MH Daily Bulletin: June 13

News relevant to the plastics industry:

At M. Holland

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell 2.5% Friday on news of higher-than-expected U.S. inflation, which threatens demand.

- In mid-morning trading today, WTI futures were down 2.0% at $118.30/bbl, Brent was down 2.0% at $119.60/bbl, and U.S. natural gas was down 2.6% at $8.62/MMBtu.

- The U.S. average gasoline price surpassed $5 a gallon Sunday morning.

- Active U.S. oil and gas rigs rose by six last week to 733, up 59% from the same time last year, while the nation added 4,775 oil field services jobs last month for a total of 628,793.

- The U.S. Gulf Coast has little room to manage a strong hurricane season without causing global supply disruptions that could further drive up prices.

- Political groups forced the closure of two more Libyan oil export terminals and reduced production at a major field.

- Prospects are receding for the U.S. to reach a nuclear deal with Iran and lift sanctions on the nation’s energy sector.

- TotalEnergies became the first foreign company to win a stake in a multi-billion dollar project to boost Qatar’s LNG exports.

- Comparatively cheap summer prices for natural gas are boosting Germany’s efforts to stockpile the fuel and meet new EU storage requirements for next winter.

- A British utility applied to reopen the nation’s largest natural gas storage facility after the site was closed five years ago.

- The British government will probe anti-competitive behavior in the oil industry after prices rose even as the nation cut certain fuel taxes for a year.

- The European Space Agency published research indicating that a massive methane leak occurred over 19 days in December at a Pemex well in the Gulf of Mexico.

- China will let its energy storage facilities make money from buying and selling electricity, a policy shift officials hope will attract more investment to help reduce power-sector emissions.

Supply Chain

- Heat warnings were in effect for over 75 million Americans in the southern and central U.S. Sunday, with unseasonably high temperatures expected to last to Wednesday.

- Electricity use hit an all-time high in Texas, with officials saying the state’s grid is operating normally.

- Drought in the U.S. and Mexico is hampering production of sriracha hot sauce.

- India could start seeing more blackouts as power demand surges to new records on soaring temperatures and rising industrial activity.

- South Korean petrochemical, auto and steel firms are drastically cutting operations as inventories pile up due to a trucker strike, now in its eighth day. Container activity is down to one-third of normal levels at the port of Busan, which handles 80% of South Korea’s cargo, while the nation’s exports in the first 10 days of June shrank 12.7% from a year ago.

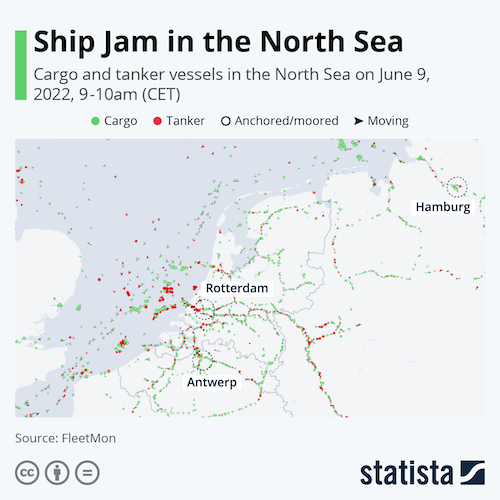

- Union workers at five German ports, including Europe’s third-largest Port of Hamburg, began striking Friday over contract disputes.

- A strike among British rail and underground workers, scheduled for three days later this month, could push 250,000 people temporarily out of work and cost the U.K.’s economy $125 million.

- International Longshore and Warehouse Union workers at the Port of Oakland, already among the worst performing container ports in the country, will stage a work stoppage June 20 to commemorate Juneteenth as the July 1 expiration of their labor contract approaches.

- U.S. ports should brace for a surge in imports in the coming months as shipments stay close to March’s record-high 2.34 million TEU equivalents, according to the National Retail Federation.

- The Port of Long Beach saw its second-busiest month on record in May, a trend likely matched by the Port of Los Angeles. On the East Coast, loaded container imports surged 18% at the Port of Charleston for its 15th consecutive month of cargo records.

- Fresh Del Monte is having more deliveries sent to “non-traditional” U.S. ports that are not fully containerized to avoid congestion on the West Coast.

- Container spot rates from Asia to North Europe could spike in the coming weeks as congestion spreads:

- DHL will raise shipping rates effective July 1, with some U.S.-bound parcel prices nearly doubling. The firm does not expect supply chains to return to pre-pandemic conditions in 2023.

- Air cargo shipments fell 11.2% in April from a year ago, outpacing slowdowns in the overall international trade in goods.

- Order lead times are down 23% since late April as companies deal with surplus inventories, shrinking the size of new orders.

- Procurement bids to suppliers in Mexico are surging while Asia-Pacific sourcing declines, according Jaggaer, a U.S. procurement specialist with over 1,700 global customers.

- China’s computer chip imports dropped 11% in the first five months of the year due to lockdown-related disruptions in manufacturing and logistics.

- Orders for PCs are forecast to shrink 8.2% this year following three straight years of growth, but will still remain above pre-pandemic levels.

- Global third-party logistics provider Neovia Logistics, based in Texas, is cutting over 100 jobs in Pennsylvania as freight activity slows and rates drop.

