MH Daily Bulletin: January 12

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil rose 3% Wednesday as an improved global economic outlook outweighed a massive build in U.S. crude stocks, normally a sign of an oversupply.

- In mid-morning trading today, WTI futures were up 1.1% at $78.28/bbl, Brent was up 1.3% at $83. and 77/bbl, and U.S. natural gas was up 5.8% at $3.8 8/MMBtu.

- U.S. crude stocks surged by 19 million barrels in the first week of 2023 — the third-largest build on record — as refiners slowly restored production after Winter Storm Elliott, according to the administration.

- Reports suggest top U.S. gas exporter Freeport LNG could further extend the seven-month outage of its LNG plant in Texas to February as it awaits regulatory approvals.

- Senior U.S. regulators walked back earlier indications that a proposal to ban gas stoves was being considered.

- Chinese jet fuel demand is poised to surge after the country scrapped most of its pandemic travel restrictions.

- More oil news related to the war in Europe:

- Global LNG imports hit a record 409 million tonnes in 2022, up nearly 8% from the prior year, driven by soaring shipments to Europe.

- The U.S. and its allies are finalizing plans for the next round of sanctions on Russia’s oil industry in the form of a cap on the sale prices of refined petroleum products. Some analysts say Moscow could see losses up to $300 million per day once the rules take effect Feb. 5.

- Unusually warm temperatures allowed Germany to conserve up to 80% of its gas inventories through the fourth quarter, up from just 50% last year.

- The EU and NATO agreed Wednesday to launch a task force for the joint protection of energy and other critical infrastructure, a response to last year’s attacks on the Nord Stream gas pipelines.

- Commodities trader Trafigura struck a deal to exit a major joint venture with Russia’s Rosneft in India, unwinding its decade-old partnership with the Russian energy giant.

- Swedish policymakers are working to allow construction of more nuclear reactors to strengthen the country’s energy security.

- Belgian tanker company Euronav is contesting rival Frontline’s effort to cancel their merger agreement, which would have created the world’s largest publicly-listed oil tanker owner and operator.

- Investment in climate tech by venture capital and private equity swelled to $59 billion in 2022, a 4% increase from 2021 led by electric-vehicle projects.

Supply Chain

- A glitch in the FAA’s hazard warning system led to a 90-minute halt to all U.S. departing flights Wednesday morning, resulting in over 10,000 flight delays and 1,300 cancellations. Ripple effects from the disruption spread internationally, as U.S. lawmakers announced a probe into the outage.

- Fallout from the FAA’s computer glitch continued today with hundreds more flights delayed or cancelled.

- Another storm system dumped heavy rain across California Wednesday, bringing estimated storm damages to some $34 billion since Dec. 25.

- South African utility Eskom said it would extend its worst-ever outages indefinitely, resulting in up to eight hours of power cuts for most South Africans each day.

- Chicago O’Hare’s key ground handling agents have agreed to terms allowing unions, averting the likelihood of significant air cargo disruption at the airport.

- Freight forwarder Flexport said it would cut about 20% of its global workforce, or more than 600 workers, as the digital-focused business copes with falling shipping demand.

- China canceled COVID-19 quarantine restrictions for crew changes at the country’s ports.

- A labor shortage concentrated in electric-vehicle production and solar-panel installation threatens to slow impacts from the U.S.’s recently passed Inflation Reduction Act, which included massive subsidies for developing clean energy.

- The U.S. government released its first-ever blueprint for using targeted research and development to hit long-term zero-emissions goals in the nation’s transportation sector, including maritime shipping.

- U.S. ports are projected to import 1.63 million TEUs next month, down about 14.7% from January’s projected imports and 23% behind the same month a year ago.

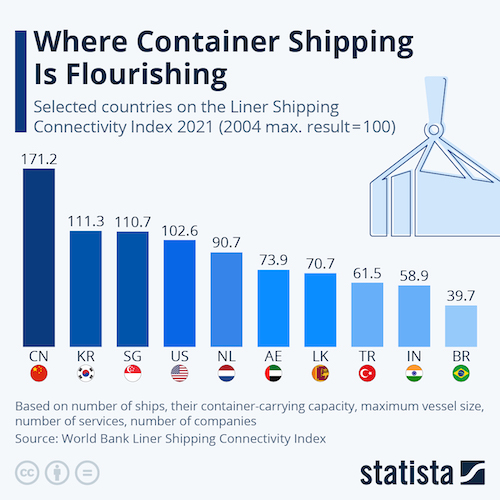

- Southern California’s queue of containerships is down to zero after touching a record-high 109 ships at this time last year.

- Some analysts say spot rates on major routes between China, the U.S. and Europe have fallen below breakeven levels.

- Europe’s unusually warm winter could spell disaster for the movement of goods later this year, as a lack of snowfall leads to lower water levels in key waterways.

- India’s inadequate port infrastructure could significantly delay the country’s plan to become the “world’s factory.”

- Chicago’s industrial real estate market saw all-time low vacancy rates of just 4.5% last year, while rents rose 14% and are poised to climb further in 2023.

- Trammel Crow and MetLife are developing a 477-acre logistics park near Georgia’s Port of Savannah.

- Portland-based railcar manufacturer Greenbrier will cease production at its century-old facility in the city.

- Values for used capesize bulk carriers have dropped roughly 20% since early 2022 amid volatility in commodities markets.

- San Francisco-based Elroy Air has garnered over $2 billion in orders for its “Chaparral” autonomous cargo drone featuring vertical takeoff and landing.

- UPS expects the number of returns it handles this holiday season to grow to about 70 million shipments, up from 65 million last year.

- Steelmaker Commercial Metals expects demand from U.S. construction activity to hold strong despite higher interest rates.

