MH Daily Bulletin: July 15

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to help manufacturers solve industry challenges and meet regulatory and supply chain demands.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil pared back steep losses early on Thursday to close just half a percent down.

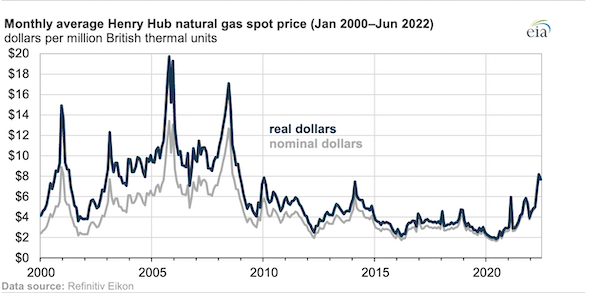

- In mid-morning trading today, WTI futures were up 2.6% at $98.31/bbl, Brent was up 2.6% at $107.70/bbl, and U.S. natural gas was up 1.9% at $6.72/MMBtu.

- The average U.S. gasoline price fell to $4.631 a gallon Thursday, still about $1.50 higher than a year ago.

- The monthly average Henry Hub spot price for U.S. natural gas, the nation’s benchmark, nearly doubled the past year from $3.84/MMBtu to $7.70/MMBtu:

- U.S. oil and gas dealmaking fell to $12 billion last quarter, about a third of the same time last year, as price volatility left buyers and sellers clashing over asset values.

- U.K. electricity prices could spike higher again this winter due to plunging output from nuclear reactors under maintenance in France, normally an abundant source of British power.

- India is reconsidering the windfall tax it recently imposed on producers and refiners as recession fears cause crude prices to fall.

- More oil news related to the war in Europe:

- France’s president urged consumers to rein in energy consumption ahead of a potential complete shutoff in Russian natural gas shipments.

- Germany withdrew gas from storage this week for the first time in three months after Russia halted deliveries via the Nord Steam 1 pipeline due to maintenance. The shutdown cut gas shipments to Austria by 70% this week.

- Shell’s chief executive warned Europe may need to start rationing energy if prices continue to escalate heading into winter.

- EU lawmakers reached early agreement to expand a gas pipeline from Azerbaijan to Europe that could provide a sizable portion of EU energy imports by 2027.

- Russia plans to launch oil trading on a new national platform in October as part of efforts to create its own oil benchmark by early next year.

- China may lift a two-year ban on imported coal from Australia over fears that escalating Western sanctions on Russia will reduce global supplies.

- Germany will allow the Czech Republic to receive more oil through the TAL pipeline from Italian ports as part of regional efforts to reduce dependence on Russian supplies.

- Turkey received a near-$1 billion loan from Deutsche Bank to start financing LNG purchases from countries besides Russia, including the U.S., Algeria and Qatar.

- Shell signaled more dividend hikes are coming on the back of soaring profits this year.

- Japan will extend its “Asia Energy Transition Initiative” to help India quicken its transition to cleaner energy.

- BP aims to produce sustainable aviation fuel in Australia by 2025 after converting its oil refinery near Perth to produce renewable fuels.

- A California startup is partnering with Alaska Airlines and Microsoft to commercialize jet fuel made from captured CO2.

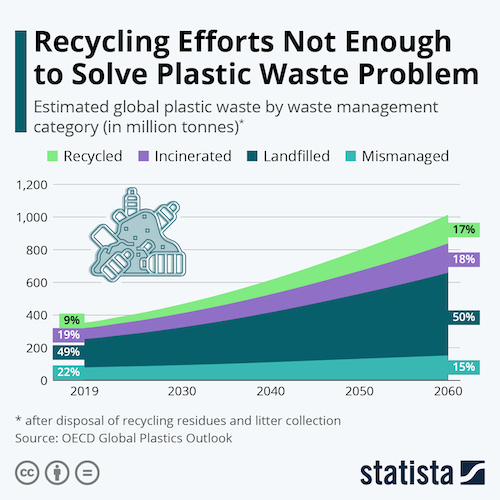

- According to the OECD, global GDP as well as plastic consumption will triple by 2060, with recycling only expected to account for 17% of plastic waste:

Supply Chain

- Yosemite National Park’s Washburn fire expanded to over 4,300 acres Thursday but appears to have shifted away from California’s giant sequoia forests.

