MH Daily Bulletin: March 27

News relevant to the plastics industry:

At M. Holland

- M. Holland’s partnership with Lavergne, a global manufacturer of customized compounded engineered resins, was recently shared in Plastics Today. To learn more about this agreement to distribute post-consumer recycled (PCR) resins for customers in North America, click here.

Supply

- Oil fell Friday, but both benchmarks ended the week higher as turmoil in the U.S. banking sector eased.

- In mid-morning trading today, WTI futures were up 2.0% at $70.67/bbl, Brent was up 1.7% at $76.24/bbl, and U.S. natural gas was down 5.3% at $2.10/MMBtu.

- U.S. natural gas prices fell for a third consecutive week as unusually warm weather made a final end-of-winter cold spell unlikely.

- Economic fears in U.S. markets have sparked unusual volatility in oil prices which experts say has little to do with the fundamental value of crude.

- Active U.S. oil and gas rigs rose by four last week to a total of 758, according to Baker Hughes.

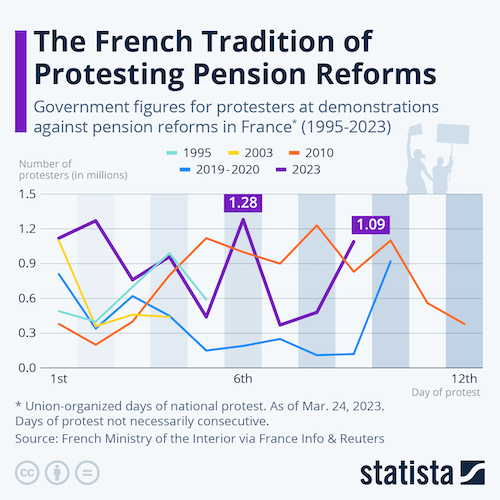

- Persistent strikes over state pension reforms at France’s Le Havre port have cut off crude deliveries to Exxon Mobil’s nearby Port Jerome refinery, temporarily shutting the plant down.

- Fuel shipments from TotalEnergies’ Normandy plant resumed Friday following a police intervention that dispersed protestors blocking deliveries.

- Saudi Arabia plans to build a $10 billion refinery and petrochemicals complex in China, scheduled to open in 2026.

- China’s state-owned oil giant Sinopec saw annual earnings fall to a lower-than-expected $9.6 billion last year.

- Global oil giants, including Halliburton and Chevron, are among those expanding their presence in North Africa after years of underinvestment in the region.

- With most of its competitors abandoning Alaska, ConocoPhillips, which has quietly become one of the largest Western oil producers, is forging ahead with drilling in the state following the U.S. administration’s approval of a major new project this month.

- Despite popular opposition, New York could soon become the first state in the U.S. to ban gas stoves in new buildings.

- German grid operators proposed a $137.72 billion development plan to enable a long-term shift to green energies.

- Scotland awarded offshore wind leases to 13 companies, including BP and TotalEnergies, to support decarbonization of North Sea oil and gas operations.

Supply Chain

- Israeli airports and ports were closed Monday as the nation was thrust into chaos by massive strikes and protests over the government’s planned judicial reforms.

- A powerful storm and multiple tornadoes tore across Mississippi and parts of Alabama Friday, killing at least 26 people and leveling hundreds of buildings.

- Countries ranging from Mexico to India and Cambodia are competing for a greater role in the world’s reconfiguring supply chains as they seek to turbocharge economic development and create millions of new jobs.

- Retailers are saving big on ocean container transport amid a dramatic fall in shipping prices, particularly for Asia-to-U.S. container trade.

- Port American, the U.S.’s largest port terminal operator, is set to invest over $43 million to expand cargo-handling at the Port of Gulfport on Mississippi’s Gulf Coast.

- The Port of Virginia plans to expand rail capacity by 35% next year at Norfolk International Terminals.

- German air and rail travel came to a halt today as workers staged a 24-hour strike over wages.

- Germany’s Port of Hamburg was closed to large ships as unionized workers began a one-day strike last week.

- Annual operating profit at the parent of Orient Overseas Container Line jumped 37% to $10.1 billion despite declining cargo volumes.

