MH Daily Bulletin: July 29

News relevant to the plastics industry:

At M. Holland

- M. Holland has obtained Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) compliance for its Mtegrity™ line of materials. Click here to read the full press release.

- Plastics News has recognized four M. Holland Mployees as Women Breaking the Mold in the industry in 2022! Learn more about Tracy Conrady, Daisy Serdan Corona, Suky Lawlor and Lindy Holland Resnick.

Supply

- Oil prices were mixed Thursday, balancing competing supply and demand fears. Prices are headed for their first weekly advance in a month.

- In mid-morning trading today, WTI futures were up 5.4% at $101.60/bbl, Brent was up 3.2% at $110.50/bbl, and U.S. natural gas was down 0.7% at $8.08/MMBtu.

- U.S. crude executives say production could stall due to a lack of fracking equipment and crews as well as capital constraints.

- U.S. refiners say demand for transportation fuels remains strong despite mixed signals from government inventory data.

- Pending U.S. legislation providing hundreds of millions of dollars for clean energy development also contains incentives to boost production of oil, gas and coal, a response to sudden supply shortages this year.

- OPEC and its allies will consider keeping oil output unchanged for September when they meet next week, despite calls from the U.S. for more supply.

- Global coal demand will rise by 0.7% this year and 0.3% next year to a new all-time high, the IEA predicts.

- Germany will impose a new natural gas tax on all consumers starting Oct. 1, a measure to support beleaguered gas importers that could triple household heating bills.

- In the latest oil news from second-quarter earnings season:

- The three largest western energy firms — Chevron, Exxon and Shell — booked a record $46 billion in combined profits in the second quarter.

- U.S. refiners Valero and PBF Energy, as well as shale producer Continental Resources, handily beat forecasts on record-high margins and a 40.6% year-to-date rise in crude prices.

- Shell and TotalEnergies will buy back a combined $8 billion in shares this quarter after posting their highest-ever quarterly profits.

- Petrobras smashed forecasts with a 26.8% net income gain.

- Flash flooding forced the overnight closure of one of the world’s biggest oil bunkering ports in the UAE, with operations only gradually resuming Thursday.

- Refiners predict Saudi Arabia will raise September crude prices for customers in Asia to a record-high margin over benchmarks, despite fears of a demand slowdown in China.

- South Africa is finalizing a plan to take over $24 billion in debt from embattled power supplier Eskom.

- China’s state-run oil firm CNOOC claims to have made the nation’s first commercial discovery of offshore shale.

- Canadian producer Cenovus Energy could spend hundreds of millions more than planned this year as it absorbs an acquisition in Alberta and restarts an offshore project off the coast of Newfoundland.

- The U.S. Department of Energy plans to spend up to $165 million on a geothermal power initiative aimed at boosting long-term utilization of the energy source.

Supply Chain

- Kentucky’s governor declared a state of emergency after flash flooding in the eastern part of the state led to multiple fatalities on Thursday.

- The National Weather Service declared heat alerts through Saturday for most of Washington, northern Idaho, California and Oregon, as the northwestern U.S. sees persistent high temperatures.

- Staff at Britain’s largest container port Felixstowe voted in favor of striking in a dispute over pay, joining a wave of labor action in the nation.

- A backup of more than 60 tankers, triple the normal queue, has formed off the coast of Mexico as ships wait for storage spaces to unload their fuel cargoes. Importers are facing penalties of up to $40,000 a day for the stranded ships, with state-owned Pemex incurring the bulk of the fees.

- Amazon is proceeding to build several multi-story, multi-million-square-foot warehouses despite stated intentions to slow its aggressive logistics expansion.

- Parts shortages are forcing more airlines to ground aircraft awaiting repairs, adding to travel disruption caused by a shortage of pilots, baggage handlers and air traffic controllers.

- House lawmakers followed the U.S. Senate Thursday in passing a $280 billion bill to boost U.S. computer chip production and tech competitiveness with China. Major chip makers hailed the approval and said they were moving ahead on various projects that had been stalled awaiting funding.

