MH Daily Bulletin: February 28

News relevant to the plastics industry:

At M. Holland

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil slid 1% Monday as strong U.S. economic data had investors bracing for more interest-rate hikes from the Federal Reserve.

- U.S. natural-gas futures hit a one-month high Monday on forecasts for colder weather next week and a rise in LNG exports.

- In mid-morning trading today, WTI futures were up 1.9% at $77.10/bbl, Brent was up 1.6% at $83.73/bbl, and U.S. natural gas was down 1.5% at $2.69/MMBtu.

- U.S. gasoline prices are down roughly 26 cents since a year ago at an average of $3.37 a gallon.

- Saudi Basic Industries Corp (SABIC) suffered a 94% decline in net income in the fourth quarter from the prior-year period, citing lower average sales prices.

- Chevron boosted its share buyback program from $15 billion to $17.5 billion.

- Pemex reported a $9.4 billion loss last quarter, more than triple that of the previous three months.

- Shell is considering relocating its headquarters from London to the U.S., where its oil-giant competitors command significantly higher stock valuations.

- Russia’s seaborne crude exports are holding close to post-invasion highs despite tighter Western sanctions.

- The EU sanctioned a Dubai-based subsidiary of Russia’s state-owned shipping giant that ferries oil and natural gas around the world.

- Support vessels used for offshore wind farms are being converted to fully electric operations.

- A shortage of boats capable of installing wind turbine foundations on the ocean floor could delay new projects next year.

- Power plants will be paid 15% less next year to provide backup electricity on the largest U.S. grid, a blow to aging coal units that have already struggled against cheap renewable energy.

- Publication of the annual Statistical Review of World Energy is transitioning from BP to the Energy Institute, a professional association. BP, which has published the key source of global industry information for 71 years, will continue contributing to the report.

- Outdoor goods retailer REI has ordered suppliers to phase out PFAS “forever chemicals” from its products.

Supply Chain

- More than 216,000 U.S. homes and businesses were without power late Monday as severe storms stretched from the West Coast to the Great Lakes.

- U.S. retailers are bracing for more shipping delays as some carriers try to prop up rates by canceling voyages.

- Unused container ship capacity is nearing its highest level of the pandemic at about 4.1% of the global fleet.

- U.S. intermodal volumes fell 8.8% last week from a year ago, according to the Association of American Railroads.

- Air cargo capacity is likely to exceed demand for the foreseeable future.

- The Port of Corpus Christi handled record U.S. crude oil exports in 2022.

- French utility Engie says Europe needs to do more to boost supply-chain self-sufficiency in renewable energy.

- The FAA is awarding nearly $1 billion to 99 U.S. airport projects under 2021’s sweeping infrastructure package.

- The CEO of railroad Union Pacific, ranked by employees as the worst place to work among S&P 500 companies, is stepping down under pressure from an activist investor.

- Walmart’s store delivery sales have tripled over the past two years to more than $1 billion a month.

- In the latest news from the auto industry:

- Tesla has temporarily stopped rolling out its $15,000 driver-assistance system until it addresses issues that led to a recall of almost 363,000 vehicles.

- Toyota boosted global production by 9% in January, its first increase in two months.

- Vietnamese electric-vehicle-maker VinFast cut the lease price for its first model shipped to the U.S. by more than 50% for some customers.

- Ford reshaped leadership in its China business as it struggles to reverse dwindling market share in the world’s largest auto market.

- Nissan raised its electric-vehicle sales goals and said it would boost power train production in the U.S.

- Stellantis and unions signed an agreement to cut up to 2,000 workers from the carmaker’s Italian operations this year.

- Tesla’s German plant in Brandenburg has quadrupled production since May to about 4,000 vehicles per week.

- The U.S. Energy Department will lend Li-Cycle Holdings $375 million as it builds a battery recycling facility in New York set to become one of the country’s largest sources of lithium next year.

- Stellantis invested $155 million for a minority stake in a copper mine in Argentina as part of its global push to secure raw materials for electric-vehicle batteries.

- Electric-vehicle startup Fisker reported increased orders for its SUV and maintained its production forecast for the year, sending its shares higher.

Domestic Markets

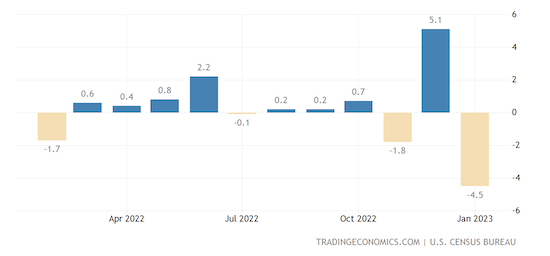

- New orders for key U.S.-manufactured capital goods rose by the most in five months in January, suggesting business spending on equipment picked up to start the first quarter. Orders for durable goods, meanwhile, sank 4.5% month over month.

- Apartment rents fell in every major metro area in the U.S. over the past six months, a trend poised to continue amid a flood of new units.

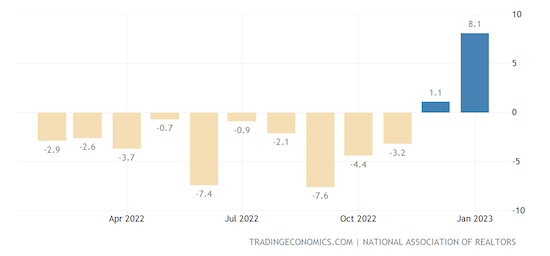

- In January, U.S. pending home sales rose by the most since June 2020.

- Stock buybacks by S&P 500 companies are projected to top $1 trillion in 2023 for the first time in a calendar year.

- Retailer Target cited “a very challenging environment” in reporting better-than-expected sales and profits in the fourth quarter but offering a cautious outlook for the full year.

- Zoom Video Communications posted higher revenues in the fourth quarter on strong growth from enterprise customers.

- Pandemic-fueled telehealth startup Cerebral is cutting 15% of its workforce amid lower demand and continued regulatory investigations.

- Pfizer is in early-stage talks to acquire cancer drugmaker Seagen in a potential multi-billion-dollar deal.

International Markets

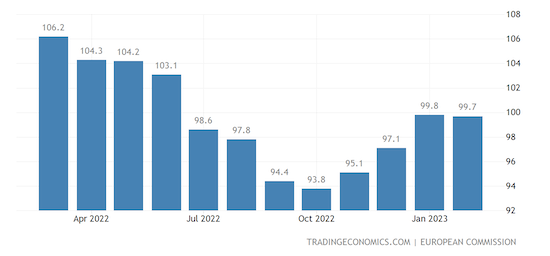

- A gauge of economic sentiment in the euro area fell in February and was well short of expectations:

- While geopolitical concerns are making many global firms think twice about investments in China, consumer-facing companies such as McDonald’s and Starbucks are expanding in a bet on a resurging consumer sector.

- The chief economist for the European Central Bank proclaimed that it is winning the inflation fight in the euro zone but that further rate hikes are ahead, including a 50-basis-point increase in March.

- U.K. grocery prices were up a record 17.1% in the four weeks ended Feb. 19.

- Five of Britain’s major grocers have had to ration salad ingredients in recent weeks due to poor harvests in countries that are trading partners.

- A 24-hour strike halted operations at several German airports Monday.

Some sources linked are subscription services.