MH Daily Bulletin: June 2

News relevant to the plastics industry:

At M. Holland

- M. Holland is exhibiting during the WAI Operations Summit & Wire Expo on June 7-8 in Dallas, Texas. This event focused on wire and cable manufacturing offers industry forecasts, technical presentations, networking and more. Join us at Booth #621 to learn more about our supply solutions for wire and cable.

- Nick Chodorow has joined M. Holland as Chief Innovation Officer. In this role, Nick will lead efforts to enhance the company’s technology platforms and accelerate its digital journey. Click here to read the full press release.

Supply

- Oil prices rose half a percent Wednesday after the EU failed to agree to a phased ban on Russian oil over renewed demands by Hungary.

- OPEC+ nations agreed to increase output in July and August by 50%, or 648,000 bpd, to offset a drop in Russian output.

- The Energy Information Administration reported a higher-than-expected 5.1 million barrel draw in oil inventories last week, sending oil prices higher in mid-morning trading, with WTI up 1.2% at $116.70/bbl and Brent up 1.0% at $117.50/bbl. U.S. natural gas was down 2.6% at $8.47/MMBtu.

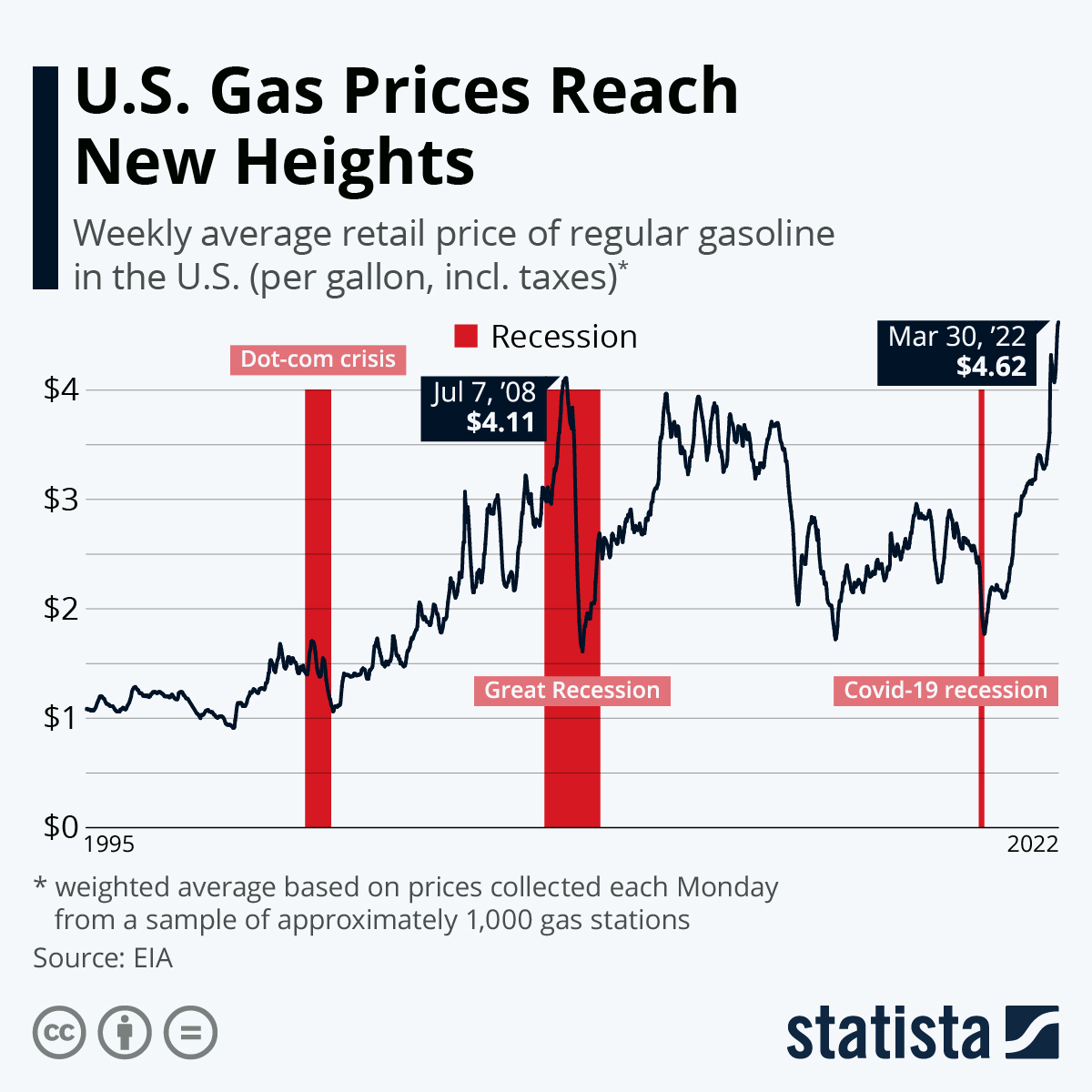

- The average U.S. gasoline price set another record Wednesday, rising to $4.67 a gallon. Some analysts warn the average could reach $5 a gallon as soon as mid-June.

- Facing criticism for not boosting output more quickly, Gulf nations have said most members do not have the extra capacity.

- OPEC+ trimmed its forecast for growth in global oil demand this year by 200,000 bpd to 3.4 million bpd.

- Asian and European LNG buyers are securing contracts with American producers, in some cases for projects years away from completion.

- More oil news related to the war in Europe:

- An OPEC+ panel that met Wednesday did not discuss suspending Russia from the group, although reports suggest the move is being considered.

- Fuels believed to be partially made from Russian crude landed in New York and New Jersey last month, as some shippers and refiners work to obscure its origins.

- High power demand and the war in Ukraine have sent global coal prices soaring, with futures this year up 137% for deliveries to Northwestern Europe, 143% in the Pacific region and prices 40% higher in Central Appalachia.

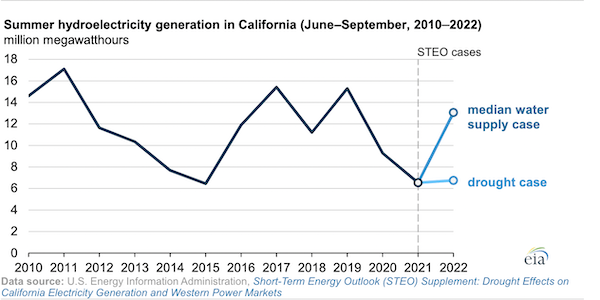

- Extreme drought in California could reduce the state’s hydroelectric generation to half of normal levels this year, the EIA warns:

