MH Daily Bulletin: November 2

News relevant to the plastics industry:

At M. Holland

- The use of recycled material was previously limited to plastic products that did not require color. Luckily, new products made from post-consumer recycled (PCR) materials, like carrier resins for masterbatches from M. Holland, can be colored. These resins enable companies to incorporate recycled plastics into their sustainability strategies. Click here to read the blog post.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil rose 2% Tuesday, buoyed by optimism that China could reopen from strict COVID-19 curbs.

- In mid-morning trading today, WTI futures were down 0.1% at $88.32/bbl, Brent was down marginally at $94.61/bbl, and U.S. natural gas was up 7.3% at $6.13/MMBtu.

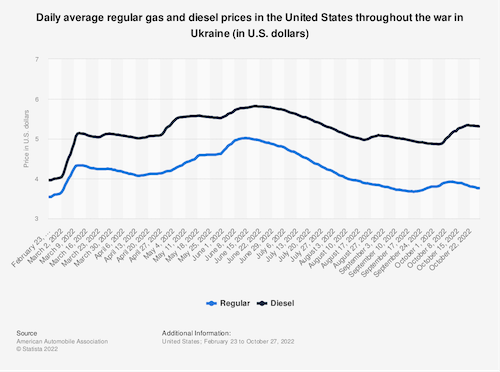

- U.S. gasoline prices rose for the first time in two weeks to an average of $3.76 a gallon last Friday.

- U.S. crude stocks fell by 6.5 million barrels last week, the American Petroleum Institute said. Government data is due today.

- U.S. upstream oil investment is still more than 45% below its 2014 peak and could be sowing seeds for a future energy crisis, OPEC says.

- U.S. LNG exports rose only slightly from September to October due to plant outages, while producers shifted more cargo to Asian buyers as European storage capacity approaches full.

- U.S. regulators are urging Freeport LNG to provide more information on its plans to restart its fire-damaged export plant in Texas, the nation’s second largest, in advance of a scheduled mid-November start date.

- Marathon and Phillips 66 became the latest U.S. refiners to smash quarterly estimates on robust fuel demand and high margins. Marathon raised its dividend by 30%.

- More oil news related to the war in Europe:

- German officials followed up on Monday’s proposal to cap natural gas prices with a new plan to put a ceiling on household and industrial electricity prices.

- Russian oil production was well short of targets in October, while its natural-gas exports to Europe and Asia have plummeted more than 40% year to date.

- Tuesday saw power restored to Kyiv, Ukraine, following a bombardment of Russian missiles that shut off its supply.

- BP will pay $2.5 billion in windfall taxes for its British North Sea business this year, the firm predicts.

- Occidental Petroleum formed a new partnership to build the world’s biggest carbon-capture plant in the U.S. Permian Basin.

- The U.S. teamed up with the UAE in an effort to attract $100 billion for investment in clean energy projects worldwide.

- U.S. nuclear firm Westinghouse, soon to be acquired by Canada’s Cameco for $7.9 billion, will build Poland’s first nuclear plant with a planned start date in 2033.

Supply Chain

- Intensifying political protests following Brazil’s presidential election are blocking Brazilian distribution lines for fuel, meat and grains, a situation authorities are calling “critical.”

- Ocean container spot rates were down to roughly $2,720 per FEU last week from pandemic highs of nearly $20,000.

- Maersk is offering shippers the opportunity to slow cargo arrivals from Asia to the U.S. and Europe, a bid to help retailers manage bloated inventories.

- Japan’s Ocean Network Express says profitability could shrink as much as 60% in the second half of its fiscal year ending in March.

- Sales at shipbuilder Samsung Heavy Industries fell 5.7% in the third quarter, causing a loss of $142 million.

- Container leaser Seaspan will be bought out by major shareholders and Japan’s Ocean Network Express for $10.9 billion.

- Truckload carriers are acknowledging that the historic strength of the recent freight cycle has diminished faster than expected.

- XPO Logistics carved out its freight brokerage and last-mile business on Tuesday.

- Profit for the cargo unit of German carrier Lufthansa rose 10% year over year in the third quarter to $331 million.

- China’s air freighter fleet will quadruple in size to more than 800 jets over the next two decades, Boeing estimates.

- Average vacancy rates at European warehouses fell to a record-low 2.3% in the third quarter, according to real estate adviser CBRE.

- In the latest news from the auto industry:

- October sales rose for Toyota (+28%), Hyundai (+7%) and Kia (+12%) behind higher demand for electric vehicles and healthy retail sales.

- Tesla is sending Chinese engineers from its Shanghai factory to its plant in Fremont, California, to boost production at the U.S. facility.

- Harley-Davidson’s newly listed LiveWire unit is struggling to attract buyers for its electric motorcycles.

- Illinois-based auto supplier Tenneco, subject of a takeover offer from Apollo Global Management, renewed plans to relocate to Detroit after scrapping the move two years ago.

- BASF plans to start production at its new electric vehicle battery site in eastern Germany by the end of the year.

- Electric vehicle battery-makers could struggle to secure raw materials as lithium demand spikes over the next few years, analysts say.

- U.S. lithium producer Livent Corp cut its full-year forecast as inflation and other economic pressures weigh on output.

- Advanced Micro Devices saw a steep drop in desktop chip demand while revenue at its data-center business surged in the third quarter.

- Tata Group is hiring tens of thousands of workers at a factory in southern India as part of a push to win more business from Apple.

- Amazon’s business in Vietnam is growing rapidly despite sagging demand elsewhere.

