MH Daily Bulletin: May 25

News relevant to the plastics industry:

At M. Holland

- M. Holland is excited to be the Headline Sponsor for the Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

- M. Holland will be closed Monday, May 30 for the Memorial Day holiday.

Supply

- Oil prices moved little Tuesday for the second consecutive day. In mid-morning trading today, WTI futures were down 0.3% at $109.50/bbl, Brent was down 0.2% at $113.30/bbl, and U.S. natural gas was up 3.9% at $9.14/MMBtu.

- The White House said it would not rule out export restrictions to ease soaring domestic fuel prices.

- Travel during U.S. Memorial Day weekend is expected to be the busiest in two years despite record-high gas prices.

- U.S. crude stocks rose by 567,000 bpd last week, according to the American Petroleum Institute. Government data will be released today.

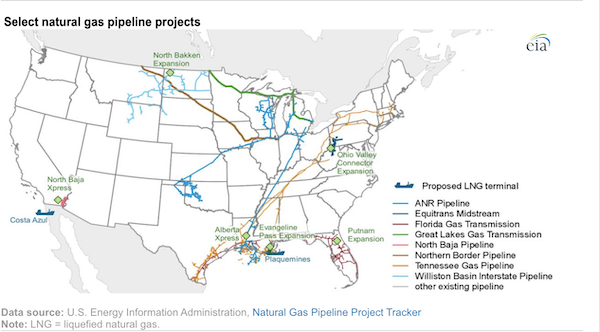

- Federal regulators approved three projects in the first quarter to increase U.S. natural gas exports via pipeline:

- More oil news related to the war in Europe:

- EU officials suggested a Russian oil embargo may not be reached for weeks, while Germany’s economy minister said an agreement could be made within days.

- The U.S. is poised to renew Chevron’s license to operate in Venezuela with few changes from the firm’s previous restricted license.

- Crude oil throughput among Indian refiners rose 8.5% in April on a surge in Russian imports.

- The UAE is shipping crude toward Europe for the first time in two years.

- Gasoline prices surged to a record-high in Britain Monday even after the government recently cut fuel duties.

- British consumers will face a sharp jump in power bills just before winter when an energy price cap expires.

- Italy’s Eni teamed up with TotalEnergies to drill an exploration gas well off the coast of Cyprus this week.

- Shareholders of Shell approved the firm’s goal of reaching net-zero emissions by 2050.

Supply Chain

- Risk conditions for wildfires in the U.S. Southwest have remained at elevated levels for weeks, primarily in New Mexico.

- California ordered its urban water suppliers to impose restrictions on usage after residents shrugged off the governor’s guidelines earlier this year.

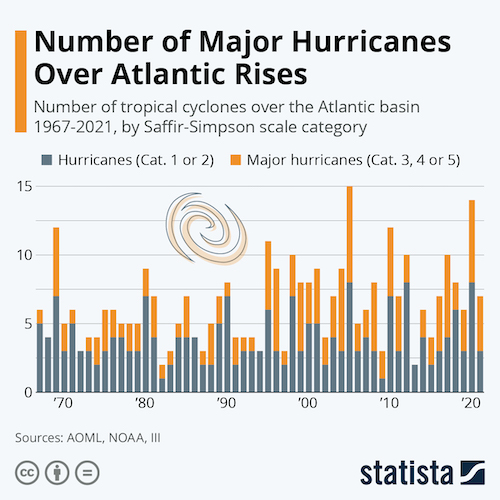

- The Atlantic is poised for its seventh straight overactive hurricane season, with forecasters expecting up to 21 named storms.

- America’s logistics networks are stretched to their limit just as retailers and manufacturers are set to begin their seasonal rush of imports ahead of the fall and winter holidays.

- The Port of Long Beach is expanding its Supply Chain Information Highway for cargo tracking to other Western ports, with hope to expand it coast-to-coast.

- U.S. rail freight carriers laid off 45,000 employees — nearly 30% of their combined workforce — over the last six years, contributing to current disruptions that are delaying raw material shipments and driving up prices.

- UPS imposed a 30-cent surcharge on its standard ground-delivery service from the U.S. to Canada and raised surcharges on six expedited services in the northbound U.S.-Canada market.

- Toyota will cut its global production plan by 100,000 to roughly 850,000 vehicles in June due to semiconductor shortages.

- Russia’s top carmaker Avtovaz plans to resume production in early June after months of electronics shortages since the nation’s invasion of Ukraine.

- U.S. companies borrowed 7% more in April to finance equipment purchases compared to a year earlier, as firms ramped up production to meet demand.

- Germany’s Lufthansa is looking to acquire a 20% stake in Italy’s state-owned ITA Airways, while its partner Mediterranean Shipping Co. bids for a 60% stake.

- Abbott Laboratories will release about 300,000 cans of a specialty infant formula for children in urgent medical need, while U.S. regulators cleared the import of about 2 million formula cans from the U.K.

- The EU is pressuring Russia to unlock wheat exports trapped in Ukraine because of Russia’s sea blockade. Forced re-routings of Ukrainian grain shipments are clogging ports in Poland.

- The growing number of countries putting export curbs on food could further raise prices, already 30% higher in April from a year ago.

Domestic Markets

- The U.S. reported 110,870 new COVID-19 infections and 349 virus fatalities Tuesday. The country is averaging over 100,000 cases per day for the first time since February.

- The U.S. saw 15% more deaths than normal during the first two years of the pandemic.

- The highly transmissible BA.2.12.1 subvariant of Omicron now makes up 58% of all new COVID-19 cases in the U.S.

- Weekly COVID-19 cases in New York rose 5% last week to 71,647.

- Chicago is expected to reach the CDC’s highest COVID-19 risk level by week’s end.

