MH Daily Bulletin: May 20

News relevant to the plastics industry:

At M. Holland

- Lindy Holland-Resnick, Market Manager for Packaging at M. Holland, is presenting during the upcoming Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio. Her session on Developing a Sustainably Minded Staff will cover how to create a holistically sustainable company from top to bottom. If you’re attending Re|focus, don’t miss Lindy’s session on Tuesday, May 24 at 11:15 am ET.

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show. Admission is free:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices saw volatile trading Thursday, rising 2.5% on signs of higher demand from China.

- In mid-morning trading, WTI futures were up marginally at $112.30/bbl, Brent was flat at $112.00/bbl, and U.S. natural gas was down 3.1% at $8.05/MMBtu.

- The average U.S. gasoline prices hit $4.59 a gallon yesterday, the 10th straight daily record as travel approaches pre-pandemic levels. The House of Representatives passed a bill to prevent price hikes during severe market disruptions, which is expected to stall in the Senate.

- Spot power and natural gas prices soared to a yearly high in several parts of the U.S. yesterday amid a broad spring heat wave.

- Low inventories of oil products and a shortage of refining capacity could cause oil shortages in parts of the U.S., analysts say. At least 10 gas stations in eastern Washington state are already sold out of gasoline and some are only selling diesel.

- U.S. refiners imported about 1.3 million bpd of crude and fuel oil from Latin America in April, a seven-month high, as buyers worked to replace Russian supplies.

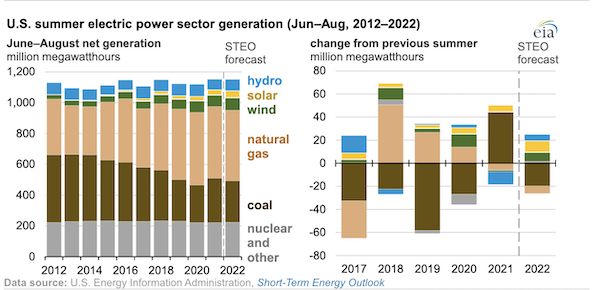

- The largest increase in U.S. electricity generation this summer will come from renewable energy sources, the EIA predicts:

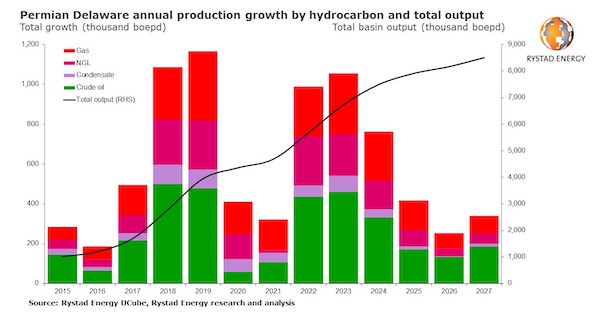

- Centennial Resource Development will acquire Colgate Energy to create a $7 billion giant focused exclusively on the U.S. Permian Basin.

- Total production in the U.S. Delaware Basin, the top-producing play in the Permian, will hit a record 5.7 million bpd-equivalent in 2022, according to Rystad:

- Eased U.S. sanctions will help Venezuela’s remaining Western producers divert crude exports to Europe from China.

- At least eight people were injured in a fiery explosion at a 580,000-bpd refinery in South Korea yesterday, threatening the nation’s fuel supply.

- Shots were fired in Libya’s Hariga port yesterday in an unsuccessful attempt to stop 1 million bpd of crude from being loaded onto a British-bound tanker.

- Indonesia is boosting energy subsidies by $23.8 billion to keep prices unchanged amid global inflation.

- Sri Lanka secured a deal to pay for fuel and cooking gas shipments that will ease crippling shortages after the island went into default on Wednesday.

- More oil news related to the war in Europe:

- Russia will cease natural gas sales to Finland tomorrow after it refused to pay for gas in rubles. Russia stopped selling to Bulgaria and Poland in late April.

- Rosneft, Russia’s state controlled oil giant, is suffering a brain drain as a number of senior executives leave the company.