- The chief of the Texas power grid affirmed the system’s ability to avoid blackouts this summer despite sweltering heat that’s already led to emergency calls for households and industry to reduce power use.

- Extreme heat in the U.K. next week could lead to power outages, canceled flights and danger to life, officials are warning.

- German port workers began a 48-hour strike yesterday, wreaking havoc on the nation’s North Sea cargo operations.

- U.K. rail workers announced plans for a second strike immediately following an initial strike set for July 27, the latest in a growing tide of British industrial unrest.

- Drayage provider ContainerPort Group is building out its trucking capacity to provide more services in Chicago, Charleston and Savannah amid rising import volumes on the East Coast.

- A Texas developer is set to start building a Houston-area logistics park connecting five nearby ports with two Class I railroads and major highways.

- South Korean container line HMM will invest $11.45 billion over the next five years to grow its eco-friendly container fleet, build more terminals at key ports and expand its bulk fleet by 90% to 55 ships.

- Wartsila, a Finnish marine company, is rolling out its first methanol-powered engine next year with the hopes of broad adoption by the shipping industry.

- U.S. solar energy prices jumped 8.1% in the second quarter as projects were stalled by soaring costs and a Commerce Department investigation into tariffs on products from Southeast Asia.

- Amazon says it sold over 300 million items this week in a record-breaking Prime Day, equating to 100,000 products a minute. Although the firm did not release revenues, new data shows that online spending in the U.S. rose 8.5% from the same time last year to $11.9 billion during the two-day event.

- Deloitte predicts U.S. back-to-school spending will rise 5.8% this year to a record $34.4 billion due to the surging cost of clothing and supplies.

- Spice maker McCormick says the pandemic’s broad-scale supply chain disruptions are largely behind it.

- In the latest news from the auto industry:

- European car sales fell 17% in June to the lowest level since 1996 due to supply issues and rampant inflation. Volkswagen was the hardest-hit major carmaker, with registrations dropping 24% from a year ago.

- Ford finalized a joint venture with South Korea’s SK On Co. to build and operate three electric vehicle battery plants in Tennessee and Kentucky at a cost of roughly $6 billion.

- GM is partnering with Pilot to build a network of at least 2,000 electric vehicle charging stalls at 500 Pilot and Flying J travel centers in the U.S.

- The U.S. and Mexico have resolved a dispute at a Panasonic auto parts factory in Reynosa, Mexico, where workers will see a 9.5% gain in wages amid soaring Mexican inflation.

- Hyundai launched its Ioniq 6 electric sedan Thursday, the first of 30 more planned electric vehicle models it plans to introduce by 2030.

- Nissan announced plans to phase out its Leaf electric vehicle by 2025. Introduced in 2010, the Leaf was ahead of its time and never caught on with consumers.

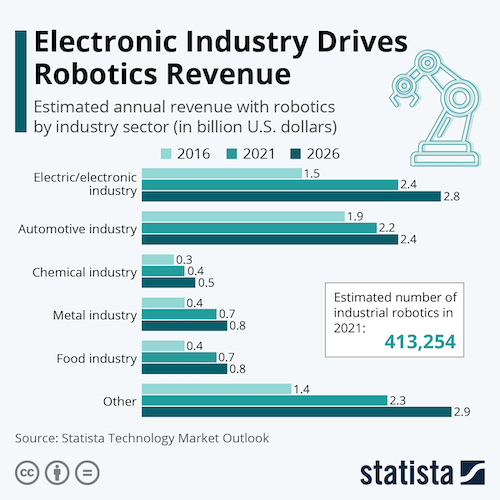

- The electronics industry overtook the auto industry as the largest client for factory robot sales in 2021:

- U.S. lawmakers are set to vote next Tuesday on a condensed funding bill providing far less than the originally planned $52 billion to boost U.S. chip manufacturing.

- China is readying to make $1.1 trillion in funds available for infrastructure spending to support the nation’s lockdown-ravaged economy, a decisive shift from its recent policy of controlling debt.

