MH Daily Bulletin: March 16

News relevant to the plastics industry:

At M. Holland

- M. Holland announced a new partnership with Lavergne, a global manufacturer specializing in the formulation of customized compounded engineered resins, to distribute PCR resins for customers in North America. Click here to read the press release.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil plunged nearly 5% Wednesday to settle at the lowest levels in over a year on concerns that a crisis in the banking sector could trigger a recession and cut demand.

- Energy futures were mixed in mid-morning trading today, with WTI down 1.3% at $66.72/bbl, Brent down 1.0% at $72.94/bbl, and U.S. natural gas up 2.5% at $2.50/MMBtu.

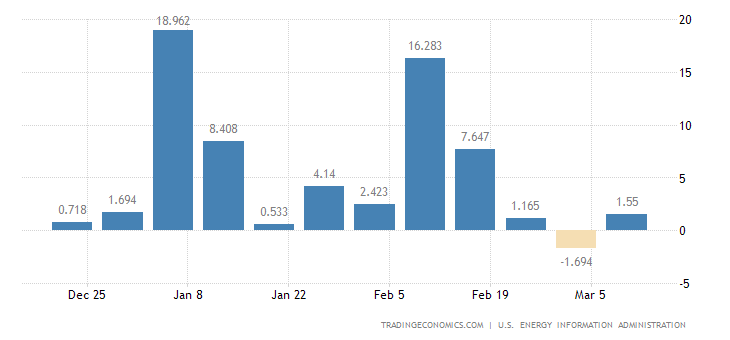

- U.S. crude stocks rose by a larger-than-expected 1.6 million barrels last week, according to the administration.

- Last year was the most volatile on record for natural gas, boosting the cost to heat homes, generate electricity and manufacture economic building blocks such as fertilizer and steel.

- The International Energy Agency expects oil markets to swing from a surplus in the first half of 2023 to a deficit in the second half when global oil demand hits a record high.

- Growing optimism about Chinese demand for crude is being tempered by concerns over Western economies, according to OPEC.

- Russia’s oil-export revenues have roughly halved in the space of a year while its oil exports have remained largely unchanged, suggesting Western sanctions are taking effect without constraining global oil supplies, the International Energy Agency says. Moscow itself predicts oil and gas production will fall this year.

- The Group of Seven advanced democracies wants to keep the price cap on Russian crude at $60/bbl despite hopes for tighter sanctions by some European capitals, according to reports.

- Chevron is urging Venezuela to clean up Lake Maracaibo in the hope of nearly doubling the amount of oil that can be loaded on ships, which currently risk running aground due to sediment deposits.

- China removed its last restrictions on the import of Australian coal.

- San Francisco Bay regulators approved measures that will effectively ban natural gas furnaces and water heaters in new structures by 2031.

Supply Chain

- The latest in a series of atmospheric river storms soaked California Tuesday, bringing another deluge of rain to the already saturated state.

- A Nor’easter swirling over New York and New England prompted emergency orders and closed roads on Wednesday.

- Cyclone Freddy has killed more than 270 people in southern Africa since it made landfall last month, making it one of the deadliest storms to hit the continent in two decades.

- A freight train reportedly carrying hazardous chemicals derailed in Arizona’s Mohave Desert late yesterday, perhaps due to a tornado reported in the area, adding to growing concerns about rail safety.

- The Cass Freight Index for expenditures for U.S. domestic freight transport dropped to 4.02 in February, down 9.7% from a year earlier to nearly the lowest level since October 2021.

- The Port of Long Beach moved 543,675 TEUs last month, down 31.7% from its record set a year ago but still 2.5% above pre-pandemic levels.

- Ohio is suing Norfolk Southern to hold the carrier financially responsible for a Feb. 3 train derailment in East Palestine, Ohio, that sent 38 cars off the tracks, including 11 tankers carrying hazardous materials.

- Unionized dockworkers and port employers in Canada have started contract negotiations.

- Cargo volume at Germany’s Frankfurt Airport fell 11% in February following an 18% drop in January.

- Large companies like Walmart and Whole Foods Market are pressing suppliers to cut prices for goods while others have been canceling orders for products from clothing to appliances, a stark change from buying strategies a year ago.

- General Electric is deploying some of its workers to suppliers to address bottlenecks in jet-engine production.

- A large majority of supply-chain executives in a PwC survey say the results of their technology investments have fallen short of expectations.

- The Port of Oakland will require tenants operating cargo-handling equipment to create a plan to eliminate carbon emissions.

- Self-driving trucks will soon start making deliveries at some of Kroger’s Dallas stores as the grocer partners with driverless tech firm Gatik.

- Samsung Electronics expects to invest $230 billion over the next 20 years to develop the world’s largest chip-making base in South Korea.

- A chip plant that Samsung is building in Taylor, Texas, will cost the company over $25 billion, up more than $8 billion from initial forecasts due to inflation.