- European gas prices are the lowest since late February with at least 10 LNG tankers scheduled to reach its shores by the end of the month.

- Russia says any oil rejected by Europe will be sent to other nations, primarily in Asia, forcing Europe to find more expensive substitutes.

- Poland will not need to use all the capacity it booked in a new pipeline from Norway as soaring energy prices curb demand.

- Texas-based Excelerate Energy signed a 10-year deal to help offset lost Russian gas supply to Finland and Estonia.

- Greece was a hot spot for Russian fuel transfers in April, new data shows.

Supply Chain

- Excluding fuel, dry van spot rates are down 30% from their late 2021 peak as concerns rise about a slowdown in consumer demand.

- There were 101 vessels waiting to cross the Panama Canal mid-week, six more than average for this time of year.

- Construction continues on a massive Bioceanic Corridor to connect Brazil’s Atlantic port of Santos with Chile’s Pacific ports of Iquique and Antofagasta by means of a series of dedicated roads.

- The minimum wage for global seafarers will rise over the next three years under a new agreement between shipowners and seafarer unions.

- TSMC, the largest chipmaker in the world, is considering building a new factory in Singapore to help address the global supply shortage.

- The Americas unit of DHL Express is expanding capacity with plans to add new cargo jets and double its electric-vehicle fleet to 654 units this year.

- Food distributor Sysco plans to buy up to 800 heavy-duty electric freight trucks from Daimler Truck North America, the largest electric-truck order to date.

- Harley-Davidson abruptly halted all production and shipping for two weeks due to an unspecified supplier’s regulatory issues with a component.

- Third-party food deliverer DoorDash is expanding rapidly in the market for grocery deliveries.

- Walmart is partnering with a California self-driving startup to bring the first autonomous delivery vehicles to Kansas.

- Surging U.S. diesel prices are partly to blame for massive price increases in key crop futures since Jan. 1, including wheat (+66%), corn (+35%) and soybeans (+25%).

- Russia rejected calls to halt a Black Sea blockade that has prevented grain shipments from Ukraine since late February and pushed up global food prices.

Domestic Markets

- The U.S. reported 109,580 new COVID-19 infections and 337 virus fatalities Thursday. Total hospitalizations are 19% higher than a week ago, while new infections are up in every state except Maine over the past two weeks.

- Health experts say COVID-19 infections could be five to 10 times higher than official counts as fewer people get tested.

- COVID-19 hospitalizations in New York state are up 25% the past 10 days to a three-month high.

- COVID-19 hospitalizations in Los Angeles County jumped 42% last week.

- Following FDA approval earlier this week, the CDC recommended Pfizer’s COVID-19 booster shot for children aged 5 to 11. Approval for Moderna’s booster will likely come soon.

- New research shows that infection with the Omicron variant of COVID-19 provides little long-term immunity against other variants in unvaccinated people.

- Broadly lifted pandemic restrictions across the U.S. have done little to ease the risks and isolation strains suffered by immunocompromised Americans.

- The U.S. Senate failed to pass billions more in pandemic aid for the restaurant industry.

- Over 65% of CEOs surveyed by The Conference Board expect the Fed’s monetary tightening will trigger a recession.

- Layoffs and discharges in recent months are at or near all-time lows, according to the Labor Department, as the tight labor supply prompts greater efforts to retain employees.

- U.S. existing home sales fell 2.4% in April to the lowest level in two years, while the median home price jumped 14.8% to an all-time high $391,200. A typical home on the market sold in just 15 days, according to online seller Redfin.

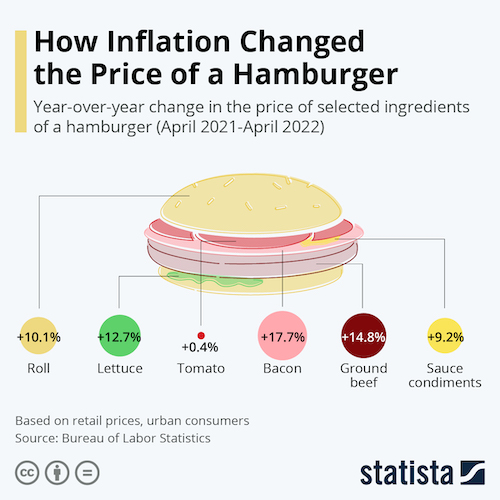

- Meat experienced some of the largest price increases among U.S. food items in April, costing almost 15% more than the same time last year:

- The board of Spirit Airlines rejected a hostile takeover bid from JetBlue Airways, setting up a shareholder vote next month to determine control of the U.S. budget carrier.

