MH Daily Bulletin: June 17

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose between 1% and 2% in volatile trading Thursday.

- Recession fears drove energy prices lower today. In mid-morning trading today, WTI futures plunged 5.2% to $111.40/bbl, Brent was off 4.4% at $114.50/bbl, and U.S. natural gas was down 3.1% at $7.24/MMBtu.

- Government officials will meet with U.S. refining executives next week as the White House ramps up pressure to boost gasoline supplies, including talks of a potential limit on fuel exports.

- U.S. refiners imported the most heavy crude in nearly two years in May.

- High oil prices may not begin to ease until halfway through next year, consultant Wood Mackenzie predicts.

- North Dakota oil production hit 900,600 bpd in April, 20% below March and well off a 2019 peak of 1.5 million bpd.

- The U.S. imposed new sanctions on Chinese, Emirati and Iranian firms that help export Iran’s petrochemicals.

- OPEC production fell below targets by 2.695 million bpd in May due to production issues in Libya and increased sanctions on Russia.

- British gasoline and diesel prices rose to an all-time high Thursday, the latest in a string of daily records.

- Sri Lanka’s fuel stocks will last for about five more days, officials say.

- A group of oil and gas producers including Equinor, Shell and TotalEnergies are in talks for what would be the world’s largest floating wind farm off the coast of Norway to power their fossil-fuel activities.

- More oil news related to the war in Europe:

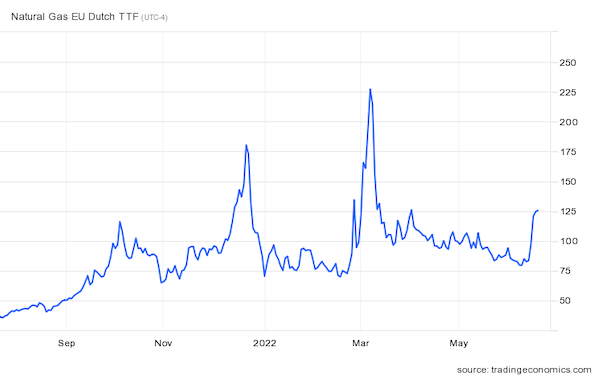

- European gas prices surged again Thursday after Gazprom cut more flows to Italy and Russia said it may suspend all deliveries on the Nord Stream 1 pipeline to Germany. Prices are now at their highest in a year, having risen 67% over the past week.

- Russian officials warned that Europe will pay sharply higher prices for energy as the nation looks to boost gas sales to China.

- The U.S. is urging EU officials to mitigate the impact of their ban on insuring Russian oil cargoes, arguing the measure could cause global prices to rise even higher.

- Russian officials say a huge fire at the nation’s biggest natural gas field did not disrupt production Thursday.

- Hungary extended a cap on basic food and fuel prices until Oct. 1 to combat surging inflation.

Supply Chain

- Parts of Chicago reached triple-digit temperatures for the first time in a decade as sweltering heat hit the U.S. Midwest. In Texas, power demand will continue breaking records through Monday due to high temperatures.

- Heavy rains caused major flooding in Montana this week, destroying infrastructure and prompting the state’s governor to ask for a federal emergency declaration.

- A dangerous heat wave will remain over Western Europe into the weekend, sending temperatures above 100°F.

- A major baby formula plant in Michigan was shut down Thursday due to flooding, less than two weeks after it resumed operations following contamination concerns.

- Workers at Chile’s state-owned Codelco, the world’s largest copper producer, will go on strike starting today if contract talks fail.

- Congestion at the Port of Shanghai has returned to levels close to normal.

- Tesla raised prices by 5% for all its U.S. car models in response to soaring raw material costs.

- Toyota plans to suspend more Japanese production in June and July due to computer chip shortages and a COVID-19 outbreak at one of its suppliers, the automaker’s third adjustment of June production plans.

- Volkswagen’s top U.S. executive said the nation faces major challenges in ramping up battery production in its shift to electric vehicles, including attracting skilled workers, mining for key metals and reducing supply chain disruptions.

- The New York Fed’s global supply chain pressure index was at 2.9 in May, down from 3.4 in April and a peak of 4.38 in December.

- The U.S. president signed into law a bill that tightens federal oversight of ocean shipping, a measure proponents say will reduce backlogs.

- Manufacturing activity in the U.S. mid-Atlantic region weakened unexpectedly in June as new orders dropped to a two-year low.

- About two-thirds of respondents in a recent survey say they are raising wages to retain warehouse workers, while 39% are offering overtime pay.

- Old Dominion Freight Line’s shipment growth pulled back sharply in May while revenue rose 26% on higher pricing and rising fuel surcharges.

- Container ship owner Costamare canceled an order for six large vessels to be built in China.

- Auction prices for used trucks are falling almost as quickly as they rose last year, leaving owner-operators stuck with overpriced equipment in a cooling freight market.

- Truckload carrier P.A.M. Transportation made its first acquisition in 19 years with a $77.4 million deal for New York-based Metropolitan Trucking.

- Supply chain software firm Descartes Systems is buying e-commerce parcel shipper XPS Technologies for $65 million.

- Insurance claims related to 2021’s months-long grounding of the Ever Given container ship in the Suez Canal will top $2 billion.

- Britain’s Unilever is changing the ingredient makeup for some of its most popular consumer products to cut costs and mitigate supply chain constraints.

- Twenty containers containing gold, silver ore and TVs were stolen from a Mexican container yard this month, the nation’s largest container heist ever.

- Firefighters brought a deadly fire at a Bangladesh container yard under control after several days of burning last week.

- Freight forwarder Kuehne + Nagel agreed to sell its Russian business to local management.

