MH Daily Bulletin: June 28

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details this week. Learn more about the tax in this Plastics News article.

- M. Holland is sponsoring AMI’s Polymers in Cables on June 28-29 in Philadelphia, Pennsylvania. This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry. M. Holland is also hosting the event’s networking reception on June 28 at 5:30 pm ET!

- If you’re attending AMI’s Polymers in Cables in Philadelphia, mark your schedule for M. Holland’s technical session:

- Paul Lorigan, Manager of Technology & Laboratory Services for M. Holland, will be giving a presentation on new cable applications for fluoropolymers, graphene and sustainability solutions. Don’t miss his talk on June 29 at 11:50 am ET.

Supply

- Oil prices rose almost 2% Monday on talks of tightened sanctions against Russia.

- In mid-morning trading today, WTI futures were up 1.9% at $111.70/bbl, Brent was up 2.3% at $117.70/bbl, and U.S. natural gas was up 0.2% at $6.52/MMBtu.

- U.S. strategic crude inventories fell by 6.9 million barrels last week to the lowest since April 1986.

- Tech issues continue to delay the U.S. administration’s release of fuel data for last week while throwing doubt on the timely release of this week’s data.

- More U.S. shale producers are reviving old wells with a second, high-pressure blast meant to temporarily boost output at low cost.

- U.S. crude exports from the Gulf Coast will hit a record 3.3 million bpd this quarter, analysts predict, including a 30% rise in shipments to Europe.

- OPEC+ trimmed its 2022 forecast for a global surplus in the oil market from 1.4 million to 1 million bpd.

- Libya may soon halt all oil exports from the Gulf of Sirte, home of the OPEC member’s main ports due to rising civil unrest.

- Ecuador could be forced to completely suspend oil production amid violent anti-government protests.

- More oil news related to the war in Europe:

- More detailed plans by G7 nations to impose a price cap on Russian oil could be released today.

- Benchmark European gas prices rose 55% the past two weeks, with most EU members expecting further cuts in Russian supplies.

- Germany is in talks about building a new LNG terminal on Canada’s east coast to provide exports to Europe.

- Russia’s seaborne crude exports plunged 20% last week primarily due to maintenance work at a key Baltic port.

- Reports suggest Russia improved the quality of its flagship crude grade over the past two months, enticing Asian traders to buy more of the discounted fuel.

- Ukrainian forces attacked a Russia-controlled drilling platform in the Black Sea, their second strike in a week.

- G7 nations are close to reversing commitments to end financing for overseas fossil fuel projects, a bid to boost global fuel supplies.

- “Smart” thermostats could help EU households save on energy in the mass, lawmakers say.

- Sri Lanka’s crippling fuel crisis came to a head, with officials shutting schools and limiting fuel supplies to essential services, including health and public transport, for the next two weeks. New data shows the island’s economy shrank 1.6% last quarter.

- British gasoline and diesel prices continued setting all-time records Monday.

- High gas prices are prompting gas stations to raise standard holds for credit card purchases, raising risks that customers may incur overdraft penalties before final transactions are settled by card issuers.

- Exxon Mobil’s chief executive expects all global passenger car sales to be electric vehicles by 2040.

- Chevron is shuttering the San Francisco Bay Area headquarters it has occupied for over 100 years and urging employees to move to Houston.

- The UAE is emerging as one of the world’s biggest state financiers of green energy, committing over $400 million to help developing nations transition and pledging to raise $4 billion for cleaner agriculture operations.

Supply Chain

- Inbound containers awaited rail transport at Southern California ports an average of 11.3 days in May, the longest in almost a year.

- Container shipping lines doubled first-quarter operating profits from last year to $43.9 billion, according to Sea-Intelligence.

- Stellantis halted production at two French plants due to component shortages from German supplier Continental.

- Large Japanese automakers are absorbing more of the burden of rising raw material costs to reduce the strain on their suppliers.

- Surging battery material costs are negating Ford’s expected profits from its electric Mustang model.

- Norway plans to capitalize on its access to minerals, metals and rare earth materials to bolster European electric-vehicle supply chains.

- Albemarle Corp. is considering locations in the U.S. Southeast for a new lithium processing plant that would double the firm’s production of the key electric-vehicle battery material.

- A chronic shortage of agricultural chemicals is threatening U.S. crop harvests this year.

- Samsung Electronics suspended new procurement orders and asked suppliers to delay or reduce shipments for several weeks due to swelling inventories.

- Quarterly sales at Nike were roughly flat despite a 5% decline in North America and a 19% decline in China. The firm’s forecast was downbeat after inventories rose 23% at the end of May with more products stuck in transit.

- Shipping delays are expanding the divide between Old Navy’s available inventory and current consumer preferences, the firm said.

- Some of the largest U.S. retailers are considering letting customers keep returns to prevent swelling inventories from expanding.

- British online apparel retailer Boohoo is considering charging customers for returning goods.

- Lufthansa is returning its Airbus A380 double-decker jets to service next summer partly due to delayed deliveries of new aircraft.

- Exports (-24%) and production (-20%) of Mexican heavy-duty trucks fell sharply in May from a year ago due to supply constraints.

- Self-driving truck-maker Gatik will begin moving shipments for Georgia-Pacific to Sam’s Club locations in the Dallas-Fort Worth area.

- Canadian National Railway announced $136 million in capital investments in Manitoba and Nova Scotia last week, as well as $30 million for its operations in Tennessee.

- UPS and the union representing its airline pilots agreed on a two-year contract extension.

- Supply chain issues are forcing more U.S. cities to cancel Fourth of July fireworks displays.

