MH Daily Bulletin: February 22

News relevant to the plastics industry:

At M. Holland

- At M. Holland, we work closely with customers to understand their goals and challenges and find the right solutions. Click here to read more about our recent collaboration with Eaton, an international power management company, to increase the adoption of additive manufacturing and easily scale production across its locations worldwide.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil slipped about 1% Tuesday on persistent concerns about global economic growth.

- In mid-morning trading today, WTI futures were down 2.2% at $74.65/bbl and Brent was down 2.1% at $81.32/bbl.

- Natural gas prices fell to their lowest level since September 2020 and are down about 80% since last August. They fell further this morning, breaking below $2.00 before rising 5.0% to $2.18 in mid-morning trading.

- Chesapeake Energy sold some oil assets to a division of British chemical maker Ineos Group for $1.4 billion. The sale marks Ineos’ entry into U.S. oil and gas production.

- U.S. utilities expect to spend almost $160 billion this year, a record-high, to fortify power grids battered by a string of extreme weather events.

- The number of criminal attacks on the U.S. power grid surged last year and is likely to continue rising this year, analysts say.

- Oil production in Norway, the biggest producer in Western Europe, slipped in January and was 3% below targets.

- The EU beat its target for cutting gas demand this winter while almost completely eliminating its dependence on Russian fossil fuels.

- Falling gas prices in Europe are making power generation from gas-fired plants more economical, marking a trend reversal since coal took over as the cheaper fuel source last year.

- Saudi Aramco dropped to third on the list of the world’s most valuable companies, now surpassed by Apple and Microsoft.

- The UAE’s national energy company plans to sell about 4% of its natural-gas business.

- Funding has been approved for a new floating LNG terminal off Israel’s coast, a project that will likely supply more exports to Europe.

- United Airlines launched a $100 million investment fund to support startups focused on research and production of sustainable aviation fuel.

Supply Chain

- Tens of thousands were without power and hundreds of flights were canceled as severe winter weather swept across U.S. Western and Central states overnight. More than 65 million people in 29 states are under winter storm alerts.

- South Africans are spending up to 10 hours per day without electricity due to rolling blackouts by struggling state utility Eskom.

- Supply-chain snarls are fading from the list of top challenges facing U.S. companies as freight congestion eases and shipping costs fall.

- Empty shipping containers are piling up at a major Chinese port as overseas orders dwindle.

- Average spot rates for bulk shipping’s largest vessels fell by about half last week.

- Companies continue to shift volume away from U.S. West Coast ports due to “trepidation among shippers” about stalled labor talks with the International Longshore and Warehouse Union, which is working without a contract.

- The Suez Canal is raising transit prices for tankers.

- Among 300 small- and medium-sized U.S. businesses in a recent survey, 88% said they will be reshoring sourcing to the U.S. or Mexico in 2023.

- Over 330 seafarers remain stranded aboard ships that have been stuck in Ukrainian ports since Russia’s invasion a year ago.

- MSC added 10 midsize container ships to its large order book.

- A Canadian court found that the nation’s government was justified in invoking emergency powers to end last year’s trucker protests.

- Industrial parts distributor Fastenal says its business-to-business e-commerce efforts are gaining traction.

- Steel mills in central and southern Turkey have suspended operations as they assess damage from recent earthquakes.

- Aircraft maker Bombardier is bringing some contracted manufacturing in-house and deploying employees to assist Tier suppliers in an effort to mitigate supply chain disruptions and risks.

- In the latest news from the auto industry:

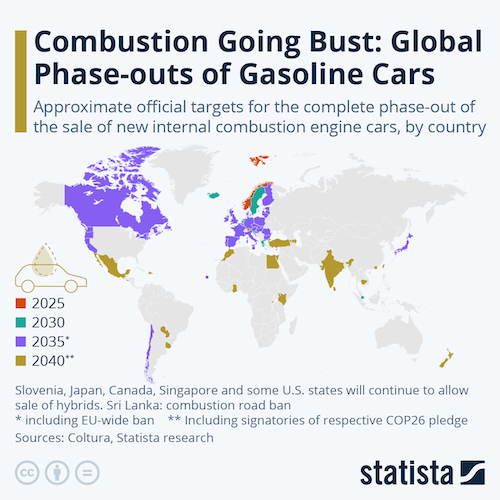

- Last week’s passage of a law that will ban the sale of gas-powered cars in the European Union by 2035 highlights the growing number of countries phasing out internal combustion engines.