- The U.S. administration is reportedly taking a second look at policies allowing computer chip exports to China amid worries of intellectual property theft.

- A fertilizer shortage could slash harvests for major grain exporters in Eastern Europe this year.

Domestic Markets

- The U.S. reported 124,048 new COVID-19 infections and 351 virus fatalities Thursday.

- Los Angeles County raised its COVID-19 alert level Thursday and will impose a new indoor mask mandate in two weeks if cases remain high.

- Hollywood producers and unions agreed to extend a COVID-19 restrictions agreement through September as studios experience a rash of COVID-19 outbreaks.

- Hawaii will become the last state to end its mask mandate for public schools Aug. 1.

- Retail sales rose a higher-than-expected 1.0% in June, driven largely by higher prices.

- A key reading of U.S. producer prices rose 11.3% year over year in June, the seventh straight month of double-digit gains and approaching the all-time high of 11.6% set in March.

- New U.S. jobless claims jumped by 9,000 last week to a total of 244,000, the most since November.

- More Fed officials announced support for a 75-basis-point hike in the central bank’s main interest rate this month.

- JPMorgan reported a 28% profit decline in Q2 as it set aside bad-debt reserves in the event of a recession. The bank is also suspending share buybacks.

- Morgan Stanley’s Q2 profit fell almost 30% on sharp declines in its investment banking business, which has struggled amid a slump in global dealmaking.

- The average U.S. mortgage rate resumed its rise this week, moving from 5.3% to 5.51%.

- The number of U.S. homes for sale rose 2% in June, the first inventory increase in three years, according to Redfin.

- Airlines have triggered the majority of flight delays and cancellations this year, a counter to claims that weather or air traffic control is the source of growing travel disruptions.

- United Airlines, the first U.S. carrier to offer wage increases to pilots during the pandemic, will head back to the negotiating table after its pilot union rejected a contract deal Thursday.

- Conagra Brands reported a 6.4% sales drop in the latest quarter as consumers pushed back against rising food prices.

- Amazon is reportedly slashing the number of items it sells under its own brands due to disappointing sales and rising regulatory scrutiny.

- Spice company McCormick introduced 100% post-consumer recycled food color bottles as it seeks to make its product lineup fully sustainable by 2025.

International Markets

- A fresh wave of COVID-19 is sweeping through Asia, with Australia, New Zealand, South Korea, the Philippines and Thailand among countries reporting rising infections. Japan recorded over 90,000 new daily COVID-19 infections for the first time since February, while Tokyo raised its virus alert level to the highest tier.

- COVID-19 infections in China are at their highest level since May as more Chinese cities mass test residents and raise penalties on people who break virus protocols. Concerns are growing over the invasive nature of surveillance used in the name of preventing outbreaks, such as movement-tracking devices.

- Fast-spreading subvariants of Omicron are driving a wave of new infections across the African continent, especially in North Africa, where cases rose by 17% last week, according to the World Health Organization.

- The Canadian government will resume mandatory, random COVID-19 testing of international arrivals at four major airports this week.

- A sore throat is now the top symptom of COVID-19, according to data from over 17,000 people who tested positive last week.

- The European Commission cut its forecasts for economic growth in the euro zone this year and next and revised upward its estimates for inflation, citing the impact of the war in Ukraine. The euro’s slip below parity with the dollar widened following the news.

- China’s GDP expanded just 0.4% year over year in the three months to June, the slowest pace of the pandemic and the second-weakest ever recorded. Economists are downgrading forecasts for the remainder of this year, making Beijing’s annual growth target of 5.5% unlikely.

- Global investors and homebuyers are losing confidence in China’s property market, evidenced by a growing tide of frustrated homeowners threatening to stop paying their mortgages on unfinished homes.

- A legal fight is brewing between airlines and London’s Heathrow Airport after the British travel hub capped the number of outgoing passengers it handles each day.

- Global spending on enterprise IT is projected to grow 3% year over year to a total of $4.53 trillion, a significant slowdown from last year’s 10.2% increase, according to research firm Gartner.

Some sources linked are subscription services.