MH Daily Bulletin: July 8

News relevant to the plastics industry:

At M. Holland

- We are numb with grief over last weekend’s mass shooting in Highland Park, Illinois, a neighboring community to M. Holland’s headquarters and home to many Mployees. Fortunately, all Mployees are safe and accounted for, but our hearts and thoughts are with the community after this tragic attack. Our President and CEO Ed Holland shared this message with Mployees this week.

Supply

- Oil prices rose 4% Thursday, rebounding from steep losses the previous two sessions.

- In mid-day trading today, WTI futures were up 1.7% at $104.40/bbl, Brent was up 2.1% at $106.80/bbl, and U.S. natural gas was down 1.9% at $6.18/MMBtu.

- The average U.S. gasoline price fell for 23 consecutive days through Thursday after hitting a record $5.02 a gallon last month. The current price stands at $4.72 a gallon.

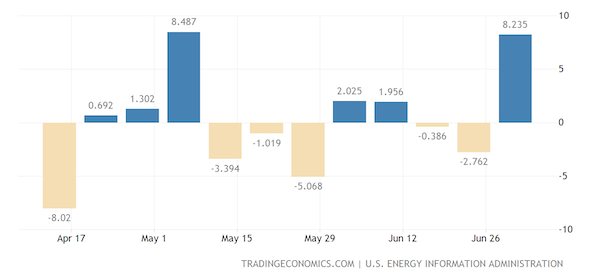

- U.S. crude stockpiles rose by 8.2 million barrels last week after the government released another batch of strategic reserves, according to the EIA. Inventories are 10% below the average for this time of year.

- Shell says refining margins have nearly tripled from Q1 and could bring a $1 billion earnings boost in the current quarter.

- Western oil majors, notably Shell and BP, continue to invest billions in the U.S. Gulf of Mexico despite mixed signals from the White House over the region’s drilling prospects.

- The U.S. administration green-lighted some LNG exports to Venezuela for at least another year.

- The White House tightened sanctions on OPEC member Iran, pressuring its government to return to a nuclear deal that would unlock the country’s oil exports.

- More oil news related to the war in Europe:

- Europe’s scramble to replace energy supplies from Russia is causing power shortages in poorer nations across the globe.

- More Western producers could be forced to exit their joint ventures as Russia moves to nationalize a second oil and gas project on its Pacific coast north of Japan.

- The Netherlands says it is fully prepared for a complete shutoff in Russian gas deliveries.

- Germany could take a stake of more than 30% in gas supplier Uniper to help protect its investment-grade credit rating.

- Chinese lockdowns spurred a 67% collapse in the country’s imports of U.S. coal in the first half of this year.

- An explosion at Kazakhstan’s largest oilfield killed two people and injured three Thursday, although authorities say production was uninterrupted.

- A heatwave has reduced water levels on the Rhine River, western Europe’s most important waterway, to the lowest seasonal level in 15 years, threatening to hamper the movement of fuel supplies.

- Dry weather forced Norway to cut some hydropower output in order to save supplies for winter.

- Exxon Mobil delivered its first sustainable aviation fuel cargo to Singapore’s Changi Airport as part of a one-year pilot program testing the new fuel on planes.

- EU lawmakers approved new long-term targets for blending sustainable aviation fuel into kerosene used for planes.

Supply Chain

- Outbound U.S. container volumes fell year over year for the 12th consecutive month in May, new data shows.

- Ocean container lines are ramping up cancellations of port calls as demand continues to decline, according to supply chain firm project44.

- The average price for airfreight shipments from Hong Kong to North America fell 10.1% from May to June, according to the Baltic Exchange.

- Local officials voted to allow a Port of Oakland terminal to be converted to a sports and residential complex, potentially clearing the way for construction of a new baseball stadium.

- More big ship owners plan to buy dual-fuel methanol-powered ships in their next round of container ship orders.

