MH Daily Bulletin: July 14

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to help manufacturers solve industry challenges and meet regulatory and supply chain demands.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices rose modestly on Wednesday even after the U.S. government reported a crude build for last week. In mid-morning trading today, WTI futures were down 2.6% at $93.84/bbl, and Brent was down 2.1% at $97.47/bbl.

- U.S. natural gas futures jumped 9% to a three-week high Wednesday on forecasts for hot weather and data showing an output drop in recent days. In mid-morning trading today, U.S. natural gas was up 1.4% at $6.78/MMBtu.

- The average U.S. gasoline price fell for the 29th day on Wednesday, with over 10,000 filling stations now offering gas at less than $4 a gallon.

- U.S. crude inventories rose a smaller-than-expected 3.3 million barrels last week, according to the EIA.

- U.S. refiners imported West African crude at the highest rate in three years last quarter, new data shows.

- Chinese oil imports fell by 1.6 million bpd from May to June to about 9.2 million bpd. Tanker data suggest a quickened pace so far this month.

- Iraq is failing in efforts to boost oil export capacity at its Gulf ports due to maintenance delays.

- Large investment firms across the globe are putting more money into hydrogen technology, seen as a potential pillar of the energy transition.

- More oil news related to the war in Europe:

- The EU is planning urgent actions — including restrictions on heating and cooling and incentives for industry to lower gas use — amid fears that Moscow will abruptly halt gas shipments to the continent.

- German power officials say household energy costs could triple and cause widespread social unrest if Russia abruptly cuts off gas deliveries. Some firms, such as tech group Bosch, are already planning for the scenario by switching from natural gas to other types of energy.

- Russian gas exports on three main lines into Germany fell to 1.3 billion cubic feet per day (bcfd) this week, down from 9.4 bcfd the same time last year.

- Germany’s first major sanction on Russian energy will start Aug. 1 with the halt of all coal imports.

- Italy has reduced its dependence on Russian gas from 40% to 25% of its total imports in just five months.

- TotalEnergies is in talks with Germany on helping the country import more LNG this year using floating storage vessels.

- Hungary banned fuel exports and scrapped a years-long cap on utility prices in moves meant to secure gas supplies for winter.

- Japan ordered the restart of as many as nine aging nuclear reactors amid concerns of a possible power crunch.

Supply Chain

- Texas’ grid operator again resorted to emergency calls to households Wednesday — including to cut power use, turn up thermostats and use fewer appliances — to avoid blackouts as power demand hits all-time highs.

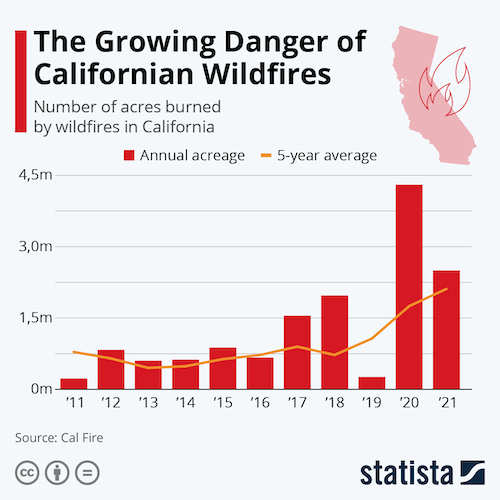

- California’s giant Sequoia trees are under threat from a wildfire in Yosemite National Park that expanded to nearly 4,000 acres Wednesday.

- Europe faces a sweltering heatwave this week and next that could bring temperatures above 100°F in several areas, including Spain and Britain.

- Trucking firms and owner-operators are scrambling to understand a new California law that upends decades-long rules allowing truckers to work as independent contractors. Protests over the law erupted at several of the state’s largest ports yesterday.

- A strike among German port workers could paralyze the nation’s North Sea cargo operations today and tomorrow.

