MH Daily Bulletin: March 6

News relevant to the plastics industry:

At M. Holland

- Plastics News named M. Holland among the Best Places to Work for 2023! This marks the company’s sixth consecutive year receiving this award. Congratulations to all 22 finalists this year!

- Plastics Business published a story written by M. Holland’s Todd Waddle, Director, Sustainability, which reviews key considerations for implementing post-consumer recycled (PCR) and post-industrial recycled (PIR) materials. Click here to read the full article.

Supply

- Oil rose over 1% Friday to end the week higher, driven by renewed optimism about demand from top importer China.

- In mid-morning trading today, WTI futures were down 0.7% at $79.15/bbl, Brent was down 0.8% at $85.17/bbl, and U.S. natural gas was down 12.6% at $2.63/MMBtu.

- Saudi Arabia raised crude prices for Europe and Asia for a second consecutive month, as new refining capacity coming on-stream in the country is expected to increase domestic demand.

- Shareholders in U.S. oil companies reaped a $128 billion windfall in 2022 thanks to a combination of global supply disruptions and intensifying Wall Street pressure to prioritize returns over exploration.

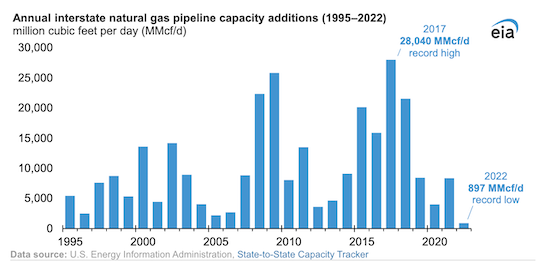

- The U.S. saw just five new natural-gas pipeline projects last year, adding the smallest amount of interstate capacity since records began in 1995.

- European cities are heating homes with natural gas fracked from wells in Texas and Louisiana, as U.S. LNG exports reach record levels.

- The U.S. administration is holding talks with global energy companies and foreign officials in an effort to set standards for certified natural gas, which producers are marketing as climate-friendly.

- Hydrogen producer Plug Power increased revenue 40% last year but fell short of projections.

Supply Chain

- A powerful storm system that battered the South and Midwest with heavy winds caused at least 11 deaths and left thousands of Americans without power over the weekend.

- After a Norfolk Southern train derailed last month near Palestine, Ohio, spilling toxic chemicals, the railroad suffered a second derailment near Springfield, Ohio, Saturday, prompting a new investigation. No injuries were reported.

- The U.S. administration is preparing a new program that could prohibit investment in certain sectors in China, a new step to guard technology.

- U.S. importers are fighting millions of dollars in fees imposed by the world’s largest ocean carriers with the help of a new federal law.

- Global air cargo capacity is back above pre-pandemic levels for the first time in four years, while total volumes dropped 4% in February compared with a year earlier.

- An international association of freight forwarders is calling for ocean carriers to restore demurrage/detention policies and fees to pre-pandemic levels.

- The London Metal Exchange suspended the inflow of Russian sourced metals into its U.S. warehouses ahead of new U.S. tariffs on Russian metals.

- Apple’s iPhones will soon be assembled at a factory under construction in the southern Indian state of Karnataka.

- Taiwanese chipmaker TSMC plans to recruit 6,000 new engineers this year despite a global downturn in the chip industry.

- U.S.-based chip supplier MKS Instruments expects quarterly revenue to fall 20% on the impact of a ransomware attack that disrupted its supply chain in February.

- A blockade is set to resume on a crucial copper-transport highway this week in Peru, the world’s second-largest producer.

- In the latest news from the auto industry:

- Volkswagen expects supply chain issues to ease and sales to rise 10%-15% to as much as $352 billion this year.

- Volkswagen executives are discussing the potential for two new factories in North America, including a battery plant.

- Volkswagen announced plans to build a $2 billion manufacturing site in South Carolina for its Scout off-road vehicles.

- With recent price declines, the cost to buy and operate some electric vehicles over several years is roughly on par with their gas-powered counterparts.

- Tesla cut prices on two of its most expensive models, its fifth price adjustment this year as it seeks to boost sales.

- Tesla sold 74,402 China-made vehicles in February, up almost 32% from a year earlier.

