MH Daily Bulletin: June 29

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details this week. Learn more about the tax in this Plastics News article.

- M. Holland’s Wire & Cable team is in Philadelphia, Pennsylvania for AMI’s Polymers in Cables this week! This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry.

- M. Holland will be closed Monday in observance of the July Fourth holiday. We wish all subscribers a safe and happy holiday weekend.

Supply

- Oil prices rose over 2% Tuesday on indications that major OPEC producers will be unable to significantly boost supply.

- In mid-day trading today, WTI futures were down 0.7% at $111.10/bbl, Brent was down 1.0% at $116.80/bbl, and U.S. natural gas was down 0.8% at $6.52/MMBtu.

- The American Petroleum Institute reported a larger-than-expected crude draw of 3.799 million barrels last week. The U.S. government will release its own data today, including last week’s delayed report.

- Sheetz gas stations will charge as little as $3.49 per gallon of gas through July 4 as part of a holiday discount.

- U.S. energy sector employment rose by 4% last year, led by work in low-carbon vehicles. The number of fossil fuel jobs declined.

- The U.S. administration is holding its first auction for onshore oil and gas sites this week covering over 140,000 acres, with 90% in Wyoming.

- Exxon Mobil and Imperial Oil will sell nearly $1.5 billion in Canadian shale and gas assets during a time when high oil prices attract the best offers.

- The value of OPEC petroleum exports surged 77% from 2020 to 2021 while active rigs rose a more modest 11%. In contrast, well completions dropped in every major OPEC nation.

- More oil news related to the war in Europe:

- U.S. authorities stopped an oil tanker from unloading its cargo in Louisiana after traveling from Russia.

- G7 leaders agreed to explore a ban on transporting Russian oil listed above a certain price, although details of the plan remain unclear. The nations also committed to boosting public investment in gas projects.

- The International Energy Agency predicts EU nations will need to cut natural gas usage 30% by early next year to prepare for a complete halt of Russian deliveries.

- Over 20 European LNG projects have been announced or accelerated since March, with the potential to replace about 80% of total imports from Russia, according to FTI Consulting.

- Norway’s Equinor is sending more crude from its giant North Sea oilfield to the European market instead of Asia, a boon for the EU.

- Britain is allowing two gas electricity plants to boost output as officials work on replacing Russian deliveries.

- Global energy consumption rose 5.8% in 2021 to top pre-pandemic levels, according to BP.

- PetroChina may sell its natural gas projects in Australia and oil sands in Canada to divert funds to more lucrative sites in the Middle East, Africa and Central Asia, reports suggest.

Supply Chain

- Tokyo could face power cuts as a days-long heatwave breaks 150-year-old temperature records for the month of June.

- South African power cuts will continue today as worker protests delay maintenance and repairs at power plants.

- Over 28,000 rail-bound containers were backed up at the Port of Los Angeles Monday, more than triple the level from February. On average, more than half the port’s truck gates are going unused due to inconsistent staffing and congestion at nearby distribution sites.

- The U.S. administration says contract negotiations between thousands of West Coast dockworkers and their employers are going well with no major sticking points.

- Shipping executives estimate that inbound container volumes across the 10 largest U.S. ports are down an average of 25% since May.

- U.S. wholesale inventories surged 25% in May from a year ago to over $880 billion.

- Just over 75,500 truck trailers moved in North American intermodal networks in May, down 26.6% from the year before.

- Trac Intermodal says it is waiting nearly three times as long for truckers to return chassis as it did before the pandemic.

- Port congestion in China is easing after a predicted boom in exports from post-lockdown Shanghai failed to materialize.

- American importers expect delays as U.S. Customs begins enforcing a ban on inbound shipments from China’s Xinjiang region, while American businesses in China expect higher compliance costs.

- Singapore is forging ahead with a $40 billion project to build the world’s biggest automated port by 2040 that would double existing space while featuring drones and driverless vehicles.

- HMM increased its holdings in smaller South Korean container carrier SM Line.

- Cox Automotive dropped its full-year forecast for U.S. auto sales from 15.3 to 14.4 million units on continued impacts from supply chain disruptions.

- Research firm AutoForecaster Solutions said the chip shortage is worsening and will cut vehicle production this year by 3.1 million units.

- Volkswagen expects to see relief in its struggle with computer chip shortages by the second half of this year, executives said.

- The global chip shortage resulted in a record number of wire fraud complaints related to unfulfilled or scam orders.

- India may reverse its recent ban on sugar exports as swelling inventories clog ports and warehouses.

- Commodities giant Glencore made more money trading oil, metals and other commodities in six months than it expected to make all year.

- Argentina cut its wheat export quota by nearly one-third on signs that the annual harvest will hit a 12-year low.

- Global corn and wheat prices were 27% and 37% higher from January to mid-June, the World Bank said.

Domestic Markets

- The U.S. reported 125,440 new COVID-19 infections and 549 virus fatalities Tuesday.

- The fast-spreading BA.4 and BA.5 subvariants of Omicron surpassed 50% of total U.S. cases.

- Officials fear BA.5 will cause a sixth wave of COVID-19 in New York City.

- A renewed mask mandate in the San Francisco Bay Area was scrapped Tuesday after less than a month.

- Yesterday, the CDC added the Dominican Republic and Kuwait to its list of high-risk countries for COVID-19 infection.

