MH Daily Bulletin: June 3

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer. In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey. Click here to read the full press release.

Supply

- Oil prices rose 1% percent Thursday on speculation that OPEC’s output boost for July will do little to help global shortages.

- In mid-morning trading, WTI futures were up 1.7% at $118.80/bbl, Brent was up 1.5% at $119.40/bbl, and U.S. natural gas was up 0.1% at $8.50/MMBtu.

- Gas prices hit a record high in Texas ($4.34/gallon) and Florida ($4.71/gallon), while a station in Los Angeles is charging over $8 a gallon.

- East Coast distillates stockpiles, composed of diesel and heating oil, drained to a new low in data going back to 1990.

- The White House is considering imposing a windfall tax on oil and gas profits to be used to provide relief to consumers at pumps.

- U.S. crude exports averaged 3.13 million bpd from January to May, the best first five months of the year on record, according to tanker data.

- U.S. exports of LNG remained close to record levels last month at 7.29 million tons, up 12% from a year ago.

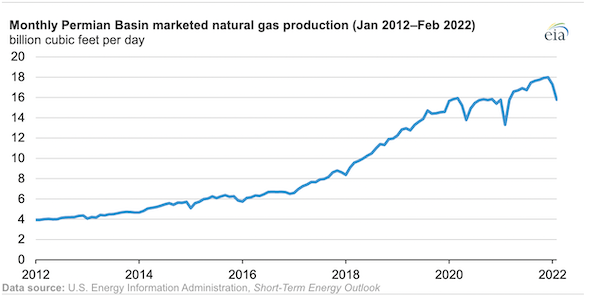

- Natural gas production from the U.S. Permian Basin reached a new annual high of 16.7 billion cubic feet per day in 2021:

- More oil news related to the war in Europe:

- After a day of negotiations with Hungary, the EU gave final approval to a phased ban on 90% of Russian oil by the end of the year.

- Moscow maintains that it can re-route oil exports to minimize losses from EU sanctions, but analysts remain skeptical.

- Northern European countries are looking at building a sub-North Sea power grid to connect offshore wind farms.

- Environmental groups are calling on U.S. regulators to bar the transport of LNG by rail.

- Amsterdam no longer believes it can lower emissions 55% by 2030 due to power grid congestion and insufficient renewable sources.

Supply Chain

- A strengthening tropical storm could dump heavy rains on Southern Florida and western Cuba Saturday.

- Texas power demand will hit an all-time high next week amid high demand and hot weather, the state’s grid operator forecast.

- Ten states have out-of-stock baby formula rates at 90% or greater, according to a survey of 130,000 stores.

- Southern California ports are the least efficient in the world, according to a joint analysis by the World Bank and S&P Global.

- Vessels at the highly congested Port of Oakland are taking six days to load and unload, while import containers wait almost 11 days for handling, new data shows.

- APM Terminals is expanding its container capacity at Alabama’s Port of Mobile by about one-third to accommodate regional growth.

- Florida’s Port of Jacksonville is making significant headway on a harbor deepening project to allow larger and heavier ships to call at the port.

- Suez Canal revenues are forecast to rise 27% year over year to roughly $7 billion.

- Earnings at Star Bulk Carriers rose 500% in the dry bulk operator’s strongest first quarter in over a decade.

- For-hire truck tonnage decreased 2% in April, the first decline in nine months, according to the American Trucking Association.

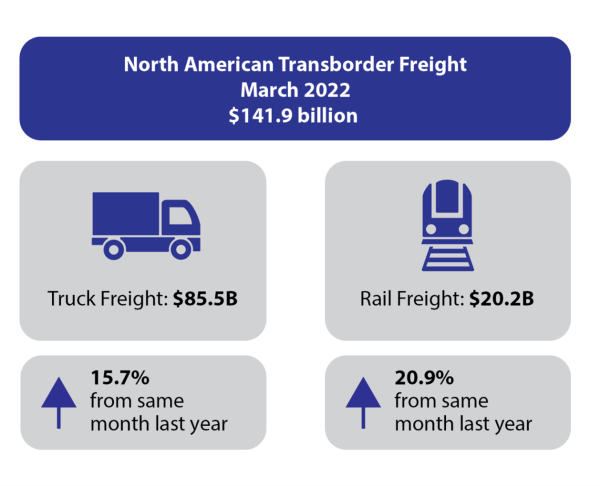

- The value of North American transborder freight moved by truck hit $85.5 billion in March, up 15.7% from the year-ago period.