- KFC’s Australian shops are serving their meals with cabbage due to a widespread lettuce shortage.

Domestic Markets

- The U.S. reported 116,445 new COVID-19 infections and 40 virus fatalities Thursday.

- The U.S. is seeing over 100,000 new COVID-19 cases per day, up from around 12,000 per day at the start of summer last year. The current infection rate has held steady for about a month.

- U.S. recession fears are rising among CEOs, economists and bank strategists.

- May credit-card spending was just 10% higher than the same month last year, a sharply slower rate than gains seen throughout 2021.

- U.S. mortgage rates jumped over 50 basis points to 5.78% last week, the largest one-week increase since 1987, according to Freddie Mac.

- New U.S. home construction fell 14.4% last month to a 1.55 million annualized rate, the lowest in more than a year, while building permits for single-family homes declined 5.5%.

- Kroger raised its profit expectations for the year, the latest retailer to defy inflation-driven slumps by focusing on essential products.

- Amazon is launching an invitation-only offer program for high-demand items to ensure that goods aren’t purchased by bots that aggravate shortages and drive up prices.

- High gasoline prices are reigniting consumer interest in small cars, sedans and hybrids, vehicles in the shortest supply in the nation.

- Stellantis announced a second round of indefinite layoffs at its Sterling, Michigan, stamping plant “in order to operate the plant in a more sustainable manner…”

- Boeing says demand for its widebody jets, including freighters, is starting to recover.

- Investors pulled $3.5 billion from sustainable U.S. mutual funds in May, a break from years of net deposits.

- Pfizer, AstraZeneca, Takeda Pharmaceutical and other big drug companies announced plans to jointly assess the greenhouse gas emissions of their suppliers.

- Kraft Heinz is testing a renewable and recyclable ketchup bottle made from wood pulp.

International Markets

- Global COVID-19 fatalities rose 4% last week, the first increase in five weeks, according to the WHO.

- India reported 12,213 new COVID-19 infections yesterday, a four-month high.

- Beijing declared victory in its latest battle with COVID-19 after testing millions of people and quarantining thousands the past week.

- China’s strict COVID-zero policy will likely stretch into next year, discouraging American and European investment, the U.S. ambassador said.

- Demand is surging in Canada for treatment of long-COVID symptoms at specialized clinics.

- European stocks tumbled Thursday after a surprise interest rate hike from the Swiss National Bank, the bank’s first in 15 years.

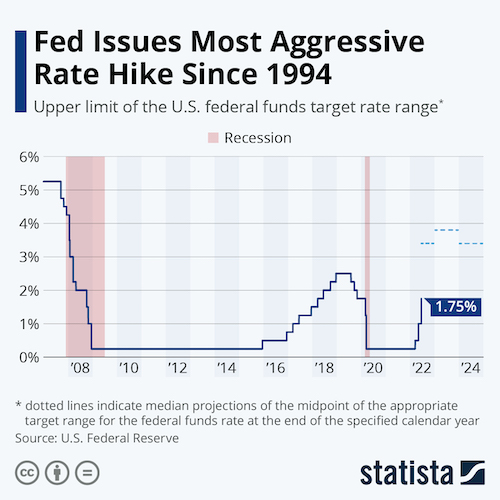

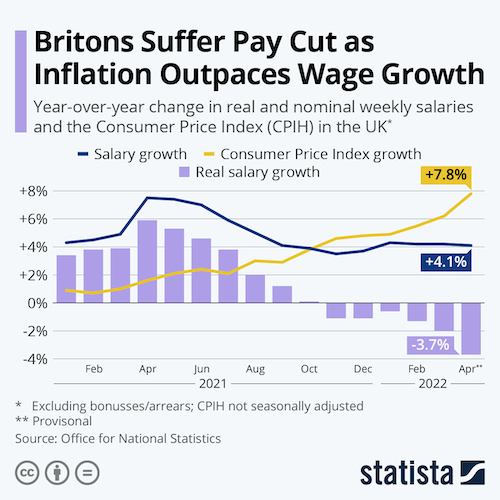

- The Bank of England raised interest rates by 25 basis points to 1.25% Thursday, as the nation’s inflation rate approaches 11%.

- The Bank of Japan maintained its ultra-low interest rate of minus 0.1% today, a sharp policy divergence with the rest of the world.

- Argentina’s central bank hiked its benchmark interest rate by 300 basis points to 52%, the sharpest rise in three years, as the nation’s inflation rate tops 60%.

- New home prices in China dropped 0.17% in May, the ninth straight month of declines.

- British job vacancies hit a new high last week as the nation’s labor market remains extraordinarily tight.

- Ministers from more than 100 countries convened at a WTO conference this week for the first time in four years, reaching partial agreement to ease intellectual property rights on COVID-19 vaccines, among other things.

- Amsterdam’s Schiphol and London’s Gatwick airports set a cap on the number of passengers they will handle this summer, citing labor shortages.

- Employees from Air France-KLM and Brussels Airlines followed Ryanair employees in planning a limited strike over working conditions later this month.

- Qatar Airways posted its first annual profit since 2017 in the year ended March 31 after the international-only carrier tripled passenger traffic.

- European vehicle registrations fell 12.5% in May, the 11th consecutive month of declines.

- A third of vehicles sold in India will be electric by 2030, a new report predicts.

- Honda, behind its major competitors in the electric vehicle (EV) race, formally entered a 50-50 joint venture with Sony with plans to introduce 30 EV models by 2030.

- Japan’s Mitsubishi Electric will set up a plant for factory automation equipment in India, its third global production hub.

- Australia’s new government raised the nation’s 2030 target for cutting carbon emissions from 26% to 43%.

Some sources linked are subscription services.