MH Daily Bulletin: November 1

News relevant to the plastics industry:

At M. Holland

- The use of recycled material was previously limited to plastic products that did not require color. Luckily, new products made from post-consumer recycled (PCR) materials, like carrier resins for masterbatches from M. Holland, can be colored. These resins enable companies to incorporate recycled plastics into their sustainability strategies. Click here to read the blog post.

- M. Holland is sponsoring the Association of Rotational Molders (ARM) Annual Meeting in Atlanta on Nov. 6-9! Please stop by Booth #19 to meet our team of Rotational Molding experts and learn more about our product offerings and grinding capabilities.

Supply

- Oil fell more than 1% Monday on weak economic data out of China, raising fears of lower demand.

- In mid-morning trading today, WTI futures were up 2.0% at $88.25/bbl, Brent was up 1.8% at $94.42/bbl, and U.S. natural gas was down 7.5% at $5.88/MMBtu.

- U.S. gasoline prices fell for the third consecutive week, now averaging $3.72 per gallon.

- U.S. oil output climbed to nearly 12 million bpd in August, the highest of the pandemic.

- Productivity and volume gains in the U.S. Permian Basin are slowing, according to top U.S. producers.

- Exxon Mobil and Chevron, the two largest U.S. oil firms, aren’t signaling any plans to increase production as they report big quarterly profits.

- The White House is stepping up calls for a windfall tax on oil and gas companies if they don’t use their profits to help lower energy costs for consumers.

- China’s crude imports fell an annual 4.3% in the first three quarters of the year, the first decline since at least 2014.

- OPEC raised its forecast for medium- and long-term oil demand and said $12.1 trillion of investment is needed to meet demand despite the quickening energy transition.

- Retail diesel is at the highest level relative to gasoline in well over a decade as parts of Europe and the U.S. run short of supply.

- BP more than doubled its third-quarter profit to $8.15 billion and expanded its share buybacks to $2.5 billion, joining other rivals in reporting bumper earnings.

- Saudi Aramco posted a 39% jump in quarterly profit as high prices boosted earnings.

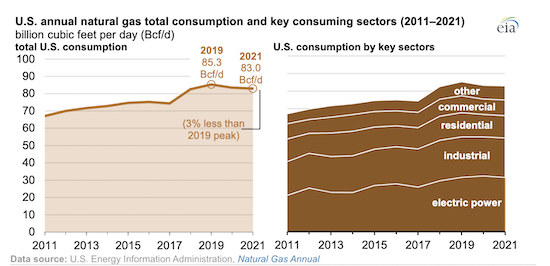

- U.S. natural gas consumption reached a record 85.3 Bcf/d in 2019 and has declined annually since then:

- More oil news related to the war in Europe:

- Beginning Dec. 5, the U.S. and its allies will prohibit companies from providing maritime services to shipments of Russian oil unless the oil is sold below a set price.

- Europe will need to rely on extra oil from the U.S. next year to make up for a loss of supplies from Russia, Italy’s Eni said.

- Norway is boosting its maritime surveillance as it works to secure vital energy infrastructure in the North Sea.

- German officials proposed a cap on natural gas prices Monday as households pay 2.5 times more than a year ago.

- German industry cut its gas consumption by nearly one-fifth last month amid the continent-wide energy crisis.

- Ukraine is warning of widespread blackouts as Russian shelling continues to hit its key energy infrastructure.

- Moscow is behind schedule on redirecting some 1.4 million bpd of crude for which it will need to find new buyers by year’s end.

- Nigeria is launching an auction for deep offshore oil and gas licenses for the first time in 15 years.

- China has plans to build at least 165 GW of new coal-fired power plants by 2024, more than the rest of the world combined.

- The U.S. administration designated two areas in the Gulf of Mexico for the development of offshore wind projects with a combined capacity to power 3 million homes.

- Mexico and the U.S. are working on ambitious plans to turn parts of the border region into a clean energy hub of solar and wind farms that could help power local manufacturing.

- Kazakhstan signed a $50 billion deal with European renewables group Svevind to build a massive hydrogen production facility.

Supply Chain

- La Nina will bring warmer-than-average temperatures to large swaths of the U.S. for the third consecutive winter.

- Decade-low water levels on the Mississippi River are endangering transports for U.S. farmers, including vital soybean shipments.

- Tropical Storm Lisa is expected to evolve into a hurricane in the Caribbean later this week.

- More truckers joined political protests in Brazil Monday, blocking roads throughout the country and threatening exports from one of the world’s top food producers.

- Port truckers in Southern California are scrambling to pick up loads as container imports decline.

- Third-quarter U.S. intermodal volumes fell 1% year over year on a 27.7% decline in intermodal trailer traffic.

- XPO Logistics posted its last quarterly earnings as a transportation conglomerate, reporting better-than-expected earnings per share.

- Japanese liner Ocean Network Express reported a massive $5.5 billion quarterly profit as high freight rates offset a “sudden decline” in demand.

- Over 40 projects in 22 U.S. states won some $703 million from the federal government to improve port infrastructure. The latest awards include $5 million for New York City, $30.1 million for the Port of Long Beach to deploy zero-emissions cargo-handling equipment and $23.5 million for the Port of Jacksonville.

- Small container vessels will likely be first on the chopping block as carriers shrink their fleets amid overcapacity concerns, analysts say.

- China’s Cosco Shipping ordered 12 methanol-powered container ships for $2.9 billion.

- Ship operator Grimaldi Group ordered 10 car carriers designed to transport electric vehicles.

