MH Daily Bulletin: January 3

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil settled 3% higher Friday, the final day of trading in 2022. After a year of wild price swings, Brent logged an annual gain of 10%, while WTI rose 7%.

- In mid-morning trading today, WTI futures were down 1.7% at $78.88/bbl, Brent was down 1.7% at $84.48/bbl, and U.S. natural gas was down 10.1% at $4.02/MMBtu.

- Active U.S. drilling rigs remained flat last week at 779, about 193 higher than the start of the year but 296 lower than the same time in 2019.

- Oil demand in China will likely soften to start the year after new data showed weak manufacturing activity in December.

- After a record 2022, coal demand will remain robust this year as countries across the globe continue to struggle with natural gas shortages, particularly in Asia.

- Chevron last week sent a tanker to Venezuela to pick up the first U.S.-bound cargo of Venezuelan crude in nearly four years.

- Venezuela-owned Citgo Petroleum could face a leadership shakeup after last week’s dissolution of the country’s interim government, under which a new commission will assess the country’s foreign assets.

- German energy firm RWE signed a deal for LNG supply from the first phase of Sempra Infrastructure’s new export terminal being built in Port Arthur, Texas.

- Brazil’s new administration extended the country’s federal fuel-tax exemption for two months.

- European policymakers looking to expand the bloc’s renewable energy capacity are drawing more opposition from stakeholders who say a wave of new projects would harm the region’s landscapes and valuable tourism industry.

- Exxon Mobil and Chevron, the nation’s two largest oil companies, will spend 70% of their capital budgets on projects in the Western hemisphere this year.

- More oil news related to the war in Europe:

- European gas prices are trading near their lowest levels since Russia invaded Ukraine on forecasts for mild weather in the weeks ahead.

- Germany halted imports of Russian oil via pipeline Jan. 1, following through with a pledge to take Europe’s ban on seaborne imports one step further.

- The U.K. says it has stopped all imports of Russian LNG.

- Russia is offering deep discounts to Asia’s biggest oil buyers as it tries to retain market share after banning the sale of its crude and petroleum products to countries imposing the G-7’s price cap. Moscow claims it is already one of China’s leading suppliers of oil and gas, having boosted volumes by 10% to the country so far this year, while exports to India are set to ramp up significantly.

- Russia’s seaborne diesel exports will hit a three-year high this month as the nation races to get cargoes into the market before a European embargo begins in February.

- The U.K.’s ceramics industry is slashing production and laying off workers following a tenfold surge in energy bills.

- Britain established a new $90 million fund to support the homegrown production of nuclear fuel in a bid to diversify uranium supplies away from Russia.

- Some German officials are calling for an official probe into whether the lifespan of the country’s nuclear plants should be extended.

Supply Chain

- A powerful storm that caused record-setting flooding, power outages and evacuations in California over the weekend is moving east, with severe weather expected to hit parts of Texas, Oklahoma, Arkansas and Louisiana.

- Southwest Airlines says it returned to normal operations Friday after more than a week of historic operational disruption caused by Winter Storm Elliott.

- Hurricane Ian and other natural catastrophes caused an estimated $115 billion of insured losses in 2022, well above the 10-year average of $81 billion, according to reinsurers.

- Continuing the U.K.’s worst period of labor unrest in four decades, British rail workers began a week-long strike today.

- South Korea will raise electricity prices by nearly 10% in the first quarter of 2023, the largest increase in four decades following a year of surging global energy prices.

- India’s capital suspended most construction activity Friday due to deteriorating air quality, which is expected to grow worse throughout the month.

- French container line CMA CGM reached a deal to divest its remaining interests in Russian ports.

- South Korea’s factory activity shrank for a sixth straight month in December as a local truckers’ strike led to the worst slump in demand in 2.5 years.

- Industrial metals prices will likely spend several more months at extreme lows amid a slowdown in global demand. Most metal prices have declined by double-digit percentages, sometimes as much 70%, from highs reached in March.

- South Korea plans to offer large tax breaks to semiconductor and other tech companies investing in the nation following similar moves to spur domestic production by the U.S. and Taiwan.

- Shipments from Foxconn’s Zhengzhou iPhone plant in China hit 90% of targets in December as the world’s largest iPhone factory works to recover from COVID-19-induced disruption.

- Indonesia, the world’s biggest palm oil producer, imposed new export controls to keep more of the commodity at home during high demand periods of upcoming holidays.

- Amazon launched the first commercial service of its drone delivery operations in California and Texas last week.

- UPS will impose U.S. residential delivery surcharges beyond peak delivery season in mid-January, a first for the shipper.

- In the latest news from the auto industry:

- Tesla saw record production of 405,278 cars in the fourth quarter but missed Wall Street estimates, burdened by continuing logistics and demand problems. The automaker’s annual deliveries reached 1.31 million, up 40% from 2021 but lower than its 50% target.

- New data shows that 4 out of 5 new cars sold in Norway last year were battery powered, the highest percentage in the world.

- Workers at Audi’s Mexico plant extended a strike deadline by 10 days to Jan. 11, as they aim to reach agreement with the automaker over wages.

- Germany’s Rheinmetall won a 250 million euro order to supply tens of millions of electric-vehicle components to an unnamed German automaker, the firm said.

- Volvo Cars assumed 100% ownership of its autonomous driving software development subsidiary, Zenseact.

Domestic Markets

- The daily average for new COVID-19 cases fell to 57,504 last week from 69,623 the week before, while average fatalities decreased to 361 from 422. Trackers suggest that recent counts could be understated due to the holidays, as evidenced by rising hospitalizations and intensive care cases.

- XBB, a new and highly infectious strain of the COVID-19 Omicron variant, has quickly spread to account for over half of all infections in New York City, CDC data shows.

