MH Daily Bulletin: January 17

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- Every year, M. Holland’s market managers take time to reflect on the major trends of the past 12 months. Click here to read our 2023 series, including business insight and recommendations for 3D printing, automotive, color and compounding, electrical and electronics, healthcare, packaging, rotational molding, sustainability, and wire and cable.

Supply

- Oil prices fell 1.3% Monday as easing COVID-19 restrictions in China raised hopes of a demand recovery in the world’s top crude importer.

- In mid-morning trading today, WTI futures were up 0.9% at $80.55/bbl, Brent was up 1.9% at $86.08/bbl, and U.S. natural gas was up 8.6% at $3.71/MMBtu.

- U.S. natural gas production is expected to grow more than 2% this year to a record daily average of 100.3 billion cubic feet, the Energy Information Administration says.

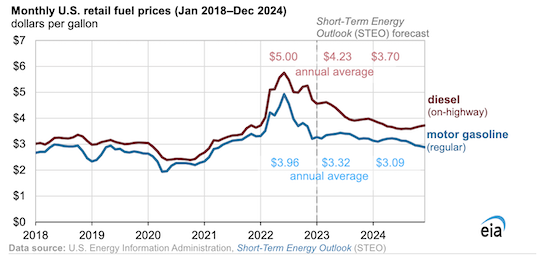

- U.S. retail prices for gasoline and diesel are forecast to decline the next two years, according to the U.S. administration:

- A survey of 1,000 energy professionals pegged the average forecast for oil prices through 2027 at $90/bbl, with $87/bbl forecast for 2023.

- China’s Panjin Haoye Chemical shut down its entire oil and refining complex after an explosion on Sunday killed five people and left eight missing.

- Exxon Mobil is preparing to approve its fifth oil project in Guyana, the world’s fastest-growing oil region since Exxon made its first offshore discovery there in 2015. Top energy companies in Asia and Europe are also looking at Guyana investments, according to reports.

- Electricity constraints are slowing plans to run Canada’s first LNG export terminal on renewable power.

- More oil news related to the war in Europe:

- European traders are rushing to fill tanks with Russian diesel ahead of a Feb. 5 ban expected to tighten global supplies and increase price volatility.

- Russia’s seaborne crude exports soared 30% last week to the highest level since April, suggesting the country has overcome an initial hit to flows that followed tighter European sanctions.

- High fuel stockpiles in China are forcing more importers to direct natural gas to Europe, where prices fell 12% Monday to the lowest level in 16 months:

- Moscow’s critical oil revenue is under further pressure with the average crude price the government uses to calculate its taxes down to a two-year low at $46.82/bbl.

- Germany’s hard coal demand from coal-fired power stations rose by 16% last year, the second straight yearly rise.

- India’s imports of Russian crude hit a record-high 1.2 million bpd in December, about 33 times higher than the same time last year, after new Western sanctions on Moscow led to deep discounts on Russian fuel.

- Surging household gas bills in the U.K. are unlikely to return to pre-invasion levels due to new windfall taxes on energy producers and an industrywide shift to greener energy, according to Equinor.

- The EU aims for member nations to start jointly buying gas by mid-2023, part of an effort to help countries refill storage and avoid a supply crunch next winter.

- Europe is falling behind on plans to launch a new LNG price benchmark due to a lack of data from market participants, officials said.

- Germany signaled support for a Spanish plan to reform Europe’s electricity market by decoupling the cost of renewable power from gas prices, preventing renewable sources from benefiting from higher prices linked to gas.

- Global investment in clean energy technology needs to soar to $4.5 trillion by the end of the decade for countries to have a shot at reaching net-zero 2050 goals, the International Energy Agency says.

- Thyssenkrupp’s plant engineering unit plans to double sales over the next several years with a focus on building more sites for the production of ammonia, a key feedstock for green hydrogen.

- German lawmakers are being pressured to exempt CO2 from anti-dumping laws to allow the gas to be exported and stored underground.

- Shares of British energy storage company ITM Power plunged 13.5% Monday after the firm announced a third profit warning in less than eight months.

Supply Chain

- California was hit again by rain and snow Monday, with forecasters predicting the end of a series of storms that have battered it since Dec. 26. Conditions are expected to be mostly dry for the rest of the month.

- A cargo ship traveling from Ukraine to Turkey ran aground in Istanbul’s Bosphorus Strait Monday, suspending vessel traffic for several hours.

- The Baltic Exchange’s dry bulk index, a widely tracked gauge of shipping costs worldwide, hit a 2.5-year low Monday amid subdued shipping activity.

- Sales of marine fuel in Singapore, the world’s largest bunkering hub, fell 4.3% in 2022 as macroeconomic headwinds weighed on global ship refueling demand.

- U.S. truckload spot rates have bounced back from mid-November lows of $1.67/mile to around $1.98/mile, suggesting the freight market could be stabilizing, according to FreightWaves.

- Siemens signed a $3.25 billion contract to supply and service freight trains in India, the biggest locomotive deal in the German engineering firm’s history.

- In the latest news from the auto industry:

- Experts predict some 2.77 million vehicles could be lost from global production plans this year due to computer chip shortages, down sharply from the estimated 4.38 million vehicles lost in 2022.

- Ford is poised to cut its dependence on Volkswagen technology for its next generation of electric cars in Europe, unraveling a core part of the automakers’ two-year-old alliance.