- Franco-Italian STMicroelectronics expects its factories to run at full steam well into 2023 on high demand from the auto and smartphone industries.

- In the latest supply chain news from second-quarter earnings season:

- Cosco Shipping said operating profit in the first half of the year nearly doubled to $14 billion.

- Hapag-Lloyd raised its full-year outlook on an 80% rise in first-half freight rates, while volumes were flat.

- Harley-Davidson’s North American sales fell by nearly one-third after production was halted in May due to supply chain issues.

- Intel’s sales unexpectedly dropped 22% to $15.3 billion as the chip maker warned of a slump in PC demand.

- Panasonic saw earnings drop 39% on fallout from China’s COVID-19 lockdowns and rising material costs.

- Mexico’s Cemex, one of the largest concrete suppliers in the world, posted a 2% earnings decline and lowered its full-year forecast.

- In the latest news from the U.S. auto industry:

- Toyota’s second-quarter production fell 10% short of targets on chip shortages at its Japanese and North American factories.

- Volkswagen said strong pricing will keep profits high this year even after deliveries fell 20% in the first half of 2022.

- Nissan’s Q2 profit fell 14% on a 22% decline in global retail sales.

- Stellantis said automakers will soon begin to lose pricing power as chip shortages ease and more vehicles flood the market.

- Sales of plug-in hybrid vehicles are falling sharply in their main market of Europe, as fully battery-electric models rise in popularity.

Domestic Markets

- The U.S. reported 126,272 new COVID-19 infections and 364 virus fatalities Thursday.

- Los Angeles County pulled back from reimposing a mask mandate after data showed declines in COVID-19 infections and hospitalizations.

- The White House will delay offering COVID-19 booster shots to people under 50 until new vaccines tailored for Omicron variants are available in the fall.

- New research suggests 5% of adults develop long-lasting changes to sense of smell or taste after a COVID-19 infection.

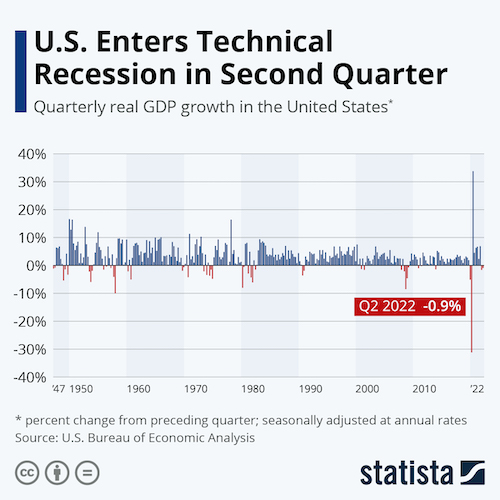

- The U.S. economy entered a technical recession with the 0.9% contraction in GDP experienced in the quarter ended in June:

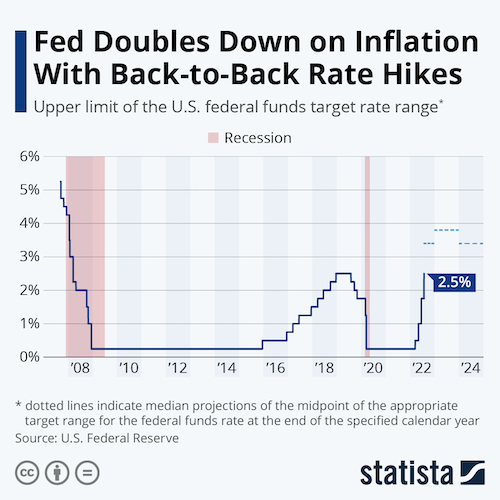

- Fed officials indicated the bank’s benchmark interest rate could rise to 3.4% by the end of the year compared to 2.5% now:

- New jobless claims last week remained among the highest of the pandemic recovery:

- U.S. consumer spending, which accounts for more than two-thirds of economic activity, grew at a 1% rate in the second quarter, the slowest pace in two years.

