MH Daily Bulletin: March 13

News relevant to the plastics industry:

At M. Holland

- Each year, M. Holland joins organizations around the globe to celebrate the profound achievements and ongoing efforts of women on International Women’s Day. To celebrate, a few Mployees shared their thoughts on this year’s theme of #EmbraceEquity. Click here to watch the video.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil climbed over 1% Friday on better-than-expected U.S. jobs data, although both benchmarks fell more than 3% on the week.

- In mid-morning trading today, WTI futures were down 2.7% at $76.89/bbl, Brent was down 2.3% at $81.14/bbl, and U.S. natural gas was up 6.0% at $2.58/MMBtu.

- Saudi Arabia’s national oil company reported record annual profit of $161 billion for 2022, the largest ever by an energy firm.

- Strikes by workers at TotalEnergies’ French refineries and depots continued over the weekend as part of widespread labor unrest spurred by the French government’s pension reform plans.

- The White House is close to approving the $8 billion Willow oil project in Alaska but also plans to expand a ban on offshore drilling in the state.

- The U.S. government is urging major commodities traders to keep hauling price-capped Russian oil to maintain global supply.

- Russia is quickening its exports of diesel through the use of ship-to-ship transfers, analysts say.

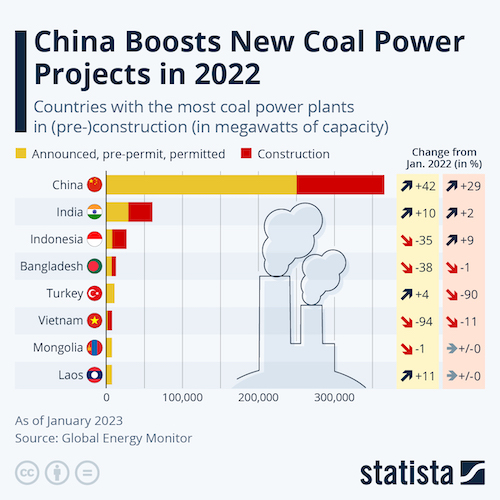

- Rising coal use is fueling a spending boom in the biggest coal-exporting countries, including Australia, Colombia and Indonesia.

- Environmentalists are calling on Europe to end incentives for biofuels production.

- European lawmakers reached a provisional deal to cut energy consumption across the bloc by 11.7% by 2030.

Supply Chain

- Torrential rains and flooding in California forced evacuations over the weekend, with more severe weather expected this week.

- The American Association of Railroads issued a rare warning against using specific railcars following a string of prominent derailments in recent weeks.

- The average spot price to ship a 40-foot container from Asia to the U.S. West Coast dropped to $1,040 last week, lower than at any point in 2019.

- Logistics operators slashed nearly 17,000 jobs last month as consumer spending shifts to services from goods and e-commerce growth stalls.

- Amazon is ramping up air cargo flights at its largest hubs while maintaining or shrinking activity elsewhere.

- Boeing will set up a facility in India to convert 737 passenger planes into dedicated freighters to tap into regional and global demand for the service.

- MSC took delivery of the first of its new class of ultra-large, 24,000+ TEU container ships.

- The U.S. and EU are expected to soon launch talks on critical minerals trade and a potential free-trade deal around clean technology.

- Canada banned the import of all Russian aluminum and steel products last week.

- The U.S. administration is working to further tighten restrictions on exporting semiconductor manufacturing gear to China, according to reports.

- In the latest news from the auto industry:

- Ford is on track to resume production of its F-150 Lightning today after a multi-week stoppage caused by a suspected battery defect.

- Ford plans to slash 1,100 jobs in Spain as part of changes to its production lineup in Europe.

- Vietnamese automaker VinFast will push back plans to start up its U.S. electric-vehicle factory until 2025, citing a procedural delay.

- Dealerships are working to stay relevant as auto manufacturers increasingly look to direct sales to buyers.

- Daimler Truck expects profits to rise this year on an improving Chinese market and easing chip shortages.

- Mitsubishi Motors plans for hybrid and electric vehicles to account for all new car sales by 2035.

- Tesla is recruiting Chinese and Korean materials suppliers to help lower the cost and boost the energy of its newest battery cells.

- ACC, a joint venture of Stellantis, Mercedes and TotalEnergies, plans to build an Italian battery-making plant to operate by 2026.

- Production setbacks are slowing the rollout of Nissan’s much anticipated Ariya crossover electric-vehicle.

Domestic Markets

- Silicon Valley Bank (SVB), the nation’s 16th largest, collapsed Friday under the weight of rising interest rates and withdraws from financially challenged tech customers, marking the second-largest bank failure in U.S history and the largest since 2008. The collapse was followed Sunday by the failure of Signature Bank in New York, the third largest bank failure on record.

- A former head of the Federal Deposit Insurance Corporation expects more banks to fail, as the agency takes unprecedented steps to protect depositors and shore up the banking system.

- The potential banking crisis makes it less likely the Federal Reserve will increase the size of its expected interest rate hike when it meets on March 22.

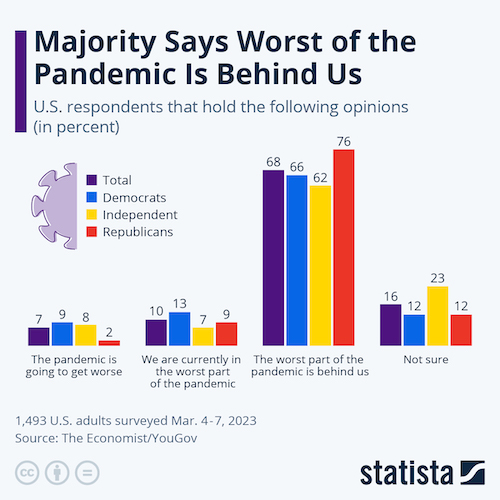

- Saturday marked the third anniversary of widespread shutdowns triggered by the pandemic, the result of a virus that continues to kill about 2,000 people a week but ranks low among priorities for the American public.

- The U.S. government posted a $262 billion budget deficit in February, up 21% from a year earlier, as outlays grew, and revenues fell.

- Disputes over who should pay for upgrades to utility poles stand in the way of the U.S.’s $60 billion plan to bring high-speed internet to every household in the next decade.

- Retailers say theft is rising as more people shop in stores, cutting into profits that were already under pressure.

- Retailer Gap aims to reset its business in 2023 after a year of dealing with weaker sales, excess inventory and executive shakeups.

- The FAA approved Boeing to resume deliveries of its widebody 787 Dreamliner this week after the plane maker addressed recent concerns raised by the agency.

- Moderna plans to hire about 2,000 employees globally this year as it scales up development of new products amid declining COVID-19 vaccine sales.

International Markets

- Europe is worried some companies could pause or slow investments on the continent in favor of moving more quickly to take advantage of incentives in the U.S.

- The U.K. economy returned to growth in January, with output 0.3% higher than the previous month.

- The Bank of Japan maintained ultra-low interest rates Friday, leaving options open ahead of a leadership change in April.

- India’s industrial output rose a larger-than-expected 5.2% in January.

- Train workers in Belgium and airport workers in Germany plan to strike this week.

- LATAM Airlines saw fourth-quarter profit of $2.54 billion, reversing from a $2.75 billion loss a year earlier.

- Saudi Arabia is close to a deal for a large number of Boeing commercial jets that will serve in the fleet of a new national airline.

- Brazilian plane maker Embraer boosted its net revenue forecast for 2023 as supply-chain pressures ease.

Some sources linked are subscription services.