MH Daily Bulletin: June 8

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

Supply

- Oil prices rose about 1% Tuesday, with WTI settling at a 13-week high of $119.41/bbl.

- In mid-morning trading today, WTI futures were up 1.4% at $121.00/bbl, Brent was up 1.5% at $122.30/bbl, and U.S. natural gas was up 3.2% at $9.59/MMBtu.

- The American Petroleum Institute reported a surprise build of 1.845 million crude barrels last week, while government data will be released today.

- Goldman Sachs raised its short-term target for Brent crude from $125/bbl to $140/bbl, while trading giant Trafigura sees oil headed to $150/bbl this year.

- A major equipment failure risks shutting LyondellBassell’s 268,000-bpd Houston oil refinery quicker than its planned closure at the end of 2023, potentially eliminating a vital source of U.S. supply.

- The average U.S. gasoline price hit a record $4.92 a gallon Monday, up 30 cents over the past week. Prices in 13 states are above $5 a gallon.

- British gasoline and diesel prices are surging to record highs.

- Over 10% of Norwegian offshore oil and gas workers plan to strike starting Sunday if state-brokered wage talks fail.

- Qatar will partner with Exxon Mobil, Total Energies, Shell and ConocoPhillips to expand the world’s largest LNG project and boost its annual output 64% by 2027.

- More oil news related to the war in Europe:

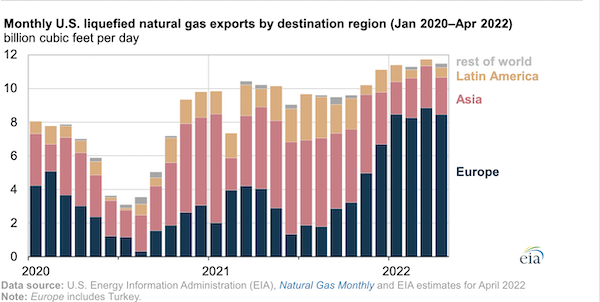

- The U.S. sent nearly 75% of its LNG output to Europe in the first four months of the year, up from a third last year.

- A government-controlled bank in Japan suspended its support for a $21 billion LNG facility under construction in Siberia, casting further doubt about the project after TotalEnergies wrote off its investment in April.

- European natural gas prices are on a five-day retreat due to an early start to summer and rising LNG storage levels.

- Russia aims to ramp up oil exports from its major eastern port of Kozmino by about 20% amid higher demand from Asian buyers.

- Future Western sanctions could include limiting Moscow’s revenue from oil exports.

- The White House is reviewing the environmental impact of what would be Maryland’s first offshore wind energy project.

- Shell launched a new green power business in Texas offering perks including free charging for electric vehicles and credit for excess household solar generation.

- Spain’s Repsol is in talks to sell 25% of its exploration and production business to help fund clean energy efforts.

- India eased rules to allow commercial and industrial consumers to switch to green sources of electricity, a bid to quicken its energy transition.

Supply Chain

- The average U.S. diesel price jumped to $5.70 a gallon Tuesday, a record.

- Texas grid operators say the state’s grid is holding up well against record power demand this week.

- U.S. economic expansion will push up power demand to new records this year and next, according to the Energy Information Administration.

- Japan called on households and companies to conserve electricity this summer to prevent supply-induced blackouts.

- California residents dismissed dire calls for water conservation in April, with the southern part of the state increasing its usage by more than 25% despite worsening drought.

- Britain’s entire train network could shut down for three days this month if more than 50,000 workers follow through with plans for a walk-out over job cuts and pay.

- Drewry says spot container rates from China to the U.S. West Coast are down 41% month over month to $9,630, while imports bound for the U.S. have dropped sharply since late May.

- Transatlantic airfreight capacity is improving alongside the sharp rebound in air passenger demand.

- Old Dominion Freight Line’s per-day revenue increased 26% in May from a year ago, following a 29.1% increase in April.

- Maersk became the first foreign carrier to move international shipping containers between ports in China.

- CMA CGM took delivery of two Boeing cargo planes a week after its air freight unit became a certified French airline, as the shipper continues to expand beyond ocean freight.

- U.S. shippers are coping with a deepening shortage of truck trailers at a time when Class 8 truck and tractor orders slipped to a six-month low in May due to supply shortages.

- Detroit-based Fruehauf is restarting trailer production for the first time in 25 years at a new $15 million plant in Kentucky.

- Competing logistics crises are hampering White House goals to kickstart the U.S. solar supply chain through the use of emergency funding. Industry experts say about two-thirds of U.S. solar projects planned for this year are at risk of being delayed or canceled.

- Union Pacific expects to miss its full-year financial targets as rising fuel and network costs weigh on margins.

- Thousands of union truck drivers began striking in South Korea Tuesday over wages.

- Uber Freight is partnering with Google parent Alphabet to develop a connected service and brokerage system for autonomous freight trucking.

- A South Korean firm claims to have completed the world’s first autonomous trip of a commercial vessel across the Pacific.

- Autonomous trucker Gatik will start delivering Georgia-Pacific’s paper goods to several dozen Sam’s Club outlets in Texas this summer.

- Schneider National plans to acquire the assets of Wisconsin-based dedicated truckload carrier deBoer Transportation.

- The closure of a GE plant in Shanghai continues to impact hospital supplies of critical imaging materials.

- Contract manufacturer Foxconn raised its quarterly and annual outlook on improving supply-chain stability in China.

- Taiwan Semiconductor Manufacturing Co. expects revenue to grow about 30% this year amid resilient global demand for electronics.

