials said.

- A closely watched inflation indicator in Japan hit a record 1.1% in October, in a sign of rising pressure from raw material and labor costs.

- The world’s worst energy crisis since the 1970s will have an outsized impact on Europe, even as most other regions avoid recession, according to the Organization for Economic Cooperation and Development.

- The European Central Bank’s next interest-rate hike will likely be another 75 basis points, policymakers suggested.

- Israel’s central bank raised its benchmark interest rate by 50 basis points Monday and signaled more rate hikes are in the pipeline.

- China’s central bank announced nearly $28 billion in loan support for major commercial banks to support housing demand and reduce property risk spillover.

- India expects bilateral trade with Australia to surge almost 50% to around $45 billion over the next five years.

- U.S. officials are traveling around the globe in a quiet diplomatic push to get Russia’s major trading partners to bolster waning compliance with Western sanctions and trade controls.

- Aircraft leasing firms are suing insurers for some $6.5 billion after losing hundreds of aircraft stuck in Russia due to Western sanctions.

- Strikes and staff shortages that disrupted European airports over the summer will likely continue to the end of the year, trade groups say, even as the outlook for airlines darkens amid a shrinking travel boom.

- Germany’s Merck aims to double the productivity of key R&D units in a bid to unveil one new product or major new product use every 1.5 years.

- Chinese search engine giant Baidu beat quarterly estimates on a recovery in online ad sales and growth in its cloud and artificial intelligence business.

- Collapsed buildings and landslides from a powerful earthquake killed over 260 people in Indonesia Monday.

Some sources linked are subscription services.