- Consumer spending on groceries fell 11.7% in the second quarter while spending on food services rose 13.5%, suggesting more Americans are eating out.

- Prices of some food items like cooking oil, coffee and avocados are starting to drop from historically high levels, the latest data shows.

- The average U.S. mortgage rate fell from 5.54% to 5.30% yesterday, according to Freddie Mac, as purchase demand tumbles amid elevated home prices.

- JetBlue Airways agreed to buy Spirit Airlines for $3.8 billion, ending a months-long bidding war with Frontier for control of the U.S. budget airline market. The deal now faces an uphill battle getting approval from regulators.

- Ford began marketing a new version of its electric F-150 to police departments across the country.

- Coca-Cola is scrapping the six-decade-old green bottle of its Sprite brand in favor of a more sustainable clear bottle.

- In the latest news from second-quarter earnings season:

- Apple limited its quarterly profit decline to 11% after weathering supply constraints and shutdowns in China, while iPhone sales remained resilient.

- Amazon posted a net loss for the second straight quarter as cloud-unit strength was offset by weakness in core online retail operations. Still, the firm’s shares rose over 13% in after-hours trading on promising revenue gains.

- Comcast’s subscriber growth was flat for the first time in company history, a sudden downshift amid rising competition from 5G telecom providers.

- Pfizer’s revenue jumped 47% in the second quarter on $8.1 billion in global sales of its COVID-19 antiviral Paxlovid.

- Southwest saw earnings double to $760 million, a record, fueled by a sharp rebound in travel demand and higher ticket prices.

- Mastercard saw gross dollar volumes rise 14% but warned that runaway inflation is sapping spending from lower-income customers.

- Shares of Roku fell 25% Thursday after the streaming firm posted a surprise loss of $112.3 million on declining advertising dollars.

- Merck & Co. reported higher-than-expected earnings and revenue on strong sales of its blockbuster cancer immunotherapy drug, Keytruda.

- Anheuser-Busch InBev, the world’s largest brewer, saw a better-than-expected 7.2% rise in core profit on rising sales in Latin America.

- Hershey raised its outlook for the year after posting a 19% jump in quarterly revenue. The firm said production issues will keep it from meeting Halloween demand this year.

International Markets

- Japan now has the most daily COVID-19 cases of any nation, with 196,000 reported Thursday.

- The IMF lowered its growth forecast for the Asia-Pacific region this year from 4.9% to 4.2%, reflecting spillover from the war in Ukraine and China’s economic slowdown.

- Chinese officials appeared to admit Thursday that the country would miss its annual growth target of 5.5% this year.

- Euro zone inflation climbed to another all-time high of 8.9% in July, driven by soaring energy and food costs as calls rise for the bloc’s central bank to make more aggressive interest-rate hikes. Germany, the euro zone’s biggest economy, saw similar inflation numbers.

- U.K. business confidence slumped again in July primarily on recessionary fears from large firms.

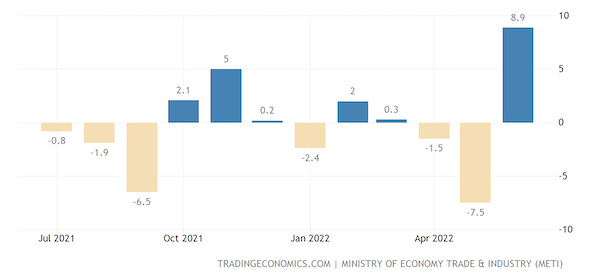

- Japanese industrial production rose by 8.9% month-over-month in June, the steepest increase on record, new data shows:

- Spain may impose a windfall tax on bank profits from interest and fees, marking the boldest action by any EU nation to offset a worsening cost-of-living crisis.

- Singapore Airlines swung to a quarterly net profit of $268 million on a fourteenfold increase in passenger traffic year over year.

- Spain-based cabin crew at easyJet suspended a planned strike after reaching a contract deal with the budget airline.

Some sources linked are subscription services.