MH Daily Bulletin: June 22

News relevant to the plastics industry:

At M. Holland

- M. Holland will be charging a fee to recover the reinstated Superfund Excise Tax for applicable U.S. orders starting July 1, 2022. Clients will be notified of details next week. Learn more about the tax in this Plastics News article.

- M. Holland is sponsoring AMI’s Polymers in Cables on June 28-29 in Philadelphia, Pennsylvania. This conference covers the latest technical developments, manufacturing solutions and trends in the wire and cable industry. M. Holland is also hosting the event’s networking reception on June 28 at 5:30 pm ET!

- If you’re attending AMI’s Polymers in Cables in Philadelphia, mark your schedule for M. Holland’s technical session:

- Paul Lorigan, Manager of Technology & Laboratory Services for M. Holland, will be giving a presentation on new cable applications for fluoropolymers, graphene and sustainability solutions. Don’t miss his talk on June 29 at 11:50 am ET.

Supply

- Oil prices rose between 0.5% and 1% Tuesday as rising summer fuel demand keeps supplies tight.

- The White House called on lawmakers to approve a three-month suspension of the federal 18.4-cent gas tax and 24.4-cent diesel tax, which sent oil prices skidding. In mid-morning trading today, WTI futures were down 5.2% at $103.80/bbl, Brent was down 4.7% at $109.30/bbl, and U.S. natural gas was up 0.9% at $6.87/MMBtu.

- New data shows American drivers are starting to buy less gasoline amid historically high prices, even as a record 42 million Americans are expected to hit the road for trips over July 4 weekend.

- U.S. refining capacity is near a decade low in 2022, according to the EIA, and about 1 million bpd lower than January of 2020.

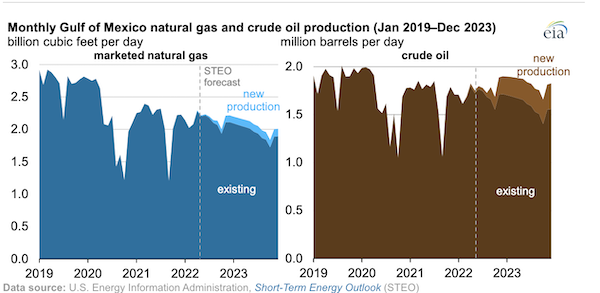

- A spate of new oilfields coming online will contribute to 5% of natural gas production and 14% of crude production in U.S. Gulf of Mexico waters by next year:

- Exxon Mobil’s chief executive is predicting at least three to five years of tight oil markets.

- Exxon Mobil and ConocoPhillips are partnering with Qatar to expand the nation’s North Field gas project, the world’s largest offshore gas deposit.

- Electricity generators on the biggest U.S. grid will be paid 32% less next year for being on standby, a move that could incentivize adding more power supply to the system stretching from New Jersey to Illinois.

- A flood of new renewable energy projects coming online, including renewable diesel plants, will not be enough to tame prices or offset the loss of refining capacity from plant closings, new studies suggest.

- More oil news related to the war in Europe:

- Germany is preparing to trigger the second stage of its three-stage gas emergency plan, which could bring higher energy costs to consumers and spark more coal plant usage. A German industry body said the nation will fall into a recession if gas supplies from Russia are halted.

- The Indian government asked state oil companies to boost purchases of cheap Russian crude in a sign of strengthened trade ties between the two countries.

- Iraq shipped its first ever cargo of LNG, marking the nation’s entry into the natural-gas market at a time when European demand is set to continue rising.

- Canada is still trying to work around sanctions to send a critical pipeline component to Russia for its Nordstream 1 line to Germany, which would boost recently reduced flows.

- EU officials are skeptical of the U.S. push to impose a price cap on Russian oil by modifying the EU’s own ban on insurance for transporting Russian crude.

- Linde, the world’s largest industrial gases company, ended its participation in Russia’s Amur gas and chemicals complex.

- Kuwait says the current premium on oil prices from Russia’s invasion is about $30/bbl.