- Values for bulk shipping’s largest vessels have jumped 16.4% since the beginning of March to their highest level in seven months.

- Increased demand in capsize vessels caused the Baltic Exchange sea freight index to rise Friday, though the overall index fell about 3% to its first weekly decline in five weeks.

- E-commerce companies are adding fees for faster shipping, raising minimum purchase requirements and making other changes that shift more costs to consumers as costs continue to climb.

- A survey found a growing share of companies plan to increase their spending on supply-chain tech this year.

- European lawmakers agreed to rules setting targets and incentives for maritime operators to slash emissions from fuel in the coming years.

- A meeting of the U.S. and Canadian administrations ended with multiple pledges to cooperate in business, including to create a bilateral semiconductor corridor.

- Apple’s Taiwanese supplier Pegatron is considering opening a second factory in India.

- In the latest news from the auto industry:

- Ford expects its electric F-Series pickup factory in Tennessee to produce half a million trucks per year, 40% more than initial forecasts, hoping to reverse its roughly $3 billion loss on electric vehicles this year.

- Rivian Automotive is relocating parts of its manufacturing team to an existing site in Illinois in a bid to speed up production.

- The EU and Germany reached a deal on the future use of combustion engines amid disputes over Europe’s planned 2035 phase-out of CO2-emitting cars.

- South Korean battery giant LG Energy Solution is in talks to supply electric-vehicle batteries to Toyota, potentially adding to a list of automaking partners that includes GM, Stellantis and Honda. The company also announced plans to build a giant $5.5 billion manufacturing complex in Arizona.

- Bolivia called on neighboring countries, including Argentina, Brazil and Chile, to work on setting a Latin America-wide policy on developing lithium for export.

- Chinese battery and material recycler GEM Co. plans to partner with a South Korean company to build a plant in United States-ally South Korea, allowing it to sell to the U.S.

- Brazilian officials are traveling to China this week to promote Chinese manufacturer BYD’s planned takeover of a former Ford factory in northeast Brazil.

- Chinese battery giant CATL plans to start mass production of batteries based on a new and less expensive materials technology called M3P later this year.

Domestic Markets

- An S&P gauge of U.S. business activity rose to 53.3 this month, the highest reading in 10 months, signaling economic expansion driven by the service sector.

- Though new orders for key U.S.-manufactured goods unexpectedly rose in February, manufacturing activity remains weak.

- Top U.S. financial officials say the nation’s banking system remains “sound and resilient” despite the failure of Silicon Valley Bank and its impact on regional lenders, whose deposits dropped by a record amount in recent weeks.

- First Citizens Bank agreed to acquire failed Silicon Valley Bank, easing concerns about a global banking crisis.

- Remote work is fading: Just under 75% of businesses said their employees teleworked rarely or not at all last year, up sharply from 60.1% in 2021 and near pre-pandemic levels.

- Demand from plane-makers has soared on the back of surging global air travel, creating fresh openings for private equity investments in aerospace.

- Bed Bath & Beyond plans to cut about 1,300 more positions in New Jersey, a move that follows a 20% reduction in its corporate and supply-chain staff.

- The U.S. administration denied a request by JetBlue and Spirit Airlines to operate under common ownership amid ongoing legal challenges to their $3.8 billion merger.

International Markets

- The United Nations Conference on Trade and Development is forecasting 1% growth in annual goods trade this quarter.

- Analysts are cutting earnings estimates for Asian companies amid a smaller-than-expected economic rebound following China’s reopening from pandemic controls.

- Japan’s core consumer inflation slowed to 3.1% in February from a 41-year-high of 4.2% the previous month.

- Business activity across the euro zone rose above estimates this month on a burst in consumer spending on services.

- Indian officials are putting more pressure on Airbus and Boeing to set up manufacturing facilities in the country.

- Mattel is maintaining some production in China, even as it launches manufacturing in Mexico, as the toy maker focuses on flexibility in a volatile geopolitical environment.

- Drought in Spain is expected to halve the country’s output of olive oil this year, pushing up prices across the globe.

Some sources linked are subscription services.