- Delta Air Lines will fly baby formula from the U.K. to Boston and Detroit on passenger flights this month free of charge following a similar move by United Airlines. Regulators skipped the required annual inspection of major baby food manufacturing plants in 2020 due COVID-19, including Abbott’s Michigan facility where bacteria contamination caused the current crisis.

- Some of the U.S.’s biggest food suppliers and restaurants, including Kraft Heinz and McDonald’s franchisees, announced they would continue raising prices in the months ahead to counter higher costs.

- German beer brewers are dealing with a severe shortage of glass bottles.

- Bottlenecks are slowing grain shipments on Ukraine’s newly established corridors through Poland and Romania, threatening supplies critical to the global food market.

- Soybean prices hit a record $17.69 per bushel last week.

- The U.S.’s first rare earth metal and manufacturing facility will be built in Oklahoma at a cost of $100 million.

- The International Monetary Organization’s maritime committee rejected plans for a shipping industry-backed program to boost research on alternative fuels.

Domestic Markets

- The U.S. reported 14,819 new COVID-19 infections and 15 virus fatalities Sunday.

- Las Vegas health officials are urging people to wear masks indoors again amid a spike in local COVID-19 cases.

- Florida recorded 262 COVID-19-related fatalities for the week ending June 3, the most of any U.S. state, while average daily case counts rose to more than 10,000 for the week ending June 10, a 4% increase from previous week.

- The CDC ended its requirement for travelers to test negative for COVID-19 before entering the U.S.

- The FDA found Pfizer’s smaller COVID-19 vaccine doses for children under age 5 to be safe and effective, setting the stage for full approval this week. Meanwhile, the agency will take longer to evaluate Novavax’s vaccine bid due to the firm’s recent change in manufacturing.

- New York City is ending its mask mandate for schoolchildren under age 5 starting today.

- Economists expect the Federal Reserve to hike its key interest rate by 50 basis points in June and July following last week’s news of four-decade-high inflation.

- U.S. consumer sentiment plunged in early June to its lowest on record, with the University of Michigan’s index falling from 58.4 to 50.2. Consumers’ long-term inflation expectations rose to a 14-year high.

- Electricity prices in the U.S. jumped 12% in May, adding an extra $540 to the average American utility cost between June and August, up $90 from last year.

- Average hourly earnings for U.S. employees declined an annual 3% in May after factoring in inflation, the Labor Department said.

- The S&P 500 is down 18% in 2022, its worst start to a year since 1962.

- The median U.S. rent rose 15% in May from a year ago, surpassing $2,000 for the first time.

- U.S. household wealth fell for the first time in two years in Q1, dropping $500 billion as stock market losses outweighed gains in home values.

- U.S. luxury home sales plunged 17.8% in the first quarter compared to a year ago, according to Redfin.

- The tight labor market in the U.S. could be a windfall for M.B.A students, with some employers offering interns full-time jobs even before they start taking their final year of classes.

- Pilot shortages, high fuel prices and surging demand will cause major disruptions to airlines this summer. A shortage of airport parking is also causing headaches for flyers.

- A major shift is occurring in the $155 billion U.S. database industry, with Oracle’s four-decade dominance slipping as a spate of new low-cost offerings enter the market.

- “Jurassic World Dominion” delivered the third $100+ million opening weekend in six weeks, a promising sign for the U.S. theater industry.

- The U.S. government will foot the full bill for New Mexico’s wildfire response, officials said.

- U.S. commercial electric truck maker Electric Last Mile Solutions announced it would file for Chapter 7 bankruptcy, just one year after the company went public.

International Markets

- China’s commercial hub of Shanghai locked down millions more people for mass COVID-19 testing over the weekend, just 10 days after lifting its two-month lockdown.

- An “explosive” COVID-19 outbreak is growing by the dozens in Beijing, prompting officials to tighten restrictions in several districts and delay a reopening of schools.

- Taiwan is cutting mandatory quarantine for all incoming travelers to three days from seven despite surging COVID-19 cases.

- The majority of people in West Africa have contracted COVID-19, surveys show, even as official records show extremely low infection counts.

- China’s factory inflation cooled to its slowest pace in 14 months in May, depressed by weak demand for steel, aluminum and other key industrial commodities.

- The U.S. dollar is up 22% versus the yen over the past year, the lowest valuation of Japan’s currency since 1982.

- GDP in the U.K. slid 0.3% in April, the second consecutive monthly decline.

- Mexico’s shift to an industrial policy with greater state intervention is costing the nation billions of dollars in foreign investment, reducing competitiveness and slowing gains in energy production, economists say.

- New data shows Canadian employers added more jobs than expected in May as the nation’s jobless rate fell to 5.1%, the lowest in data going back to 1976.

- Russian officials predict car sales will fall by half this year as the industry deals with fallout from Western sanctions.

- A Dutch firm will start deliveries of the world’s first production-ready solar car later this year, with the technology promising months of charge-less driving in summer conditions.

- India’s top solar glass maker plans to raise production fivefold on expectations that soaring fuel prices will quicken a shift to renewables.

- Corporate plans to slash greenhouse gas emissions fall well short of what is needed to combat climate change, according to a new global study of net-zero efforts in the public and private sector.

Some sources linked are subscription services.