MH Daily Bulletin: July 13

News relevant to the plastics industry:

At M. Holland

- M. Holland has launched a new Healthcare Packaging line card to help manufacturers solve industry challenges and meet regulatory and supply chain demands.

- M. Holland’s 3D Printing group offers a rapid response alternative for producing selected parts where resin availability is tight. For more information, email our 3D Printing team.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil prices fell over 7% on Tuesday, with Brent settling below $100/bbl for the first time in three months.

- Oil prices were mixed n mid-morning trading today, with WTI futures up 0.2% at $96.05/bbl, Brent down 0.2% at $99.30/bbl. U.S. natural gas was up 5.9% at $6.53/MMBtu.

- The average U.S. gasoline price has fallen for 28 straight days to $4.655 a gallon, while stockpiles remain at their lowest seasonal level in seven years.

- U.S. crude stocks rose a surprise 4.8 million barrels last week, according to the American Petroleum Institute. Government data will be released today.

- The U.S. Energy Information Administration forecast a rise in U.S. crude production and petroleum demand in 2022 as the economy grows, although production will remain below 2019 levels. Meanwhile, power consumption and natural gas production and demand are forecast to hit record highs.

- Spare capacity in OPEC nations has been running low, with most producers pumping at maximum capacity. The group forecast on Tuesday that oil demand will rise by 2.7 million bpd in 2023, a 2% increase, down from growth of 3.4 million bpd this year.

- Recession fears are prompting investors to dump petroleum-related derivatives at one of the fastest rates of the pandemic era, trading data shows.

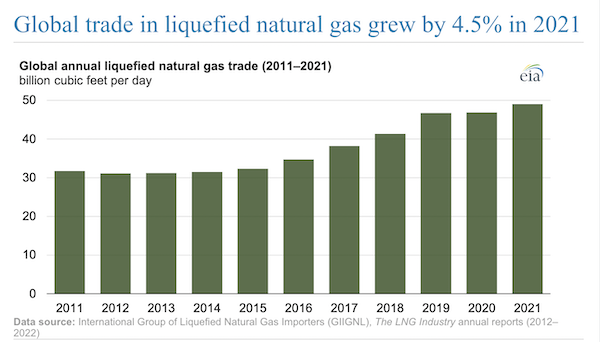

- Global LNG trade rose by 4.5% last year, according to the U.S. administration:

- Japan, the world’s second largest LNG importer, is urging the U.S. to boost production and deliveries to ensure stable supply.

- More oil news related to the war in Europe:

- The International Energy Agency says the worst oil-supply crisis in decades is showing early signs of easing as sanctions on Russian crude have had less impact on production than expected. Separately, the group is pushing to include gasoline and diesel in plans for a price cap on Russian crude, officials say.

- Spanish officials say the country would not see severe consequences if Russia were to completely halt gas shipments.

- Ukraine’s state-owned gas company is asking creditors to defer payments for two years due to the inability of customers to pay during war.

- Russian exports of diesel and other fuel products to the Middle East have risen every month since February, a further signal of the war’s disruption on long-established trade routes.

- Nonprofits say the relatively small underwriting fees that banks earn from fossil-fuel companies are no longer worth the environmental impact and reputational risk.

- British lawmakers approved a 25% windfall tax on oil and gas producers that could generate $6 billion to help with household energy bills over the next year.

Supply Chain

- After the second-warmest June on record, countries in western Europe are bracing for their second dangerous heat wave of the summer, with all-time temperature records set to be broken this week in the U.K., Portugal, Spain and France.

- U.S. diesel prices are down 24.2 cents from a late-June high of $5.81 a gallon, according to the EIA.

- U.S. retail imports rose 2.7% year over year to a record 2.4 million TEUs in May, the latest month for which final numbers are available.

- Amazon’s two-day Prime sale is off to a promising start, with typical household spending up 20% from the early hours of the sale last June, according to one measure.

- The White House faces a deadline next week to intervene in nationwide U.S. railroad labor talks covering 115,000 workers as potential strike action looms.

- Firms that stockpiled computer chips during pandemic shortages are now facing a glut of supplies, particularly for chips used in discount PCs and smartphones.

