MH Daily Bulletin: July 25

News relevant to the plastics industry:

At M. Holland

- M. Holland has obtained Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) compliance for its Mtegrity™ line of materials. Click here to read the full press release.

- Plastics News has recognized four M. Holland Mployees as Women Breaking the Mold in the industry in 2022! Learn more about Tracy Conrady, Daisy Serdan Corona, Suky Lawlor and Lindy Holland Resnick.

Supply

- On Friday, U.S. crude settled below $95/bbl for the first time since April after the EU eased sanctions on firms trading Russian oil, potentially freeing up supplies.

- In mid-morning trading today, WTI futures were up 1.2% at $95.85/bbl, Brent was up 1.0% at $104.20/bbl, and U.S. natural gas was up 3.0% at $8.55/MMBtu.

- Active U.S. oil rigs held flat at 599 last week, according to Baker Hughes.

- The U.S. will surpass Australia and Qatar to become the world’s top LNG exporter this year, according to forecasts from the U.S. administration.

- Schlumberger’s second-quarter revenue rose 20% year over year as drilling activity rebounded in all markets, prompting the oilfield firm to raise its full-year forecasts.

- More oil news related to the war in Europe:

- Citing concerns over global energy security, the EU decided to ease sanctions to allow major trading houses to buy and sell Russian crude for delivery to third-party nations.

- Coal-fueled electricity generation rose to a record high in 2021 and is on track to hit another record this year, as power demand stays high and Russia’s invasion limits supplies of gas.

- Amid reports that a U.S.-led price cap on Russia crude could take effect by the end of the year, Russian officials said they would not supply oil to countries that take part in the plan.

- Hungary is looking to fill a large new gas reserve mostly with Russian supplies, a significant break with EU policy.

- More European cities are imposing small measures to save energy before winter, including dimming street lamps, limiting temperatures in public buildings and urging residents to take shorter showers.

- TotalEnergies will lower fuel prices at all French service stations in the final four months of the year to support the eroding purchasing power of households, the firm said.

- Middle Eastern countries are sending more than double the volume of crude to Europe than they did a year ago as Russian supplies falter.

- Fuel production in India, the world’s third-largest consumer, rose an annual 17.9% in June as refiners continued snapping up discounted Russian crude.

- Saudi Arabia hopes to unlock more than 1 million bpd of extra crude for export by 2030 as it switches to gas-fueled electricity generation domestically.

- Exxon Mobil is expanding in Guyana, South America’s oil hotspot, with the drilling of another 35 wells starting in 2023.

- ConocoPhillips is mulling selling its minority stake in a Shell-operated oil and gas platform in the U.S. Gulf of Mexico, which would fully take the firm out of U.S. offshore operations.

Supply Chain

- Dozens of U.S. temperature records were broken last week as a band of heat moved over much of the country, according to the National Weather Service. High temperatures are forecast to linger for several days in the Pacific Northwest, with heat reaching up to 110°F in some inland areas, while Seattle, Portland and parts of Northern California could see temperatures break daily records by Tuesday. Residents living near Yosemite National Park were forced to evacuate as California’s Oak Fire grew to more than 14,000 acres Sunday.

- British electricity prices are nearly five times higher than their seasonal average, exacerbating the nation’s cost-of-living crisis.

- A surge in strikes and other labor protests is threatening industries all over the world, especially in logistics and transport.

- Truckers blockading the Port of Oakland for much of last week took a day-long break Saturday but could resume protests during normal port traffic today. The port’s import container dwell times have spiked 41% since mid-July to 17.5 days.

- South Korea’s Daewoo Shipbuilding reached agreement with contract workers to end a weeks-long strike that racked up $600 million in losses and delayed deliveries of LNG vessels.

- A 60,000-worker strike at Mexican telecom giant Telmex ended last Friday following agreement on a contract deal.

- Ground crews working for Lufthansa will strike for one day Wednesday as they seek a monthly wage increase of 9.5%.