- Kohl’s reported a 5.2% drop in quarterly revenue and slashed its sales and profit targets, citing a cutback in consumer spending.

- Hyundai confirmed rumors that it will build a $7 billion electric vehicle plant in Georgia.

- Hundreds of nursing homes have closed or are on the brink of closing amid declining enrollment and higher labor and supply costs.

International Markets

- COVID-19 fatalities fell 21% last week while cases rose in most parts of the world, the WHO said.

- Shanghai found its first new COVID-19 cases outside quarantine areas Friday, triggering stricter curbs and mass testing in one district.

- Taiwan’s daily COVID-19 infections topped 90,000 for the first time yesterday.

- British health officials are recommending a new round of COVID-19 boosters for vulnerable populations before the fall.

- Health officials across the EU met with vaccine makers to discuss amendments to contracts amid waning demand for the shots.

- More news related to the war in Europe:

- The U.S. Senate passed a $40 billion aid package for Ukraine, sending the measure to the White House for a final signature.

- The G-7 industrialized nations agreed to a $19 billion short-term aid package for Ukraine.

- McDonald’s agreed to sell its Russian business to a large licensee just days after announcing its exit from the country.

- Food prices in Russia were up 20% in April.

- China’s central bank unexpectedly cut a key interest rate in a policy shift that economists say could help its beleaguered housing market while only bringing limited relief to its economy. China’s fiscal stimulus could surpass $5 trillion this year, equaling roughly a third of the nation’s economy.

- At 2.8%, U.S. economic growth is expected to outpace that of China for the first time since 1976 this year.

- Consumer prices in Japan rose at a pace above 2% for the first time in more than 13 years in April.

- British consumer confidence is at a 48-year low, new data shows.

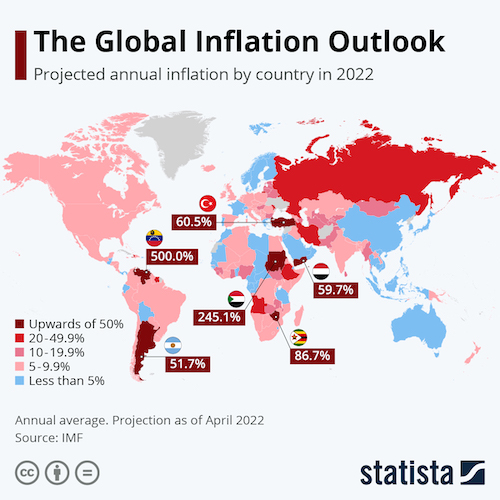

- Developing countries are expected to see the worst inflation rates this year at an average of 8.7%, according to the IMF:

- Duty-free shops and makers of travel-related items are seeing sales rebound as travel approaches pre-pandemic levels.

- Canada is banning equipment made by China’s Huawei Technologies and ZTE Corp. from being used on the nation’s 5G mobile network due to security concerns.

- Canada Goose forecast annual sales and profit above market expectations on hopes for a recovery in its key Chinese market and as demand for luxury apparel remains strong.

- Mercedes will deemphasize the entry-level market and cut some entry-level vehicles from its product line.

- Renault unveiled a prototype hydrogen fuel cell-powered SUV dubbed the “Scenic Vision,” to be available by 2032.

- Polestar, Volvo’s high-end electric vehicle unit, cut production estimates by 15,000 this year due to the impacts of Chinese lockdowns.

- Volkswagen is exploring a partnership to supply electric components to Indian automaker Mahindra.

- A European electric vehicle charging firm raised funds to triple its stations in France to 7,000 by 2025.

Some sources linked are subscription services.