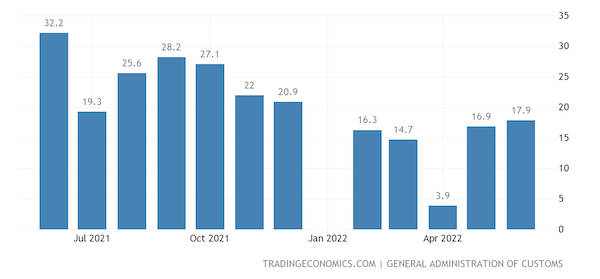

- China’s exports grew by a larger-than-expected 17.9% in June as post-lockdown logistics issues eased:

- Supply disruptions at Lamb Weston prompted the U.S. food processing giant to switch ingredients for its starches.

- PepsiCo’s revenue rose 5.2% in the latest quarter from a year ago after the firm boosted prices by 12%. More price hikes could come as company data shows little impact from inflation on consumer spending.

- Peloton will cease all in-house production of its bikes and treadmills amid high costs and reduced demand for its once popular exercise equipment. The move will force layoffs for almost 600 workers.

- In the latest news from the auto industry:

- Hyundai reached a tentative wage deal with its South Korea labor union, potentially avoiding a strike and production losses at its biggest manufacturing base.

- A quarter of Americans say their next car will be an electric vehicle due to the surging cost of fuel, according to AAA.

- Indian start-up Blue Energy Motors inked a deal with Italian commercial truck maker Iveco to supply engines for new LNG-powered trucks.

- Arkansas electric-vehicle startup Canoo will supply 4,500 delivery vans to Walmart starting in the fourth quarter of this year.

- The U.S. joined the International Energy Agency in calling for Asian nations to diversify their energy and mineral supply chains in a bid to reduce dependence on Russia and China.

- British home remodeling and repair prices were up 26% year over year in May.

- The U.S. administration announced over $300 million in available grants to improve and expand ferry services across the country.

- Ukrainian grain exports could begin to rise with alternative river routes that bypass Russia’s blockade of Black Sea ports.

Domestic Markets

- The U.S. reported 160,227 new COVID-19 infections and 444 virus fatalities Tuesday.

- The fast-spreading BA.5 subvariant of Omicron now makes up 65% of all COVID-19 cases in the U.S., the CDC said. The strain is especially prominent in Florida and the U.S. Southeast.

- U.S. health officials are urging people over 50 to get another COVID-19 booster shot as infections tick up across much of the country.

- New York City’s COVID-19 test positivity rate is 15%, the highest since January. Local health officials are urging residents to return to mask-wearing.

- COVID-19 hospitalizations in Houston have nearly doubled over the past month.

- Average daily COVID-19 infections in California fell 12% last week, although officials warn the slump is likely due to a lack of reporting over Fourth of July.

- The IMF cut its growth projections for the U.S. economy this year from 2.9% to 2.3% and raised its unemployment-rate estimate, citing surging inflation.

- Inflation was up 9.1% year over year in June, a four-decade high. Seven in 10 Americans believe the U.S. will fall into a recession within months, a new poll shows.

- Google announced plans to slow hiring for the remainder of the year as its chief executive warned of a potential economic recession.

- The inflation rate for goods purchased online slowed sharply to 0.3% last month, down from 2% in May.

- Almost one-quarter of the 20 million Americans who quit their jobs in the “Great Resignation” from January to May regret their decision, according to a new survey.

- The rising cost of living is forcing more people to move back in with their parents, including a record number of 40- and 50-year-olds.

- Even companies that have fully embraced remote work are buying new real estate, a bet that employee collaboration will benefit from regular office use.

- Silicon Valley added 1.6 million square feet of new office space in the first quarter, a 46% rise from the same time a year ago.

- Boeing’s 51 jet deliveries in June were up 38% from the same time last year for the highest monthly total since March 2019.

- American Airlines expects to post its first quarterly profit of the pandemic as booming travel demand helps offset mounting costs.

- More large Spirit Airlines shareholders are urging the firm to renounce its deal with Frontier Group Holdings and publicly back a merger with JetBlue.

- Volkswagen is teaming up with Redwood Materials to recycle electric vehicle batteries, joining a growing list of automakers working with the Nevada-based startup.