- In the latest news from the auto industry:

- Toyota posted a worse-than-expected 25% drop in quarterly profit and cut its annual output target as shortages of older but vital computer chips persist.

- New car prices have declined from July peaks as auto inventories gradually return.

- Geopolitical tensions could limit the expansion of electric vehicle battery production across the globe, experts say.

- Europe continues to encourage the U.S. to expand electric vehicle tax incentives beyond North America, with top trade officials expected to meet this week.

- Federal authorities are investigating U.S.-based self-driving startup TuSimple over whether it improperly financed and transferred technology to a Chinese startup.

- Ford opened a $260 million global tech and business center on the outskirts of Mexico City.

- Panasonic will break ground for its new battery plant in Kansas this month, with mass production set to begin by early 2025.

- Electric vehicle maker Nikola is working with KeyState Natural Gas Synthesis to build Pennsylvania’s first low-carbon hydrogen production supply chain by 2026.

- The United Auto Workers is seeking permission to hold a union election at a new battery plant in Ohio co-owned by GM.

- Rolls-Royce unveiled its first fully electric luxury vehicle.

- Turkey aims to sell its first domestically produced electric vehicle across Europe starting next year.

- Foxconn is moving some iPhone production out of its COVID-hit facility in Zhengzhou, China, in an effort to maintain production.

- The global smartphone market has recorded three straight quarters of declining shipments, as consumer demand for discretionary products falls.

- Northern California’s Port of Humboldt Bay is gearing up to become the West Coast’s first hub for offshore wind energy installations.

- Unusual weather patterns have curtailed global wine production this year.

- A German trade union called on several thousand workers to strike today at 15 sites, including an Airbus factory in Hamburg.

Domestic Markets

- The U.S. reported 44,437 new COVID-19 infections and 123 virus fatalities Monday.

- COVID-19 hospitalizations are surging in New York City, where some 11,000 people were in hospital with the virus last week, up from about 750 in mid-September.

- COVID-19 subvariants BQ.1 and BQ.1.1 now account for 27% of infections in the U.S., a sharp jump from last week.

- An estimated 2% of U.S. adults may have long-COVID, new research suggests.

- The U.S. Supreme Court upheld the TSA’s authority to impose mask mandates on flights and other forms of transit during national emergencies.

- The Federal Reserve is expected to deliver a fourth consecutive interest-rate hike of 75 basis points when it meets tomorrow and Wednesday.

- The U.S. Treasury will issue $550 billion in debt this quarter, up $150 billion from an August estimate.

- On average, Americans are spending 12% more at the grocery store compared to last year, the largest 12-month increase since 1979.

- More than one-third of U.S. small businesses were unable to pay their rent in full in October as inflation raised other costs and expenses.

- With mortgage rates now above 7%, just 133,000 U.S. homeowners can save money by refinancing at today’s rates, down from a peak of over 19 million in late 2020.

- U.S. airline traffic is running above pre-COVID-19 levels for the first time since the beginning of the pandemic.

- Pilots at Delta Air Lines voted to authorize a strike if negotiators cannot reach agreement on a new employment contract.

- Under new leadership, Twitter will cut 25% of its workforce in an initial round of layoffs.

- A federal judge has blocked Penguin Random House from acquiring rival book publisher Simon & Schuster for about $2.18 billion, citing antitrust concerns.

- Thermo Fisher Scientific will buy Binding Site Group for $2.6 billion, boosting its specialty diagnostics business.

International Markets

- Chinese cities are stepping up zero-COVID curbs as outbreaks widen.

- Macau, where 19 COVID-19 cases have been reported over the past week, mass tested all of its 700,000 residents.

- China began rolling out the world’s first inhalable COVID-19 vaccine in Shanghai last week.

- More than a dozen variants of the COVID-19 Omicron strain could be the cause of new virus waves across the globe this winter, what health officials are calling a “variant soup.”

- Top Canadian executives issued a letter urging the government to bring state employees back to the office amid a decline in public services that is affecting the business community.

- The euro zone is likely entering recession after its October business activity contracted at the fastest pace in nearly two years, according to S&P Global.

- Global employment growth will slow this quarter amid fallout from geopolitics and tighter monetary policy, economists say.

- U.S. officials are reportedly urging the EU to impose its own export controls on China.

- Manufacturing activity was down across Asia in October.

- Factory activity in China remained in contraction territory in October, according to the Caixin/S&P Global manufacturing purchasing managers’ index.

- China’s property market continued to slump in October, with prices and sales falling.

- The economy of Hong Kong shrank 4.5% in the third quarter, its worst performance in two years. The island’s available office space has tripled over the past three years amid dimming appeal for global firms.

- South Korea’s October exports fell 5.7% from a year ago, the sharpest decline since August 2020 on slumping demand from China.

- Japan spent a record $42.8 billion on currency intervention in October to prop up the yen.

- Britain’s currency is starting to stabilize as turbulence in U.K. politics over the last few weeks subsides.

- Portugal’s economic growth accelerated to 0.4% in the third quarter thanks to an unexpected rise in private consumption.

- Russia is set for the deepest recession of any large economy this year.

- More countries in Asia are resuming international flights, although airspace restrictions over Russia are causing long and costly detours.

- Central Asian demand for jet fuel is soaring as the region replaces Moscow as a key air traffic hub.

- Icelandair is seeking to become the first national airline to operate all its domestic routes with emissions-free aircraft by the end of the decade.

- Sony’s gaming business saw a 49% fall in quarterly profit after booking higher costs from game development and acquisitions.

Some sources linked are subscription services.