MH Daily Bulletin: November 16

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose over 1% Tuesday after positive U.S. inflation data suggested oil demand could rise.

- In mid-morning trading today, WTI futures were down 2.1 % at $85.12/bbl, Brent was down 1.6% at $92.38/bbl, and U.S. natural gas was down 3.2% at $5.84/MMBtu.

- U.S. crude stocks fell by 5.835 million barrels last week, according to the American Petroleum Institute. Government data is due today. Globally, oil inventories are at their lowest level since 2004.

- Car travel is projected to be up 20% this Thanksgiving weekend with gas prices at $3.68 a gallon, the highest on record for the holiday.

- The spread between diesel fuel and gasoline and crude is at the highest on record, with diesel up 50% this year and gasoline up 14%.

- Global diesel demand will fall slightly next year due to stubbornly high inflation, according to the International Energy Agency (IEA).

- Freeport LNG will likely cancel November and December shipments as repairs continue on its fire-damaged export facility in Texas. European gas futures spiked on the news:

- Canada’s TC Energy says poor weather forced it to curtail unspecified volumes from its 622,000-bpd Keystone oil pipeline out of Alberta.

- South African coal exports, already set to slide 14% this year, will decline further after a train derailed on a key export route.

- More oil news related to the war in Europe:

- Piped oil supply to parts of Eastern and Central Europe has been suspended due to Russian shelling near the border of Poland.

- Germany finished building its first floating LNG terminal at the North Sea port of Wilhelmshaven, with plans to construct at least four more.

- Europe will need to replace 1 million bpd of crude once its ban on Russian imports takes effect Dec. 5.

- Germany is delaying a decision to impose price brakes on household gas and electricity.

- Russia delivered its first shipment of crude to the UAE as it scrambles to find new buyers outside Europe.

- Mozambique shipped its first load of LNG to Europe.

- Moscow allowed Japan to keep its stake in the massive Sakhalin-1 oil and gas project in Russia’s Far East.

- Ukraine’s energy situation is “critical” after weeks of Russian attacks on the nation’s infrastructure, authorities say.

- Europe plans to tighten its emissions target under the Paris climate accord within the next year.

- Japan is expanding its public auctions for offshore wind projects slated for December.

- Inpex, Japan’s biggest oil and gas explorer, announced plans to produce carbon-neutral “blue hydrogen” starting in 2025.

- Most localities that pledge to reach net-zero emissions have little to no plans to track and report progress, according to new research.

- Shell subsidiary Chemical Appalachia fired up a new polyethylene plant in Pennsylvania with 1.6 million tonnes of annual production capacity.

Supply Chain

- The U.S. Chamber of Commerce, the nation’s largest business lobby, jumped behind calls for Congress to help negotiate a stalled deal between union workers and freight railroads.

- Spanish truckers suspended their strike Tuesday, just one day after launching the indefinite labor action, blaming harassment from authorities.

- South Africans will see regular power outages for the next year as state utility Eskom struggles to repair infrastructure.

- Port of Los Angeles volumes fell to their lowest since 2009 last month as shippers sent cargo elsewhere to avoid feared disruptions from West Coast labor talks.

- The Cass Freight Index for expenditures hit 4.399 in October, up 11.1% year-over-year for the smallest annual gain since 2020.

- Burrell Aviation will invest $110 million to build 65 acres of air-cargo operations at Colorado Springs Airport.

- Greek shipowners are rapidly stepping up their orders for new vessels.

- Contract logistics firm GXO Logistics has doubled its use of automation in the past year.

- Cindy Sanborn, the first woman to serve as COO of a major U.S. railroad, is stepping down from her post at Norfolk Southern.

- Apple plans to source computer chips from a new plant in Arizona by 2024, a major step toward cutting reliance on Asian production.

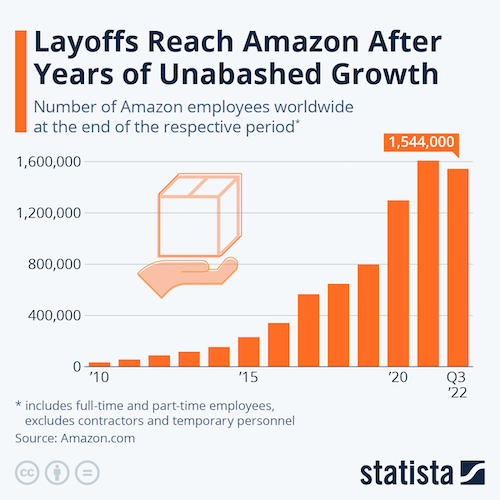

- Amazon’s announced layoffs of some 10,000 people will extend beyond its troubled smart speaker unit and include e-commerce and logistics operations, a surprise during the peak shipping season.

- China controls more than 80% of the global supply chain for solar energy, limiting capacity expansions in other countries, notably the U.S.

- In the latest news from the auto industry:

- Battery recycler Redwood Materials entered a multi-billion-dollar agreement to supply Panasonic’s new Kansas plant in 2025.

- Mexico’s administration is calling for U.S. and Canadian firms to build the country’s first commercial lithium production.

- China is verging on capturing 60% of global electric vehicle sales this year.

- Tesla cut waiting times for several car models after inventories rose sharply in October.

