MH Daily Bulletin: November 21

News relevant to the plastics industry:

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 24 and Friday, Nov. 25 in observance of the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil dropped Friday, with Brent (-9%) and WTI (-10%) logging their second week of declines.

- Crude futures were down further in mid-morning trading today, with WTI off 5.6% at $75.62/bbl and Brent down 5.3% at $83.01/bbl. U.S. natural gas was up 4.7% at $6.60/MMBtu.

- Delegates at the COP27 climate summit reached agreement on a global “loss and damage” fund that would pay for climate-related damage in low-income nations. A separate measure to speed up global emissions reductions failed.

- Active U.S. drilling rigs rose by three last week to a total of 782, about 300 below pre-pandemic levels, according to Baker Hughes.

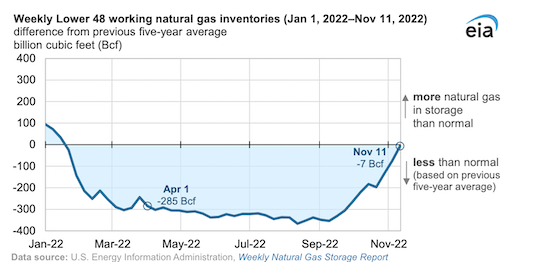

- U.S. natural-gas stocks have returned to typical levels heading into winter, easing supply concerns:

- U.S. fracking operations are getting greater scrutiny after Texas saw its fourth-largest earthquake ever last week and seismic activity in the Permian Basin rises to dangerous levels.

- Texas’ Eagle Ford shale formation is seeing a surge in interest and M&A activity.

- China’s Sinopec signed a 27-year LNG deal with Qatar as companies scramble to lock up supply.

- Commonwealth LNG received approval to build an 8.4-million-ton LNG project on the Louisiana Gulf Coast.

- South Texas producer Ranger Oil is exploring a potential sale in a bid to capitalize on high energy prices. Several North American natural-gas producers are also looking to cash out at top dollar.

- Private equity firm KKR is seeking buyers for Canadian producer Westbrick Energy for roughly $1.5 billion.

- More oil news related to the war in Europe:

- Heavy shelling over the weekend damaged Ukraine’s Zaporizhzhia nuclear power facility, threatening a nuclear disaster at Europe’s largest nuclear power station, now under Russian control.

- Expected shortages in Europe’s crude supply have failed to materialize, leading to an oversupply at European refineries. Meanwhile, the continent’s natural-gas storage is about 95% full, easing supply concerns for this winter even as questions loom over shortages in the years ahead.

- G7 nations could announce a price cap on Russian crude as soon as Wednesday, which would likely take effect Dec. 5.

- Oil tanker earnings are surging as Western sanctions on Russia shift global trading routes.

- France is preparing for a severe power crunch in January as most of its nuclear reactors remain shut down for maintenance.

- More than a dozen regions in Ukraine, including the capital Kyiv, are grappling with power shortages following relentless Russian attacks on the nation’s infrastructure. Officials have started calling for some people in the hardest-hit areas to evacuate.

Supply Chain

- Two Great Lakes storms dumped over six feet of snow in parts of New York over the weekend, leading to widespread transport disruption.

- A quarter of Americans could face energy shortfalls in the most severe weather this winter, according to power grid operators.

- The White House is seeking applications for over $13 billion in available funding to help modernize the U.S. power grid.

- One rail union ratified a White House brokered labor contract and another rejected it, adding to uncertainty about a possible rail strike.

- Maersk-owned tugboat operator Svitzer called off a planned worker lockout that threatened to shut down Australia’s major ports.

- West Coast container ship delays have largely been resolved, while more than 65 ships are stuck in queues on the East Coast, according to Goldman Sachs.

- Containers waited an average of 3.5 days for inland transport at the ports of Los Angeles and Long Beach last month, the shortest dwell time in over two years.

- The Port of New York and New Jersey surpassed the Port of Los Angeles as the nation’s busiest for the third straight month in October, with activity at the western port down to levels not seen since October 2009.

- U.S. truckers are reporting that warehouses and inland rail hubs remain clogged, while Union Pacific said container congestion at its Chicago and Dallas yards won’t clear until the end of the year.

- Down 23% year over year, U.S. trucking spot rates are dipping far below costs, according to ACT Research.

- Improved shipping reliability is leaving some retail importers with too much inbound stock, a trend worsened by shoppers who are delaying holiday purchases to score last-minute deals.

- Boeing expects air cargo traffic to double over the next two decades alongside a 60% expansion in the world’s freighter fleet.

- MSC Air Cargo plans to launch its first airfreight service with Boeing 777-200F freighters in December.

- A COVID-19-induced worker shortage at Foxconn’s Zhengzhou factory could cause significant supply-chain disruption for Apple this holiday season.

- Britain will force Chinese-owned tech firm Nexperia to sell at least 86% of Britain’s biggest computer chip factory, citing national security.

- In the latest news from the auto industry:

- A shortage of common legacy chips has cost Ford 1.3 million vehicles in lost production over the past two years and 4 million lost employee workdays this year, according to its CEO.

- Online car seller Carvana says it miscalculated the impact of rising interest rates and will need to lay off another 8% of its workforce, adding to the 12% laid off earlier this year.

- GM says it could shave $2,000 off the cost of its vehicles by expanding its digital selling platform. The automaker also predicted annual revenue growth of 12% over the next three years, led by increased adoption of electric vehicles.

- Jaguar Land Rover is scooping up laid-off engineers from major U.S. tech firms to help expand its electric vehicle program.

- U.S. self-driving car maker Nuro will lay off one-fifth of its employees after admitting to overhiring during the past year.