- Hapag-Lloyd placed new congestion surcharges on two French ports and warned that bottlenecks are growing at ports across Europe.

- Average waiting times for bulk carriers at the Port of Rotterdam spiked to over eight days in recent weeks as congestion grows at Europe’s largest port.

- Germany’s Frankfurt Airport began curtailing freighter flights amid schedule disruption and a shortage of ground-handling workers.

- A measure of U.S. freight transport capacity fell 5.9% in June to a two-year low of 58.4, according to the Logistics Managers Index.

- The Port of Los Angeles’ top official urged railroads and importers Wednesday to quickly remove stacked-up cargo that risks exacerbating supply chain congestion.

- J.B. Hunt plans to open its first West Coast transload facility for intermodal containers near the Ports of Los Angeles and Long Beach.

- Average global demurrage and detention charges have fallen this year but remain around 12% higher than before the pandemic largely due to inflated fees at U.S. ports.

- Prices for key solar-panel material polysilicon are up for the seventh week in a row, threatening clean-energy installations across the globe.

- Congressional lawmakers appear to be backing away from a $52 billion injection into U.S. chip manufacturing as part of a larger bill to boost competitiveness with China.

- U.K. rail workers and station staff will strike again on July 27 over pay and working conditions, the latest in a growing tide of British industrial unrest.

- Japan’s MUFG Bank, the nation’s largest lender, is offering to buy corporate excess inventories to ease pressure on firms’ balance sheets.

- In the latest news from the auto industry:

- Overall sales in the U.S. automotive sector fell 11% in June and were down 8.1% in the first half of the year.

- Panasonic Energy, Tesla’s main battery supplier in the U.S., announced plans to build a $4 billion electric vehicle battery factory in Kansas by 2028.

- German tech group Bosch announced $3 billion in investments to boost European auto chip production 20% by the end of the decade.

- Electric vehicle startups that promised to disrupt the auto industry are now scrambling to cut costs amid the type of industry slowdown that has long plagued more established automakers.

- Ukraine is making progress on talks to unlock grain shipments from Black Sea ports, which could begin to move as early as next week.

- Proposed U.S. legislation would set targets to eliminate greenhouse gas emissions from international ships calling at U.S. ports by 2030.

Domestic Markets

- The U.S. reported 191,735 new COVID-19 infections and 880 virus fatalities Wednesday. The CDC predicts nearly 40 states and territories will see rising hospitalizations over the next two weeks, particularly in the U.S. South.

- The fast-spreading BA.4 and BA.5 subvariants of Omicron now make up more than 80% of all COVID-19 infections in the U.S.

- Los Angeles could impose a new indoor mask-wearing mandate if COVID-19 infections remain on the CDC’s “high” level for two weeks. Warner Bros. is in the midst of the worst COVID-19 outbreak of the pandemic in the studio and network industry.

- The BA.5 subvariant of Omicron accounts for an estimated two-thirds of COVID-19 cases in the New York region.

- The FDA granted emergency approval to Novavax’s two-dose COVID-19 vaccine Wednesday, making it the fourth shot available for use among U.S. adults.

