MH Daily Bulletin: January 24

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- A recent Plastics News article highlights M. Holland’s restructuring of its management team. Click here to read the full article.

- 2022 was a difficult year for supply chains, with 3D printing, Color & Compounding and Rotational Molding all weathering challenges to keep inventories up to date. Click here to read what M. Holland’s market managers had to say about their predictions for the three industries in 2023.

- M. Holland announced the restructuring of its leadership team to support accelerated growth and the next phase of the company’s evolution. Click here to read the full press release.

Supply

- Oil prices were mixed Monday, settling near their highest levels since early December.

- In mid-morning trading today, WTI futures were down 0.6% at $81.10/bbl, Brent was down 0.6% at $87.69/bbl, and U.S. natural gas was down 0.4% at $3.43/MMBtu.

- U.S. gasoline prices rose 32.7 cents the past month amid a rebound in crude oil, according to AAA.

- Oilfield servicer Baker Hughes saw a 32% jump in fourth-quarter orders but reported disappointing earnings due to supply-chain disruption and labor shortages.

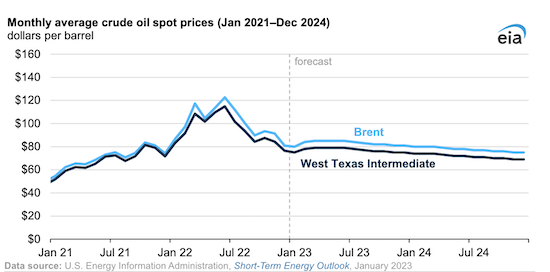

- The U.S. administration predicts Brent will rise from an average of $81/bbl in December to $83/bbl in the first quarter of 2023 due to Europe’s upcoming ban on seaborne imports of Russian petroleum products:

- More news related to the war in Ukraine:

- Benchmark European gas prices jumped Monday as demand increased amid a cold snap across the continent’s northwest.

- The EU’s market regulators are warning about potentially adverse impacts from the bloc’s upcoming cap on gas prices, set to launch in mid-February.

- The EU laid out multiple proposals aimed at overhauling its electricity market to better protect consumer energy bills from short-term swings in fossil-fuel prices, with a final plan set to be unveiled in March.

- The G7 will delay a review of its price cap on Russian oil until March, a month later than planned, to provide time for more detailed analysis.

- The U.K. government will start paying some households to use less energy at peak hours to incentivize energy saving.

- Eni and Algeria’s Sonatrach are studying joint projects to improve the north African country’s energy export capacity, especially to Europe.

Supply Chain

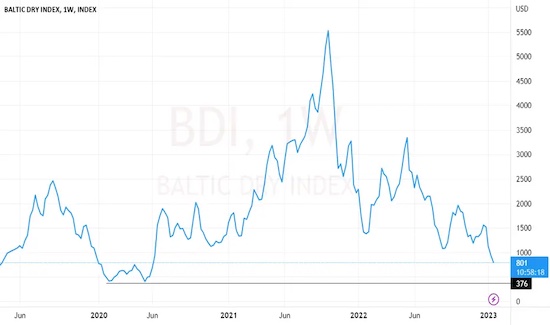

- The Baltic Dry Index for dry-bulk shipping prices dropped to 763 to start the week, down to its lowest level since June 2020.

- The Baltic Exchange’s gauge of spot rates for capesize bulkers, bulk shipping’s largest vessels, has fallen to just above operating expense levels.

- Dozens of bulk ships are backed up off Australia’s main coal hubs due to heavy rain.

- Nigeria opened a billion-dollar, China-built deep seaport in Lagos Monday, a bid to turn the country into an African hub for transshipment.

- U.S.-based Crowley and Denmark’s Esvagt are teaming up to build a service vessel for the U.S. East Coast’s emerging offshore wind industry.

- Hong Kong flagship carrier Cathay Pacific saw cargo volume fall 21% in December from the year before and 40% below pre-pandemic levels.

- Amazon launched a dedicated air cargo service in India this week amid surging e-commerce activity in the country.

- Western U.S. railroad BNSF plans to invest $3.96 billion in capital and maintenance projects this year.

- A new generation of personal-computer and data-center chips from British tech company Arm is putting more pressure on Intel, long the undisputed leader in U.K. markets.

- Apple plans to source as much as 25% of its production from India, compared with 5%-7% currently, as the iPhone maker continues to reduce manufacturing in China.

- In the latest news from the auto industry:

- Reports suggest Ford plans to cut up to 3,200 jobs across Europe and move some product development work to the U.S.

