MH Daily Bulletin: March 1

News relevant to the plastics industry:

At M. Holland

- Plastics News named M. Holland among the Best Places to Work for 2023! This marks the company’s sixth consecutive year receiving this award. Congratulations to all 22 finalists this year!

Supply

- Oil rose nearly 2% Tuesday on growing expectations of a strong economic rebound in China.

- Oil prices eased in mid-morning trading today on fears of rising inventories, with WTI futures down 1.0% at $76.30/bbl and Brent down 0.7% at $82.89/bbl. U.S. natural gas was up 0.3% at $2.75/MMBtu.

- U.S. crude stocks likely rose by 6.2 million barrels last week, the American Petroleum Institute said. Government data is due today.

- U.S. crude production fell in December to 12.1 million bpd, its lowest since August 2022, the Energy Information Administration said.

- OPEC’s crude oil production for February was 150,000 bpd higher than the previous month.

- European natural gas prices fell for a third consecutive month in February as demand plunged amid mild weather.

- Russia managed to export 7.32 million bpd of crude and crude products in February, largely on par with late-2022 volumes.

- Output at Russia’s Sakhalin-1 oil and gas operation fell below 50% of planned volumes in 2022 after Exxon Mobil exited the project.

- Russia will probably keep selling as much oil as it can to India despite the rebound in Chinese demand, analysts say.

- The collapse of natural gas prices has caused a corresponding drop in oil and gas M&A activity, with deals last year at the lowest level since 2005.

- Oil field services firm Atlas Energy Solutions expects a $2 billion valuation in its upcoming U.S. IPO.

- The Justice Department sued Denka Performance Elastomer LLC, formerly owned by DuPont, over alleged hazardous chemical exposures to the local community.

- Big miners are spending billions of dollars on deals and raising budgets for new projects in a bet that the global energy transition will boost demand for copper, nickel and other critical materials.

- Wind power now accounts for 25% of Texas’ electricity generation.

Supply Chain

- The average U.S. diesel price dropped to $4.29 per gallon last week, about 8.2 cents lower than the previous week.

- The White House is close to approving an expansion of ethanal blended gasoline (E15) in some Midwest states, a potential win for the agricultural industry at the expense of fossil fuel producers.

- The U.S. Commerce Department kicked off the application process for $53 billion in semiconductor manufacturing subsidies Tuesday. The funds will come with strings attached, including limitations on stock buybacks and some employee benefits requirements.

- U.S. aluminum companies are voicing support for the White House’s plans to impose 200% tariffs on Russian aluminum.

- A manufacturer of Apple’s AirPods will invest $280 million to shift some production from China to Vietnam, the firm announced.

- Sam’s Club is expanding its supply-chain network with plans to open 16 new facilities over the next five years.

- China’s Cosco Shipping opened a sea and air logistics center in Guangzhou.

- Caterpillar dodged a walkout, announcing a tentative labor agreement yesterday with the union representing workers at four of its facilities.

- In the latest news from the auto industry:

- The U.S. Postal Service plans to buy 9,250 Ford E-Transit battery-electric vehicles starting later this year.

- GM is cutting hundreds of executive-level and salaried jobs as it trims costs.

- Tesla has committed to building a new manufacturing facility in northern Mexico, the country’s president said.

- Tesla’s sales in China are running short of their fourth-quarter pace, indicating the impact of discounted prices is waning.

- South Korea’s L&F Co. shares jumped 19% after winning a $2.9 billion order from Tesla to provide cathode materials for its electric-vehicle batteries.

- Rivian Automotive reported mixed quarterly results as pressure mounts for the electric-vehicle startup to show it can overcome initial growing pains.

- Stellantis will invest $155 million in three plants in Indiana to produce electric drive modules.

Domestic Markets

- U.S. wholesale inventories fell by 0.4% from December to January, the first decline since July 2020:

- Bank of America says the Federal Reserve may hike interest rates to nearly 6% due to persistently strong economic conditions.

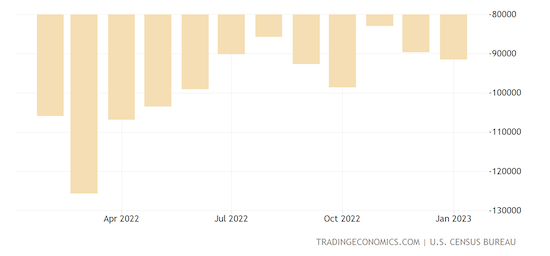

- The U.S. trade deficit in goods rose by a modest 2% in January to $91.5 billion.

- The dollar rose against major currencies in Tuesday trading, marking its first monthly gain since September 2020.

- U.S. consumer confidence unexpectedly fell in February, according to a Conference Board gauge.

- Two online recruiters report that private sector job postings are falling faster than government data suggests, a sign of a weakening labor market.

- U.S. single-family home prices rose at their slowest pace in 2.5 years in December.

- U.S. banks reported a 5.8% decline in profits last year.

- Goldman Sachs signaled it is considering a sale of its consumer arm after it suffered billions of dollars in losses last year.

- HP forecast second-quarter profit above estimates as it benefits from cost cuts and a recovery in demand in China.

- Grocery delivery company Instacart generated sharply higher sales and profit in the fourth quarter.

International Markets

- Inflation in France and Spain unexpectedly rose this month, pushing up EU rate-hike expectations.

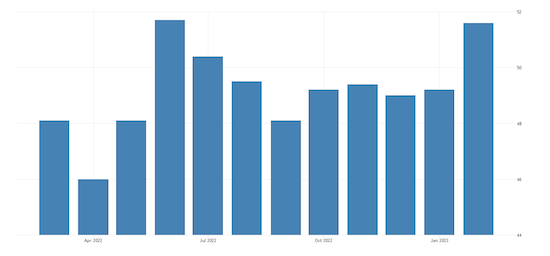

- The Caixin/S&P index of China’s manufacturing activity rose to 51.6 in February from 49.2 the previous month, the first increase in the sector since last July. The official government PMI was even higher at 52.6, which would mark the fastest growth in a decade.

- The U.K. and EU agreed on a new trading arrangement for Northern Ireland to alleviate post-Brexit friction over cross-border trade rules.

- South Korea’s export slump deepened by 15.9% in February.

- Canada’s economy was flat in the final three months of 2022, massively underperforming expectations.

- India’s economic growth slowed to a 4.4% pace in the fourth quarter amid weakness in the manufacturing sector.

- U.S. offices are just 40% to 60% occupied compared to their pre-pandemic levels amid a shift to remote work, while occupancy levels in Europe and Asia have reached 70%-90% and 80%-110%, respectively.

- The death toll from recent earthquakes in Turkey and Syria is up to 51,000.

Some sources linked are subscription services.