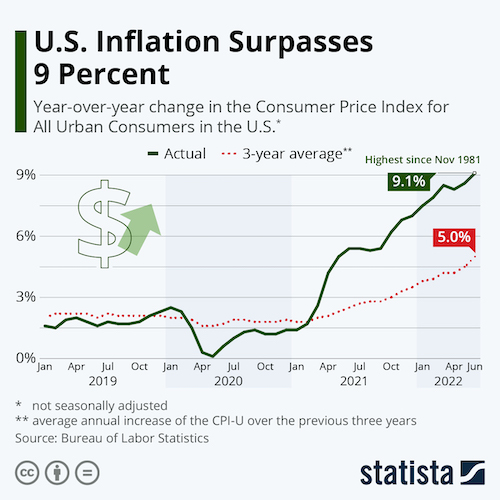

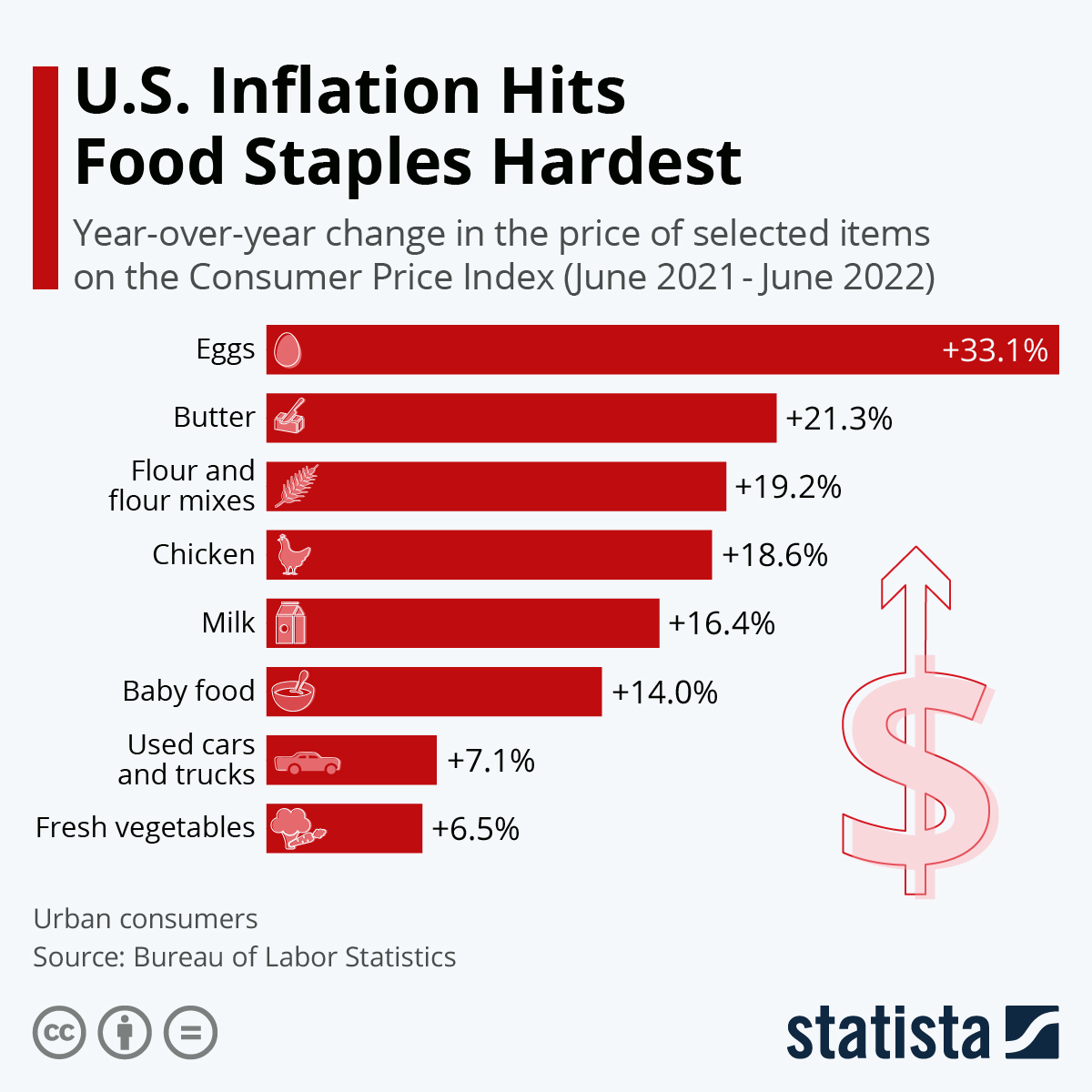

- Price rises for food, energy and housing primarily drove the U.S.’s inflation rate to its fresh four-decade high of 9.1% in June, data shows.