- About 19% of cars sold in California last year were zero-emission vehicles, accounting for 40% of all such sales in the U.S.

- U.S. electric-truck maker Rivian is losing more high-level executives as it works to scale up operations.

- GM plans to invest over $900 million in four U.S. plants for production of V-8 gas engines and electric-vehicle components.

- The U.S. pledged to help build an electric-vehicle battery supply chain in Zambia and Congo.

- Honda and battery maker GS Yuasa plan to establish a joint venture to build high-capacity lithium-ion batteries by the end of 2023.

- Volkswagen’s energy and charging division could be headed for a public listing, executives indicated.

- Chinese automaker Geely is planning a big investment to turn London Electric Vehicle Company, maker of London’s iconic black taxis, into a high-volume all-electric brand.

- The e-mobility division of Italy’s biggest utility will start making its street charging services available to Toyota and Lexus drivers.

Domestic Markets

- The U.S. reported 2,175 new COVID-19 infections and no virus fatalities Monday.

- The FDA proposed a new set of guidelines encouraging people to get vaccinated against COVID-19 every year, as is typical with flu shots.

- In a sign of potential weakening ahead for labor markets, companies cut 35,000 temporary workers in December, the fifth consecutive month of cuts.

- 3M said it is cutting 2,500 jobs after reporting a 6% drop in fourth-quarter revenues.

- Johnson & Johnson’s fourth-quarter earnings fell 25% and revenues slipped 4% on a drop in sales of its COVID-19 vaccine.

- The Conference Board’s widely tracked gauge of U.S. economic activity tumbled for a tenth straight month in December, including a weakened outlook for manufacturing, home building, job and financial markets.

- Newell Brands announced plans to cut about 13% of its office positions to save costs amid stubbornly high inflation that has pressured consumer spending.

- Business travel from small and medium-size firms is helping drive a recovery in the hotel industry, new data shows, with transactions reaching 80% of pre-pandemic levels in the third quarter.

- Ericsson says telecom operators in markets including the U.S. are delaying placing new orders for 5G gear amid economic uncertainty.

- Paint and coatings manufacturer PPG Industries expects a COVID-19 wave to disrupt its China business for the second time in as many months.

- Industrial parts supplier Fastenal saw fourth-quarter sales rise 10.7% from a year ago, the slowest pace in 2022.

- Industrial components maker Timken says it is closing a 50-year-old plant in South Carolina.

International Markets

- In the latest China news:

- A cold spell that spread across China last week broke temperature records Sunday, the coldest day the country has ever recorded.

- Facing easing demand from the U.S. and Europe, the global luxury industry is picking up momentum on high-end spenders in China, new data shows.

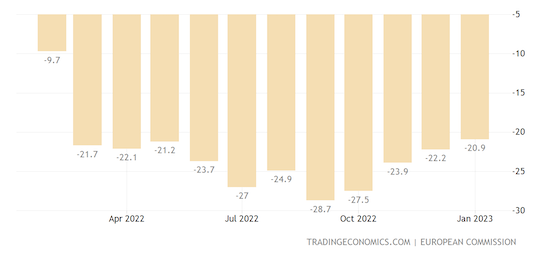

- A gauge of consumer confidence in the euro area rose by 1.1 points to -20.9 in January, the highest reading in almost a year on hopes of lower energy prices:

- British consumer sentiment fell for the first time in four months in January, returning to near-50-year lows on persistent concerns about the soaring cost of living.

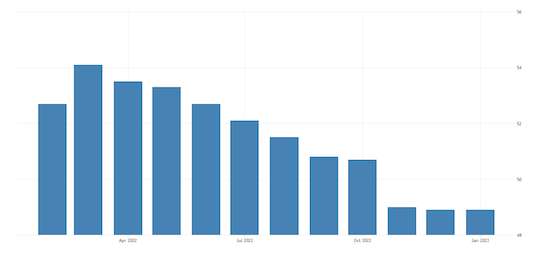

- Japanese manufacturing activity shrank for a third month in January, with the au Jibun Bank purchasing managers’ index staying flat at 48.9:

- Mexico’s headline inflation likely remained steady around 7.86% in the first half of January, while core inflation likely slowed.

- Inflation in Venezuela hit 234% last year, representing a slowdown from the previous year, according to officials.

- The operator of Germany’s BER airport in Berlin expects to ground all regular passenger flights Wednesday due to a worker strike.

Some sources linked are subscription services.