- The Cass Freight Index for domestic U.S. freight shipments dropped to 1.203 in June, down 2.3% from a year ago but up 23.9% from pre-pandemic levels.

- Intermodal rail backups near Toronto and Montreal are triggering expanding congestion at Canada’s West Coast ports.

- The global shipping market may face a container surplus as large as 6 million TEUs following two years of intensive ordering.

- The corporate supply-chain finance market grew 38% to $1.8 trillion last year as more companies offered lending to cash-strapped vendors, many of whom saw delayed payments during the early days of the pandemic.

- Opposition is growing among truck safety and insurance groups over the U.S. government’s plan to allow commercial truck driving apprenticeships for people under age 21.

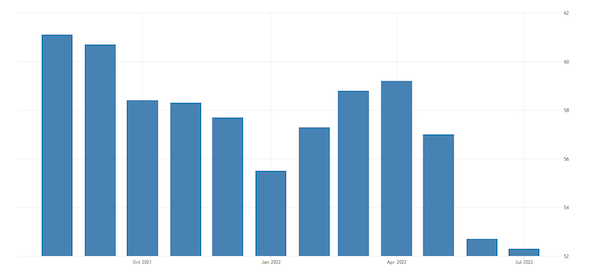

- S&P’s purchasing managers index of U.S. manufacturing activity edged down from 52.7 to 52.3 in July, marking the slowest growth in manufacturing in two years.

- In the latest news from the auto industry:

- Honda will slash production by up to 30% in Japan next month due to persistent supply chain issues.

- British electric van maker Arrival may cut up to 800 jobs after losing $10.4 million last quarter.

- A heat wave roiling Texas recently forced Toyota to suspend production at its San Antonio plant to conserve power.

- Amazon is prepping to roll out thousands of electric delivery vans in major U.S. metro areas in the coming weeks.

- Daimler Truck is scaling up production of its second battery-electric fleet van, the Mercedes-Benz eEconic.

- Turkey’s auto sector grew 26.3% year on year in June to 135,424 vehicles, with exports jumping 22.9%.

- China is on track to build 31 major semiconductor factories between 2020 and 2024, more than Taiwan (19) and the U.S. (12).

- The Port of Dover, Britain’s main gateway to Europe, declared a “critical incident” Friday as a labor shortage at French customs creates long delays.

- Falling container volumes at the Port of Rotterdam offset a rapid pickup in LNG and coal cargoes, leaving the port’s first-half throughput almost flat year over year.

- Falling scrap prices prompted a 50% drop in vessel demolitions so far this year.

- Russian missiles hit the port of Odessa one day after

Domestic Markets

- The U.S. reported 126,128 new COVID-19 infections and 355 virus fatalities Sunday. New cases and hospitalizations over the past two weeks are up 19% and 15%, respectively.

- The fast-spreading BA.5 subvariant of Omicron now accounts for 80% of U.S. COVID-19 cases, including a high proportion of reinfections.

- Driven by the BA.5 subvariant of Omicron, COVID-19 reinfections (+52%) and hospitalizations (+35%) rose sharply in New York state the past month.

- COVID-19 cases may be plateauing in Los Angeles County, where infections were down 2% week over week to an average of roughly 6,600 per day.

- Variant-driven waves of COVID-19 are becoming harder to track as more Americans turn to rapid, at-home antigen tests that are less detailed than lab-reviewed PCR tests.

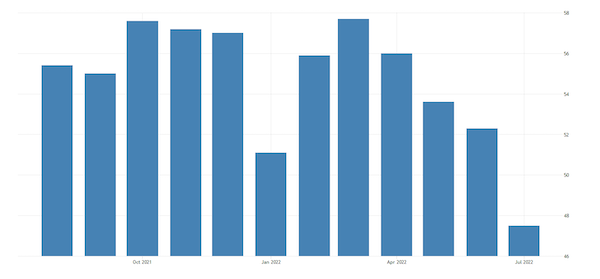

- S&P’s composite purchasing managers index — a broad measure of U.S. business activity — fell sharply from 52.3 to 47.5 in July, the first contraction in two years.

