MH Daily Bulletin: January 6

News relevant to the plastics industry:

At M. Holland

- M. Holland is the headline sponsor for AMI’s Thermoplastic Concentrates & Masterbatch Summit in Orlando on Jan. 24-26. Stop by Booth #16 to speak with our experts and attend a talk on regulatory compliance changes by Christopher Thelen, M. Holland’s Senior Regulatory Specialist, on Jan. 24 at 4:20 pm.

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

- The U.S. Inflation Reduction Act (IRA) includes nearly $500 billion in new spending and tax breaks that will catalyze the clean energy transition, increase tax revenues and reduce healthcare costs. Dwight Morgan, Executive Vice President of Corporate Development at M. Holland, recently provided insight on what the IRA includes and key considerations for the plastics industry. Click here to read the full post.

Supply

- Oil snapped a two-day slide Thursday, rising 1% on data showing lower U.S. fuel stocks.

- In mid-morning trading today, WTI futures were up 1.8% at $74.98/bbl and Brent was up 1.8% at $80.07/bbl.

- U.S. natural gas plunged another 7% Thursday to around $3.88/MMBtu, the lowest level in a year. Futures were up 0.9% at $3.78/MMBtu in morning trading today.

- U.S. crude stocks rose by 1.7 million barrels last week, according to the Energy Information Administration.

- On Thursday, U.S. operator Colonial Pipeline shut its 885,000-bpd fuel line to the U.S. Northeast after a spill in Virginia. Flows could resume as soon as Saturday.

- Saudi Arabia cut the prices for all its crude grades loading for Asia next month to the lowest level in more than a year, signaling that demand remains sluggish.

- U.S. refiner Phillips 66 expects supplies of gasoline and diesel to be tight this summer after facilities already ran at near-full capacity in the fourth quarter.

- China is in talks to resume some imports of Australian coal after a more than two-year ban caused by diplomatic tensions.

- U.S. producer Hess Corp says another offshore discovery in Guyana could result from drilling this month, which could push the tiny South American nation’s total output above a planned 1.2 million bpd.

- Output from Vietnam’s largest oil refinery could plummet 25% early this month due to technical challenges, the government said.

- More oil news related to the war in Europe:

- British energy demand is set to rise next week as temperatures come down from abnormal winter highs.

- Russia is offering deep discounts to Asia’s biggest oil buyers for its Arctic crude grades that previously were sold in Europe.

- The Russia-operated West Qurna 2 oilfield in Iraq, one of the biggest projects in the world, could see delays that put year-end development targets out of reach, according to reports.

- A nationwide shortage of transformers is slowing electrification projects and threatening power grid security and crisis recovery.

- A California town is experimenting with a new microgrid composed of lithium batteries and hydrogen fuel cells that can supply two days of power during emergency shutoffs.

- Growth in the U.S. solar industry is expected to slow this year, with impacts from incentives in the recently passed Inflation Reduction Act not likely to be seen until early 2024, according to stakeholders.

Supply Chain

- A massive storm unleashed high winds, torrential rain and heavy snow across California for a second day Thursday, knocking out power to tens of thousands and threatening much of the state with flash flooding.

- Rail strikes in Britain left many businesses unable to obtain essential products, while key business districts in London appear deserted as workers are forced to stay home.

- Chicago said it will revoke licenses of cargo handling contractors at O’Hare International Airport who roadblock union organizing efforts, threatening significant air freight disruption in the region.

- The Baltic Dry Index of dry-bulk shipping rates fell to 1,176 this week, down about 33% since Dec. 20.

- About a third of retail supply-chain managers say they are cautious about returning import business to West Coast ports after two years of pandemic congestion there, according to surveys.

- Union Pacific has removed its penalties on containers stored at Chicago and Kansas City yards after a decline in intermodal traffic last month allowed the railroad to reduce backlogs.

- U.S. workers are less likely to become delivery drivers due to rising fuel and car-maintenance costs, contributing to shortages that dent store sales and frustrate customers with long wait times.

- Companies entered leases for just 132 million square feet of U.S. industrial space last quarter, down almost 30% from the previous three months for the second straight quarterly decline, according to Cushman & Wakefield.

- The skyrocketing pace of warehouse automation is expected to cool this year, experts say.