- Ocean Network Express ordered 10 mid-sized container ships to be powered by ammonia and methanol.

- Swedish tanker owner Stena cut its quarterly loss by about a quarter to $76 million.

- Dubai is selling a minority stake in its flagship port and two nearby business parks to a Canadian pension fund, a bid to cut the debt of the facilities.

- France will remove bird flu-related restrictions on poultry farming after recent outbreaks forced 16 million birds to be culled.

Domestic Markets

- The U.S. reported 121,658 new COVID-19 infections and 469 virus fatalities Tuesday.

- Two more highly contagious subvariants of Omicron — dubbed BA.4 and BA.5 – now make up 5% and 8% respectively of U.S. COVID-19 cases.

- The FDA endorsed Novavax’s COVID-19 vaccine Tuesday, setting the stage for full authorization of the nation’s fourth vaccine.

- Moderna announced that its redesigned COVID-19 booster delivered improved protection against Omicron in tests.

- The CDC raised its travel alert for Monkeypox to a level 2, recommending people practice “enhanced precautions” after thousands of cases appeared worldwide.

- The U.S. Treasury Secretary said last year’s prediction of “transitory” inflation was an error and that the government will likely revise upward its inflation forecast in the weeks ahead.

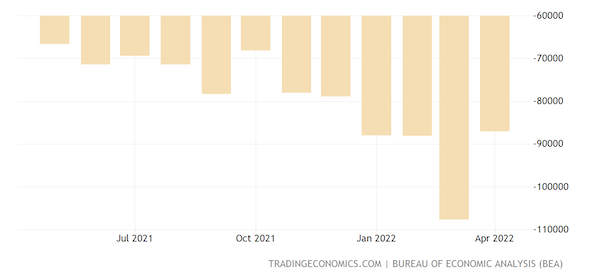

- The U.S. trade deficit dropped 19.1% in April to $87.1 billion, down from March’s all-time high on a sharp decline in imports.

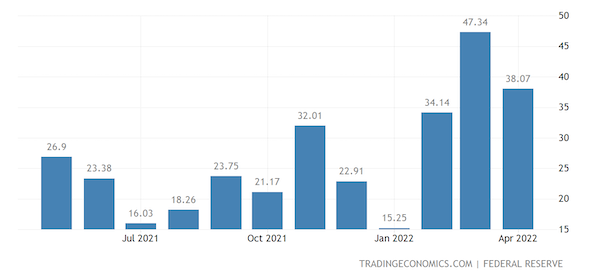

- U.S. consumer borrowing surged 10.1% on an annualized basis to $38.1 billion in April following a record jump a month earlier, fueled by rising prices and the continued strength of the economy.

- Companies are hanging onto LIBOR-based contracts despite a regulatory push away from the discredited interest-rate benchmark, which is set to expire next summer.

- Macroeconomic pressures on firms, such as staffing shortages and supply chain delays, have likely contributed to deteriorating customer service across most industries.

- Regional airports and airlines are losing flights as big airlines lure the scarce supply of pilots.

- The typical premium on homes in risky fire areas has surged during the pandemic as more Americans move out of big cities.

- U.S. hotel prices are up 33% the past year, with the largest rises in Miami and Long Island.

- Inflation is making it 22.4% more expensive for Americans to take care of their lawns, according to online home-services firm Angi.

- Peloton is replacing its finance chief as the firm deals with waning demand after facing production and delivery issues.

- Taco Bell is pioneering a revamped drive-thru experience with four lanes, digital check-in screens, video technology and a vertical lift for transporting menu items.

- Polestar, a Swedish maker of electric performance vehicles, will introduce its first car to the U.S. market this October.

International Markets

- The World Health Organisation’s top official said a global pact to waive intellectual property rights for vaccines could be reached by next week.

- A European study found babies exposed to COVID-19 in the womb had a higher risk of neurodevelopmental changes.

- More news related to the war in Europe:

- The U.S. Treasury Department banned U.S. investors from purchasing Russian debt.

- Russian state flagship airline Aeroflot plans to raise up to $3 billion to stay afloat amid punishing Western sanctions.

- Microsoft will suspend new sales of products and services in Russia as it substantially scales down its operations.

- Advertising giant Publicis Groupe lowered its global ad-spending forecast for 2022, citing Russia’s invasion.

- The World Bank cut its forecast for global economic growth this year to 2.9% from an earlier 4.1%, warning that several years of high inflation and below-average growth lie ahead. The Organisation for Economic Cooperation and Development made a similar revision to its forecast.

- Canadian exports rose just 0.6% in April after planned maintenance slowed production from its profitable oil sands.

- India’s central bank hiked its interest rate by 50 basis points to 4.9% yesterday, the second increase in two months.

- Chile’s central bank lifted its interest rate by 75 basis points yesterday to 9%, a two-decade high.

- Roughly 13% of British mortgage borrowers could go into financial distress if high inflation keeps pace next year, economists warn.

- Switzerland’s Credit Suisse Group warned its capital position is eroding as companies opt not to sell new stock or bonds amid volatile conditions, wiping out a main source of revenue. The declines could lead to a second-quarter loss and potential layoffs.

- Scandinavian Airlines is facing liquidity problems after the Swedish government rejected its request for almost $1 billion in needed restructuring dollars.

- Ryanair saw 15.4 million passengers in May, an all-time high.

- Cazoo, a British online used-car platform, will cut its workforce by 15% as economic headwinds lead the firm to abandon growth plans.

- A day after announcing it would hire over 4,000 new tech workers, Citigroup said it plans to add 3,000 workers for its Asia institutional business.

Some sources linked are subscription services.