MH Daily Bulletin: June 15

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices settled 1% lower Tuesday on fears of a higher-than-expected U.S. interest rate hike today.

- In mid-morning trading today, WTI futures were down 0.6% at $118.20/bbl, Brent was down 0.5% at $120.60/bbl, and U.S. natural gas was up 6.0% at $7.62/MMBtu.

- The American Petroleum Institute reported a surprise 736,000-barrel build in U.S. crude inventories last week, with government data to be released today.

- The U.S. government unleashed its fourth sale of 45 million barrels of crude oil from strategic reserves, with deliveries set for August and September.

- The U.S. Senate Finance Committee may introduce a bill putting a 21% tax on excessive oil company profits.

- The U.S.’s top oil lobby is pressuring the administration to lift some restrictions on fossil fuel development to help ease soaring energy prices.

- The founder of U.S. shale producer Continental Resources offered to take the firm private in a deal worth $25 billion.

- West Virginia threatened to halt all business with six of the nation’s largest financial institutions over their alleged maltreatment of the fossil fuel industry.

- OPEC production slumped by 176,000 bpd from April to May, led by a near-total drop-off in Libyan output.

- In its monthly report, OPEC kept to its forecast that global oil demand will exceed pre-pandemic levels this year but warned that demand growth could slow in 2023. Much of next year’s growth will be driven by China, the International Energy Agency said.

- China’s army of small, privately owned oil refiners is raising output on hopes of recovering fuel demand and as refining margins swell from imports of cheap Russian oil.

- Strong demand is pushing spot LNG tanker rates to new all-time highs, some 50% higher than a year ago.

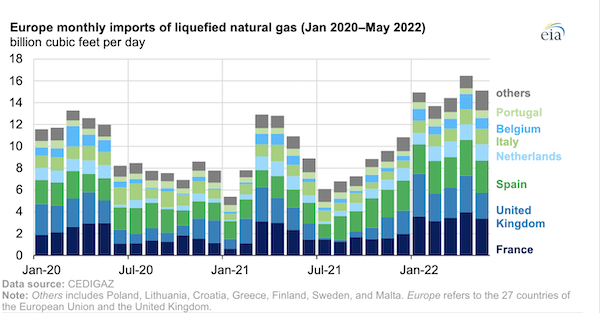

- The EU and the U.K. imported a record amount of LNG in April, the EIA said:

- More oil news related to the war in Europe:

- Russia’s self-reported oil and gas revenues dropped by more than half from April to May, largely due to currency movements.

- A key piece of equipment for Russia’s Nord Stream gas pipeline to Europe is stuck in Canada due to Western sanctions, sending flows down 40% and causing European gas prices to spike by double digits on Tuesday.

- The U.S. will allow certain energy-related transactions with Russian banks to continue through Dec. 5, corresponding to the EU’s deadline for ending Russian crude imports.

- High fuel prices are exacerbating a cost-of-living crisis in the U.K., with some earners spending up to a fifth of weekly wages just to fill up their tanks.

- Mexico’s administration is maintaining a generous regimen of subsidies and tax exemptions covering roughly 36% of true fuel costs, despite growing hits to the nation’s revenue.

- Brazil’s subsidized fuel prices will remain some 20% below international levels after Petrobras delayed an expected price hike.

- China is launching a larger-than-expected campaign to build hydro energy storage that could meet 23% of the nation’s peak power demand by 2025.

- NextEra Energy, owner of Florida Power & Light and one of the world’s biggest renewable developers, plans to use massive solar farms to make most of its operations carbon-free by 2045.

- The EU is considering a one-year delay to 2027 for the launch of its carbon market for buildings and transport.

- BP is taking the lead on a $30+ billion project to produce massive amounts of hydrogen from renewable sources in Australia’s Outback.

Supply Chain

- High temperatures enveloped one-third of the U.S. population across the Upper Midwest to the Southeast on Tuesday.

- Arizona’s Pipeline Fire near Flagstaff nearly quadrupled to 20,000 acres Tuesday.

