MH Daily Bulletin: November 18

News relevant to the plastics industry:

At M. Holland

- M. Holland’s U.S. and Puerto Rico offices will be closed Thursday, Nov. 24 and Friday, Nov. 25 in observance of the Thanksgiving holiday.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell more than 3% Thursday on news of mounting COVID-19 cases in China. Futures are poised for their second straight weekly loss.

- In mid-morning trading today, WTI futures fell below $80, down 2.6% at $79.54/bbl, Brent was down 2.6% at $87.48/bbl, and U.S. natural gas was down 0.2% at $6.36/MMBtu.

- The U.S. price gap between diesel and gasoline hit $1.61 per gallon Thursday, an all-time high as diesel prices soar.

- Global oil demand surpassed pre-pandemic levels by 1 million bpd in September, driven by diesel consumption in China and gasoline demand in the U.S.

- Saudi Arabian oil exports are down 6%, or 430,000 bpd, over the past month as the nation delivers on an OPEC agreement to shore up global crude markets.

- U.S. producer Hess Corp. expects U.S. oil production to hit 13 million bpd in the next few years and then plateau amid widespread investor pressure to focus on returns over growth.

- The idled St. Croix refinery, one of the largest in the Western Hemisphere, once expected to boost overall supply in the Caribbean, could take years to return to operation due to stricter rules under the U.S. Clean Air Act.

- More oil news related to the war in Europe:

- At a Nov. 24 meeting, the EU’s executive arm will propose a price cap on European natural gas prices, bringing months of internal debate to a head.

- German companies facing soaring energy costs see the U.S. as the most attractive global investment destination, a new survey showed.

- Europe will give Ukraine temporary cold-weather shelter, generators and grid repair to help it tide energy shortages this winter.

- Swedish authorities found traces of explosives near damaged undersea natural-gas pipelines in the Baltic Sea, bolstering allegations of sabotage.

- Italian utility Enel will build a new solar manufacturing facility in the U.S. to support the creation of a North American supply chain.

- The U.S. administration has identified some 1.7 million acres offshore the central Atlantic coast for potential wind development.

- Negotiations over a global carbon-trading program are expected to last well into next year.

- LyondellBasell is considering expanding propylene production capacity by 35% at its Channelview Complex near Houston.

Supply Chain

- New York’s governor declared a state of emergency for Buffalo and western New York, which are in the midst of a potentially record-setting lake effect snowstorm that began on Wednesday and is expected to continue until this evening.

- The organization responsible for the reliability of U.S. power grids says a large portion of North America is at risk of running short on electricity during peak winter conditions this year.

- Hundreds of ground handlers at London Heathrow are starting a three-day strike today over a contract dispute.

- Britain’s biggest transport union voted to extend a period for potential rail strikes for another six months.

- Retail shelves could be fully stocked, and some prices will be lower this holiday season as the worst of two years of pandemic supply-chain disruptions subside, executives say.

- U.S. less-than-truckload carriers widely agree that tonnages have continued shrinking from October into November.

- Amazon’s air cargo unit made its first touchdown at Manchester-Boston Regional Airport, marking the extension of its air network into New England.

- Shippers expect persistent spot-rate declines to translate into substantial ocean contract rate reductions in 2023.

- Israeli container line Zim lowered its full-year earnings forecast as shipping demand falls and quarterly profit fell 20% year over year.

- Daily spot rates for very large crude carriers are surging as high as $136,000.

- In the latest news from the auto industry:

- European car sales rose 14% year over year in October as supply-chain issues eased, the third straight month of gains.

- France and Spain joined a pledge to stop sales of gas-powered cars by 2035, five years earlier than planned.

- Volkswagen is considering pushing back some electric vehicle development, including scrapping plans for a $2.1 billion factory in Germany, as it hits road bumps in its massive electrification overhaul.

- Volkswagen will cease making cars with manual transmissions at its joint venture in China as momentum shifts toward e-vehicles.

- The head of GM’s Mexico unit says the country is falling behind on electric vehicle adoption goals for 2030.

- GM added Brazilian mining giant Vale to its growing roster of battery material suppliers as the automaker prepares to ramp up production and profits from electric vehicles by 2025, thanks in large part to new federal subsidies.

- Vietnamese automaker VinFast plans to bring four electric vehicles to the U.S. market by the end of 2023.

- U.S. officials at the global COP27 climate summit say the nation aims to only produce and sell zero-emissions heavy-duty trucks by 2040.

- California slated another $1 billion to fund expansion of its charging network for electric heavy-duty trucks.

- Warehouse operator Prologis installed electric-truck charging stations at two of its properties in California.

- Lyft and driverless tech firm Motional are partnering on a new robotaxi service in Los Angeles.

- Stellantis will dive further into autonomous development with the acquisition of software-maker aiMotive.

- Chinese electric-vehicle (EV) giant BYD will start selling two new models in Brazil this month. Separately, the automaker will pause a planned spinoff of its chip subsidiary to instead focus on making more semiconductors for EVs.

- German industrial group Thyssenkrupp warned of “nosediving” sales and profits next year due to high inflation and energy costs.

- U.S. chip tools-maker Applied Materials boosted its first-quarter revenue forecast as easing supply-chain issues help it meet pent-up demand from chipmakers.

- Congress is making a bipartisan effort to ban government business with Chinese chipmakers.