- Schneider National completed the move of its western intermodal operations to Union Pacific after its 30-year contract with BNSF Railway ended.

- Last year’s orders for alternative-fuel commercial ships were mostly for vessels powered by LNG, with methanol a distant second, new data shows.

- Japanese ocean shipper K Line expects to see record financials for its fiscal year ending in March, led by gains in its dry bulk and car carrier businesses.

- Supply-chain issues held Airbus around 40 aircraft short of its 700 delivery target last year, early numbers show.

- Early figures show profit at Samsung Electronics tumbled by two-thirds to an eight-year low last quarter on sharply lower demand for electronics and memory chips.

- Dell Technologies plans to stop using China-made chips by 2024 amid concerns over U.S.-Beijing tensions and trade rules, according to reports.

- Foxconn says output at its iPhone plant in China has returned to normal levels after December revenue fell 12.3% due to COVID-19 disruptions.

- Clothing companies that boosted direct-to-consumer business during the pandemic are bolstering their wholesale distribution again under more favorable terms.

- In the latest news from the auto industry:

- Full-year sales at Ford fell 2.2% to a total of 1.86 million units, a smaller decline compared with a year earlier. The automaker’s electric-vehicle sales surged 126%.

- China’s decision to end a decade-long subsidy for electric vehicles has forced automakers to deepen discounts to remain competitive, including Tesla, which slashed prices again on its two most popular models this week. The automaker’s deliveries of China-made cars fell 44% from November to December, hitting the lowest level in five months.

- Mercedes-Benz is set to invest billions of dollars into building 10,000 fast-charging points in North America, Europe and China by 2030.

- Volvo’s December sales rose 13%, but its full-year sales were down 12% due to parts shortages and supply-chain issues.

- Chinese automakers are able to build electric vehicles at a substantial discount to their European counterparts, putting pressure on EU manufacturers in their home market, according to auto suppliers.

- India’s retail car sales could fall sharply in the final quarter of the fiscal year as stricter efficiency rules drive up manufacturing costs.

- Stellantis announced plans to create a new unit focused on growing its data services business as software-related capabilities come to the forefront for popular car models.

- Intel says its Mobileye self-driving unit will bring in more than $17 billion in revenue by the end of the decade.

- U.S. chip designer Qualcomm is partnering with Salesforce to build a new connected vehicle platform for automakers, the companies announced.

- Amazon is partnering with EVgo to streamline the customer experience for locating and using electric-vehicle chargers through Amazon’s digital assistants.

- New York City will use $10 million in federal dollars to buy over 900 electric vehicles for its municipal fleet and install hundreds of charging ports across the city.

- This week’s Consumer Electronics Show in Las Vegas unveiled several new major auto projects, including a new line of electric vehicles built by Sony and Honda, a color-changing car from BMW, and an electric Ram pickup from Stellantis.

- Mercedes-Benz gained regulatory approval to start deploying advanced self-driving technology in Nevada.

- The percentage of U.S. consumers paying at least $1,000 a month for auto loans soared to a record 16% in recent weeks, adding to concerns of a potential wave of missed payments.

Domestic Markets

- The U.S. reported 128,402 new COVID-19 infections and 805 virus fatalities Thursday.

- Over 40% of U.S. COVID-19 cases are believed to be caused by the new and highly infectious XBB.1.5 variant, up from only 4% of cases at the beginning of December.

- COVID-19 cases in Massachusetts are up 43% the past two weeks, including an 80% spike in Boston.

- U.S. public schools have lost more than 1 million students since the start of the pandemic, prompting some districts to close buildings and reduce programs.

