MH Daily Bulletin: January 13

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil gained 1.5% Thursday on news of further declines in U.S. inflation and optimism about economic recovery in China. Crude prices are on pace for a 6% gain this week.

- In mid-morning trading today, WTI futures were up 0.7% at $78.97/bbl, Brent was up 0.5% at $84.47/bbl, and U.S. natural gas was down 3.5% at $3.57/MMBtu.

- The White House indicated it is open to releasing more crude from strategic reserves should the need arise.

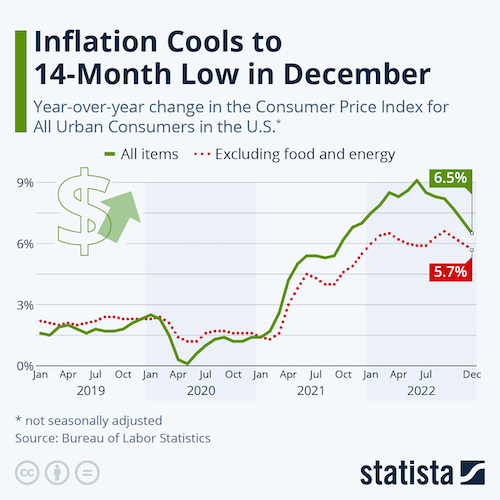

- The cost of energy in the U.S. rose at a much slower 7.3% year-over-year pace in December, down from a 13.1% rise the previous month, according to the latest inflation data:

- China’s oil consumption is expected to hit a record this year after the world’s biggest importer abandoned its COVID-19 restrictions. The country’s crude imports fell nearly 1% in 2022, the second annual drop in a row.

- Morgan Stanley expects the global oil market to tighten in the third and fourth quarters this year, supported by a recovery in demand from China.

- Reports suggest ConocoPhillips is open to selling Venezuela’s oil in the U.S. as a way to recover some $10 billion it is owed by the South American country.

- OPEC+ saw combined crude production rise to 42.71 million bpd in December, but still roughly 1.8 million bpd below targets, according to S&P Global.

- Saudi Aramco plans to boost gas production by more than 50% by 2030.

- British energy services provider Centrica expects to see a nearly eightfold increase in full-year profit.

- A French trade union called for strikes in the refinery sector to protest the government’s plan to raise the nation’s retirement age by two years.

- Bulgarian lawmakers backed a resolution to avoid the early phase-out of coal-fired power plants.

- China effectively ended its two-year ban on Australian coal Thursday.

- More oil news related to the war in Europe:

- Crude oil loadings from Russia’s Baltic ports will likely rebound strongly this month from December as freight issues ease.

- Russia more than doubled its rail exports of liquefied petroleum gas (LPG) to China last year as part of its drive to diversify its energy exports.

- British officials are confident the country will have enough energy supply to get through next winter.

- Inpex, Japan’s biggest oil and natural gas developer, is banking on near-term tightness in energy markets as it quickens its expansion of LNG output.

- Climeworks AG, a Swiss startup, says it conducted large-scale removal of CO2 from the open air, providing a potential kickstart to the nascent industry.

- Britain generated a record 21 GW of electricity from wind power this week, providing significant relief to gas supplies.

- China’s Ming Yang Smart Energy unveiled the world’s largest wind turbine with a rotating diameter the size of nine soccer fields.

- The Netherlands says its long-term switch from fossil fuels to renewable energy could cause electricity shortages by the end of the decade.

- A Swedish firm uncovered Europe’s largest deposit of rare earth elements, a boon to the continent’s transition to green energy.

- India will start taking bids in May for government subsidies aimed at building out the country’s hydrogen production.

Supply Chain

- Severe storm systems are expected to continue battering California through the weekend.

- U.S. air regulators said operations were back to normal Thursday, a day after an FAA computer glitch prompted a national grounding of flights. The grounding coupled with Winter Storm Elliott have created some of the most chaotic conditions in over a decade for U.S. airlines this winter.

- Britain’s Royal Mail suffered an unidentified cyber incident that left it unable to send parcels and letters overseas.

- U.S. freight costs fell 4.3% year over year in December, the first decline in 28 months, according to Cass Information Systems.

- Global air cargo volumes were down 8% in December compared with a year ago, the 10th straight month of declines.

- Global airfreight prices fell an average of 33.6% in the final week of 2022 from a year earlier, according to the Baltic Air Freight Index.

- New container ships representing 10% of existing capacity are due to be delivered this year.

- The U.S. House of Representatives reintroduced a bill that would let truck drivers as young as age 18 move containers to and from marine terminals.

- Brazil’s administration is dropping plans to privatize the country’s ports.

- China’s semiconductor sales plunged 21% in November, new data shows.

- TSMC warned first-quarter revenue could fall 5%, and the Taiwanese chipmaker plans to cut capital expenditures this year due to a slowdown in demand.

- China’s BOE Technology, a supplier to Apple and Samsung, plans to build two display-screen factories in Vietnam.

- The U.S., Canada and Mexico outlined a broad plan to reduce North American imports from Asia by 25%, part of a drive to bolster regional supply chains.

- India and the U.S. agreed to cooperate to build sustainable supply chains and boost bilateral trade, top officials said Thursday.