- Workers accused U.S. electric-vehicle-maker Rivian of dangerous safety oversights in its bid to rapidly advance production.

- Food-services supplier Sysco plans to have 800 electric heavy-duty trucks in its fleet by 2026.

- Japanese automaker Nidec plans to build a $715 million plant in Mexico to make electric-vehicle motors.

- South African logistics firm Transnet restarted some operations on a key coal-carrying rail line following a train derailment earlier this month.

- Postal workers at Britain’s Royal Mail will strike for six days around Christmas in a dispute concerning pay and conditions.

- Private equity-owned chemicals transporter Quantix acquired five operators in the Gulf Coast region.

Domestic Markets

- The U.S. averaged 40,102 new daily COVID-19 infections last week, down from 41,284 the prior week. The seven-day average for virus deaths declined to 317 from 335 a week ago.

- Omicron subvariants BQ.1 and BQ.1.1 now account for nearly half of U.S. COVID-19 cases, compared to just 39.5% last week.

- Pfizer says its Omicron-tailored booster shot is substantially more effective against the fast-spreading BQ.1.1 strain of COVID-19 than its original shot.

- COVID-19 cases are rising sharply in Los Angeles, with officials strongly recommending that people resume wearing masks indoors.

- Several Federal Reserve officials, including the president of Boston’s branch and the Fed governor, suggested the central bank will continue with its 75-point interest-rate hikes at the next meeting in mid-December. The Atlanta Fed signaled it is ready for a slower pace.

- Softer-than-expected U.S. inflation data is giving a boost to the housing industry as hopes grow that the Federal Reserve will slow its pace of interest-rate hikes.

- U.S. small businesses are cutting back on borrowing or delaying expansion, as high interest rates add additional challenges to labor shortages and supply-chain disruptions.

- The most recent Census Bureau data shows 41% of Americans, or about 95 million people, are having difficulty paying for essential household items, up from 29% a year earlier.

- Analysts project fourth-quarter U.S. earnings will decline for the first time in two years as rising interest rates hit economic growth.

- U.S. antitrust officials are scrutinizing the alliance between American Airlines and JetBlue Airways, saying it is a de facto merger that could have a negative impact on consumers.

- Honeywell International will pay $1.3 billion to end asbestos-related claims stemming from its former North American Refractories Company, the industrial giant said.

- Foot Locker shares jumped 18% Friday after high shopper demand led to better-than-expected quarterly results.

- Taiwan Semiconductor Manufacturing Company, which supplies about 90% of the world’s highest-power computer chips, will bring some its most advanced technology to its planned site in Arizona as geopolitical tensions raise concerns about manufacturing in Taiwan.

International Markets

- China is nearing its highest COVID-19 levels of the pandemic, including some 25,000 infections Friday and Saturday. Stay-at-home orders are spreading in Beijing, which saw China’s first virus fatality in almost six months Sunday.

- China locked down millions in the southern city of Guangzhou due to COVID-19 outbreaks, requiring residents to show proof of a negative test to leave their homes.

- Just 13% of Asian companies expect their employees to work in the office full-time, five days per week, new data shows.

- General strikes are rising across Europe in protest over high energy prices and mounting costs of living. In Britain, a cost-of-living crisis could wipe out eight years of growth in household income, government forecasters say.

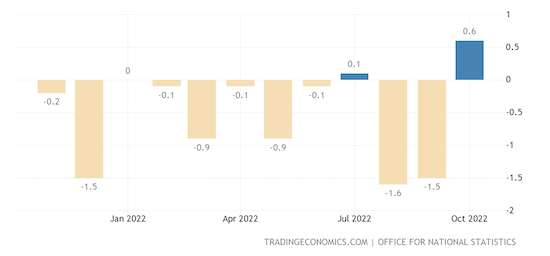

- British retail sales rose a larger-than-expected 0.6% in October:

- A new report from the U.K.’s Office for Budget Responsibility forecasts that real household incomes will shrink 7% by April 2024 and send the economy into a recession that could last well over one year.

- Chinese retail sales unexpectedly dropped in October as consumer spending buckled under the country’s dual campaigns against rising property prices and COVID-19 outbreaks.

- The U.S. has imported more goods from Europe than from China this year, a major shift from the past decade, as Russia’s war in Ukraine and China’s economic slump reorganize trade flows. German exports to the U.S. alone surged almost 50% year-over-year in September.

- Germany will tighten rules for companies deeply exposed to China, making them disclose more information and possibly conduct stress tests for geopolitical risks.

- Producer prices in Germany fell a surprising 4.2% in October, the first monthly decline since May 2020. Analysts had expected a 0.9% increase.

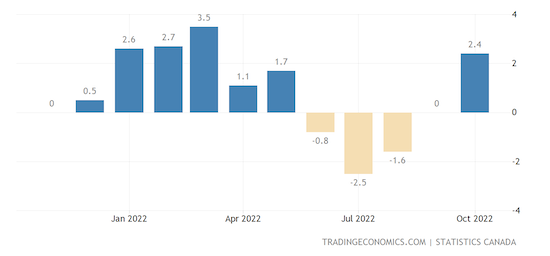

- Canadian producer prices rose 2.4% from September to October, the biggest gain since March:

- India’s central bank says the nation’s economy will expand by 7% this fiscal year.

- Tata Group-owned Air India says it is holding talks with Boeing and Airbus about ordering new aircraft. Separately, the group plans to merge its four airline holdings under the Air India brand.

- European securities regulators proposed strict curbs on environmentally labeled investment funds, citing concerns over greenwashing.

Some sources linked are subscription services.