- Samsung Electronics is maintaining its investments in new chip-making capacity despite falling profits.

- Global PC sales are expected to rebound in late 2023 as devices deployed during the pandemic reach the end of their life cycle, analysts say.

- Apple is reportedly working on adding touch screens to its Mac computers for rollout in 2025.

- At their summit this week, the presidents of Mexico and the U.S. and the prime minister of Canada agreed to collaborate on five initiatives to strengthen supply chains.

- In the latest news from the auto industry:

- A dispute panel ruled that Canada and Mexico won their challenge to the U.S. interpretation of content rules for cars under the new North American trade pact, a decision that favors parts makers north and south of the U.S. border.

- Tesla is nearing a preliminary deal to build production facilities in Indonesia with a capacity of 1 million units, according to reports.

- U.S. auto safety regulators warned this week that the increased weight of electric vehicles poses substantially more risks during an accident.

- New-vehicle inventory in the U.S. was up 81% toward the end of 2022, with almost 740,000 more vehicles available than in 2021, according to Cox Automotive.

- German auto group VDA expects 10.3 million cars to be produced in the country this year, about 20% below pre-pandemic levels.

- Volkswagen’s Skoda Auto unit saw global deliveries fall by 16.7% in 2022 due to parts shortages, supply-chain problems and the war in Ukraine.

- Audi’s Mexico unit reached agreement with union workers for salary raises, averting a potential strike.

- China’s overall passenger vehicle sales are projected to rise 5% this year, according to Volkswagen.

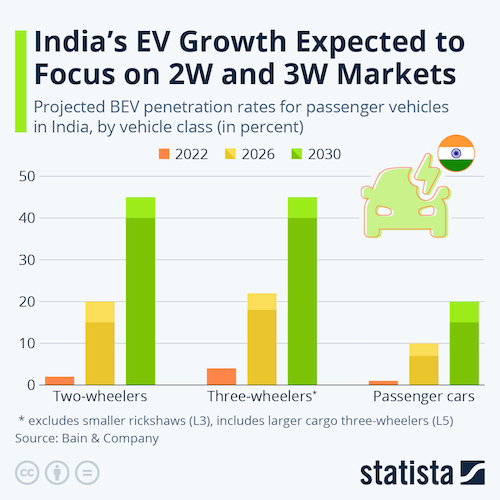

- Chinese electric-vehicle giant BYD will launch its third car in India by the fourth quarter of this year.

- India’s Tata Motors plans to expand its electric car portfolio with new models and higher price points this year.

Domestic Markets

- The U.S. reported 142,010 new COVID-19 infections and 1,673 virus fatalities Wednesday.

- The U.S. government extended the nation’s COVID-19 state of emergency amid concerns about rapidly spreading cases of the XBB.1.5 variant. The move allows millions of Americans to continue receiving free tests, vaccines and treatments.

- Initial jobless claims decreased by 1,000 to a seasonally adjusted 205,000 last week, highlighting a continued tightness in the nation’s labor market.

- Banking giant HSBC expects the Federal Reserve to hike its target interest rate for the last time at its Jan. 31-Feb. 1 monetary policy meeting, raising it by 50 basis points to a range of 4.75%-5%.

- Goldman Sachs began laying off some 6.5% of its global workforce Wednesday, the most concrete example of a deep cost-cutting drive across Wall Street.

- BlackRock, the world’s largest asset manager, plans to dismiss about 2.5% of its global workforce as it grapples with sharp declines in equity and bond markets.

- Dow Jones, a division of News Corp that includes the Wall Street Journal, started laying off employees Wednesday as part of a broader trend among news outlets.

- Starbucks became the latest big firm to pull back work-from-home allowances offered during the pandemic.

- Applications for U.S. home purchase loans fell 1% last week to their lowest level since 2014.

- More states are imposing bans on PFAS “forever chemicals”, with new laws taking effect this month in Maine, Vermont and Washington.

International Markets

- The World Health Organization expects that the highly infectious XBB.1.5 variant of COVID-19 is behind a surge of cases in several countries across the globe.

- International health experts say China’s lack of data on COVID-19 will make it challenging to manage risks over the Lunar New Year holiday, known as the world’s largest annual migration of people.

- Health officials from around the globe will convene this week to discuss setting up a system of wastewater monitoring for COVID-19, including at airports.

- South Korea says nearly 80% of its imported cases of COVID-19 come from China.

- Outbound flights from China jumped almost 200% in the first week after the nation reopened its borders but remained at about 15% of pre-pandemic levels.

- The World Bank expects global GDP growth for the 2020-2024 period to fall under 2%, what would be the slowest five-year pace since 1960.

- China’s industrial output likely grew 3.6% in 2022 despite production and logistics disruptions from COVID-19 curbs, officials said.

- The European Central Bank will likely continue raising interest rates at future meetings in an effort to bring down inflation to 2% over the medium-term, according to an ECB official.

- Around 100,000 civil servants in the U.K. plan to stage a 24-hour strike next month in an escalation of a dispute over jobs, pay and conditions.

- Retail sales in Brazil fell 0.6% in November, the biggest drop in five months.

- Electrolux, Europe’s biggest appliance maker, reported a fourth-quarter loss, citing high costs and weak demand from both consumers and retailers, especially in North America.

- Global sales of luxury fashion items could rise up to 8% this year thanks to China’s reopening and resilient demand in the U.S., analysts say.

- British bank Standard Chartered is considering a sale of its aviation unit that owns a fleet worth around $3.7 billion, according to reports.

- Thousands of farmers are protesting in Spain over the government’s decision to ration water from a key river after the country suffered its hottest year on record in 2022.

Some sources linked are subscription services.