- Toyota expects to produce as many as 10.6 million electric vehicles this year with a 10% downside risk over possible component shortages.

- Volkswagen has broad plans to expand its high- and low-end offerings in China, executives said.

- Stellantis is set to invest in a geothermal project in Germany with lithium developer Vulcan Energy Resources to help power an electric-vehicle manufacturing facility.

- Wyoming lawmakers are proposing a voluntary “phase-out” of electric-vehicle sales by 2035, a symbolic move aimed at supporting the state’s oil and gas industry.

- U.S. electric-truck-maker Nikola plans to close a new California battery-making plant it acquired from Romeo Power, potentially impacting up to 400 jobs.

- Australia-based Recharge Industries plans to construct a $210 million factory to build lithium-ion batteries free of materials from China.

- Taiwanese chipmaker United Microelectronics will start imposing strict cost controls after softening demand led to a 10% decline in quarterly revenue.

- AerCap, the world’s largest aircraft lessor, expects delivery problems at Boeing and Airbus to last for years.

- China’s economic reopening should propel global air traffic to pre-pandemic levels by mid-2023, but airlines will continue to face struggles due to a shortage of jets, industry experts say.

- Aluminum futures are trading at their highest level in six months on prospects of robust demand stemming from China’s economic reopening.

- South Africa, Africa’s most industrialized country, faces a 45% chance of recession this year due to a deepening electricity crisis, experts say.

Domestic Markets

- The U.S. reported 5,745 new COVID-19 infections and 25 virus fatalities Monday.

- The fast-spreading XBB.1.5 variant of COVID-19 is most prevalent in parts of the U.S. Northeast and comprises 73% of infections in New York City.

- Boston is launching efforts to monitor COVID-19 levels in the city’s wastewater.

- People who exercise regularly have lower rates of hospitalization and death from COVID-19, new research shows.

- An estimated 1 in 10 people with COVID-19 will end up experiencing long-term symptoms, according to new research.

- High inflation and pandemic stress prompted medical residents at five prominent teaching hospitals to unionize last year as they seek better pay and working conditions.

- Walgreens removed online purchase limits for its over-the-counter fever medicines as supply conditions improve following one of the U.S.’s worst flu seasons in a decade.

- Companies in the S&P 500 are projected to boost capital spending by an estimated 6% this year compared to 20% in 2022, a response to higher financing costs and rising economic uncertainty, according to Ernst & Young.

- Conagra Brands raised prices 17% in the latest quarter, adding to the 10% hike it imposed in the previous two quarters.

International Markets

- In the latest China news:

- China’s economy grew at a weak but better-than-expected pace of 2.8% in the fourth quarter, dragging down full-year growth to 3%, a near 50-year low.

- Experts say the nearly 60,000 COVID-19 deaths China reported for the first five weeks of its current outbreak could be undercounted by hundreds of thousands.

- The nation’s Lunar New Year will bring a wave of more than 2 billion trips across the country in coming weeks, raising fears of a sharply expanding COVID-19 outbreak.

- Authorities say they will boost funding for COVID-19 prevention and control, especially in rural and low-income areas facing an incoming wave of the virus.

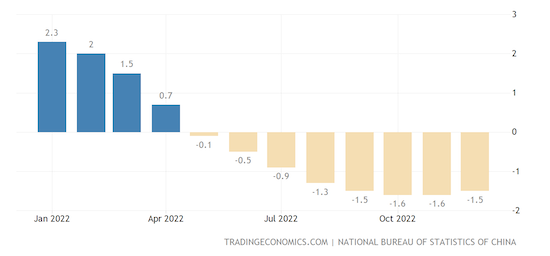

- New home prices in China’s 70 major cities dropped by an average of 1.5% in December, marking one of the steepest declines in nearly eight years:

- Moody’s predicts the economies of Germany, Italy and Slovakia will shrink below pre-pandemic levels as part of a “mild” recession this year.

- German wholesale price inflation rose to 12.8% year over year in December, the softest rise in 1.5 years:

- Tens of thousands of British nurses plan to strike in February for the third time in as many months, putting pressure on the country’s new government and threatening further disruption in the healthcare sector.

- Producer prices in Japan surged 10.2% year over year in December, exceeding market expectations on a mixture of high global commodity prices and a weak yen.

- Canadian manufacturing sales were flat in December following a downwardly revised 2.4% increase the previous month.

- The majority of Canadian businesses expect a mild recession in 2023 as higher interest rates curb investment plans, according to a new survey.

- Canadian home prices fell by a record 13.2% in 2022 as rapidly rising interest rates forced a major market adjustment. Home sales, meanwhile, fell 39.1% in December from a year ago.

- India’s trade deficit widened sharply in December after the country’s exports fell 12.2% due to weakening global demand.

- India’s wholesale price inflation declined to 4.95% in December, the lowest in nearly two years.

- Price inflation in Australia slowed to a 0.2% month-over-month pace in December, the slowest in four months.

- Venezuela’s public sector workers are mounting the biggest political protests in years as inflation erodes wages.

- Global dealmaking slowed sharply from the first to the second half of 2022, marking the biggest six-month swing since records began in 1980.

- Microsoft is likely to receive an EU antitrust warning over its $69 billion acquisition of video-game maker Activision Blizzard, adding to similar challenges in the U.S. and Britain.

- London-based Vodafone Group plans to shed hundreds of jobs as part of a major cost-cutting drive announced in November.

Some sources linked are subscription services.