MH Daily Bulletin: November 3

News relevant to the plastics industry:

At M. Holland

- The use of recycled material was previously limited to plastic products that did not require color. Luckily, new products made from post-consumer recycled (PCR) materials, like carrier resins for masterbatches from M. Holland, can be colored. These resins enable companies to incorporate recycled plastics into their sustainability strategies. Click here to read the blog post.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil rose almost 2% Wednesday on news of another drop in U.S. crude stocks.

- In mid-morning trading today, WTI futures were down 2.1% at $88.11/bbl, Brent was down 1.5% at $64.69/bbl, and U.S. natural gas was down 4.9% at $5.96/MMBtu.

- U.S. crude stocks fell by 3.1 million barrels last week, according to the Energy Information Administration.

- OPEC’s output likely fell in October, putting the group more than 1.3 million bpd below monthly targets.

- U.S. heating costs could soar 28% this winter from a year ago, according to the government. Prices will be especially high in New England, which faces a regional heating oil shortage and high natural gas prices.

- China’s natural gas consumption is on pace to decline this year for the first time in two decades, as the country cedes its position as the world’s top LNG importer to Japan.

- Soaring costs for U.S. energy producers are far from abating, according to Chesapeake Energy. Rival Devon Energy saw its shares fall 13% Wednesday on fourth-quarter forecasts clouded by higher spending on labor, materials and equipment.

- France’s fuel supplies are improving despite 45% of its oil refining capacity remaining offline due to worker strikes.

- Venezuelan oil production fell 25% from September to October to one of its lowest levels of the year.

- More oil news related to the war in Europe:

- Europe’s energy crisis poses the biggest-ever threat to German businesses, surveys indicate.

- Europe risks losing energy-intensive industries as companies permanently shift production to places with cheaper energy, such as the U.S.

- Russia became India’s top oil supplier in October, surpassing both Iraq and Saudi Arabia.

- The White House announced a new aid program to give over $13 billion to low- and moderate-income Americans looking for help paying energy bills or making their homes more efficient.

- Oil and gas companies are asking the U.S. government to exempt hundreds of thousands of the nation’s smallest wells from upcoming rules requiring drillers to find and plug leaks of methane.

Supply Chain

- Hurricane Lisa made landfall in Belize Wednesday and is forecast to bring heavy rains across Central America and Mexico in the coming days. Gulf of Mexico oil production could also be affected, forecasters say.

- Political protests blocking key roadways in Brazil are starting to ease.

- With a temperature average of 63°F, France saw its hottest October since records began in 1945, consistent with Europe’s unusually fast pace of warming temperatures compared with the rest of the world.

- Maersk notched bumper profit of $8.8 billion in the third quarter but said peak freight rates have passed and global container demand will fall more than expected this year.

- Maersk expects revenue from its logistics services to surpass its ocean business by the middle of the decade with “dark clouds on the horizon” for global shipping demand.

- The Logistics Managers’ Index of capacity rose to 73.1 in October, indicating capacity grew at the fastest pace on record. Meanwhile, an index of U.S. supplier deliveries fell to 46.8 for the month, showing that manufacturing activity is slowing and deliveries are moving at the fastest pace in over a decade, according to the Institute for Supply Management.

- Over 60% of American businesses have started reshoring or near-shoring their production in reaction to supply snarls and geopolitics, according to Deloitte.

- Qualcomm saw quarterly sales rise 22% but warned of sharply falling demand for smartphone shipments in the months ahead.

- Advanced Micro Devices forecast a 14% rise in fourth-quarter sales, a sharp contrast to expected sales declines at Intel and Nvidia.

- In the latest news from the auto industry:

- Tesla plans to start mass production of its Cybertruck pickup at the end of 2023.

- Tesla closed its flagship showroom in China to pare retail costs.

- Strong demand for luxury vehicles boosted quarterly profit at Bentley and Ferrari, while Aston Martin struggled under persistent supply-chain issues.

- Higher electric vehicle sales led Volvo to a 7% sales gain October.

- Subaru predicts U.S. demand for new vehicles will remain strong despite rising prices and interest rates.

- Britishvolt, a struggling electric vehicle battery startup based in northeast England, has been given several more weeks to secure long-term funding to avoid insolvency.

- China’s luxury electric vehicle maker Geely plans to start selling in Europe next year.

- Prices for platinum and palladium, key materials for vehicle exhaust systems, will fall next year as economic pressures slow demand, analysts say.

- Procter & Gamble executives say the company will keep raising prices to offset higher freight and commodity costs.

- DHL’s e-commerce unit will hire 2,000 sorters and encoders to handle holiday demand this year.

- Amazon is pushing back the opening of a Detroit fulfillment center until next year.

- A Vietnamese company halted the launch of the country’s all-cargo airline due to weak demand.

- Overstocked retailers are cutting back on lenient pandemic-era return policies heading into the holiday season.

- The U.S. is facing a shortage of common antibiotic amoxicillin.

- The recent dip in Europe’s natural-gas prices is letting fertilizer companies restart production after slashing output earlier this year, a boon for farmers.

- Russia abruptly resumed participation in a deal to allow Ukrainian grain exports from the Black Sea. Some insurers have resumed coverage for ships in the region.

- Exxon Mobil, LyondellBasell and Cyclyx International are pairing up to build an advanced plastics recycling facility in greater Houston by 2024.

