MH Daily Bulletin: March 10

News relevant to the plastics industry:

At M. Holland

- Each year, M. Holland joins organizations around the globe to celebrate the profound achievements and ongoing efforts of women on International Women’s Day. To celebrate, a few Mployees shared their thoughts on this year’s theme of #EmbraceEquity. Click here to watch the video.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell 1% to a two-week low on Thursday amid increased worries of a U.S. recession.

- In mid-morning trading today, WTI futures were up 0.4% at $76.04/bbl, Brent was up 0.5% at $82.02/bbl, and U.S. natural gas was down 2.3% at $2.48/MMBtu.

- TotalEnergies was unable to make deliveries from its French refineries Thursday due to widespread worker strikes.

- The EU is adding eight LNG regasification terminals, raising the total to 35, as it continues its transition from Russian energy sources.

- Refiner Citgo Petroleum reported record net profit of $2.8 billion last year on strong motor fuel demand.

- China’s crude imports are down 1.3% year to date from the same time in 2022 but are expected to pick up significantly later this year.

- Oil majors with operations in Brazil filed an injunction against the government’s surprise new export tax on oil passed a week ago.

- By the end of 2023, governments across the globe could end up spending a combined $1.65 trillion to subsidize energy costs after Russia’s invasion of Ukraine.

- New U.S. solar installations dropped 16% to 20.2 GW last year, largely due to an import ban on some Chinese components.

- The U.S. administration is proposing much stricter limits on wastewater pollution from coal-burning power plants.

- The EU unveiled new rules Thursday that would in some cases match government funding for clean-energy projects with U.S. incentives.

- German hydrogen firm Thyssenkrupp Nucera has seen project interest soar in the U.S. as a result of the Inflation Reduction Act.

- The rise of more advanced artificial-intelligence tools will significantly boost energy requirements of major companies, experts say.

Supply Chain

- U.S. container imports likely plunged 20% in the first two months of 2023, according to Descartes Systems Group. Continued destocking of bloated wholesale inventories is likely to depress imports until later in the year.

- Major U.S. ports are expected to see 1.74 million TEUs of imports this month, down some 26% from a year ago.

- Trucking and rail rates out of Los Angeles are falling more than the national average as port volumes decline in Southern California.

- Cargojet is cutting the number of B777 aircraft it plans to convert to freighters due to a weakening economic outlook.

- Maersk is shifting detention billing to consignees ahead of new regulations by the Federal Maritime Commission.

- Japanese ocean carrier NYK Line is selling its recently created airfreight unit due to unmanageable costs.

- Deutsche Post DHL saw just a 1.7% year-over-year gain in fourth-quarter revenue amid a muted peak season.

- The U.S. and India are pledging to work together to spur investment in semiconductor development.

- In the latest news from the auto industry:

- China’s passenger car sales shrank almost 20% in the first two months of the year.

- Chinese automaker BYD plans a big push into battery-electric commercial vehicles in markets including China, Europe and Japan.

- GM is starting a voluntary buyout program for the majority of its U.S. salaried employees that could ultimately total about $1.5 billion.

- The average electric car sold in the U.S. is approaching 300 miles between charges, the highest in the world.

- Experts do not expect global sales of combustion-engine cars to ever reach pre-pandemic levels.

- Customer service satisfaction among owners of electric vehicles is lower than those who own combustion-engine cars, according to a new survey by J.D. Power.

- BMW reported a 12% rise in fourth-quarter earnings. lagging some analysts’ expectations.

- Chinese battery giant CATL posted sharply slower growth in fourth-quarter net profit after consumer caution hit electric-vehicle demand in the world’s largest auto market.

Domestic Markets

- The four biggest U.S. banks lost $52 billion of market value Thursday, part of a broad rout across financial stocks after a Silicon Valley lender exposed potential cracks in the financial system, saying a drop in bond values and withdrawals by companies forced it to sell assets and seek more equity capital.

- Household net worth rose 2% to a total of $147.71 trillion in the fourth quarter of 2022, as rising stock market prices offset falling real estate values.

- U.S. employers added 311,000 jobs in February, a slower but still robust growth rate, as unemployment rose to 3.6% and hourly wages grew 4.6%.

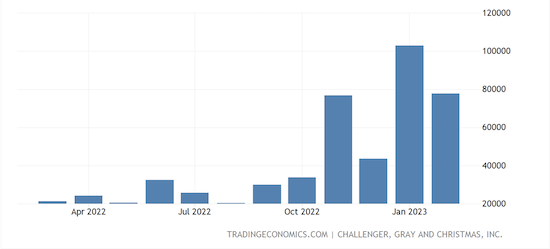

- Layoffs rose fivefold year-over-year in February to 77,770, with tech jobs accounting for about a third of the total, according to analysts.

- Experts say that America’s wide-ranging worker shortage could become a tax on growth and trigger a new wave of offshoring, like the one the $52 billion Chips Act is aiming to reverse.

- U.S. buyback announcements are running at a record pace this year despite the majority coming from only five companies, according to JPMorgan.

- Rising interest rates and remote work are prompting some of the nation’s wealthier landlords to skip payments on office buildings.

- The U.S. State Department said that passport renewals can take up to 11 weeks due to a surge in international travel.

- General Electric forecast a hefty revenue gain at its aviation business through 2025, driven by strong demand for jet engines and aftermarket services.

- Bayer AG plans to spend $1 billion on drug research and development in the U.S. this year as it works to double its sales in the country by 2030.

- Walmart’s online subscription service, Walmart+, is gaining ground against Amazon’s Prime service, new figures show.

- Vinyl records outsold CDs last year for the first time since 1987.

International Markets

- European bank stocks plunged today following the rout in U.S. bank stocks after a Silicon Valley lender faced a capital squeeze.

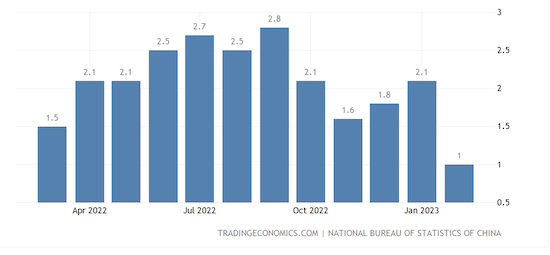

- China’s annual inflation rate fell to a lower-than-expected 1% in February from 2.1% the prior month:

- The U.S. and Canada are set for a historically large gap between their monetary tightening campaigns after Canada’s central bank signaled it would stop raising rates after this week.

- Mexico’s annual inflation rate eased to 7.62% in February, the lowest in a year:

- Italy’s Prada expects revenue growth to outpace rivals this year after sales exceeded targets in 2022 thanks to strong performance in Europe.

- Europe is emerging from its second-warmest winter on record, while parts of northern China were hit by record-high temperatures in recent weeks.

Some sources linked are subscription services.