MH Daily Bulletin: November 7

News relevant to the plastics industry:

At M. Holland

- At our recent Plastics Reflections Web Series event, M. Holland experts discussed the macroeconomic factors influencing global and domestic economies, including impacts on the plastics industry. Click here to read the recap.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil rose 5% Friday with just five weeks remaining until the EU’s ban on Russian oil begins to tighten global supply.

- In mid-morning trading today, WTI futures were up 0.5% at $93.03/bbl, Brent was up 0.3% at $98.90/bbl, and U.S. natural gas was up 11.6% at $7.14/MMBtu.

- Saudi Arabia lowered most oil prices for Asia as Chinese lockdowns push down demand.

- Active U.S. drilling rigs rose by two last week to 770, roughly 305 below pre-pandemic levels, according to Baker Hughes. Despite an extended streak of strong profits, U.S. shale companies are slowing their oilfield activity and keeping production mostly flat.

- U.S. oil refiners will keep running plants at or above 90% of capacity this quarter as tight supplies spur high profits.

- Sempra Infrastructure’s planned $10.5 billion U.S. Gulf Coast export site will be the largest LNG terminal built since Russia invaded Ukraine.

- Citing strong demand, Canada’s Enbridge will launch a $2.65 billion expansion of the southern segment of its British Columbia gas pipeline system.

- Houston-based Coterra Energy saw shares fall 8% Friday after it cut its estimate of proven oil reserves by up to 20%.

- Exxon Mobil is considering leasing or selling some 50% of its unused office space at its sprawling new 385-acre headquarters in Houston, according to reports.

- Blackstone, the world’s largest alternative asset manager, will sell U.S. producer PRI Operating for $2 billion, as it continues its retreat from the oil patch due to disappointing returns and environmental concerns.

- More oil news related to the war in Europe:

- The U.S.’s upcoming cap on the price of Russian oil cargoes will only apply to their first sale on land and will take place at a fixed rate rather than floating rate.

- French utility Électricité de France says repair work on half its nuclear reactors will sharply cut fourth-quarter electricity supply.

- Italy and the Czech Republic are using new taxes and borrowing to help subsidize electricity costs.

- External power has been restored to Ukraine’s Zaporizhzhia nuclear plant, temporarily erasing fears of a nuclear incident.

- Ukraine is stepping up blackouts in Kyiv and other regions, authorities said.

- Some 30 LNG carriers loaded with $2 billion of natural gas are parked outside European ports awaiting an expected increase in prices before unloading and cashing in.

- United Nations climate talks began in Egypt Sunday, kicking off with breakthrough discussions on how wealthy countries can help pay for the damages caused by global warming elsewhere.

Supply Chain

- Over 1 million TEUs of container capacity, representing some 4.6% of the global fleet, has been idled since late October as demand cools.

- The seventh of 12 railroad unions approved a White House-brokered labor agreement, raising hopes that a rail strike can be averted. Two unions have rejected the pact, and others have yet to vote.

- Rising capesize rates pushed the Baltic Exchange’s sea freight index upward for the first time in two weeks.

- Port Houston announced a new dwell fee for lingering import containers, a response to congestion caused by record throughput.

- An MSC-owned firm is building a 165-acre container terminal that will boost capacity at the Port of Baltimore.

- The U.S. trucking industry added a surprise 13,200 jobs in October, the third-most in a decade. Warehouse and storage companies cut payrolls by almost 20,000, the fourth straight monthly pullback.

- Werner Enterprises is preparing for a “subdued” peak season after quarterly revenue came in flat.

- ABF Freight owner ArcBest says tonnage is starting to fall after rising 4.4% in the third quarter.

- Echo Global Logistics acquired fellow Chicago-area freight broker Fastmore Logistics.

- Global air cargo volumes fell an annual 8% in October, the eighth consecutive month of declines.

- Korean Air’s cargo revenue rose 12% to $1.3 billion in the third quarter, accounting for more than half its total sales.

- DHL Express, the air unit of Deutsche Post DHL, will raise tariff rates by 7.9% on all U.S. shipments starting Jan. 1.

- Persistent rain has stranded thousands of tons of wheat and canola at Canada’s biggest port of Vancouver.

- British postal workers are planning two 48-hour strikes during Black Friday and Cyber Monday this year.

- In the latest news from the vehicles industry:

- Ford is urging the U.S. government to loosen rules so that more electric vehicles qualify for up to $7,500 in consumer tax credits.

- South Korea is seeking a three-year grace period for its automakers to keep getting electric vehicle incentives in the U.S.

- Japanese officials are warning that U.S. electric vehicle tax credits will deter investment in the nation.

- British car sales will hit a 40-year low this year, according to a major trade group.

- Chinese car-battery maker CALB will build its first European production site in Portugal.

- Canadian auto supplier Magna International lowered its annual sales forecast after missing third-quarter profit targets.

- Shares of online car seller Carvana are down 96% this year as rising interest rates sap demand for financing.

- Class 8 truck orders remained strong in October at 42,500 units.

- Spot rates in the crude tanker market are set to rise ahead of Europe’s upcoming ban on Russian crude. Some tanker operators have already seen record quarterly profit amid the global scramble to buy fuel.

- Euronav pushed its planned merger with rival tanker operator Frontline into next year.

- A consortium of Asia-based shipping firms ordered five new LNG carriers after securing a long-term charter contract with QatarEnergy, among the world’s largest LNG producers.

- About $185 billion of last year’s landmark $1 trillion U.S. infrastructure bill has already been distributed, according to the White House.

