MH Daily Bulletin: May 19

News relevant to the plastics industry:

At M. Holland

- Lindy Holland-Resnick, Market Manager for Packaging at M. Holland, is presenting during the upcoming Re|focus Sustainability & Recycling Summit in Cincinnati, Ohio. Her session on Developing a Sustainably Minded Staff will cover how to create a holistically sustainable company from top to bottom. If you’re attending Re|focus, don’t miss Lindy’s session on Tuesday, May 24 at 11:15 am ET.

- M. Holland is excited to be the Headline Sponsor for the upcoming Injection Molding & Design Expo in Detroit! This two-day trade show will highlight the latest technologies, materials, equipment and opportunities in injection molding. The event is May 25-26 and admission is free. Click here to learn more.

- If you’re attending the Injection Molding & Design Expo in Detroit, check out M. Holland’s speakers during the show:

- Haleyanne Freedman, M. Holland’s 3D Printing Market Manager, will be discussing Open Platform Adoption in Additive Manufacturing. Don’t miss her presentation in the Designing the Future Theater on Wednesday, May 25 at 4:00 pm ET.

- Josh Blackmore, M. Holland’s Global Healthcare Manager, is facilitating a training seminar on Understanding Material Selection for Medical Devices, from Qualification to Approval. Mark your schedules for this session in the Training and Development Theater on Thursday, May 26 at 9:15 am ET.

Supply

- Oil prices fell 2.5% Wednesday, with Brent remaining at an unusual discount to WTI for the first time in two years.

- In mid-morning trading today, WTI futures were down 1.0% at $108.50/bbl, Brent was down 0.3% at $108.80/bbl, and U.S. natural gas was down 0.8% at $8.30/MMBtu.

- U.S. crude inventories fell a surprise 3.4 million barrels last week and are 14% below the five-year average for this time of year, according to the EIA.

- Capacity use at both East Coast and Gulf Coast refineries hit 95% last week, suggesting refiners are racing to put more refined product on the market.

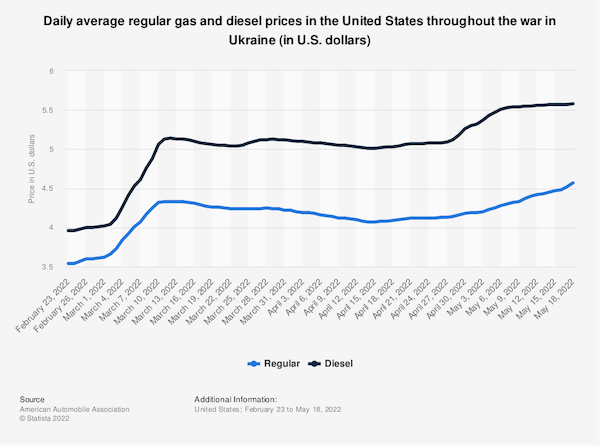

- U.S. gasoline prices hit another record of $4.567 a gallon yesterday. Prices topped $6 a gallon in California, the highest in the nation.

- The U.K. is seeing record gasoline and diesel prices, while gasoline prices are the equivalent of $9 a gallon in Europe.

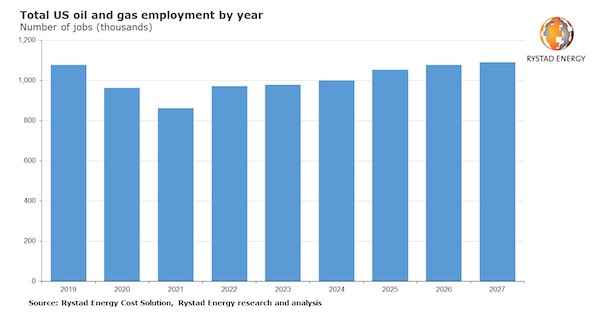

- The oil and gas industry lost 200,000 jobs — roughly 20% of its workforce — during the pandemic, with a full recovery not expected for at least five years.

- Saudi Arabia could see oil revenues rise as much as 66% this year on the back of higher prices and boosted production.

- Sanctioned Iranian oil exports likely rose 30% in the first quarter on greater shipments to China.

- More oil news related to the war in Europe:

- China is reportedly in talks with Russia to buy an unspecified amount of cheap oil for its strategic reserves.

- Finland is preparing for Russia to cut off its gas supply by week’s end.

- Russian gas flows to Europe via Ukraine plummeted 50% last week after Ukraine halted the use of a central pipeline.

- The EU unveiled a $317 billion plan aimed at ending dependence on Russian energy within five years. The plan would streamline and help fund renewable projects while booking more gas from the U.S., Middle East and Africa.

- Italy’s energy major Eni opened an account with Gazprom to pay for Russian gas in rubles.