- Sysco is moving drivers and warehouse workers to a four-day workweek in a bid to improve retention.

- Trans-Atlantic airfreight rates are falling as airlines ramp up passenger flights and load factors decline.

- Some Asian manufacturers say the pandemic-driven boom in overseas demand is fading.

- Development of at least one of Apple’s flagship iPhone models is being delayed after COVID-19 lockdowns in China.

- Walmart is building four new e-commerce warehouses it says will expand its next- or two-day shipping service to 95% of the U.S. population.

- Prices for plastic payment cards could rise up to 20% by next year due to a shortage of dedicated computer chips.

- Daimler Truck, the world’s largest truck maker, says chip shortages are starting to ease while an order backlog keeps its factories busy.

- The U.S. Postal Service’s consolidation plans could free the carrier to purchase more electric vehicles, officials said.

- UPS acquired same-day deliverer Delivery Solutions.

- Wisconsin is struggling to find tenants for a large technology park after Foxconn scaled back its megafactory plans.

- Stellantis is mixing up its North American purchasing and supply chain leadership as the auto maker struggles with supplier relations.

Domestic Markets

- The U.S. reported 100,485 new COVID-19 infections and 346 virus fatalities Thursday. The nation is averaging 94,000 cases per day, although experts believe the true count could be much higher.

- California’s Alameda County, home of Oakland, is reimposing a mask mandate for indoor public settings. Officials say Los Angeles could see a renewed mandate this month.

- COVID-19 vaccines for children under age 5 could be available as soon as June 21, officials indicated.

- Dogs may be more reliable COVID-19 detectors than rapid antigen tests, new research suggests.

- U.S. payrolls grew by a healthy 390,000 in May, the first dip below 400,000 in the past 12 months, as the unemployment rate held steady at 3.6%.

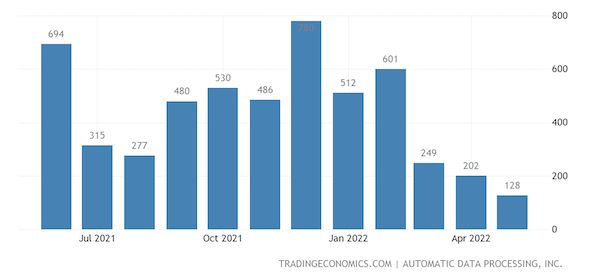

- ADP says U.S. companies added just 128,000 jobs in May, the slowest growth of the pandemic recovery. Hiring could slow further as economic headwinds gather, economists say.

- U.S. jobless claims fell 11% last week to 200,000, remaining near historic lows. The U.S. has now recovered 95% of jobs lost during the first two months of the pandemic.

- Over 50% of U.S. small businesses reported having unfilled positions last month.

- U.S. worker productivity fell at a 7.3% annual pace in the first quarter, the steepest decline since 1947.

- U.S. home listings rose 8% year over year in May, the first increase since June 2019. The average price for a 30-year mortgage dropped to 5.09%, marking the third week of declines.

- With prices high and inventory tight, over 50% of homebuyers say the process is as stressful as planning a wedding or being fired.

- Social Security trustees say the program’s reserves will be depleted in 2035, a year later than projected last year.

- The number of restaurants adding service fees rose by 36.4% the past year in what is seen as an inflation-fighting alternative to higher menu prices.

- The U.S. Dollar Index, which tracks the currency against a basket of others, is up roughly 13% over the past year.

- Microsoft on Thursday cut its earnings and revenue guidance for the fiscal fourth quarter, citing unfavorable currency movements.

- Tesla is putting a pause on hiring and said it may need to cut around 10% of staff.

- Chanel plans to open dedicated boutiques for top-spending clients as the luxury giant’s rapid growth risks overcrowding its stores.

- Ford announced plans to add 6,200 U.S. manufacturing jobs and invest $3.7 billion into plants in Michigan, Ohio and Missouri.

- GM’s Cruise will launch a fully automated ride hailing service in San Francisco in coming weeks after receiving California’s first permit for the paid service.

- GM dropped its Chevrolet Bolt prices by 18% after sales were halted for six months due to a battery recall.

- Eight automakers adopted new recommendations to improve emergency response guidelines for lithium-ion battery fires in electric vehicles.

International Markets

- Shanghai reported seven COVID-19 cases yesterday, the first community infections since lockdowns were lifted this week.