- Rising civil unrest in Peru is disrupting copper mining in the world’s second largest producer of the metal.

- Walmart announced a new partnership to provide Salesforce’s retailing clients with delivery services using Walmart’s vast transportation network.

- Paint and coatings-maker RPM International will cut production at some of its plants as it contends with softening demand.

- British metals company Liberty Steel will suspend work at two domestic plants and cut output at others due to high energy costs.

- U.S. contract logistics provider GXO Logistics expects to nearly double its revenue and triple its adjusted earnings by 2027.

- In the latest news from the auto industry:

- Volkswagen Group’s global sales fell 7% to 8.3 million units last year, the lowest in over a decade.

- Tesla is cutting prices in the U.S. by nearly 20% on some models to boost tepid demand.

- Tesla is reportedly delaying plans to expand its Shanghai factory after seeing its China-made car sales hit a five-month low in December.

- Luxury electric-vehicle-maker Lucid Group surpassed its 2022 production target, but logistics issues held deliveries to about 60% of finished cars.

- Bloomberg expects global plug-in vehicle sales to grow from 10 million in 2022 to a record 13.6 million this year with China continuing as the largest market.

- Car battery prices rose for the first time in at least 12 years in 2022 due to higher commodity prices and inflation.

- Ford is expected to replace South Korea’s SK On with LG Energy Solution as its partner for a new electric-vehicle battery plant in Turkey.

- German auto supplier Bosch will invest $1 billion in a new research and assembly center in China.

- MG Motor India, a subsidiary of Chinese automaker SAIC, expects electric vehicles to account for 30% of overall sales this year.

- India’s Tata Group is considering setting up plants in India and Europe to produce battery cells for electric vehicles.

- Car sales in Russia collapsed by almost 60% last year as the industry reeled under the impact of Western sanctions.

Domestic Markets

- The U.S. reported 63,240 new COVID-19 infections and 678 virus fatalities Thursday.

- COVID-19 cases are up 90% the past two weeks in Florida.

- Over 7,000 nurses at two New York City hospitals returned to work Thursday after reaching a deal to end a strike.

- The U.S. cancer mortality rate has dropped by one-third over the past three decades due to changes in preventive measures and screening.

- U.S. consumer prices unexpectedly fell 0.1% in December, the first month-over-month decline in 2.5 years, amid declining prices for gasoline, cars and other goods. Annual inflation, meanwhile, dropped to 6.5%, the sixth straight monthly slowdown.

- The U.S.’s latest inflation data is likely to keep the Federal Reserve on track to reduce the size of interest-rate increases to 25 basis points at its next meeting on Feb. 1.

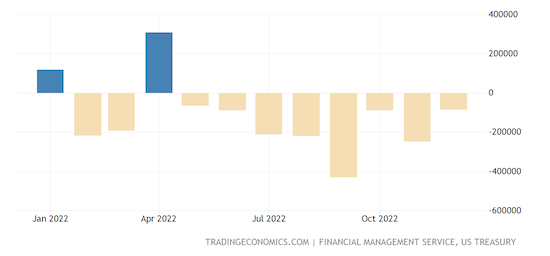

- The U.S. government’s December budget deficit quadrupled from a year ago to $85 billion. Receipts shrank modestly but outlays grew to a new December record.

- Home prices in Manhattan fell 17% in December from a year earlier, the latest sign of slowing activity in some of the hottest U.S. housing markets.

- American Airlines expects to see higher fourth-quarter profit after travel stayed strong during the key holiday season.

- Spirit Airlines pilots approved a two-year agreement that will boost their pay by an average of 34%. New pilot contracts are expected to drive up costs at other U.S. airlines this year.

- U.S. low-cost carrier JetBlue Airways plans to launch hundreds of new routes this year under a partnership with American Airlines.

International Markets

- In the latest China news:

- Authorities are warning people against visiting elderly relatives during the Lunar New Year holiday as signs point to rising COVID-19 cases in regional and low-income areas.

- At least half of a Beijing hospital’s 2,000 employees were infected with COVID-19 during the city’s latest wave, officials said.

- China has not updated its daily COVID-19 reports for three days, adding to international concern over the country’s lack of transparency.

- China’s inflation rate rose from 1.6% in November to 1.8% in December and is expected to accelerate further in the months ahead.

- Merck plans to launch its COVID-19 antiviral treatment in China today.

- Japan is logging record numbers of daily COVID-19 fatalities, officials say.

- Germany’s net borrowing rose to $124.5 billion last year due to pandemic spending and fallout from the war in Ukraine, the third-highest level on record behind 2020 and 2021.

- South Korea’s import prices rose 9.1% in December, the slowest pace in 21 months due to a drop in oil prices. Separately, the nation’s central bank raised its benchmark interest rate by 25 basis points to 3.5% Thursday, as expected.

- Argentina’s annual inflation hit 94.8% last year, the highest rate in over three decades.

- More airlines are bringing back jumbo four-engine jets as they race to meet rebounding demand for first- and business-class travel.

- Ryanair expects to see a “very strong” summer season, likely prompting an increase in short-haul air fares.

- The world’s oceans absorbed record amounts of heat from the atmosphere last year, fueling powerful storms and weather systems that hit communities across the globe, climate scientists say.

Some sources linked are subscription services.