- One in five COVID-infected adults has experienced at least one symptom that could be considered long-COVID, health experts say.

- Neurological effects of long-COVID can persist for more than a year even as other symptoms abate, new research suggests.

- The Atlanta Federal Reserve president said a pause in rising interest rates could come in September if inflation declines more than expected over the summer.

- Executives at Bank of America say U.S. consumers have money to spend and will likely be undeterred by inflation and economic gloom.

- Sales of new homes tumbled 16.6% in April following the fastest rise in mortgage rates for any four-month period since 1981. Still, home prices are expected to rise by double-digit percentages this year, which could price out over half of people trying to buy a home.

- More Americans are quitting their jobs and staying at new jobs for less than 12 months before quitting again, new data shows.

- Just 22% of people approaching retirement age say they will have enough money to maintain a comfortable standard of living, down from 26% a year ago.

- U.S. tech stocks fell sharply Tuesday following disappointing quarterly results at Snap, owner of Snapchat and other social media sites. All but one major online advertiser has reported slowdowns in quarterly revenue.

- Ride-hailer Lyft will join rival Uber in slowing hiring and reducing department budgets amid a cooling of investor optimism on tech stocks. Lyft’s shares are down 60% this year.

- Wendy’s shares rose 17% after its largest shareholder said it was exploring an acquisition for the restaurant to improve sales and deal with rising costs.

- Starbucks is selling its cold-pressed juice brand to put greater focus on its coffee-drink business and its retail experience.

- Bank of America will give a $4,000 reimbursement to employees who buy an electric vehicle.

- Stellantis and Samsung are partnering to build a $2.5 billion battery plant in Indiana.

- BMW’s all-electric version of its luxury flagship 7-Series sedan will have 536 horsepower and 300 miles of range on a single charge.

- Vietnamese carmaker VinFast is shifting its legal and financial headquarters to Singapore as it readies to produce its first vehicles for the U.S. and Europe.

- A French industrial gas company opened its largest liquid hydrogen production and logistics facility in North Las Vegas to supply growing needs for hydrogen-fueled vehicles.

- The U.S. Navy unveiled a new climate strategy aimed at improving its resilience against rising sea levels and coastal erosion, along with quickening a shift to low-carbon fuels and hybrid engines.

International Markets

- Shanghai reported 480 new COVID-19 infections Tuesday, a 14% drop from Monday as lockdowns are due to be lifted in a little more than a week.

- Another 1,800 people were forced into quarantine in Beijing, while the nearby port city of Tianjin locked down its city center amid a small flareup of COVID-19.

- Taiwan is registering over 80,000 COVID-19 cases per day after seeing just 15,000 for the entirety of 2021.

- The highly transmissible BA.2.12.1 subvariant of Omicron appeared in Hong Kong, although officials doubt it will trigger a new virus wave.

- Germany will suspend COVID-19 entry rules for travelers this summer.

- Pfizer will provide nearly two dozen products, including its top-selling COVID-19 vaccine and treatment, at cost in some low-income countries.

- Service sector activity in the U.S., eurozone, U.K. and Australia all grew more slowly in May amid rising prices, according to S&P Global surveys.

- A global survey of 52,000 workers in 44 countries show at least 20% plan to change jobs in the next year.

- The number of Canadians who say their finances are worse today than a year earlier reached 41%, nearing a 14-year high.

- Hyundai plans to invest nearly $50 billion in South Korea through 2025 to strengthen its presence in several markets, including electrification, robotics, urban air mobility and automation.

- More news related to the war in Europe:

- The U.S. Treasury Department moved to cut off Russia’s payments on its dollar-denominated foreign-debt, putting the nation on a path toward default this summer.

- Hungary’s prime minister declared a wartime state of emergency Tuesday, allowing the country to take quicker unilateral steps in response to Russia’s invasion.

- China rolled out a broad package of measures to support businesses and stimulate demand as it seeks to offset damage from lockdowns, including $21 billion in tax rebates and over $40 billion in railway construction bonds. Economists say the nation’s GDP will rise 4.5% this year, a percent lower than official targets.

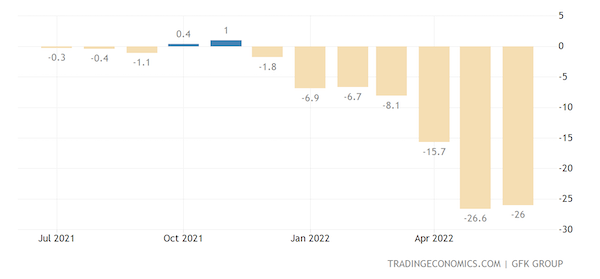

- Consumer sentiment continued to drop sharply this month in Germany to all-time lows, according to the GfK Consumer Climate Indicator:

- India’s Serum Institute, the world’s biggest vaccine maker, is considering setting up its first manufacturing plant in Africa following its success in selling COVID-19 shots.

- Electric vehicle battery startup Britishvolt is buying a German battery maker for $38.6 million to help it scale up production.

- Uber will add 12,000 drivers in more than 80 Italian cities after striking a deal with the nation’s largest taxi dispatcher.

- Austria is the latest government to enter the green bond market with a $4.3 billion debt sale on Tuesday, which will be used to fund environmentally friendly projects.

- Researchers say governments must put greater focus on reducing other types of emissions besides carbon to effectively fight climate effects.

- Countries around the world raised $84 billion last year by charging firms for emitting carbon dioxide, up 60% from 2020. Analysts say prices are still not high enough to curb climate change and that gathering economic headwinds could further deter progress.

- Banks and insurers that fail to manage climate risks could face a 15% hit to annual profits and higher capital requirements, the Bank of England said.

Some sources linked are subscription services.