- India reported 3,712 COVID-19 cases yesterday, the highest in a month, as cases doubled in Mumbai.

- Portugal currently has the world’s second highest per capita COVID-19 infection rate.

- Moderna is pushing back some COVID-19 vaccine deliveries to Europe due to falling demand.

- Up to 67% of the world’s population has COVID-19 antibodies from either vaccination or infection, the World Health Organization estimates.

- More than 6 million tourists visited Spain in April, up tenfold from the prior year, while spending rose to near 2019 levels.

- More news related to the war in Europe:

- Ukraine’s central bank hiked its benchmark interest rate from 10% to 25% Thursday, the highest since 2015.

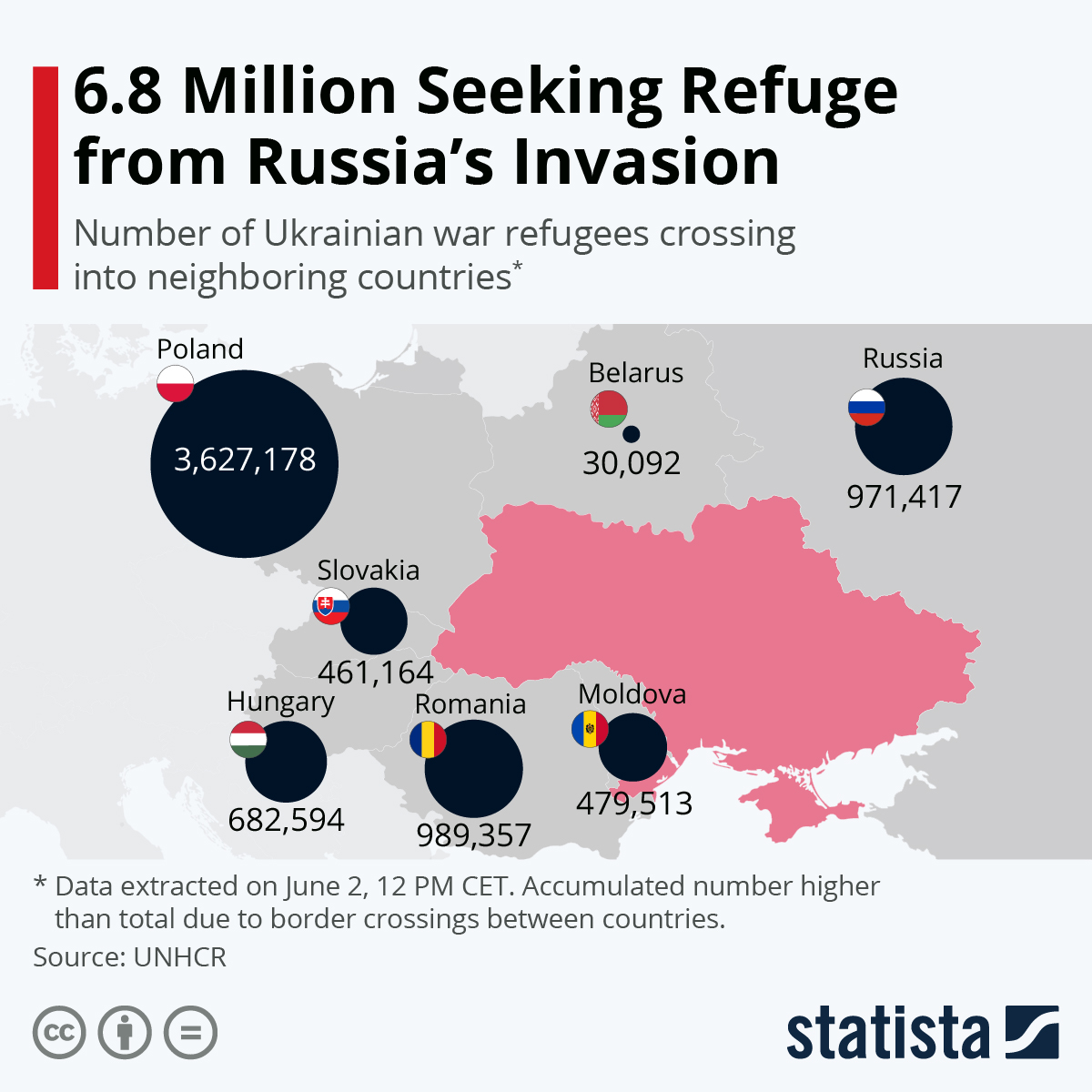

- The Ukrainian refugee count is nearing 7 million people, according to the United Nations:

- The Bank of Canada increased its interest rate by 50 basis points this week, its second consecutive jumbo hike.