- Battling 40-year high inflation, the Federal Reserve is forecast to deliver another 75-basis-point interest-rate hike at its meeting this week.

- Much-awaited earnings reports are due this week for some of the largest U.S. firms, including Apple and Amazon.

- Surging inflation in the U.S. is causing more people to switch jobs, with job hoppers in the latest quarter enjoying an average wage hike of 6.4%, versus an average 4.7% increase for those who stayed in their present jobs, the biggest gap in 20 years.

- The labor market is showing signs of weakening, with jobless claims on the rise and more companies announcing staff reductions.

- Cost-conscious consumers are purchasing more store brands at the supermarket for the first time in the pandemic, as lower marketing costs and less variety give the brands an advantage over their name brand competitors.

- American Airlines canceled over 1,100 flights in July and August to provide a “buffer” against expected disruption.

- Second-quarter revenue at American Express rose 31% as cardholder spending on travel and entertainment topped pre-pandemic levels.

- Top U.S. wireless carrier Verizon reported lower-than-expected subscriber growth in the second quarter in the face of stiff competition and cautious consumers.

- Tesla is trying to tap into millions of dollars of public funding to build out its electric vehicle charging network, including a plan to open up its chargers to other car brands for the first time.

International Markets

- Japan’s daily COVID-19 cases topped 200,000 for the first time Saturday, the fourth day of record infections.

- Australia continues to experience a surge in COVID-19 hospitalizations, with the number of patients rising to 5,450 Monday, a record.

- Mainland China saw 680 new COVID-19 cases Sunday, down from Saturday’s 869 and its lowest daily tally in more than a week. COVID-19 infections rose by 7% in the U.K. last week.

- The World Health Organization declared monkeypox a public health emergency of international concern, the group’s highest alert. The U.S. has reported about 2,000 cases of the illness but is well-stocked on tests and vaccines, officials say.

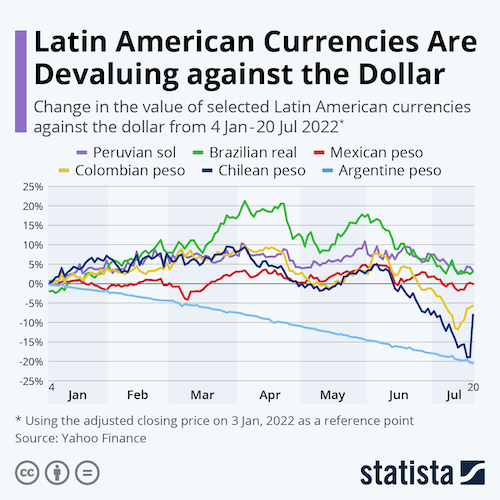

- Latin American currencies are down sharply against the dollar this year, pushing up domestic inflation rates and making it harder for many countries to pay back foreign debt::

- British businesses grew at their slowest pace in 17 months in July, according to S&P Global.

- Euro zone businesses continued to report mounting inflation and accelerating wage growth in July, according to surveys by the European Central Bank.

- Japanese manufacturing activity grew at its slowest pace in 10 months in July as output and new orders contracted.

- China’s economy grew a tepid 0.4% in the April-June quarter, one of the worst quarters since 1992 as widespread lockdowns hammered industrial activity and demand.

- Over half of flights departing Toronto Pearson International Airport arrived late to their destination in July, the worst rate among the top 100 global airports.

- The rising cost of living in the U.S., along with inflated housing prices and a surging dollar, are prompting many Americans to relocate to Europe, with Italy, Portugal, Spain, Greece and France receiving the highest number of expats.

- Polystyrene maker DIC is partnering with SAP to pilot a waste plastics system using blockchain to track traceability.

Some sources linked are subscription services.