- In the latest news from the auto industry:

- Volkswagen is launching a massive $20 billion effort to produce electric vehicle batteries through six new or modified facilities in Europe.

- Over 1,800 Stellantis workers in Italy agreed to resign as the automaker says fewer people will be needed to make electric vehicles.

- Wait times for certain Lexus SUV models in Japan are nearing four years due to supply disruptions.

- Boeing’s chief executive says the plane maker could be forced to cancel production of its 737 MAX 10 jet due to regulatory issues that may not be resolved by a December deadline.

- RH, the high-end furniture seller formerly known as Restoration Hardware, became the latest furniture retailer to cut its financial targets as consumers pull back on goods spending.

- GE Appliances will begin testing electric trucks to ship products between logistics sites in Georgia, Kentucky and Tennessee.

- FedEx is working to better integrate its intermodal operations in Dallas-Fort Worth and Kansas City, saying the effort could save $2 billion in five years.

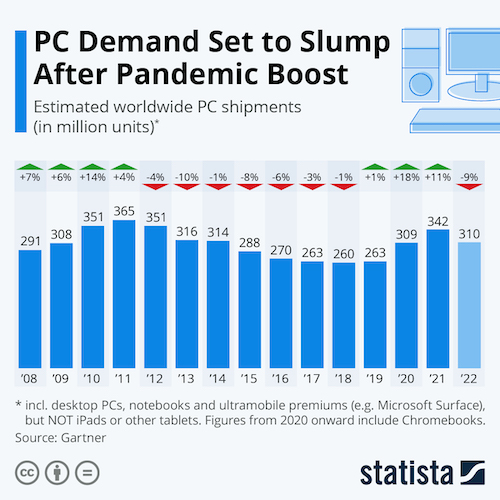

- Global PC shipments could drop 9% this year on declining demand, tech consulting firm Gartner predicts:

- The U.S. Transportation Department awarded over $968 million to 85 airport projects to help address the country’s aging aviation infrastructure.

- Romania is reopening Soviet-era rail lines to help Ukraine transport backed-up grain supplies to global markets.

Domestic Markets

- The U.S. reported 118,681 new COVID-19 infections and 1,111 virus fatalities Thursday.

- COVID-19 cases in Los Angeles County rose to a five-month high over Fourth of July weekend.

- COVID-19 cases are steadily rising in northern Texas, particularly the Dallas region, where the fast-spreading BA.4 and BA.5 subvariants of Omicron make up more than half of new infections.

- Alaska has the second highest COVID-19 case rate in the nation, even as hospitalizations with the virus decline.

- Omicron BA.5 appears to be four times more resistant to antibodies than other variants and can reinfect people in just a few weeks, according to health experts, who fear it could become the second largest virus wave of the pandemic in coming weeks.

- U.S. stocks posted their fourth straight session of gains Thursday, the longest winning streak since March.

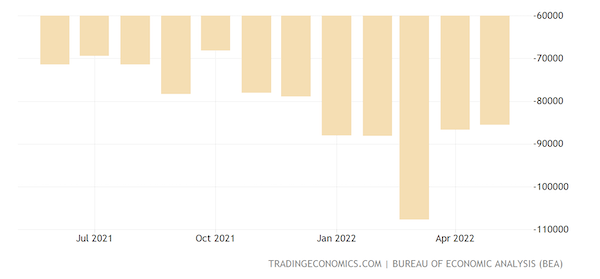

- The U.S. trade deficit narrowed by $1.1 billion to a five-month low of $85.5 billion in May, while exports hit a record-high $255.9 billion, driven primarily by industrial supplies and materials.

- Two Federal Reserve officials announced their support for a 75-basis-point interest-rate hike later this month.

- Layoffs announced by U.S.-based employers surged 57% from May to June, new data shows.

- The average U.S. mortgage rate fell from 5.7% to 5.3% last week, the largest one-week drop since 2008.

- Home prices in San Francisco Bay rose at an unusually low rate of 2% year over year in June, likely reflecting the choice of more workers to move away from the expensive city as they continue working from home.