- Mexico’s state-owned oil company Pemex took in $5.4 billion above profit estimates between January and May, giving it more breathing room to pay substantial debts while supporting billions of dollars in government fuel subsidies.

- After an initial rejection on environmental grounds, Shell’s plan to develop a large natural gas field in the North Sea that could eventually provide 6.5% of the nation’s output was approved by British regulators.

- The U.K.’s new windfall tax on oil and gas profits could cost producers $3.3 billion through 2025.

- France is asking large commercial buildings to cut energy use to safeguard its power grid, as widespread maintenance and repairs lower the nation’s normally plentiful nuclear production.

- Google is partnering with a French utility to optimize the distribution of wind power to European power markets.

- China plans to source 33% of its electricity from renewable power sources by 2025, up from 28.8% in 2020.

- Global electric vehicle sales are poised to more than triple by 2025, displacing over 2.5 million bpd of oil demand.

- The tradeable credits of the U.S.’s Renewable Fuel Standard program, which requires fuel to contain a minimum volume of renewables, spiked 11% Wednesday on reports that the White House will raise 2021 biofuel blending mandates.

Supply Chain

- A tropical depression threatening to become the Atlantic’s first named storm of the season could bring torrential rains and high seas to Florida by the end of the week.

- The U.S. will struggle to meet power demand in the coming months amid greater frequency of extreme weather events, experts say.

- New restrictions on outdoor water use in Southern California went into effect yesterday.

- Unions representing 40,000 British rail workers across 16 companies voted to strike, setting the stage for the biggest walkout since 1955.

- Containers are stacking up at northern European ports after carriers blanked one-third of sailings during Shanghai’s two-month lockdown.

- The East Coast’s busiest port, the Port of New York and New Jersey, is changing its leadership as container ship backups mount.

- A 25-ship backup off the coast of Southern California ports is less than one-quarter of the record backup in January, while spot container rates have dropped almost 20% this year.

- Loaded container imports at the Port of Oakland fell 17% year over year in April.

- A $12 billion plan by the Oakland Athletics to build a stadium, luxury condos, office and retail space on the city’s waterfront is threatened by lawsuits from a variety of logistics groups.