- After suffering a nearly 10% fall in sales of F-150 trucks last year, Ford is studying ways to boost output of gas-powered and hybrid F-150 trucks as part of a broader plan to boost production of several models.

- The U.S. and EU are working toward an agreement that would make European battery minerals eligible for tax credits, officials say.

- Mercedes-Benz began construction on a sustainable battery recycling factory in southern Germany last week.

- China’s electric-vehicle-makers are increasingly selling cars abroad following bumper success in their domestic market.

Domestic Markets

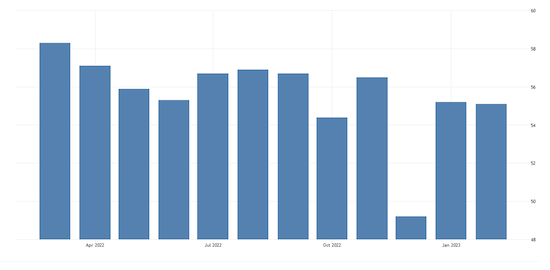

- The U.S. services sector grew at a steady pace in February, with new orders and employment rising to more than one-year highs.

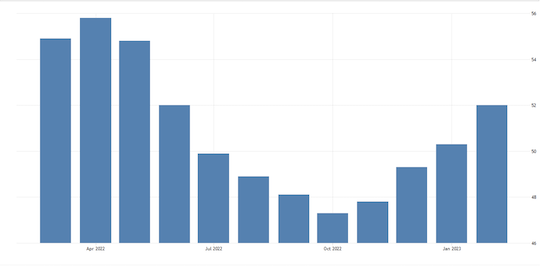

- U.S. manufacturing activity declined for a sixth straight month in February, according to the Institute for Supply Management.

- Home mortgage applications slid during the week ended that Feb. 24 to the lowest level in 28 years as high borrowing costs continue to squeeze buyer affordability.

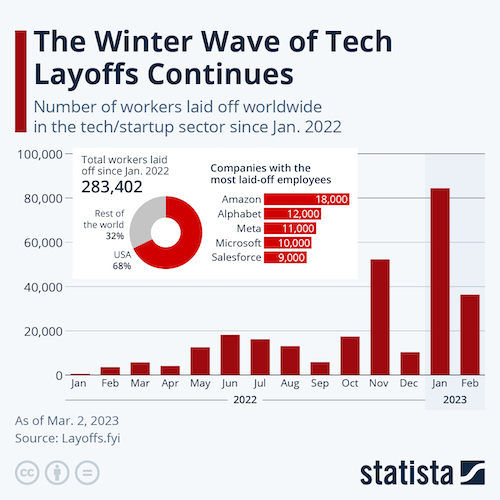

- Many analysts are skeptical that a recent spell of high-profile tech layoffs is a precursor to recession.

- Amazon is pausing construction of its sprawling second headquarters near Washington, D.C., as the company reassesses office needs due to remote work.

- Discount retailing giant TJX is taking advantage of buying opportunities, growing its branded inventory and sales as major retailers close stores and liquidate excess stock.

- Target will enable customers to make curbside returns starting this spring.

International Markets

- A gauge of business activity in the euro zone climbed to an eight-month high of 52 last month, led by the bloc’s dominant services industry, according to S&P Global.

- Euro zone producer prices fell by a larger-than-expected 17.7% year over year in February.

- The U.K. is likely to extend support for household energy bills by an additional three months through the end of June to help squeezed consumers.

- Home prices in Toronto fell 17.9% in February from a year earlier, while sales were down 47%.

- China unveiled its lowest GDP growth target — 5% — in more than 25 years as it faces challenges following its emergence from three years of strict COVID-19 measures.

- Activity in China’s services sector expanded at the fastest pace in six months in February, according to a private survey.

- Russia’s wheat exports nearly doubled in the last two months from a year ago due to bumper harvests, making Russian grain one of the cheapest globally.

- German airline Lufthansa swung to a 1.51 billion euro profit in 2022 and expects a significant improvement in earnings this year.

- Indian budget carrier IndiGo is in considering an order of more than 500 Boeing and Airbus jets, potentially smashing an order record set by a domestic rival just a few weeks ago.

- Boeing received an order for 15 737-9 aircraft from Hong Kong’s Greater Bay Airlines.

Some sources linked are subscription services.