- UPS is building a logistics-as-a-service unit that will offer logistics expertise to help companies manage their transportation networks.

- Ukraine is pushing forward with Black Sea grain exports despite threats from Russia that ships aren’t safe using the route and as insurers pull back from issuing new coverage for ships in the region. Russia’s defense minister reportedly said today his country will resume honoring the “humanitarian grain corridor” brokered by Turkey and the U.N.

- Argentina could soon let wheat exporters delay committed shipments without penalty as drought impacts the nation’s crops and creates domestic supply concerns.

Domestic Markets

- The U.S. reported 36,332 new COVID-19 infections and 399 virus fatalities Tuesday.

- Omicron subvariants BQ.1 and BQ.1.1 surpassed the BA.5 strain as the most dominant in New York last week.

- Pfizer says a pipeline of promising drugs will drive growth even as overall demand for its COVID-19 vaccine declines.

- Wealthy Americans paid 97% more in estate tax in 2021 as death rates as well as estate values rose during the pandemic.

- The Dow Jones Industrial Average notched its best October on record with 14% growth.

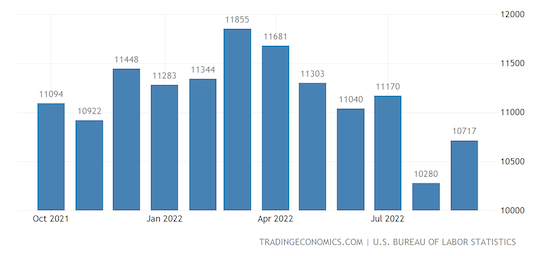

- U.S. job openings unexpectedly rose to 10.7 million in September, suggesting the labor market remains tight:

- There are now 1.85 jobs available for each unemployed worker.

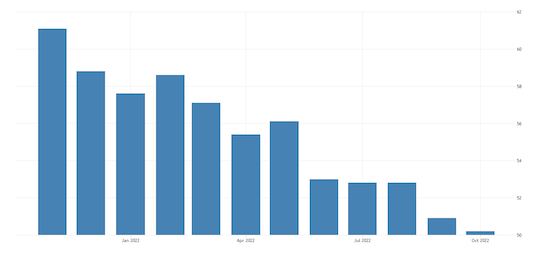

- U.S. manufacturing activity grew at the slowest pace in 2.5 years in October, barely remaining in expansion territory.

- Prices paid by U.S. businesses for inputs fell for a seventh month in October, driven by retreating commodity prices, according to the Institute for Supply Management.

- U.S. construction spending took a surprise turn upward in September:

- Inflation will drastically increase the cost of Thanksgiving dinner this year, according to the latest pricing data, prompting consumers to downsize celebrations and streamline menus.

- A union of 10,000 United pilots overwhelmingly rejected a contract proposal Tuesday, just one day after the group authorized a potential strike.

- Amazon’s market value dipped below $1 trillion Tuesday for the first time since the early pandemic.

- In the latest news from earnings season:

- Uber shares soared after the ride-hailer’s quarterly revenue rose 72% from a year earlier, bolstered by higher prices. Profits from the company’s Uber Freight digital freight business fell to $1 million from $5 million the prior quarter.

- Airbnb’s quarterly growth slowed to 29% on impacts of the stronger U.S. dollar and a slowdown in bookings.

- Snack-food-maker Mondelez lifted its full-year outlook after quarterly sales rose 8.1%.

- Insurer AIG saw a 39% profit decline on investment losses and large bills from Hurricane Ian.

- Eli Lilly lowered its annual forecast after quarterly revenue moderated to a 2% gain.

- Third-quarter sales at industrial parts supplier Grainger rose 16.9% to $3.9 billion.

- Johnson & Johnson will buy heart-pump-maker Abiomed in a $16.6 billion deal, its biggest acquisition in years.

- Google is signing more renewable supply deals in a bid to operate its data centers on carbon-free energy by 2030.

- Amazon launched a merchant cash-advance program that it says will help small and midsize businesses continually facing cash crunches.

- More dry shampoo brands are facing scrutiny for high levels of cancer-causing benzene, the chemical that led Unilever to pull products from shelves in October.

- CRDC Global says it has opened the only factory in North America that can convert difficult-to-recycle plastic waste into a new concrete additive called RESIN8.

International Markets

- China ordered a seven-day lockdown in the area surrounding Foxconn’s main factory in Zhengzhou, the world’s largest maker of Apple iPhones, which will further disrupt output and shipments.

- Chinese electric-vehicle-maker Nio suspended production due to tightening COVID-19 restrictions in the country.

- Yum China Holdings, which operates KFC, Pizza Hut and Taco Bell restaurants in the country, temporarily closed over 10% of its stores in October due to COVID-19 restrictions.

- Canada will admit a record number of new immigrants in the coming years as the country looks to remedy an acute labor shortage.

- A U.S.-Canada diplomatic spat over border security has prevented a full return of the Nexus border program, which expedites entry of hundreds of thousands of business travelers.

- Canadian factory output remained in contraction territory in October, while Mexico’s expanded slightly.

- British manufacturing saw its biggest contraction since the early pandemic in October, with S&P Global’s index falling from 48.4 to 46.2. Readings below 50 indicate economic contraction.

- New LinkedIn data suggests the remote-working wave has peaked and started declining in Britain.

- Brazilian exports grew by an annual 27.1% in October, driven by a large increase in shipments to China.

Some sources linked are subscription services.