- Container shipping lines saw a combined net profit of $59.3 billion in the first quarter, more than three times the year-ago level.

- Walmart was the largest U.S. ocean container importer last year by volume, while Koch Industries was the largest exporter.

- For the first time ever, Apple is moving some iPad production to Vietnam from China, a reaction to strict COVID lockdowns in Shanghai.

- The world’s largest smartphone market in China could sink 11.5% this year and account for four-fifths of a global reduction in shipping volume, analysts say.

- Lumber futures are down 12% this week and 46% this year on fears of a softening housing market.

- Some apparel retailers are dialing back policies that allow free returns of online orders, while spiking cotton costs cause headaches for Asian manufacturers.

- The percentage of out-of-stock baby formula at U.S. retailers rose from 11% in January to 23% in late May.

- Malaysia banned exports of chicken to protect domestic prices, which have doubled this year.

- Talks are slowly progressing between Russia, Ukraine and Turkey to unlock grain exports from mined Black Sea ports.

- China began relaxing quarantine restrictions for Chinese seafarers returning from overseas assignments starting last week.

- Beijing ordered state-owned banks to build a $120 billion line of credit to support infrastructure projects.

- Roughly 59 million parcels were handled in U.S. distribution networks daily in 2021, up from 56 million daily in 2020, according to Pitney Bowes.

- European importers are spreading their sourcing efforts among multiple locations and ordering smaller shipments in response to supply-chain disruption in China.

- Hapag-Lloyd aims to grow its services in Africa with the acquisition of a specialized German container liner.

- Singapore is banking on a new data-sharing platform backed by some of the world’s largest traders to cut down on fraud in commodities markets.

- Walmart aims to automate all its regional distribution centers under an expanded agreement with automation specialist Symbotic.

Domestic Markets

- The U.S. reported 239,132 new COVID-19 infections and 687 virus fatalities Wednesday.

- The CDC is recommending people in Southern Florida wear masks indoors due to a spike in COVID-19 cases.

- Pfizer asked U.S. health regulators to authorize a three-dose COVID-19 vaccine regimen for children under five years old, which could be approved as soon as this month.