Domestic Markets

- The U.S. reported 72,836 new COVID-19 infections and 742 virus fatalities Wednesday.

- Scientists are closely watching new COVID-19 strains that appear to combine the deadly effects of Delta with the infectiousness of Omicron.

- The U.S. Federal Reserve raised its key interest rate another 75 basis points Wednesday, its sixth hike this year and fourth consecutive 75-point jump. Officials suggested future hikes will be more modest, although the ultimate top-end borrowing rate could end up higher than initially thought.

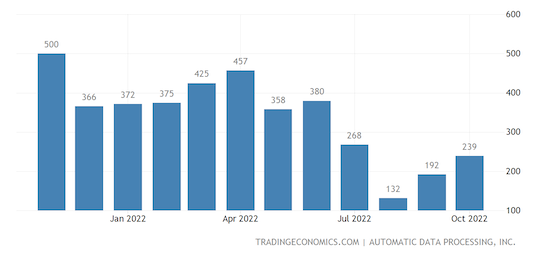

- Led by leisure and hospitality, U.S. private-sector payrolls rose by a larger-than-expected 239,000 in October, according to ADP:

- The International Monetary Fund is considering raising its forecast for U.S. growth after the nation’s stronger-than-expected third-quarter GDP data.

- Mortgage volumes at Wells Fargo are collapsing, sparking concerns the lender will start cutting employees.

- U.S. airfares rose 43% year over year in September in what airline executives call the new normal of pricing. Rates could remain high for other forms of transport, too, including ride hailing.

- The pilots’ union for American Airlines rejected a new contract offer Wednesday.

- Yum Brands, owner of KFC and Taco Bell, beat Wall Street estimates on a 5% gain in global sales led by its value deals.

- Estée Lauder’s sales fell 5% last quarter, hurt by lockdowns in China and weaker demand from overstocked U.S. retailers.

- eBay’s quarterly results beat Wall Street targets as inflation-wary shoppers snapped up refurbished goods and the e-commerce firm expanded its luxury offerings.

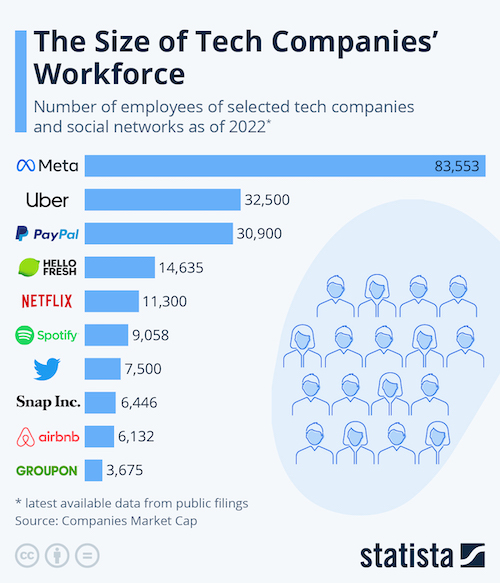

- Twitter’s new ownership plans to cut about 3,700 jobs, or half the company’s workforce, to drive down costs.

- CVS, Walgreens and Walmart agreed to pay about $13.8 billion to resolve thousands of U.S. state and local lawsuits accusing them of mishandling opioid pain drugs.

- Starbucks plans to fully revamp its U.S. café model as decade-old facilities struggle to keep up with consumer demand.

- Thousands of firms will fail to meet pledges to combat climate change without more employee training on sustainability, Microsoft says.

- The world’s biggest consumer goods companies are falling behind on sustainable plastic packaging efforts, analysts say.

- A new law in New York will require manufacturers to offer free and convenient electronics recycling starting in January.

International Markets

- New COVID-19 cases globally fell 17% last week from the prior week, while virus fatalities were down 5%.

- Moody’s downgraded its outlook for banks in Germany, Italy and four other countries, as Europe’s energy crisis and high inflation weaken their economies.

- The pandemic and the war in Ukraine have collectively cost the German economy over $415 billion in lost value creation.

- Hong Kong and most Gulf states were the quickest to announce interest-rate hikes in lockstep with the U.S. Federal Reserve Wednesday.

- The Bank of England raised rates by 75 basis points today, its largest increase since 1989.

- Asian equities saw meager inflows in October after a massive selling spree in reaction to new U.S. export controls on China and China’s slow economic recovery.

- Venezuela’s 12-month inflation now stands at 114.1%.

- Russia’s economy shrank by 5% on an annualized basis in September, new data shows.

- European budget airline Wizz Air will expand capacity by 35% this winter on forecasts of strong travel demand.

- Passenger numbers on Russian airlines were down 20% in September from a year ago on continued fallout from Western sanctions.

- The largest pilots’ union of Latam Airlines in Chile voted to strike Wednesday, a day before the company said it was planning on concluding its exit from bankruptcy.

- Chemicals maker DuPont scrapped its $5.2 billion buyout of engineering materials maker Rogers Corp after the deal failed to clear Chinese regulatory hurdles, a pattern likely to be repeated with other deals requiring China’s approval.

- On Wednesday, Canada ordered three Chinese firms to divest their interests in Canadian critical mineral companies on grounds of national security.

- Canada Goose lowered its full-year outlook as persistent lockdowns and store closures in China hurt business.

Some sources linked are subscription services.