- China could see another power crunch this summer as miners race to meet government targets with lower-quality and less efficient coal.

- The British government unveiled an $18.4 billion support package to help households manage surging energy costs.

- Iraq believes it can raise its production capacity from 4.4 million bpd to 6 million bpd over the next five years.

- Namibia hopes that a recent spate of oil finds will double the southern African nation’s economy within 20 years.

- Years in the making, South Africa’s plans to transition from coal to gas are being undermined by the rapid expansion of cheap renewable energy, which economists say is a better option.

- German lawmakers plan to reject an EU proposal to ban the sale of new gas-powered cars by 2035.

Supply Chain

- At least two dozen U.S. cities have already seen new record temperatures as a weekslong heatwave continues pushing east.

- New Mexico’s Calf Canyon blaze has burned over 340,000 acres since April, making it the largest fire in the state’s history.

- Extended drought conditions in parts of Europe are raising the chance for wildfire activity, forecasters say.

- Record rains in south China are forcing millions of people to relocate.

- Tens of thousands of striking British rail workers brought the U.K.’s travel network to a standstill on Tuesday, with more than 1 million commuters in London alone staying home.

- An aggregate measure of U.S. logistics costs soared 22.4% last year to a total of $1.85 trillion, roughly equal to 8% of the nation’s GDP. This was the highest share of logistics spending relative to GDP since 2008, according to the Council of Supply Chain Management Professionals.

- The most recent Logistics Managers Index showed U.S. logistics activity dropped several points to 67.1 in May, the lowest level since December 2020.

- Supply constraints account for about half of the surge in U.S. inflation, according to the San Francisco Federal Reserve.

- Several import groups are asking the White House to help ensure there is no disruption from the West Coast labor talks affecting thousands of dockworkers.

- The U.S. Supreme Court agreed to hear a case on whether New Jersey can unilaterally pull out of the Waterfront Commission of New York Harbor, a bistate crime-fighting agency it has operated with New York for almost 70 years.

- Pressure is growing within companies and from Western governments to source manufacturing beyond China.

- Gap plans to increase its apparel sourcing from Central America by about $50 million annually over the next three years.

- FedEx partnered with freight-tracking firm FourKites to build a data platform that can predict shipping delays and reschedule routes.

- A German drone delivery company received new funding to expand services beyond medical products to include groceries.

- Sales of luxury goods are set to rise at least 5% this year as demand remains strong among U.S. and European shoppers.

- Japan’s Imabari Shipbuilding is near a deal to build four new container ships for a record price tag of up to $260 million each.

- The University of Arkansas undergraduate supply-chain management program was ranked as the best in the U.S. by IT consultant Gartner.

- U.S. automakers are making a last-ditch effort to convince lawmakers to approve extending electric vehicle incentives that could help maintain production growth as supplier costs mount.

- A group of U.S. solar developers will jointly invest $6 billion to build out the domestic solar supply chain.

- Recession fears are pulling down agricultural commodities, a welcome development for rampant food inflation.

Domestic Markets

- The U.S. reported 155,151 new COVID-19 infections and 482 virus fatalities Tuesday.

- The U.S. began distributing COVID-19 shots to children under age 5 yesterday following weekend regulatory approval.

- California’s latest rise in COVID-19 cases appears to be easing.

- Broadway theaters will drop their mask mandates next month for the first time since theaters fully reopened last September.

- GM, Ford and Stellantis will return to optional mask-wearing at their U.S. plants.

- Many long-COVID-19 victims suffer cognitive and motor coordination issues six months and longer after recovering from the virus.

- Over a dozen firms are building new glove-making plants in the U.S. after the pandemic caused a shortage, an effort boosted by $572 million in federal dollars.

- The pace of U.S. job postings slowed in recent weeks, according to career site Indeed, as recession fears prompt employers to rethink filling open positions.

- Goldman Sachs economists see a 30% probability of a U.S. recession within the next year, up from an initial forecast of 15%, while Citigroup pegged the likelihood at 50%.