- Investors say the Federal Reserve is more likely to raise its benchmark interest rate by a full 100 basis points this month after yesterday’s report of surging inflation in June.

- Released yesterday, the Federal Reserve’s Beige Book of anecdotal evidence pointed to slowing economic growth in several parts of the country in recent weeks.

- Higher tax revenues and the phaseout of pandemic relief slashed the federal government’s budget by a record $1.7 trillion in the first nine months of the fiscal year.

- Inflation surpassed 10% in several of the largest U.S. metro areas in June, including Miami, Baltimore, Houston and Seattle.

- U.S. rents rose 0.8% in June, new data shows, marking the fastest pace since 1986. The median monthly lease rate in Manhattan hit a record $4,050 in June, 25% higher than last year.

- Delta’s $12.31 billion in Q2 revenue fell just short of market expectations as flight capacity surpassed 80% of pre-pandemic levels. The airline warned cost pressures would continue rising this year even as demand is forecast to rebound well past summer.

- Delta Air Lines is set to order at least 100 Boeing 737 MAX jets as well as a dozen smaller Airbus A220 jetliners.

- Travelers are starting to use innovative methods, including adding tracking devices to bags, to ensure they can find their luggage amid chaos at understaffed airport baggage operations.

- Many U.S. retailers are are opting for new leadership or moving ahead with pandemic-delayed succession plans amid challenges adapting to supply bottlenecks, historic inflation, staffing issues and crime.

International Markets

- There were 1,562,967 new COVID-19 cases last week in the Americas, down 0.9% from the prior week, but health officials warned of the spreading BA.4 and BA.5 Omicron variants.

- The World Health Organization urged governments to reinstate COVID-19 restrictions amid rising infection and death rates.

- Daily COVID-19 infections in South Korea jumped above 40,000 for the first time in two months.

- Tokyo recorded 16,878 new COVID-19 cases Wednesday, the highest since February.

- AstraZeneca’s COVID-19 vaccine is estimated to have saved over 6 million lives in the first year of its rollout, research shows.

- Europe affirmed plans to offer updated COVID-19 vaccines tailored to the Omicron variant this fall.

- More news related to the war in Europe:

- The EU is working with the U.S. on a joint approach to enforcing economic sanctions on Russia, including greater collaboration on sharing confidential data.

- Dutch truck and bus maker Iveco Group will exit its joint venture in Russia after months of planning the move.

- The IMF said it will soon downgrade its global economic growth forecasts for this year and next due to fallout from the war in Ukraine.

- The euro’s first dip below the U.S. dollar in 20 years this week was spurred by U.S. rate hikes and recession fears that boosted the dollar’s appeal as a safe-haven currency.

- Canada’s central bank raised its main interest rate by 100 basis points yesterday to 2.5%, marking its largest rate hike since 1998.

- Chile’s central bank raised its benchmark interest rate by 75 basis points to 9.75% Wednesday and said more rate hikes would be coming soon.

- U.S. companies plan to invest over $40 billion in Mexico through 2024, the Mexican administration said.

- Singapore’s economy expanded a larger-than-expected 4.8% in the second quarter amid strong growth in goods production and services activity.

- Hungary raised taxes on small businesses yesterday, prompting an hours-long blockage of a main bridge in Budapest.

- Average daily hotel rates are about 17% higher across the globe than the same time in 2019.

- Lufthansa canceled thousands more flights from German airport hubs this summer, citing staff shortages.

- A worker strike that has crippled the operations of Scandinavia’s largest airline SAS will continue today after negotiators failed to reach agreement on Wednesday.

- Royal Mail managers will strike later this month over proposed job and pay cuts at the British postal service.

- Chicago-based financial firm Morningstar is cutting hundreds of jobs in China due to the nation’s “complex business environment.”

- Mercedes-Benz will start assembling its first electric bus in Brazil later this year as municipal demand grows in Latin America’s largest economy.

Some sources linked are subscription services.