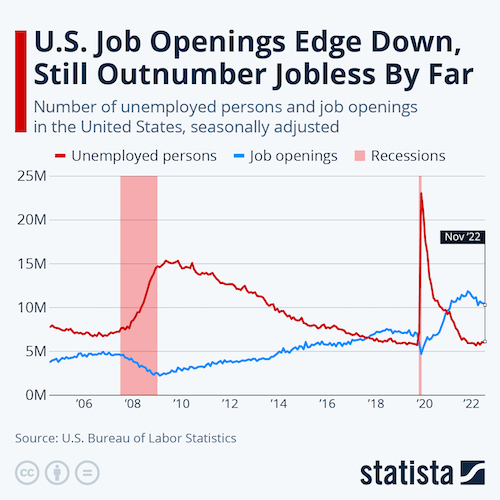

- Non-farm payrolls rose by 234,000 jobs in December, higher than expected, as the unemployment rate fell to 3.5%, the lowest in over 50 years:

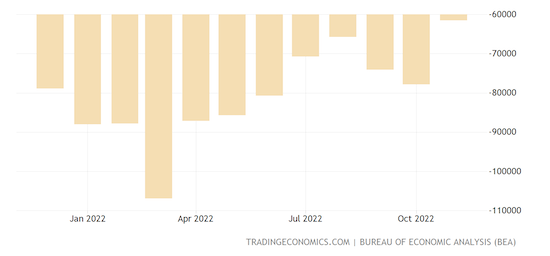

- The U.S. trade deficit plummeted 21% in November to $61.5 billion — the steepest decline in 14 years — as slowing demand hit imports.

- U.S. employers said they cut 43,651 jobs in December, down 43% from the previous month but well above the 19,052 cuts in December 2021, according to employment firm Challenger, Gray & Christmas.

- Online spending during the 2022 holiday season rose by a better-than-expected 3.5% from a year ago, according to Adobe Analytics, as retailers used hefty discounts to lure inflation-weary shoppers.

- The Federal Trade Commission proposed a landmark overhaul of employment rules that would bar companies from using noncompete clauses, a legal maneuver that critics say has stifled the middle class.

- U.S. home sellers gave concessions in nearly 42% of sales last quarter, the highest share of any three-month period, as they struggle to find buyers amid high interest rates, according to Redfin.

- Bed Bath & Beyond is preparing to seek bankruptcy protection in coming weeks following poor sales and an inability to compete with large online and big-box retailers.

- Packaged-food-maker Conagra Brands raised its full-year forecast after beating quarterly results Thursday.

International Markets

- Global COVID-19 cases rose 25% between Dec. 5 and Jan. 1, while fatalities jumped 21%.

- In the latest China news:

- The World Health Organization said it received COVID-19 data from China Thursday, with figures showing a 50% increase in hospitalizations in the week ending Jan. 1.

- Local reports suggest funeral homes in major Chinese cities are already at capacity due to surging COVID-19 fatalities.

- Germany joined a string of countries imposing COVID-19 testing rules on travelers from China.

- China expects passenger travel to double from a year ago during this month’s Lunar New Year.

- China will likely see home sales fall for the second straight year in 2023, but the pace of declines will ease thanks to support measures and relaxed COVID-19 policies, experts say.

- The XBB.1.5 strain of COVID-19 has now spread to 29 countries across the world, with the World Health Organization warning it may be the fastest-spreading variant of the pandemic.

- Thailand is bringing back proof-of-vaccination requirements for incoming travelers, officials said Thursday.

- Euro zone producer prices fell 0.9% month over month in November mainly due to a sharp decline in energy costs. Prices were up 27.1% compared to a year earlier.

- Japan’s service-sector activity rebounded in December thanks to a boom in international and domestic tourism as pandemic curbs were relaxed, according to a business survey.

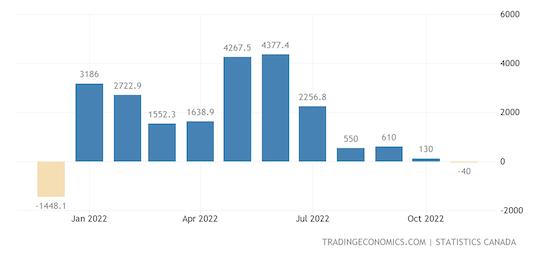

- Canada saw an unexpected goods-trade deficit of $30.2 million in November, its second deficit of the year due to a broad decline in energy exports.

- India’s economy is expected to grow 5.5% in fiscal 2023, slightly below expectations after growing 8.7% the previous year, according to analysts.

- Ukraine’s GDP dropped 30.4% last year, its sharpest decline in three decades due to Russia’s invasion, officials said.

- Venezuelan consumer prices rose at a sharp 37.2% pace from November to December, heightening the risk of the country’s return to hyperinflation.

Some sources linked are subscription services.