- A near-record half of U.S. small businesses report having unfilled job openings in June despite raising wages.

- National office use hit a pandemic-era high of 44% in early June even as more firms plan real estate reductions in anticipation of an economic downturn.

- State debt levels rose 4% in 2021, the fastest rate in five years amid historically low interest rates and strong investor demand for municipal bonds.

- A quarter of Americans surveyed say high prices and the lack of U.S. charging infrastructure will prevent them from buying an electric vehicle. Separately, infrastructure shortfalls could set RV makers years behind traditional automakers in electrifying their vehicles.

- Spirit Airlines will postpone for a third time a shareholder vote on merging with Frontier as the carrier continues negotiations with rival bidder JetBlue Airways.

- Boeing’s deal to sell 50 737 MAX jets to Qatar Airways has lapsed, reports suggest.

- Merck is in advanced talks to buy cancer-focused biotech firm Seagen Inc. in a deal that could be worth $40 billion.

- The White House’s public request for input marked a first step toward eventually limiting single-use plastics in over $650 billion of federal procurement each year.

- The U.S. administration is floating a new requirement that states create their own two- and four-year plans for reducing vehicle emissions in line with federal net-zero targets.

International Markets

- Health authorities in France and Spain are again recommending people wear masks in indoor public spaces amid an uptick in COVID-19 cases.

- Local officials across China are scrambling to mass-test and prevent cities from going under mandatory lockdowns amid several small COVID-19 outbreaks. On Thursday, Shanghai reported 45 cases, Shandong province reported 66 cases, Anhui province reported 157 cases and Beijing reported zero cases.

- After a public backlash, Beijing quickly scrapped a COVID-19 vaccine mandate for indoor venues a day after implementing it.

- Hong Kong recorded over 3,000 new COVID-19 infections Thursday, the most in three months.

- Australia will start giving out fourth COVID-19 vaccine doses to people over age 30 as new infections tick up.

- COVID-19 cases have risen up to 40% in parts of Sweden the past several weeks, health officials say.

- New COVID-19 cases in Bangladesh more than doubled the past two weeks.

- The Netherlands is verging on becoming the first nation to make remote work a legal right, forcing employers to consider remote working requests and give a reason if denying them.

- Mexico’s annual inflation hit 7.99% in June, the fastest pace in 21 years and all but confirming more interest-rate hikes by the central bank.

- Canada booked its largest trade surplus since 2008 in May primarily on higher prices for its energy exports.

- Japan’s household spending posted a surprise drop in May for the third consecutive month, new data shows.

- France unveiled a $20.35 billion inflation-relief package on Thursday that will include new fuel discounts and rent caps.

- The Chinese government is considering a $220 billion sale of special municipal bonds in the second half of this year, an unprecedented acceleration of infrastructure funding aimed at boosting the country’s lagging economy.

- The number of emerging markets with distressed debt has more than doubled in the past six months, threatening to drag the developing world into a cascade of defaults.

- Global funding for startups fell 23% quarter over quarter, one of the steepest declines in a decade as more venture capitalists bow out of the current financing market.

- Britain’s labor market grew at its slowest pace in 16 months in June, signaling a potential return to pre-pandemic normalcy, according to S&P Global.

- British housing prices rose 13% year over year in June, the largest rise since 2004.

- German carrier Lufthansa is set to eliminate about one-fifth of departures from key German airports due to staff shortages.

- Hong Kong’s airport is unveiling a third runway that will increase its footprint by 50% today, part of an $18 billion expansion project that comes as flight capacity to and from the island has nearly halted due to pandemic restrictions.

- China unveiled a raft of new steps to encourage passenger vehicle demand, including new tax breaks for electric vehicles and infrastructure spending to expand the nation’s charging network.

- India’s Tata Motors plans to more than double its current production of electric vehicles by 2023.

Some sources linked are subscription services.