MH Daily Bulletin: January 11

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil rose slightly Tuesday after the U.S. government forecast record global petroleum consumption of 102.2 million bpd next year, driven by growth in India and China.

- In mid-morning trading today, WTI futures were up 1.0% at $75.83/bbl, Brent was up 1.1% at $80.95/bbl, and U.S. natural gas was down 1.7% at $3.58/MMBtu.

- U.S. crude stocks rose by almost 15 million barrels last week as refining activity continued to recover from Winter Storm Elliott, according to data from the American Petroleum Institute. Government data is due today.

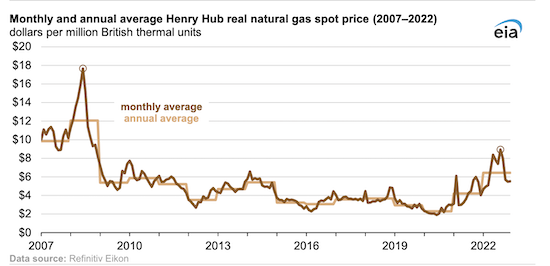

- Wholesale U.S. natural gas averaged $6.45/MMBtu in 2022, the highest level since 2008:

- Natural gas prices in California are running fivefold higher than the nation’s benchmark price this month as unseasonably cold weather, an impaired pipeline and low inventories combine to impact the local market.

- Price volatility is hindering the U.S. government’s attempts to refill strategic crude reserves, according to traders.

- The U.S. House of Representatives is set to vote this week on ending sales of U.S. strategic crude reserves to China.

- Chevron’s first cargo of Venezuelan crude under a new U.S. license has departed from a hub near Aruba to a Mississippi refinery.

- New York could become the first state in the U.S. to ban natural gas heating and appliances in new buildings over climate concerns.

- New reports show that Shell explored a sale of its Norwegian oil and gas fields last year, a move that would have marked the latest in a string of retreats from the North Sea by the world’s biggest energy firms as they focus on investments in newer, more profitable basins.

- Petrobras will cut the price of natural gas for its customers by 11.1% in February due to lower international oil prices and depreciation of the Brazilian currency, officials said Tuesday.

- Iraq’s first new refinery in decades is expected to reach full capacity of 140,000 bpd by July.

- More than two-thirds of U.S. LNG exports last week were destined for Europe, compared with just 27% headed for Asia, despite prices in Europe being lower than prices in Asia.

- More oil news related to the war in Europe:

- Russia’s budget deficit rose to a new record in December led by plunging revenues from oil exports.

- G7 nations are looking to set two price caps on Russian refined products in February, officials said.

- Russian gas transit to Europe via Ukraine fell 16% the past week amid mild weather conditions.

- German gas storage operators say there is little chance the country will experience a shortage of fuel either this winter or next.

- Spain is seeking EU approval to set prices for nuclear and hydroelectric power, part of an effort to decouple the cost of electricity from gas pricing and to curb windfall profits for the cheaper sourcing options.

- EU regulators will start publishing a daily LNG price assessment Friday, the first step in the bloc’s plan to form a new European benchmark price for the fuel.

- The solar division of South Korean conglomerate Hanwha will invest $2.5 billion to expand its solar panel plant in Dalton, Georgia, taking advantage of subsidies to boost domestic clean energy investment in the recently passed Inflation Reduction Act.

Supply Chain

- A computer outage forced the Federal Aviation Administration to ground all flights nationwide for several hours this morning.

- Some 33 million Californians saw severe weather Tuesday, which knocked out power to over 180,000 homes and raised the state’s death toll from recent storms to 16.

- Weather and climate disasters in the U.S. last year caused some $165 billion in damages, according to the latest figures.

- Brazilian power firm Eletrobras is investigating potential sabotage of multiple transmission towers during recent political riots in the country.

- U.S. container imports settled around 1.9 million TEUs in December, down 19% from a year earlier and nearly the same as pre-pandemic levels. Analysts say steeper declines in import volumes are on the horizon.

- Ports America and MSC are offering around $800 million to back construction of a $1.8 billion container terminal at the Port of New Orleans.

- U.S. railroads moved 365,553 carloads and intermodal units in December, a 6.8% decline from the year before.

- A federal judge blocked CSX from pursuing anti-competition claims against Norfolk Southern in a dispute related to rail access at Virginia’s largest shipping dock.

- FedEx says it will further cut Sunday package deliveries in March as it looks to adjust to slowing consumer demand.

- Amazon announced plans to shut three warehouses in Britain in a move impacting around 1,200 jobs.

- Amazon will roll out a new feature by the end of this month to allow online merchants outside its platform to use its payment and delivery services.

- Kenya Airways says it is experiencing flight disruptions due to delays in securing repair parts.

- Apple plans to start using its own customer displays in mobile devices as early as 2024, dealing a blow to prominent suppliers including Samsung and LG.

- Leaders of the U.S., Canada and Mexico met in Mexico City Tuesday where they pledged to tighten economic ties, boost supply chains and raise North American semiconductor output.

- In the latest news from the auto industry:

- U.S. electric-vehicle sales soared by two-thirds last year even as broader car sales contracted.

- The closely watched Manheim Used Vehicle Value Index, which tracks wholesale auction values in the U.S., fell 14.9% last year, its worst annual performance on record.

- Tesla applied to expand its gigafactory in Texas with a $775.7 million investment, what would be one of its largest expansion projects.