- Germany’s largest utility plans to keep importing Russian gas into the 2030s on existing contracts, while it refrains from making new ones.

- Germany and three other European countries pledged to create 150 GW of wind power by 2050, capable of powering 230 million homes and fueling the production of hydrogen for industrial use.

- Investors will pump over $1 trillion into boosting offshore wind installations ninefold by 2030, Wood Mackenzie predicts.

- Panama is building a new biorefinery by 2026 to produce lower-carbon aviation fuel and renewable marine diesel.

- California is seeking part of the $8 billion in federal dollars earmarked for supporting hydrogen fuel projects.

Supply Chain

- Power demand in Texas could keep breaking May records until a heatwave subsides this weekend, grid operators say.

- Temperatures will rise to spring records across the Northeast Saturday, including a forecasted 98°F in Philadelphia.

- Power supplies in much of the U.S. and part of Canada will be stretched this summer amid heat, drought and supply-chain issues, according to the North American regulatory body that oversees grid stability.

- A major water leak in central Japan disrupted supply to more than 130 businesses near the production center of Toyota, which shut down its factory in the region.

- April was the 11th straight month where yearly volume gains at East/Gulf Coast ports outperformed West Coast ports.

- Roughly 14 ships are waiting to enter the East Coast’s busiest port of New York and New Jersey, the largest backlog of the pandemic, as container ships flood other ports to avoid congestion in Southern California.

- The Port of Los Angeles had its second-busiest April in history despite posting a 6.5% annual decline in cargo volumes. The Port of Long Beach posted its busiest April on record.

- CMA CGM signed an exclusive air cargo partnership with Air France-KLM that will combine the two firms’ cargo networks, freighter capacity and freight services.

- Monaco-based shipping group Scorpio is partnering with a British battery firm to develop batteries used in the maritime space.

- Road fatalities involving heavy-duty trucks rose 13% from 2020 to 2021, reversing a downward trend before the pandemic.

- A self-driving startup backed by Ford and Volkswagen began testing its fully driverless vehicles on roads in Miami and Austin, Texas.

- China is in talks with automakers about extending electric vehicle subsidies that were set to expire this year.

- European car sales fell 20% in April from a year ago, the 10th straight month of declines, due to high prices and supply shortages.

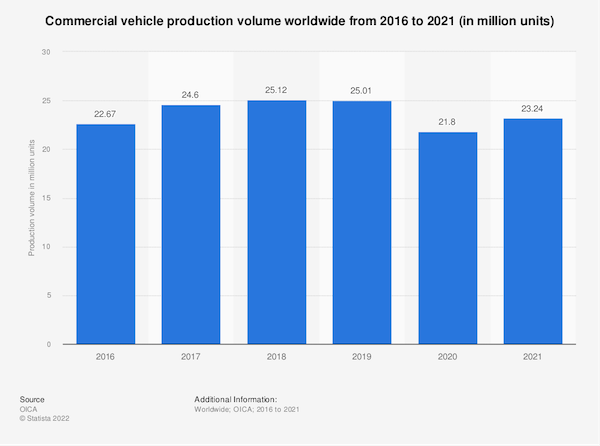

- Global commercial vehicle production fell 13% during the logistics snarls of the first year of the pandemic, while chip shortages denied a full rebound in 2021:

- The White House invoked the Defense Production Act to increase production of baby formula and allow commercial aircraft to pick up overseas formula that meets U.S. standards.

- Indonesia, the world’s biggest shipper of edible oils, will lift its ban on palm oil exports on May 23, a potentially major source of relief to global food markets.

Domestic Markets

- The U.S. reported 208,383 new COVID-19 infections and 943 virus fatalities Wednesday. The seven-day infection average hit 94,000, up fourfold from lows in late March, as the CDC predicts hospitalizations and fatalities to rise the next four weeks.

- Federal health officials said one-third of Americans live in areas where masks should be worn indoors again due to high COVID-19 risks.

- The BA.2.12.1 Omicron subvariant — which health officials say is 25% more contagious than BA.2 — now accounts for nearly 80% of new infections in New York state. Despite rising infections, New York City’s mayor will not impose new mask mandates.

- The White House resumed COVID-19 briefings on Wednesday after a six-week hiatus.

- Sales of Pfizer’s COVID-19 antiviral pill surged 315% the past four weeks amid rising infections nationwide.

- Apple reimposed mask mandates at 100 retail locations throughout the country.

- The New York Times delayed its plan for employees to return to the office in June.

- About 75% of long-COVID patients were not hospitalized with the virus initially but saw symptoms worsen over time.

- New survey results suggest two-thirds of people who caught COVID-19 this spring worked through their illness.

- First-time unemployment claims rose by 21,000 to 218,000 last week, the highest in four months.

- The U.S. had just 1.7 million weddings in the first year of the pandemic, a 17% decline from 2019 and the lowest level since 1963.