- The dollar gained about 8% in 2022, its best year since 2015 on the back of a string of interest-rate hikes and fears of a sharp slowdown in global economic growth.

- Just over half of U.S. states are showing signs of slowing economic activity, a key threshold that often signals a looming recession, according to the St. Louis Fed. Meanwhile, more than two-thirds of economists at 23 major financial institutions expect the U.S. to see a downturn this year.

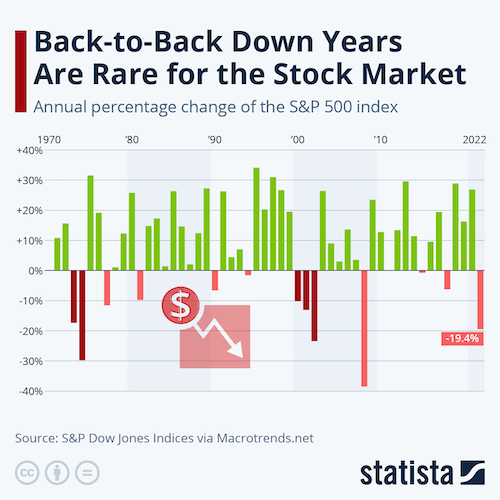

- Wall Street’s three main indexes booked their first yearly drop since 2018 as the Federal Reserve imposed its fastest pace of interest-rate hikes in four decades. In percentage terms, all three indexes saw their worst performance since 2008, with the S&P 500 down 19.4%, the Dow down 8.8% and the Nasdaq down 33.1%.

- S&P 500 companies spent a record $561 billion on dividends in 2022, a trend that is expected to continue this year as more companies that suspended or cut dividends early in the pandemic resume payouts.

- Wages for workers who stayed at their jobs rose 5.5% in November from a year earlier, the biggest gain in 25 years of record-keeping as more companies offer big raises to retain workers in the tight labor market.

- December marked the first time in five months that U.S. small businesses said it has become easier to find workers, according to a Wall Street Journal survey.

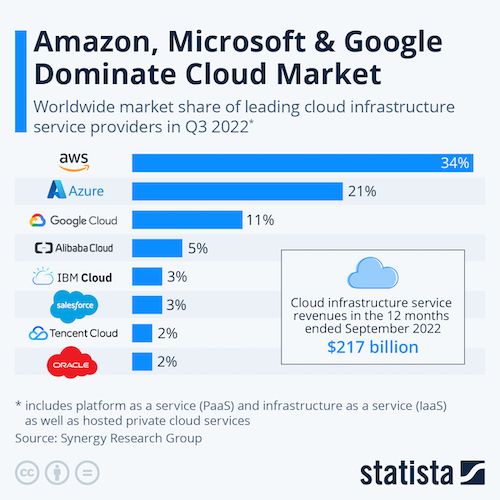

- Tech companies laid off workers in 2022 at the fastest pace of the pandemic, cutting over 150,000 jobs. Big U.S. tech firms are seeing growth slow in their cloud units as increasingly cost-conscious firms work to optimize their data needs.

- GE HealthCare Technologies, the healthcare spinoff of General Electric Co., started trading this week in a milestone for the industrial giant’s three-way split of its aviation, power and healthcare businesses.

- A record 58 million American and Canadian households bought camping equipment in the past year, a trend likely to continue in 2023 as people prioritize “nature tourism.”

International Markets

- In the latest China news:

- A top Chinese public health official warned of widespread COVID-19 outbreaks across the country’s more vulnerable rural areas as millions of citizens prepare to travel home for the coming Lunar New Year holiday.

- Concerned over the lack of data from China on potentially new COVID-19 variants, many of the world’s major economies, including Britain, France and Canada, imposed new testing requirements on travelers arriving from the nation. Belgium will start testing wastewater from planes arriving from China, while Morocco banned all travelers from China outright.

- China’s yuan closed the final trading session of 2022 at roughly 6.95 per dollar, down 8.6% on the year for its worst annual performance in almost three decades.

- China’s manufacturing, services and property sectors all weakened sharply in the fourth quarter due to COVID-19 disruptions, resulting in a likely economic contraction, according to a spate of new business surveys. Service-sector and manufacturing activity plunged the most since February 2020.

- A months-long decline in China’s home prices accelerated in December, reflecting persistently weak demand despite a rash of support measures.

- A third of the global economy will likely be hit with recession this year, including half of the EU, according to the International Monetary Fund.

- The U.K. is expected to see the worst recession and weakest recovery of major global economies in 2023, British economists say.

- A months-long contraction in the manufacturing output of Germany, France and Spain slowed in December, indicating the worst has passed, according to surveys from S&P Global.

- Germany’s finance minister expects inflation in Europe’s largest economy to slow to a pace of 7% in 2023, still well above a 2% target.

- Spanish consumer inflation hit 5.8% in December, the slowest pace this year thanks to lower electricity prices.

- India’s rupee ended 2022 as one of Asia’s worst-performing currencies with a fall of 10.14%, its biggest decline in almost a decade. The nation’s manufacturing activity, meanwhile, closed the year with strong growth, according to S&P Global.

- Brazil posted a record $62.3 billion trade surplus last year on a 19.3% rise in exports, led by the agriculture and livestock industries.

- Following an eight-year economic collapse, Venezuela’s economy grew almost 18% year over year in the first three quarters of 2022, according to its central bank.

- Japan is boosting payments to families who move out of Tokyo in a bid to reduce overcrowding and reverse decades of population decline outside big cities.

- Hong Kong home sales fell 40% year over year in 2022 due largely to strict pandemic measures that kept the island’s borders closed for much of the year.

- Indonesia removed all remaining COVID-19 restrictions last week.

Some sources linked are subscription services.