- U.S. highway regulators plan to propose new fuel economy standards for 2027 model cars.

- European premium brands BMW (-4.8%), Mercedes-Benz (-1%) and Audi (-3.9%) posted better full-year deliveries than mass-market automaker Volkswagen (-6.8%) in 2022, the latest data shows.

- Several top executives at Rivian Automotive have left the electric-vehicle startup in recent months as the company exits a year in which it fell short of production targets.

- China’s passenger car sales rose 2.4% in December as consumers rushed to make use of expiring electric-vehicle subsidies.

- Companies including GM, Ford and Google agreed to cooperate on scaling up the use of so-called virtual power plants that aim to ease loads on power grids when supply is short.

- Chinese smartphone-maker Xiaomi is developing an electric car.

- British self-driving software startup Oxbotica raised $140 million to speed deployment of its technology for use at ports, airports and in heavy industry.

- Aluminum makers are set to boost low-carbon output by 10% this year, driving down the cost for automakers seeking climate-friendly supplies.

Domestic Markets

- The U.S. reported 59,695 new COVID-19 infections and 864 virus fatalities Tuesday.

- The Pentagon dropped its COVID-19 mandate for troops yesterday.

- Deaths in the U.S. rose 19% between 2019 and 2020 following the onset of the pandemic, the largest spike in mortality in over a century.

- Combined fourth-quarter revenues at the six biggest U.S. banks are projected to be flat compared with a year ago, while earnings are forecast to drop by an average of about 25%, analysts say.

- JPMorgan’s chief executive says U.S. consumer health is in “good shape” with spending still up around 10% over pre-pandemic levels.

- Wells Fargo, among the leaders in mortgage lending, is retreating from home financing with further staff cuts ahead, restricting lending to bank customers and minority homebuyers.

- U.S. wholesale inventories rose 1% in November, lifting the inventories-to-sales ratio to its highest level in nearly 2.5 years:

- Top economists at the University of Chicago expect the Federal Reserve to raise interest rates to a peak of 5.5% this year.

- Many of the U.S.’s most prominent office developers are shifting gears toward buying or building out other types of real estate, including residential spaces.

- The cost of goods sold online in the U.S. fell 1.6% year over year in December, largely due to holiday discounts, according to Adobe.

- Boeing reported a healthy jump in orders and deliveries in 2022 but trailed Airbus for the fourth straight year, as the rival increased deliveries to China.

- Packaged food-maker Conagra Brands says it will stop hiking prices on its snacks and frozen foods after this quarter.

- Albertsons saw sales rise 8.5% in the latest quarter as higher prices for food and other household products continued to boost the grocer’s top line.

- Oatley is selling two of its U.S. plants amid flagging demand for its oat-based milk products.

- Bed Bath & Beyond saw sales decline 33% on its way to a $400 million quarterly loss. The retailer said it plans to lay off more employees amid growing expectations that it will enter bankruptcy.

- GE HealthCare Technologies, which was spun off as a public company last week from conglomerate General Electric, expects organic revenue growth of up to 7% this year on robust consumer demand, even as inflation remains a concern.

- Southwest Airlines started offering some one-way tickets for just $49 Tuesday as the carrier looks to make up for massive flight disruptions in late December.

International Markets

- Local reports and satellite images of funeral homes in China throw doubt on the country’s official tally of just 37 COVID-19 deaths since Dec. 7, according to international observers. Experts estimate the nation is suffering 5,000 deaths per day, while the government claims it has suffered just 5,200 fatalities for the entire pandemic.

- Almost 90% of people in China’s third-biggest province of Henan have been infected with COVID-19, a top local official said.

- China suspended issuing short-term visas in South Korea and Japan Tuesday, the nation’s first retaliatory measure against countries that recently began requiring negative COVID-19 tests from Chinese travelers. Meanwhile, more nations are issuing travel warnings and imposing restrictions on Chinese travelers, prompted in part by fears of the new XBB.1.5 variant of the virus.

- The World Health Organization recommended that passengers on long-haul flights wear masks due to COVID-19 spikes in China and the U.S. The organization will decide by the end of this month whether the COVID-19 pandemic still represents a global health emergency, three years after the status was first declared.

- The World Bank sharply lowered its growth forecast for the global economy this year from 3% to just 1.7% as high inflation elevates the risk for a worldwide recession.

- Morgan Stanley slightly raised its growth forecast for China’s economy to 5.7% this year, citing its dismantling of pandemic controls.

- New bank lending in China set a record-high last year after the central bank issued multiple rounds of support for the nation’s COVID-19-hit economy.

- Goldman Sachs raised its growth forecast for the euro zone economy to 0.6% this year, compared to previous forecasts for a contraction.

- Brazilian inflation hit 5.79% last year, much lower than some individual monthly peaks but still above government targets.

- Ukrainian consumer prices rose a lower-than-expected 26.6% last year on impacts from Russia’s invasion, officials said.

- The pandemic’s surge in private jet use is showing no signs of slowing down, with global flights on business aircraft rising 14% above pre-pandemic levels in 2022.

- The Mexican government bought the brand of defunct air carrier Mexicana and will restore it for a planned government-owned airline to be run by the military.

- Europe saw its second-warmest year on record in 2022, leading to widespread crop failures and drought conditions.

Some sources linked are subscription services.