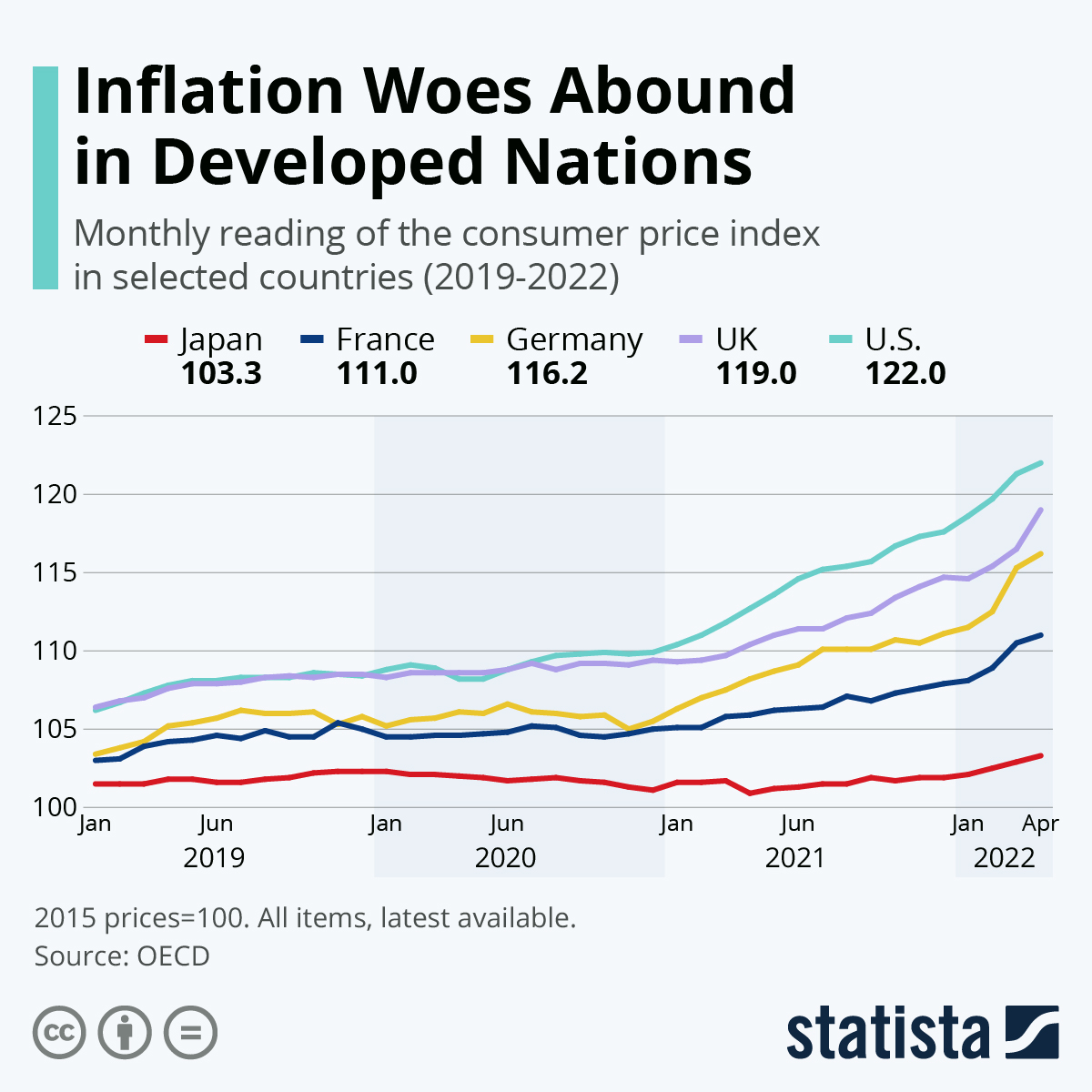

- The U.S. saw the highest inflation among major global economies during the pandemic:

- JPMorgan Chase’s CEO predicts U.S. consumers have six to nine months of spending power left in their bank accounts before the risk of major economic disruption.

- Just 14% of Americans rate economic conditions as “excellent” or “good,” while 46% say they are “poor,” according to Gallup.

- U.S. manufacturing activity picked up in May as demand for goods remained strong, according to the Institute for Supply Management.

- All major Korean and Japanese automakers posted double-digit U.S. sales declines year over year last month. Volkswagen’s sales were down 26% the first four months of the year, while Volvo’s sales dropped 28.3% in May.

- Buick will release its first electric vehicle for the North American market by 2024 as it transitions to an all-electric fleet by 2030.

- Tesla is requiring all employees to spend at least 40 hours per week in the office.

- Delta Air Lines raised its revenue guidance but said costs are up more than expected this quarter on rising fuel costs and constrained capacity. Yesterday, the airline unveiled a five-year, $4 billion revamp of its terminal in New York City’s LaGuardia Airport.

International Markets

- COVID-19 cases in the Americas rose 10.4% last week.

- China is building a network of tens of thousands of lab testing booths in major cities, dashing hopes that the nation will back down on its zero-tolerance COVID policy.

- At least half of foreign companies in Shanghai are waiting until next week to reopen while they implement hygiene measures.

- Hong Kong COVID-19 cases spiked 50% yesterday as many people reported past infections to prove their immunity by an island-wide deadline.

- Israel plans to scrap isolation requirements for COVID-19 patients by the end of June.

- Two million Britons are believed to have long-COVID, the most of the pandemic.

- More news related to the war in Europe:

- Russia’s factory output fell sharply in April, including a 61% drop in auto production, before picking up in May.

- U.S. administration officials are divided over how much further the U.S. can push sanctions against Russia without sparking global economic instability, reports suggest.

- British regulators are letting food makers substitute ingredients without changing labels due to supply shortages from Ukraine.

- Amid widespread inventory shortages, Russian car dealerships have been authorized to sell vehicles without air bags or anti-lock brakes.

- The U.S. and Taiwan launched a first-ever initiative that could one day form the basis of a free-trade agreement in a wide variety of markets.

- Mexico’s central bank lowered the nation’s growth forecasts from 2.4% to 2.2% this year and from 2.9% to 2.4% next year.

- Vietnam Airlines is on the brink of delisting after reporting its ninth straight quarterly loss.

- Bloomberg predicts the global fleet of combustion-engine vehicles will peak this year at 1.2 billion before declining by half over the next decade.

- The U.K. government is launching a roughly $50 million program to back development of self-driving delivery vehicles.

Some sources linked are subscription services.