- South Korean inflation surpassed 5% for the first time in more than 13 years in May.

- Brazil’s GDP grew a lower-than-expected 1% in the first quarter.

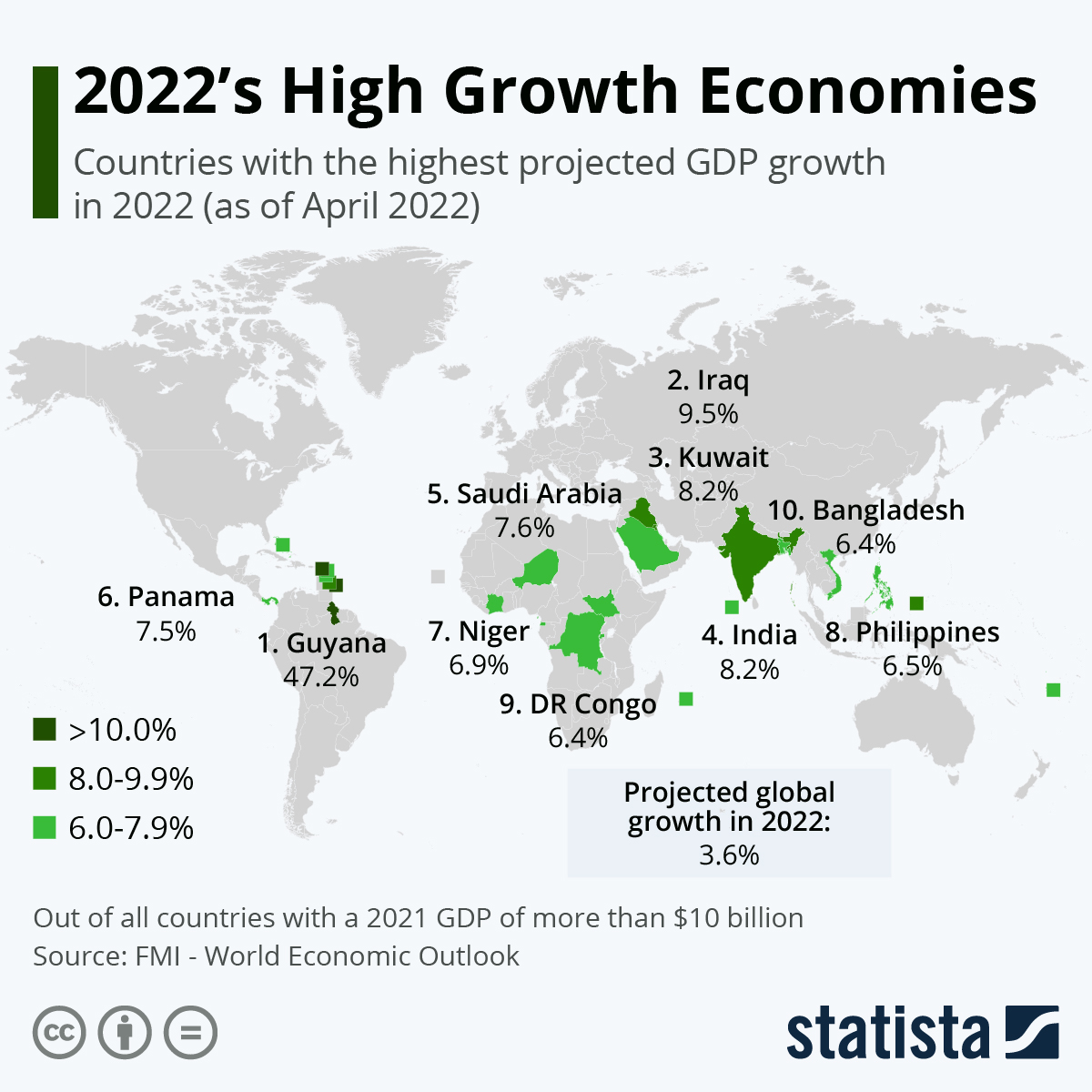

- India’s rapid GDP growth rate could put the nation ahead of Japan as Asia’s second largest economy by 2030:

- China’s largest private automaker is launching satellites into orbit to build a high-precision navigation system for self-driving vehicles.

Some sources linked are subscription services.