MH Daily Bulletin: March 15

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil dropped over 4% to a three-month low Tuesday on worries of a fresh financial crisis caused by U.S. inflation and regional bank failures.

- Energy futures were down further in mid-morning trading today, with WTI off 4.1% at $68.43/bbl, Brent down 3.8% at $74.88/bbl, and U.S. natural gas down 3.9% at $2.47/MMBtu.

- U.S. crude stocks likely rose by 1.155 million barrels last week, according to the American Petroleum Institute. Government data is due today.

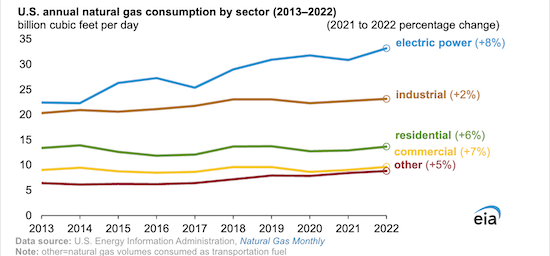

- U.S. natural gas consumption averaged 88.5 billion cubic feet per day last year, a record in data going back to 1949:

- OPEC revised upward its forecast for Chinese oil demand growth this year as the country continues rebuilding from the pandemic.

- China’s refinery output was up 3.3% in the first two months of the year compared with the prior-year period.

- Spain has imported 84% more Russian LNG since early 2022, highlighting the continued dependence of some European countries on Russian fuel.

- Global crude trade is seeing more unusual shipping behavior following tightened sanctions on Russia, including tankers staying put for months near the Gulf of Oman.

- The EU plans to expand its capacity to receive LNG by almost one-third next year as it presses ahead with replacing pipeline supplies from Russia.

- Six environmental groups mounted a court challenge to the White House’s approval of the ConocoPhillips Willow oil and gas project in Alaska.

- U.S. senators reintroduced a bipartisan bill that would allow nationwide sales of gasoline with a higher blend of ethanol year-round.

- China is likely to install nearly three times more wind turbines and solar panels by 2030 than its current target, Goldman Sachs predicts.

- Chevron is working with agribusiness firms Corteva and Bunge to produce renewable fuels from canola crops, the companies announced.

Supply Chain

- A major storm dropped more than two feet of snow in portions of northwest Massachusetts and southern Vermont Tuesday, bringing regional power outages and travel disruptions.

- The U.S. Surface Transportation Board approved the merger between Canadian Pacific Railway and Kansas City Southern, paving the way for the first freight railway linking Canada, Mexico and the U.S.

- Trucking executives say they expect a strong rebound in freight demand in the second half of the year.

- Shortages of truck chassis and other freight transport equipment in the U.S. are dissipating.

- Worsening traffic congestion in the U.S. Sun Belt is threatening economic growth in some regions, experts say.

- Retail diesel fuel prices in the U.S. fell last week for the sixth consecutive week and for the 16th week in the past 20.

- Canadian package carrier Purolator will spend about $730 million to buy a fleet of electric parcel vans and electrify its terminals.

- A.P. Moller-Maersk is opening its first route to Ukraine since Russia’s invasion.

- Israeli shipping line Zim expects a second-half turnaround after fourth-quarter net profit plummeted to $417 million from $1.71 billion a year earlier.

- Sherwin-Williams faces a new lawsuit for adding a 4% supply-chain surcharge at the checkout line for its paints.

- North Carolina-based truckload carrier FreightWorks ceased operations after a sudden loss of business, impacting 200 employees.

- Infinera, a U.S. manufacturer of semiconductors for the telecom industry, is exploring a sale, according to reports.

- In the latest news from the auto industry:

- GM will extend a production halt at its Silao Assembly Plant in Mexico through March 20 due to a supply-chain issue.

- Volkswagen still plans to bring an affordable electric vehicle to market by 2025, with a potential sticker price of around $26,790.

- Honda’s U.S. unit will move production of its Accord sedan from Ohio to Indiana in 2025 as part of a shift to building electric vehicles.

- A joint startup between U.S.-based Silk EV and Chinese automaker FAW scrapped plans to build a production site in Italy.

- Stellantis is eyeing Spain as the potential home for a small-vehicle production hub.

Domestic Markets

- U.S. retail sales fell a greater-than-expected 0.4% in February.

- Producer prices unexpectedly dipped 0.1% in February and were revised downward for January, signaling a softening in the economy.

- The Federal Reserve is expected to raise its benchmark rate by 25 basis points next week and again in May after a government report showed U.S. inflation remained high in February.

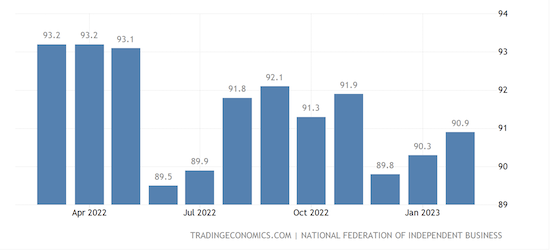

- U.S. small-business confidence rose to a three-month high in February, although many owners continued to struggle with finding workers, according to a new survey.

- The rate on a 30-year fixed mortgage fell to 6.57%, down from 7.05% a week ago, amid turmoil in the banking sector after the collapse to two regional banks.

- Homebuilder Lennar reported better-than-expected quarterly profit as high property prices helped offset continued supply shortages.

- Facebook–parent Meta announced plans to cut 10,000 jobs this year, its second round of mass layoffs announced in recent months.

- Apple is delaying bonuses for some corporate divisions and expanding a cost–cutting effort, according to reports.

- Boeing delivered 28 aircraft in February, down from 38 the previous month amid supply-chain problems and a delivery pause for the 787 Dreamliner.

- U.S. airline executives said they were optimistic about travel demand for the rest of the year, shaking off worries about operating costs and fears of slowing demand.

- Southwest Airlines plans to hire more staff this winter to address problems that led to large-scale cancellations last holiday season.

- Tyson Foods will close two U.S. chicken plants with almost 1,700 employees in May as it works to streamline operations.

- Dollar Tree has stopped selling eggs after the staple food skyrocketed in price by as much as 60% during the fall.

- Amazon plans to launch and test its first satellites providing internet-from-space service to customers as soon as 2024.

International Markets

- Renewed concerns hit the European banking sector after Credit Suisse’s major stockholder said it can’t provide the bank with further financial support if it falters.

- Despite the turmoil in the banking sector, the European Central Bank is expected to raise rates another 50 basis points when it meets tomorrow.

- Chinese consumers are returning to hotels, restaurants and some shops, but they are cautious about what they buy, disappointing hopes for an immediate post-pandemic splurge.

- China will raise its retirement age gradually and in phases to cope with the country’s rapidly aging population, officials said Tuesday.

- Spanish consumer prices rose 6% in the 12 months through February, up slightly from January.

- Argentina’s annual inflation rate surpassed 100% in February, the first time it hit triple figures since a period of hyperinflation in 1991.

- Two Saudi Arabian airlines announced plans to order 78 Boeing 787 Dreamliners, the fifth largest commercial order by value in Boeing’s history.

- Plastics recycling capacity in the EU grew by 17% in 2021.

Some sources linked are subscription services.