- GM plans to add more deals on top of the 20 it has already formed to boost its North American battery supply chain.

- Ford leadership says reshoring supply chains to the U.S. will help preserve jobs as the automaker switches to less labor-intensive production of electric vehicles.

- Daimler Truck says the truck manufacturing supply chain remains “broken” despite easing chip shortages.

- Electric vehicle stations could one day require as much power as a small town in order to accommodate both passenger and freight vehicles.

- Electric vehicles are among the least reliable in the U.S., according to the latest Consumer Reports survey.

- Japanese trading house Mitsui & Co. will launch a logistics business using self-driving trucks as early as 2026.

- Workers at the world’s largest copper mine in Chile will temporarily strike next week to press labor demands.

- Textile fiber suppliers Invista and Lenzing will start manufacturing carbon-neutral materials in the U.S. and ship the goods by rail to reduce emissions.

- British supermarkets have started rationing eggs after the nation’s worst-ever outbreak of bird flu.

- Ukraine’s wheat plantings are down 40% from last year’s record high, signaling tighter global supply and higher food prices.

Domestic Markets

- The U.S. reported 40,279 new COVID-19 infections and 387 virus fatalities Tuesday.

- U.S. stocks jumped Tuesday on hopes of more stabilized relations between the U.S. and China after their leaders met in Indonesia.

- Bloomberg economists upped projections for a U.S. recession within the next year to 65%.

- Retail sales rose a higher than expected 1.3% in October.

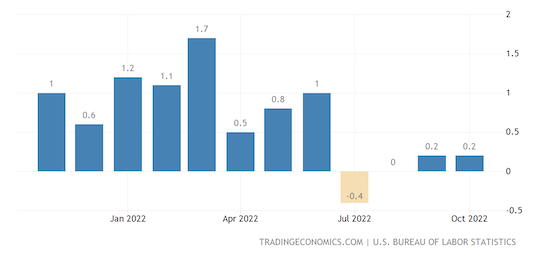

- After the U.S. producer-price index rose a smaller-than-expected 0.2% in October, a further sign of easing inflation, some analysts expect the Federal Reserve to slow its aggressive pace of interest-rate hikes:

- U.S. households added $351 billion in debt last quarter, the sharpest gain in 15 years.

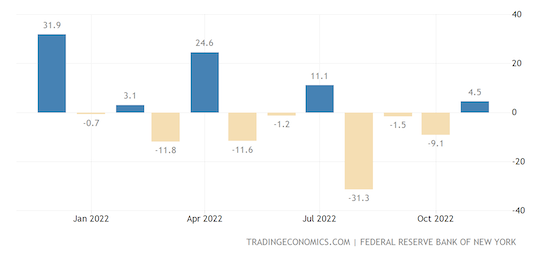

- An index of New York state manufacturing activity rebounded sharply from -9.1 in October to 4.5 this month:

- Taxi regulators in New York City approved a 23% increase in fares, the first hike since 2012, and also lifted rates for Uber and Lyft drivers.

- Most Americans need at least a six figure income to afford the typical home, up 46% from a year ago, according to Redfin.

- U.S. home prices could tumble as much as 20% in the wake of surging mortgage rates, according to the Dallas Fed.

- Downsizing U.S. tech firms are flooding business districts with office space across the country.

- Thanksgiving travel activity will near the busiest in two decades despite remaining about 2% below 2019 levels, according to projections.

- Walmart lifted its outlook as resilient demand for essentials led to an 8.2% rise in quarterly sales. The retailer also announced a $20 billion share buyback plan.

- Target’s third quarter sales rose, but earnings tumbled 52%, prompting the company to lower its outlook and announce up to $3 billion in cost cutting. Target’s stock sank by double digits in premarket trading on the news.

- Amazon is stepping further into the healthcare market with a new referral service that aims to link patients with virtual providers.

- The market for cyber insurance is starting to stabilize after a surge in ransomware attacks drove up premiums in recent years.

- The U.S. SEC assessed $6.4 billion in fines and ill-gotten gains in fiscal year 2022, a record.

- Airlines are asking U.S. regulators for more time to retrofit planes to handle 5G network interference.

International Markets

- China posted 17,772 new COVID-19 infections Tuesday as fears spread over widening lockdowns in many of its largest cities. Despite the surge, authorities also began easing curbs for domestic group tourism.

- Tokyo saw 11,196 new COVID-19 infections Tuesday, the first tally above 10,000 in two months.

- Australian authorities are dissuading people from getting a fifth COVID-19 vaccine shot despite a new wave of virus infections building.

- The annual inflation rate in the U.K. hit 11.1% in October, highest since 1981.

- Canadian factory sales were essentially flat from August to September, the latest data shows.

- Exports of German machinery fell by 2.8% in the first nine months of 2022 as COVID-19 curbs in China weighed on business there.

- Colombia’s economy grew 7% in the third quarter from a year ago, topping market expectations.

- Canadian home sales rose 1.3% from September to October, the first monthly gain since February.

- Foreign direct investment in Saudi Arabia plunged 85% year over year in the latest quarter.

- Luxury fashion brand Estee Lauder will buy rival Tom Ford for $2.8 billion.

Some sources linked are subscription services.