- U.S. consumers will pay about 17% more for Fourth of July cookouts this year due to inflation and the agricultural impacts of Russia’s invasion.

Domestic Markets

- The U.S. reported 124,834 new COVID-19 infections and 270 virus fatalities Monday.

- The fast-spreading BA.4 and BA.5 subvariants of Omicron could cause “substantial” COVID-19 infections this summer, health experts say.

- Roughly 7.5% of Americans are struggling with long-COVID symptoms, new research shows.

- Almost 13% of the U.S. Army National Guard is at risk of discharge ahead of a COVID-19 vaccine deadline this Thursday.

- FDA advisers will decide today whether to allow COVID-19 vaccine makers to update their shots for new variants this fall.

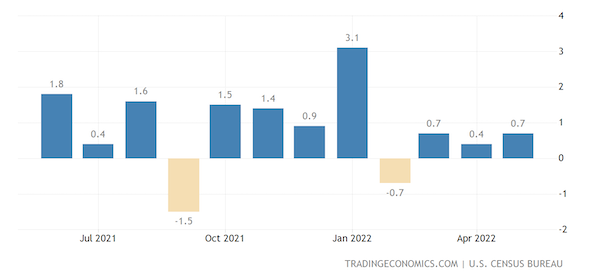

- U.S. durable goods orders rose 0.7% in May, driven mostly by rising sales for cars, computers and military aircraft. Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, rose a respectable 0.5%.

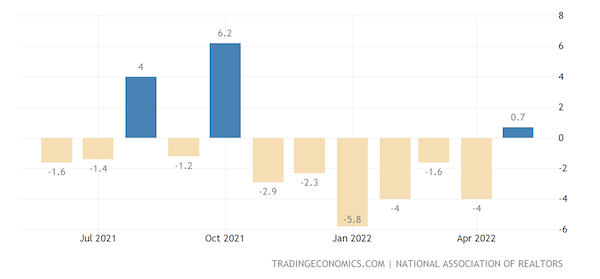

- The U.S. pending home sales index, an indicator of home sales based on contract signings, rose unexpectedly by 0.7% in May, the first increase in seven months.

- Four of the six biggest U.S. banks boosted their dividend payments Monday after the Federal Reserve’s stress testing showed they could keep lending even in a severe recession.

- Almost half of Americans report greater financial stress due to rising costs for housing, healthcare and other expenses.

- Stocks of consumer-staples firms are rising by double-digit percentages amid a broader bear market for U.S. equities.

- U.S. cities that saw the biggest jumps in home prices during the pandemic now have the largest share of price cuts, according to Zillow.

- Business is slowing sharply in the home-lending business, forcing cutbacks and layoffs at online home sellers and the mortgage units of major banks.

- The median U.S. rent price topped $2,000 for the first time in May, up 15% over the past year.

- A Federal Reserve index of Texas manufacturing activity fell to -17.7 in June, extending declines from the prior month to the lowest level in two years:

- Airlines canceled over 700 U.S. flights Monday due to a combination of adverse weather and staff shortages.

- JetBlue Airways again raised its offer to acquire Spirit Airlines, a day after a proxy firm gave an influential endorsement to Frontier’s rival bid.

- Carnival Cruise Line is forecasting a profit for the current quarter as passenger volumes near pre-pandemic levels.

- Car-renting, ride-hailing and bike-sharing firms are expected to generate over $660 billion per year by 2030, a nearly 40% increase from 2020.

- Volkswagen is close to selling part of its U.S. electric vehicle charging network to Siemens for over $2 billion.

- U.S. telecom firm SubCom received a $600 million contract to build a 10,500-mile fiber optic subsea cable from Singapore to France.

- Denver’s city council voted to replace a monthly charge for trash pickup to a “pay as you throw” volume-based system.

International Markets

- COVID-19 cases in the U.K. rose 23% last week.

- French health officials recommend people resume mask-wearing in crowded areas and on public transport after the nation saw the most COVID-19 infections in over two months on Monday.

- China reduced quarantine times for inbound travelers by half, the biggest shift in its COVID-19 policy in months.

- A Beijing official indicated the city would persist with its zero-COVID policy for at least the next five years.

- H&M permanently closed its flagship store in Shanghai after consumer demand slumped during lockdowns.

- Thai scientists are developing an anti-viral nasal spray that could kill the coronavirus upon entry into the nose.

- More news related to the war in Europe:

- Russia officially defaulted on its foreign debt obligations for the first time in over a century, the White House said, a charge that Moscow denied outright.

- The White House raised the tariff rate on remaining Russian imports to 35%, a consequence of Russia losing its favored-trade status.

- Holiday Inn-owner IHG will cease all operations in Russia.

- Canada boosted sanctions on Russia to include a ban on exports of manufacturing technology.

- Russian exporters boosted shipments of a key steelmaking ingredient by 30% in March from the previous month, suggesting discounts are superseding pledges by European firms to stop sourcing from Russia.

- The slowdown in the U.S. housing market is affecting Asian supply chain data, with orders from American importers for Chinese manufactured goods down 20%-30%.

- A Bloomberg index of Canadian consumer confidence fell for the ninth week to near an all-time low.

- Gauges of consumer confidence in both Germany and France fell sharply this month.

- Sweden’s Northvolt, a battery supplier to BMW and Volkswagen, plans to go public within two years amid booming demand for electric vehicles.

- Amsterdam’s Schiphol airport is cutting flights by 11% this year to reduce noise pollution.

- The cost of charging Britain’s most popular electric vehicle is up 37% since December amid surging power prices.

- Denmark is testing the world’s first 3D-printed reefs in a bid to improve North Sea ecosystems.

Some sources linked are subscription services.