- A strike among U.S. West Coast dockworkers is unlikely even if contract talks fail by a July 1 deadline, both sides say.

- Thousands of South Korean truckers stopped striking Tuesday after securing wage protections from the government.

- Dozens of people were killed when a fire ripped through a container yard near Bangladesh’s Port of Chittagong last week.

- The Port of Houston is expanding gate hours as import volumes stretch its handling capacity.

- U.S. railroads carried 928,742 carloads in May, a 3.5% drop from a year ago and the second straight monthly decline.

- CSX’s chief executive says the railroad has been turning away freight as it struggles to hire enough workers.

- The rise of autonomous trucking threatens the truck stop industry and the communities of workers providing services to resting drivers.

- Mexican cargo carrier mas is expanding into China with freighter flights to Zhengzhou and Chongqing.

- Ford is temporarily halting deliveries and recalling 49,000 electric Mustangs in the U.S. over concerns about power losses caused by an overheating part.

- Walmart is increasingly using its roughly 4,700 stores in the U.S. as hubs for e-commerce fulfillment.

- Cisco Systems has the best performing supply chain for the third straight year, followed by Schneider Electric, Colgate-Palmolive, Johnson & Johnson and PepsiCo, according to IT consultant Gartner.

- U.S. housewares manufacturer Home Products International filed for Chapter 11 bankruptcy protection, blaming rising plastic resin prices.

- Electric-vehicle maker Fisker says it is nearing the end of its supply chain crisis after design changes allowed it to use more available computer chips.

- The U.S., Canada and other countries established a new partnership aimed at securing supplies of critical minerals essential for clean energy and other technologies, dubbed the Minerals Security Partnership.

- FedEx shares rose 13% Tuesday after the firm boosted its dividend by 53%.

- White House officials met with solar manufacturers Tuesday to walk through details on how factories can expand production under the Defense Production Act.

- European steel prices are down roughly one-third since March’s record on weaker manufacturing demand and bloated inventories.

- China is scaling up efforts to reduce the country’s reliance on imported iron ore.

- Russia’s invasion will create a global wheat shortage for at least three seasons by keeping much of Ukraine’s crop from markets, officials say. This is even as Ukrainian exporters began sending their first grain shipments on a new Baltic Sea route that promises to reduce the nation’s massive backlog.

- Hormel Foods warned that an escalating bird-flu outbreak in the U.S. could squeeze turkey supplies starting this quarter.

Domestic Markets

- The U.S. reported 125,830 new COVID-19 infections and 382 virus fatalities Tuesday.

- Average daily COVID-19 cases in California rose 21% last week.

- The fast-spreading BA.4 and BA.5 subvariants of Omicron now make up over 21% of COVID-19 cases circulating in the U.S.

- The FDA unanimously recommended Moderna’s COVID-19 for children and teens aged 6 to 17, paving the way for the CDC’s approval.

- Pfizer halted enrollment in a trial for its COVID-19 antiviral drug Paxlovid after data showed it had little effect in reducing symptoms in standard-risk people.

- U.S. retail sales unexpectedly fell 0.3% in May and dropped even further after factoring in inflation.

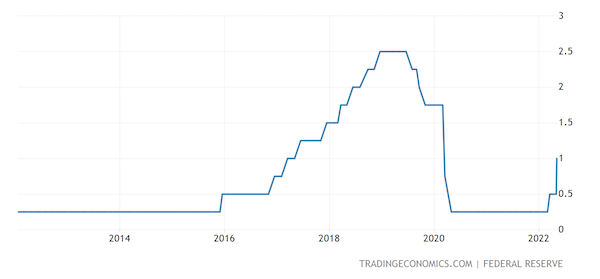

- The Federal Reserve will meet today to decide on the next increase in its benchmark interest rate, which investors, banks and others believe will be 75 basis points.

- U.S. small business confidence dipped slightly in May on inflation worries, according to the National Federation of Independent Business.