- Growth of Chinese exports probably cooled in October amid falling global demand, economists say.

- Apple warned of long lead times for its popular iPhone 14 Pro and iPhone Pro Max due to production interruptions at Foxconn’s Zhengzhou, China, site, subject of a recent COVID-19 lockdown.

- Some Bed Bath & Beyond suppliers are restricting shipments as the retailer struggles to rebuild from over a year of plummeting sales.

- Lego broke ground on a factory in Vietnam that it says will be carbon neutral.

Domestic Markets

- The U.S. averaged 39,016 new daily COVID-19 infections last week, up from 37,985 the prior week. The seven-day average for virus deaths declined to 358 from 378 a week ago.

- Rising cases of the flu and respiratory illness are straining the U.S. healthcare system, as it beefs up for COVID-19 surges this winter.

- Pfizer says its updated COVID-19 booster was four times as effective against the Omicron strain than original booster shots. The firm’s Paxlovid antiviral may also lower the risk of long-COVID, according to new research.

- Four Federal Reserve policymakers say they will consider a smaller interest-rate hike at the central bank’s next meeting.

- The Federal Reserve’s semiannual report on financial stability suggests that households, banks and businesses have been able to adapt to rapidly tightened financial conditions this year.

- Investors are dumping money into cash at one of the fastest rates of the pandemic amid heightened volatility and questions over the U.S. interest-rate outlook.

- Rising interest rates will cost debt-laden companies an additional $200 billion in interest costs in 2022 and 2023, as Wall Street bank lending and deal activity slow to a decade low.

- WalletHub says the Federal Reserve’s latest rate hike could cost Americans with credit card debt more than $5 billion in extra interest over the next 12 months.

- Eight of 10 human-resources leaders recently surveyed say they are reducing staff through layoffs, hiring freezes or other tactics, even as the job market remains tight.

- Industry executives say inflation is doing little to discourage consumers from spending heavily on travel and entertainment heading into the holidays.

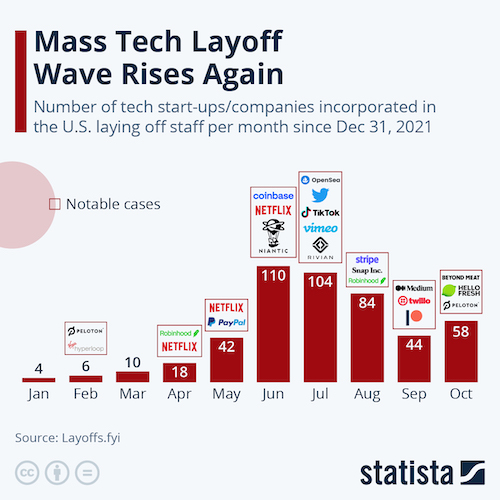

- The U.S. is seeing an abundance of tech talent in the labor pool as major U.S. firms, including Twitter and Lyft, begin laying off employees to cut costs.

- Meta Platforms, parent of Facebook, is the latest company considering layoffs, reportedly planning to let go of thousands of workers this week.

- In the latest news from earnings season:

- Hershey raised its outlook as demand stays strong despite a 7.7% increase in average product pricing in the third quarter.

- Berkshire Hathaway posted over $10 billion in quarterly losses amid volatile financial markets.

- Hefty logistics and material costs nearly halved quarterly profit at Inter IKEA Holding, the manufacturing business at the center of IKEA’s global retailing operation.

- Online furniture seller Wayfair saw its customer base fall by 23% in the third quarter from a year ago.

- Home Depot retail workers voted against forming a union at a location in Pennsylvania, signaling a potential easing of the pandemic’s surge in retail labor activity.

- U.S. regulators are letting JetBlue hold on to valuable flight rights at NYC airports despite the carrier’s failure to meet minimum flight volume.

International Markets

- China saw 4,420 new COVID-19 cases Sunday, a six-month high as lockdowns spread in the factory hub of Guangzhou and other places. Officials say the nation will “unswervingly” stick to its COVID-zero policy, despite rumors to the contrary.

- China approved Pfizer/BioNTech’s COVID-19 vaccine for foreign residents, the country’s first approval of an mRNA shot.

- Hong Kong relaxed COVID-19 restrictions for arriving tour groups.

- Japanese health officials say an eighth wave of COVID-19 is rising.

- Euro zone business activity shrank at the fastest pace since late 2020 in October, according to closely watched surveys. The bloc’s producer prices rose slightly less than expected but were still 41.9% higher than a year ago.

- German industrial orders slumped in October due to weak foreign demand, putting the nation on course for a recession.

- The EU warned it may retaliate against U.S. green tax incentives in the recently passed Inflation Reduction Act.

- Canadian economic activity barely remained in expansion territory in October, according to the latest Ivey Purchasing Managers’ Index. However, job gains were some 10 times higher than forecasts.

- Mexico’s economy is expected to slow in the near term, expanding just 2.1% this year and 1.2% in 2023, according to the IMF.

- Venezuela’s monthly inflation hit 6.2% in October, a sharp slowdown from September’s 28.7%.

- A weeks-long U.S. audit of New York-listed Chinese firms has reportedly ended, raising hopes that many of the firms will stay on U.S. exchanges.

- China’s domestically made C919 aircraft, a rival to single-aisle jets from Boeing and Airbus, will make its public debut this week.

- Global food prices fell slightly in October and were down 14.9% from an all-time high in March, according to the United Nations.

Some sources linked are subscription services.