- The U.S. Treasury Secretary warned the global economy risks entering a period of high inflation and weak growth, also known as stagflation.

- JPMorgan cut its forecast for U.S. GDP growth from 3% to 2.4% in the second half of 2022.

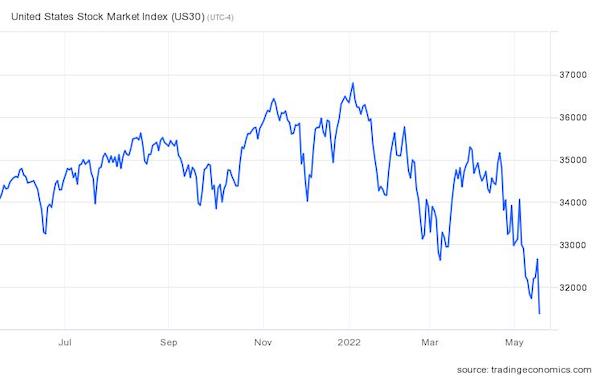

- U.S. stock futures fell sharply Wednesday, with the Dow and S&P 500 posting their biggest single-day declines in two years:

- Investors are dumping retail stocks at the fastest pace since 1987 after quarterly results suggested they are struggling to pass along inflationary costs to consumers.

- Cisco stock plunged 13% yesterday after it cut its full-year earnings outlook by two-thirds, citing lockdowns in China and Russia’s invasion of Ukraine.

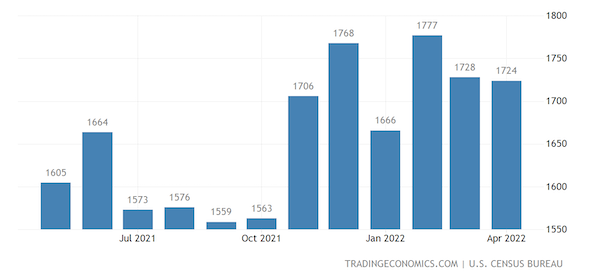

- U.S. housing starts fell 0.2% to a 1.72 million annualized rate in April while construction backlogs climbed to the highest level since 1974, signaling a cooldown in the housing market.

- The share of subprime credit card and personal loans at least 60 days late is rising unusually fast, according to Equifax, with car loans taking the biggest hit.

- Consumer food prices spiked 9.4% in April from a year ago, the largest gain since 1981, with chicken up 25% and bacon up 35%.

- British Airways owner IAG agreed to buy 50 Boeing 737 MAX jets, a lift for the beleaguered plane maker after losing a series of sales to rival Airbus.

- Carvana’s license to sell cars in Illinois was suspended over improper paperwork used in its transactions.

- Mastercard launched a new program allowing customers to pay with facial or palm recognition at select retailers.

International Markets

- COVID-19 cases in the Americas surged 27.2% last week, driven mostly by the U.S.

- Some Shanghai residents were permitted to shop for groceries after the city reported zero new infections outside quarantined areas for the fifth day. Authorities also allowed 864 financial institutions to resume work in “closed-loop” systems, meaning more professionals could be asked to sleep on makeshift beds in offices.

- China relaxed some COVID-19 test rules for U.S. and other travelers, including shortening the pre-departure quarantine period for inbound visitors.

- The World Health Organization says the world is no better prepared for the pandemic than it was in 2020 and may be in a worse place due to severe economic tolls the past two years.

- More news related to the war in Europe:

- Sweden’s and Finland’s applications to join NATO are in limbo after Turkey’s objection.

- GDP growth in Russia slowed to 3.5% in the first quarter, with international analysts expecting a contraction of 10% to 15% for the year.

- Ukraine’s economic output could halve this year, the United Nations said.

- The EU proposed sending $9.5 billion to help Ukraine pay its bills this year.

- Google has relocated its employees in Russia out of the country, and its Russian subsidiary will file for bankruptcy after its accounts were seized by Russian authorities.

- The first Russian soldier prosecuted for war crimes in Ukraine pleaded guilty.

- The U.S. Embassy in Ukraine’s capital reopened for the first time in three months.

- Canada’s inflation rate hit 6.8% in April, the highest since 1991.

- Japan’s economy shrank 1% in the first quarter, its first decline in two quarters. The nation’s trade deficit spiked 28% in April due to soaring energy costs, despite a healthy rise in exports.

- Sri Lanka defaulted on its debt for the first time in its history.

- The global lithium industry needs $42 billion of investment by 2030 to meet demand for battery-making material, analysts say.

- Natural catastrophes are costing global insurers some 250% more than 30 years ago due to an increase in flooding, storms and wildfires.

- Deutsche Bank will require all global suppliers and vendors to have a sustainability rating from July onward, the bank said.

Some sources linked are subscription services.