- Investors are snapping up shopping centers and other brick-and-mortar real estate in a promising sign for the beleaguered retail property sector. Transaction volumes were up 82% from January to April compared to a year ago.

- Congress likely won’t need to raise the federal government’s borrowing limit before the third quarter of 2023, reflecting strong growth in tax collections.

- Total U.S. home equity rose almost 20% in the first quarter to $27.8 trillion, a record-high, according to the Federal Reserve.

- The average U.S. mortgage rate has doubled from the start of the year and now tops 6%, with some of the nation’s hottest markets, including in California, beginning to show signs of a slowdown.

- Redfin and Compass, two leading online sellers of real estate, respectively, are laying off between 6% and 10% of staff amid cooling activity in the housing market.

- Boeing made 35 plane deliveries in May, more than double the same month last year.

- U.S. airlines worry the FAA will not have enough air traffic controllers to meet rising travel demand.

- Caterpillar is moving its Illinois headquarters to a suburb of Dallas, joining a string of major manufacturers looking at the U.S. Southwest for its space, appealing taxes and growing tech workforce.

- A Massachusetts ballot measure over the job classification of ride-share drivers was rejected by the state’s top court, a blow to Uber’s and Lyft’s goal of classifying drivers as independent contractors rather than employees.

- Delaware will close remaining loopholes to effectively ban all plastic bag use at retail locations starting in July.

International Markets

- Hong Kong tightened restrictions on nightclubs and bars responsible for the island’s recent rise in COVID-19 cases. A transition in Hong Kong’s leadership next month could bring different pandemic restrictions.

- A new wave of COVID-19 may be starting in the U.K., driven by the fast-spreading BA.4 and BA.5 subvariants of Omicron.

- Canada will end its mandatory COVID-19 vaccination policy for air and rail travelers beginning June 20.

- EU countries are pressuring COVID-19 vaccine makers to renegotiate contracts amid weakening demand.

- Global profit expectations fell in June to their weakest level in almost 14 years, according to a Bank of America survey, with 73% of investors forecasting a weaker economy over the next 12 months.

- The euro zone’s trade deficit almost doubled in April from the previous month, while industrial production rose 0.4%. Meanwhile, the bloc’s central bank will hold an emergency meeting today to discuss bond-market turbulence that followed its plan to reduce bond buying and raise interest rates.

- China’s industrial production unexpectedly grew by 0.7% in May from a year ago, supported by rebounding manufacturing output as lockdowns eased:

- Earnings at Asian firms declined 3.2% in the March quarter, the first decline in seven quarters on the supply impact of Chinese lockdowns.

- Canadian factory sales rose 1.7% in April, the seventh straight monthly rise on gains in energy products, cars and metals.

- When adjusted for inflation, average household earnings in Britain were 3.4% lower than a year ago in April, the sharpest decline in two decades.

- Argentina’s 12-month inflation rate topped 60% in May.

- More news related to the war in Europe:

- Russia will start restricting public access to some government data in an attempt to protect the country from additional Western sanctions.

- U.S. restrictions on Russian exports are cutting off Moscow from the vast majority of technology needed to sustain its invasion, officials say. Global semiconductor exports to Russia are down 90% since late February.

- Companies’ self-sanctioning may be exacerbating the global inflationary impact of Russia’s invasion, officials say.

- Labor shortages prompted British Airways to cancel over 100 flights to and from London Heathrow airport Tuesday.

- Ryanair expects summer fares to be up to 9% higher than pre-pandemic levels amid surging travel demand.

- Cathay Pacific Airways of Hong Kong, one of the few places still imposing quarantines on arriving travelers, carried just 4% of the passengers and 34% of the cargo that it carried before the pandemic, as the airline maintained forecasts for a steep loss this year.

- Certification issues are pushing back Airbus’ plans to start delivering its milestone A321XLR narrow body jetliner.

- Volkswagen and Mercedes indicated they could achieve the EU’s plan to ban gas-powered cars by 2035.

- BMW is testing new batteries in an electric SUV model that can reportedly hold a charge for 600 miles.

Some sources linked are subscription services.