MH Daily Bulletin: November 14

News relevant to the plastics industry:

At M. Holland

- M. Holland is hosting a free 3D Printing Technology Forum in Chicago on Nov. 16! Attendees will learn how additive manufacturing technologies can support the development of applications — especially injection molding. Click here to RSVP, or contact 3dinfo@mholland.com for more information.

Supply

- Brent fell 2.6% and WTI fell 4% last week as rising U.S. crude stocks pointed to greater supply.

- In mid-morning trading today, WTI futures were down 2.6% at $86.68/bbl, Brent was down 2.0% at $94.09/bbl, and U.S. natural gas was up 6.9% at $6.82/MMBtu.

- Active U.S. drilling rigs rose for a second week to their highest level since March 2020.

- A fake social media post about Freeport LNG sent U.S. natural gas futures into a brief tailspin Friday.

- Saudi Arabia says OPEC+ will remain “cautious” on oil production as it gets set to hold its next meeting in December.

- Work-from-home orders and fears of spreading COVID-19 have reduced China’s mobility and fuel demand, easing pressure on global supply.

- Several Chinese refiners are asking Saudi Aramco for less crude amid weakening domestic demand.

- A Black Sea oil terminal handling 1% of the world’s supply has loaded its first tanker since maintenance shut it down in August.

- Exxon Mobil, along with its partners, announced a new oil discovery in Angola, the first commercial oil discovery by the oil major in almost 20 years.

- More oil news related to the war in Europe:

- Persistent disagreements could quash Europe’s plan to curb gas prices across the continent.

- Russian oil output could fall as much as 1.5 million bpd, or 14% of its current level, when Europe’s import ban takes effect Dec. 5.

- Europe’s energy crisis will push Germany to take on an estimated $46.62 billion in debt next year, more than double initial forecasts.

- Some German government advisers are calling for a ban on dividends and bonuses from companies that benefit from gas or electricity price subsidies.

- Israel says it will need several years before it can significantly increase its natural gas supplies to Europe.

- Norwegian startup Freyr Battery and energy conglomerate Koch Industries are ramping up plans for a multi-billion-dollar factory in Georgia that will produce batteries for the U.S. power grid.

- Europe will need up to $462 billion in investment to keep its current level of nuclear generation capacity, research suggests.

- A new study suggests that the U.S. will need to increase its electricity generation capacity by as much as 480% to meet its 2050 decarbonization goals outlined in the Paris Climate Agreement.

- The U.S. EPA will soon require oil and gas companies to monitor and repair methane leaks, part of a spate of new rules meant to reduce methane emissions by 87% in 2030. Canada and Nigeria announced similar measures.

- A U.S.-led initiative to help the global farming industry cut emissions has doubled investment commitments to $8 billion.

- Germany announced it will pull out of the 1994 Energy Charter Treaty, which allows utility firms to sue governments if they make changes to energy policies, the sixth major government to exit the agreement behind France, Spain, the Netherlands, Slovenia and Poland.

- The U.S., Europe and other governments issued a joint statement Friday pledging to take action to address climate change and energy crises.

Supply Chain

- Florida’s east coast infrastructure was battered by Hurricane Nicole last week, while heavy rains continued to drench Georgia and the Carolinas over the weekend.

- Power market operators in the U.S. West say that the region’s growing use of renewables will require greater reserves in the coming years to help maintain grid reliability. The news comes as the electricity industry increasingly turns to blackouts, usually a tool of last resort, to get through temperature extremes and tight supplies.

- The economic hit from the Mississippi River’s historically low water levels could reach $20 billion, according to AccuWeather.

- South African rail company Transnet said repairs to a key commodity export line have been significantly delayed by violence.

- S&P predicts global container demand will grow at an average annual rate of 3% through 2030.

- Hapag-Lloyd forecast a muted market in the months ahead after net profit more than doubled to $13.8 billion euros in the first nine months of 2022.

- A persistent backup of ships at Georgia’s Port of Savannah could last until the end of the year.

- Executives say the delivery of more than 400 new ships in the next two years will drive down freight rates, which have already fallen 90% from pandemic highs in the last year.

- The U.S. had 633.8 million square feet of industrial space under construction last quarter, up substantially from 586.7 million in the second quarter.

- U.S. voters approved tens of billions of dollars in infrastructure projects in last week’s midterm elections.

- U.S. chipmaker GlobalFoundries will cut jobs and freeze hiring in a bid to cut operating expenses by $200 million each year.

- Supply-chain disruptions are starting to hit medical-device-makers as hospitals resume normal activities after two years of pandemic disruption.

- In the latest news from the auto industry:

- Tesla is weighing exporting its China-made vehicles to the U.S. amid slower demand from China’s consumers.

- Tesla will open its proprietary charging network to other electric-vehicle-makers.

- The Beijing International Automobile Exhibition, China’s most important auto fair, has been canceled due to COVID-19.

- Volkswagen’s South Africa unit is looking at new gas-engine markets in Asia and Latin America as Europe restricts shipments as part of a shift to electric vehicles.

- Lion Electric nearly quadrupled its truck deliveries last quarter to 156 vehicles.