- Global demand for silver is set to rise 16% this year as the metal’s use in vehicles and solar panels surges.

- A United Nations-brokered deal allowing Ukraine to ship grain from the Black Sea was extended by four months, a boon for global food supply.

- FedEx and Cart.com are partnering to create an e-commerce platform to compete with the likes of Amazon and Shopify.

Domestic Markets

- The U.S. reported 52,503 new COVID-19 infections and 407 virus fatalities Thursday.

- Benchmark U.S. interest rates could hit 7% at their peak under a worst-case scenario, according to the president of the St. Louis Fed.

- Reuters economists expect the Federal Reserve to downshift to a 50-point rate hike at its next meeting in December.

- Despite rising interest rates and fears of a recession, capital spending by big U.S. firms rose 20% to a record $200 billion in the third quarter.

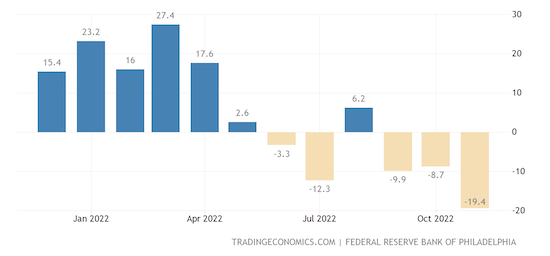

- A gauge of manufacturing activity in the U.S. mid-Atlantic fell unexpectedly to one of its lowest levels in a decade this month:

- Financial tech companies are increasingly becoming acquisition targets for traditional U.S. banks, as rising interest rates and falling valuations darken their prospects.

- Higher interest rates helped Wells Fargo collect more than $3 billion in third-quarter profit.

- One in four retail investors report putting less into the stock market in order to cover essential expenses like groceries, gasoline and housing.

- U.S. shoppers are seeing fewer discounts for everyday purchases as consumer-goods makers limit price-cutting to maintain profits.

- Existing home sales fell 5.9% in October from the prior month, the ninth consecutive monthly decline.

- U.S. mortgage rates took their biggest weekly decline in over 40 years last week after a rapid run-up that quickly priced out homebuyers.

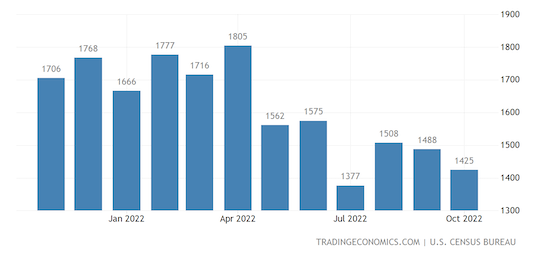

- U.S. homebuilding fell by a sharp 4.2% in October, with single-family projects dropping to the lowest level in 2.5 years:

- San Francisco could lose $200 million in property tax revenue by 2028 as firms continue shifting to remote work.

- U.S. workers will continue having an upper hand in the job market as reduced immigration and an aging population shrink the nation’s pool of workers.

- Amazon plans for a sweeping round of job reductions to extend into 2023.

- Starbucks workers at more than 100 U.S. stores went on strike Thursday in their largest labor action since a unionization campaign last year.

- Kohl’s withdrew its full-year forecasts after third-quarter sales fell 6.9%.

- Macy’s raised its outlook on resilient demand for high-end clothes and beauty products.

- Gap beat third-quarter estimates on a 2.5% gain in net sales.

- U.S. air regulators do not expect to certify Boeing’s 737 MAX 7 model before a key deadline at the end of the year, which could push back commercial deliveries of the jet by years.

- Boeing will consolidate its struggling defense unit by halving its number of divisions and making leadership changes.

- U.S. regulators gave the green light for construction of a new $4.2 billion terminal at John F. Kennedy International Airport.

International Markets

- Last week’s rise in global COVID-19 infections was led by increases of 25% in Japan, 19% in South Korea and 6% in the U.S. The numbers are probably understated due to relaxed testing and reporting.

- China posted 23,276 new COVID-19 cases Wednesday, about 3,000 more than a day earlier, and over 24,000 yesterday as the government tries to navigate a path between its COVID-zero policy and growing lockdown fatigue among the population.

- The city of Guangzhou, a manufacturing hub in southern China, plans to build COVID-19 quarantine facilities to accommodate up to 250,000 people.

- Hong Kong will ease COVID-19 testing rules on incoming travelers starting next week.

- Britain’s $66 billion in announced spending cuts and tax increases over the next five years make it the first major Western economy to try to limit debt growth after two years of pandemic-fueled spending. Government forecasters say the nation’s economy will contract 2% next year.

- Japanese inflation rose 3.6% year over year in October, the fastest pace since 1982. Central bank officials pledged to continue ultra-loose monetary policy in a bid to support wages.

- German exports will likely fall next year as nearly half of German firms that sell abroad expect an economic downturn.

- Brazil cut its GDP growth forecast from 2.5% to 2.1% for 2023 amid worsening economic conditions across the globe.

- The Bank of Israel is expected to raise short-term interest rates for a sixth straight time next week.

- Companies looking to abide by Western sanctions on Russia are facing increasingly sophisticated attempts to evade detection from individuals and other business partners.

- Chinese internet giant Alibaba posted a surprise quarterly loss amid depressed consumer sentiment.

Some sources linked are subscription services.