- Tesla is laying off over 200 employees as it permanently shuts its office in San Mateo, California, court filings show.

- U.S. auto regulators rejected a proposal that would have allowed electric vehicles to make customized safety sounds at lower speeds to protect pedestrians.

- The U.S.’s recycling rate would need to double by 2025 to generate enough supply for large beverage makers, new research shows.

International Markets

- Global COVID-19 cases are up 30% the past two weeks, according to the WHO.

- The World Health Organization is urging immunocompromised people in Europe to get a second COVID-19 booster dose as infections rise across the continent.

- Japan logged over 76,000 new COVID-19 cases Tuesday, double a week ago, to the highest level since March.

- South Korea reported 37,000 new COVID-19 cases on Tuesday, a two-month high.

- More news related to the war in Europe:

- Western firms will have more time to negotiate their exit from Russia after lawmakers there failed to pass a bill allowing Moscow to take control of company assets.

- Lego is laying off 90 Moscow employees and indefinitely suspending its operations in Russia.

- The EU has officially frozen over $13.83 billion of assets held by Russia’s ultra-rich people and entities.

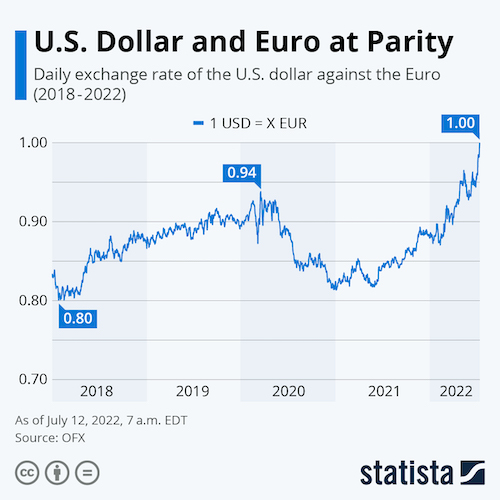

- The euro and the U.S. dollar reached parity on Tuesday for the first time in 20 years, as the euro suffers steep declines caused by fallout from the war in Ukraine.

- Economic data released this morning shows output at factories across the euro zone rose more than expected in May.

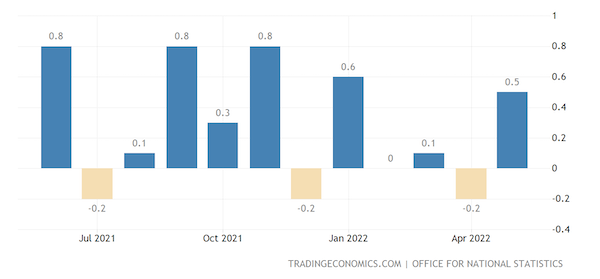

- The British economy unexpectedly grew 0.5% in May, recovering from April’s contraction with a sizable boost in manufacturing output:

- Confidence at Japanese manufacturers in July was subdued, reflecting pressure from continued chip shortages and China’s heavy-handed pandemic response, according to a new poll.

- Over one-third of industrial firms in France reported raising prices in June, while 29% expect to do so this month, a new survey shows.

- India’s retail inflation rose more than expected for the sixth straight month in June, gaining over 7% and prompting forecasts of more interest-rate hikes.

- Spain’s new taxes on banks and energy firms will be used to ease consumer prices for the next two years, officials say.

- Tourism spending in Canada remains 34% below 2019 levels despite strong gains over the past year, a reflection of sticker-shock prices on everything from gasoline to airline tickets to hotels.

- Heathrow Airport’s move to limit passenger departures and suspend ticket sales to summer travelers garnered widespread criticism, while airport data shows the London hub is among the least-disrupted major airports in Europe.

- The European Commission is proposing new rules that would make the bloc’s “use-it-or-lose-it” airport slot rule more flexible to respond to unexpected disruptions.

- Mexican airline Aeroméxico, which emerged from bankruptcy in March, will delist from Mexico’s national stock exchange and list with the NYSE or NASDAQ.

- Chinese automaker Geely Holding unveiled a new electric pickup truck just as pandemic restrictions fuel demand for outdoor activities and trips.

- British auction house Christie’s sold over $4.1 billion worth of art this spring, up 17% from a year ago.

Some sources linked are subscription services.