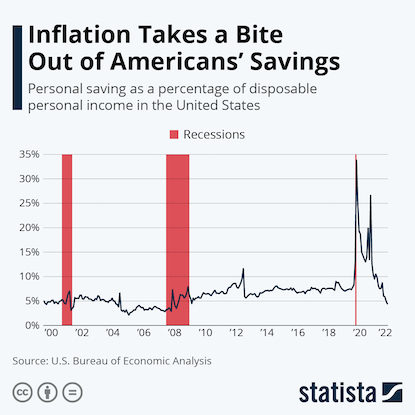

- Americans are now saving less than at any point since the Great Recession, indicating tighter budgets amid soaring costs for food, fuel and housing.

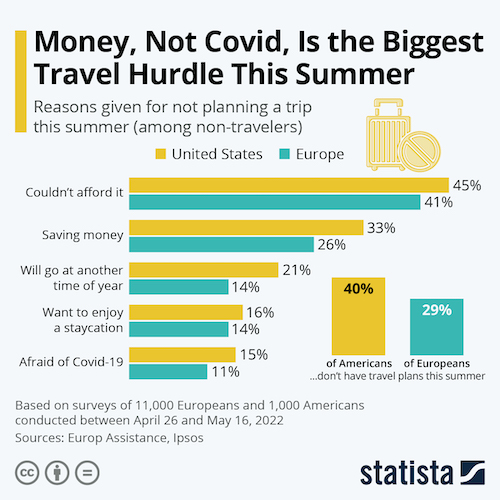

- Squeezed consumers are deferring travel vacations in favor of bolstering their bank accounts:

- U.S. existing home sales fell for a fourth month in May to the lowest level in two years, while the nation’s median home price jumped 14.8% to a record $407,600.

- U.S. single-family rents surged 14% year over year in April, the 13th period of record-breaking annual gains. Miami posted the biggest gain at 41%, about seven times the growth rate of a year ago.

- Kellogg plans to separate into three independent public companies, sectioning off its iconic brands into distinct snacking, cereal and plant-based businesses.

- Toyota is partnering with Carson City, Nevada-based Redwood Materials to create a sustainable closed-loop battery for its electrified powertrains.

- American Airlines will drop service to a fourth U.S. city — Dubuque, Iowa — in September amid an ongoing pilot shortage.

International Markets

- British officials are calling for vulnerable populations to get booster vaccine doses amid an increase in COVID-19 cases and hospitalizations.

- Beijing reported five new COVID-19 cases Tuesday.

- COVID-19 cases in Singapore rose 23% last week, driven by the fast-spreading BA.4 and BA.5 subvariants of Omicron.

- Macau, the world’s largest gambling hub and a special administrative region of China, locked down hundreds of people at a hotel due to a spreading COVID-19 outbreak.

- South Korea’s new COVID-19 cases fell to the lowest level in more than five months on Monday.

- More news related to the war in Europe:

- EU leaders aim to maintain pressure on Russia at their summit this week by committing to further work on sanctions.

- Ukraine could need as much as $1.1 trillion to rebuild after Russia’s invasion, the European Investment Bank said.

- Airbus is pushing against sanctions on Russian titanium sales, which comprise about 65% of the plane maker’s supply.

- Canadian retailers saw a 1.6% increase in receipts in May, as shoppers show a willingness to continue spending despite lower purchasing power.

- EasyJet’s Spanish workers will strike for nine days next month over a contract dispute.

- Britain is giving airlines a waiver from rules requiring them to use airport slots or lose them, allowing them to safely pull capacity to stem rising travel chaos.

- Toyota aims to boost July-September production by 40% from the same time last year despite continued supply disruptions, the automaker said.

- Chinese car shipments rebounded after lockdowns ended last month, with electric vehicle exports more than doubling to $1.2 billion.

- Audi will spend over $320 million to boost electric vehicle production at its factory in western Hungary.

- Honda is splitting the bill with a Chinese automaker on a new, $522 million electric vehicle factory in China’s Guangdong province.

Some sources linked are subscription services.