- More than half of Americans surveyed want package companies to switch to electric delivery vans.

- Swedish electric vehicle-maker Polestar saw its operating losses narrow in the third quarter to $196.4 million, down from $292.2 million last year, while its revenue jumped to $435.4 million.

- Large U.S. retailers are canceling orders, resisting price increases and asking suppliers for discounts in a scramble to adapt to falling consumer demand.

- European retailers fear this Christmas could be the worst in a decade as shoppers cut spending while the costs of doing business show no sign of abating.

- FedEx’s LTL freight unit will furlough some of its 45,000 employees for about 90 days beginning in December.

- European executives say consumer tolerance for higher prices may be at its limit.

- China’s largest annual shopping festival ended with subdued orders and little enthusiasm.

- Many German firms are looking to diversify their manufacturing operations by expanding beyond China, particularly in Vietnam.

- The London Metal Exchange decided against a ban on new deliveries of Russian metal, a blow to big western aluminum producers.

- Germany’s IG Metall union of metal and electric workers, the nation’s largest labor group, is calling for strikes over an ongoing wage dispute.

- Gap struck a distribution deal to sell some of its apparel on Amazon.

- The U.S. has blocked more than 1,000 shipments of solar energy components from China since June amid concerns about slave labor in the nation, leaving hundreds of millions of dollars’ worth of unused equipment stuck at the nation’s ports.

Domestic Markets

- .The U.S. averaged 41,284 daily new COVID-19 infections last week, up from 39,016 the prior week. The seven-day average for virus deaths declined to 335 from 358 a week ago. Infections are up about 10% the past two weeks on the spread of a pair of new Omicron subvariants, BQ.1.1 and BQ.1.

- More than 5.6 million COVID-19 vaccine and booster shots were given out last week, the most since January.

- Doctors in the U.S. say that the chance of experiencing a rebound COVID-19 infection after taking Pfizer’s Paxlovid treatment is significantly greater than initially thought, now thought to be as much as 30%, up from the original assumption of less than 2%.

- The U.S. administration signaled it will keep COVID-19’s status as a public-health emergency well into the spring.

- COVID-19 hospitalizations among infants younger than six months old surged elevenfold between April and July, according to the CDC.

- The S&P 500 and Nasdaq saw their biggest daily gains in 2.5 years last week, as annual U.S. inflation slipped below 8% for the first time in eight months.

- The U.S. treasury secretary says it is unclear if inflation has reached a turning point despite favorable data from October.

- American households are holding a combined $4.7 trillion in cash, aided by help from the federal stimulus, as consumer spending remained strong in September.

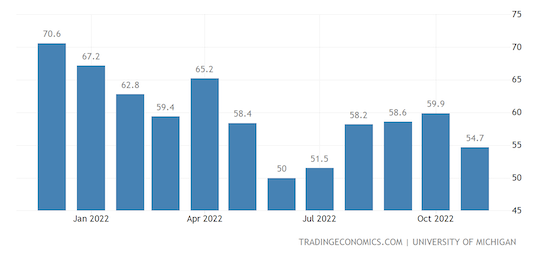

- The University of Michigan’s consumer sentiment index slumped from 59.9 to 54.7 in November:

- Consumers are benefiting from deep discounting by retailers well ahead of the traditional Black Friday kickoff of the holiday season.

- Disney was the latest major U.S. firm to make cuts to its employee base as part of efforts to navigate a potential economic downturn.

- Facebook parent Meta will wind down some of its hardware projects after making the first mass layoffs in its 18-year history last week.

- Surveys suggest U.S. home-buying conditions in the eyes of would-be buyers are the worst since 1978.

- American Airlines pilots’ union is exploring a merger with the union representing pilots at United and Delta in a bid to gain leverage in contract negotiations.

- Beyond Meat reported tumbling sales and growing losses in the third quarter.

International Markets

- China stopped routine Monday morning COVID-19 testing in a number of cities after declaring last week it will ease virus rules. International watchers are taking China’s relaxation of pandemic rules with a grain of salt, saying the moves may actually be a way to preserve restrictions for longer.

- German health officials say the country may be headed for a surge in COVID-19 cases this winter.

- Mexican industrial output fell 0.2% from August to September, the latest data shows.

- Argentina reached agreement with retailers to freeze or tightly regulate prices of some 1,500 products to contain surging inflation that could top 100% this year.

- India’s industrial output rose 3.1% year over year in September, topping expectations.

- Top U.S. officials have moved to deepen economic ties with India and Japan in recent days.

- The U.S. administration signaled that sanctions on Russia will remain in place even after an eventual peace agreement with Ukraine.

- China is asking banks to give more support to property developers in a sweeping new round of rescue measures aimed at shoring up the country’s struggling real estate sector.

- U.S. hotel operators expect to see more losses from China’s strict COVID-19 lockdowns, which have already halted property construction and impeded travel to one of the world’s key tourism markets.

- Luxury fashion brand Estee Lauder is nearing a deal to buy rival Tom Ford for about $2.8 billion.

Some sources linked are subscription services.