- Apple supplier Foxconn plans to ramp up investment outside of China to attract automakers to its contract manufacturing and will build a $200 million plant in India to service a recently won contract to make Apple AirPods.

- China plans to cut annual crude steel production in 2023, marking the third consecutive year the government has mandated output to rein in carbon emissions.

- In the latest news from the auto industry:

- BMW expects 25% of its new car sales to be electric by 2025, a third by 2026, and over 50% well ahead of its 2030 target.

- Tesla’s 49,917 U.S. registrations in January prevailed over BMW, the No. 2 U.S. seller of EVs, which had 31,070 registrations.

- Companies in South Korea’s southeastern hub of Pohang, home to one of the world’s biggest steelmakers, are aggressively building electric-vehicle battery campuses as automakers hurry to find reliable suppliers outside China.

- Mexico’s truck production and exports saw sharp increases in February, helped by continued demand from the U.S. and “nearshoring” of manufacturing sites.

- BMW says modifying existing cars to run on e-fuels, synthetic fuels made using captured carbon and renewable energy, can have a massive impact on decarbonizing transportation.

Domestic Markets

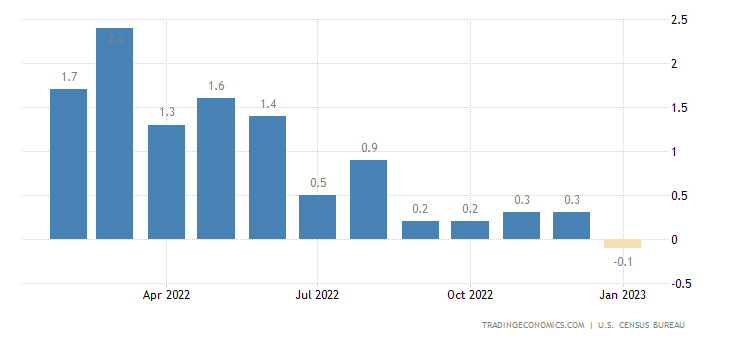

- U.S. business inventories fell for the first time in nearly two years in January.

- Goldman Sachs lowered its forecast for fourth-quarter U.S. GDP growth, citing risks to the lending environment as smaller banks pull back on loans to preserve liquidity.

- U.S. homebuilder sentiment unexpectedly improved for a third month in March, reflecting a pickup in both sales and buyer traffic.

- Meta joined Amazon, Starbucks and Walt Disney as the latest big company to walk back generous remote-working policies this year.

- Boeing predicts a surge in global aircraft financing toward pre-pandemic levels this year.

International Markets

- Switzerland’s central bank will loan up to $54 billion to Credit Suisse to shore up the bank’s balance sheet and, hopefully, mitigate fears of a banking crisis.

- Despite speculation that the European Central Bank might alter its path of interest rate hikes due to the banking crisis, the bank raised rates another 50 basis points at its meeting today.

- China’s retail sales rebounded sharply in January and February as the country emerged from lockdowns, while manufacturing remained sluggish due to soft export demand. The nation’s embattled property sector also made progress in its climb out of a months-long slump, according to new data.

- Australia’s job market bounced up in February, creating more jobs than expected as the unemployment rate fell to near 50-year lows.

- Hundreds of thousands of workers in France walked off their jobs and marched in demonstrations from Paris to Nice on Wednesday ahead of a crucial vote to raise the country’s retirement age.

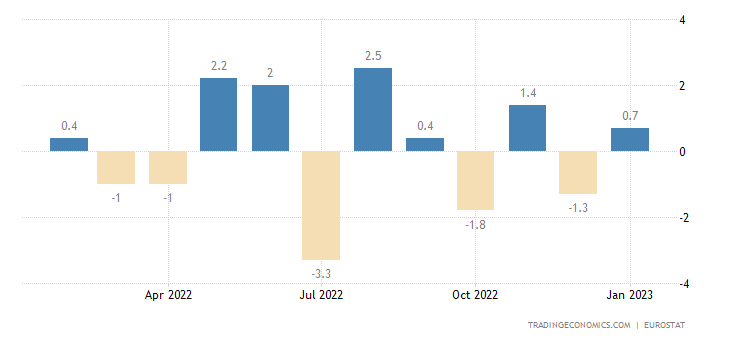

- Industrial production in the euro zone rose by 0.7% in January, beating market expectations.

- The German economy will be unable to escape a recession in 2023, according to a prominent economic institute.

- H&M, the world’s second-biggest fashion retailer, reported a smaller-than-expected increase in first-quarter sales in the latest sign it is struggling to compete with popular rivals.

- Environmentalists are alarmed by plastic rocks called “plastiglomerates” found on Brazil’s Trindade Island made from sun melted plastic ocean debris, such as fishing nets, agglomerated with natural sediment.

Some sources linked are subscription services.