- FDA advisers recommended that vaccine makers update their COVID-19 shots to boost effectiveness against new virus strains this fall.

- Consumer sentiment about the U.S. economy is at its lowest point in nearly a decade, new data from the Conference Board shows.

- The U.S. trade deficit in goods fell 2.2% in May to $104.3 billion, a second straight decline that could give a lift to GDP in the current quarter.

- The Richmond Fed’s manufacturing index came in at a lower-than-expected -19 in June, the lowest reading in over two years.

- New data shows U.S. home-price growth slowed modestly from March to April, although prices were still up more than 20% year over year.

- U.S. airlines cut 2,100 more flights in June from the same month in 2019 amid rising chaos at airports.

- Delta Air Lines pilots will picket for several hours tomorrow at major airports across the country to protest pay and mass flight cancellations. The airline is letting travelers change flights for free this holiday weekend ahead of more expected disruptions.

- Firms are slated to invest over $700 million in U.S. manufacturing capacity for electric-vehicle chargers, the White House said.

- Tesla is laying off hundreds of workers as it shutters a facility in San Mateo, California.

- U.S. vehicle quality declined to a 36-year low this year, J.D. Power says.

- Fewer Americans plan to take road trips over the next several months due to surging gasoline prices, surveys show.

- Use of Teslas among ride-share drivers is surging due to high gas prices.

- Goldman Sachs’ consumer unit is expected to lose over $1.2 billion this year due to rising costs.

- Walgreens Boots Alliance scrapped a plan to sell its Boots pharmacy business due to a lack of interest.

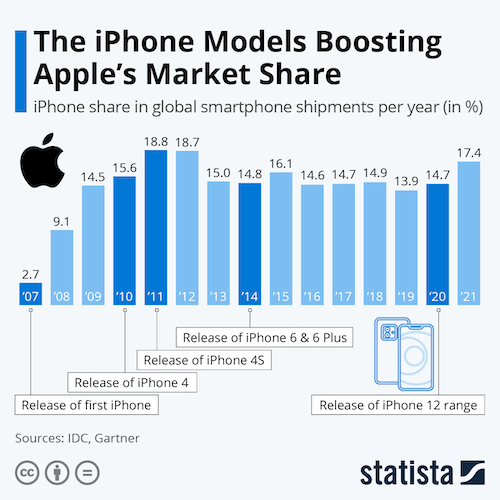

- Apple’s revolutionary iPhone celebrated its 15th anniversary yesterday:

International Markets

- The pandemic was largely off the agenda at the G7 summit in Germany the past week, a stark turnaround in global priorities from last year.

- Singapore recorded over 11,500 new COVID-19 infections yesterday, a three-month high.

- Shanghai Disney will reopen tomorrow after a months-long shutdown.

- More news related to the war in Europe:

- The U.S. concluded its meeting with G7 nations by sanctioning 70 more Russian firms, including defense conglomerate Rostec, and banning gold imports from the country.

- EU’s central bank signaled it would more modestly raise interest rates over the coming months amid weaker growth prospects caused by the war in Ukraine.

- Michelin and Finland’s Nokian Tyres will be the first Western tire makers to fully exit Russia.

- Nissan extended its production halt in Russia by another six months to October.

- Appliance maker Whirlpool expects to take a $400 million loss in the current quarter after it fully halts Russian operations.

- Smirnoff maker Diageo, the world’s largest spirits maker, will wind down its business in Russia by year’s end.

- British food prices rose 6% in June from a year ago, worsening the nation’s cost-of-living crisis.

- The EU’s economic sentiment index for the Euro Area fell to its lowest level since March of last year, while a companion index of uncertainty rose.

- France slashed its GDP growth forecast from 4% to 2.5% this year amid gathering economic headwinds.

- Hungary’s central bank hiked its benchmark interest rate 185 basis points to 7.75% Tuesday, the largest increase since 2008.

- Japanese retail sales rose a healthy 3.6% in May, the third monthly increase, despite consumer sentiment in the nation dropping to an 18-month low.

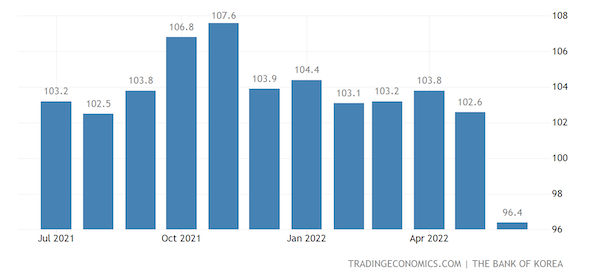

- A measure of South Korean consumer sentiment plunged 6.2 points in June to the lowest in over a year:

- Swiss healthcare giant Novartis plans to cut up to 8,000 jobs globally by 2024, accounting for roughly 7.4% of its workforce.

- Lufthansa is cutting 2% of its flights between August and October as staffing shortages and strikes continue to hamper operations.

- EU countries endorsed a plan Tuesday to effectively ban combustion-engine cars by 2035.

- Maruti, India’s largest automaker, says hybrid vehicles are a better fit than all-electric vehicles for the nation’s climate targets.

- Britain will soon become the first major economy to report greenhouse gas emissions on a quarterly basis.

Some sources linked are subscription services.