- Toyota agreed to union demands in Japan for the highest wage hikes in two decades, while Honda said hourly wages will rise 5% as the country battles its highest inflation rate in 40 years.

- Tesla paused plans to produce entire batteries in Brandenburg, Germany, and will instead carry out some production in the U.S., where tax incentives are more favorable.

- Rising inventory levels are leading to lower gross margins for car dealers.

- New car registrations in Europe surged 11% in January, the sixth consecutive monthly rise.

- Toyota will start producing mid- to large-sized electric SUVs at its Kentucky plant as soon as summer 2025, the automaker said.

- Chinese electric-vehicle-maker Nio is building a new factory in eastern China to produce budget EVs for export to Europe.

- Tesla owners worry the automaker’s decision to open up parts of its Supercharger network will raise wait times to recharge cars.

- After recent price cuts, Tesla’s Model 3 sedan is selling for about $4,930 less than the average new vehicle sold in the U.S.

Domestic Markets

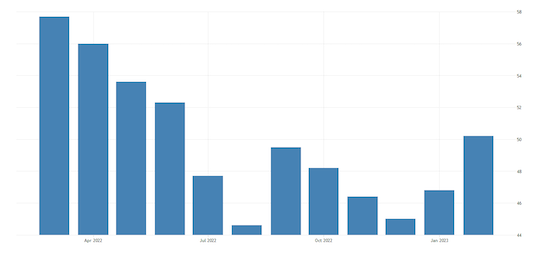

- U.S. business activity unexpectedly rebounded in February to its highest level in eight months, according to an S&P Global composite index.

- The White House will trim mortgage insurance costs for first-time and low-income buyers, a bid to boost affordability while home prices remain inflated.

- Higher interest rates and fears of a recession are reducing commercial-property transactions and values.

- The U.S. office vacancy rate was 12.3% in the final quarter last year, higher than the pre-pandemic 9.2% at the end of 2019.

- Amazon employees petitioned to reverse a return-to-office mandate announced by the company last Friday.

- Amazon will be able to close its purchase of 1Life Healthcare, an operator of primary-care clinics, after the FTC said it would not sue in time to block the $3.9 billion deal.

- General Mills raised its sales and profit forecasts in a bet that consumer demand will remain strong despite more price hikes in the pipeline.

- Consulting giant McKinsey & Co. plans to cut about 2,000 jobs in one of its biggest-ever rounds of layoffs.

- Holiday Inn owner IHG missed full-year revenue expectations largely on impacts from COVID-19 curbs in China.

- Medical device-maker Medtronic issued a profit warning for the next fiscal year due to deepening inflation in various markets.

- Demand and prices for recycled plastics continued to fall in January and February, continuing a trend that began last summer as the economy cooled.

International Markets

- Business activity in the U.S., euro zone and the U.K. picked up in February, a sign of resilience as Russia’s invasion of Ukraine enters its second year.

- U.S. and EU officials say China is increasingly using its courts and patent panels to undermine foreign intellectual-property rights.

- The U.K.’s manufacturing output slumped in February while price pressures continued to cool, an industry survey showed.

- German investor morale continued to recover in February as the economic outlook for the euro zone’s largest economy continues to brighten.

- Big manufacturers in Japan saw disappointing activity in February while the mood in the nation’s service sector slid for a second month.

- Some Chinese provinces are giving newlyweds 30 days of paid leave in the hope of boosting a flagging birth rate, an issue with massive implications for the nation’s long-term economic health.

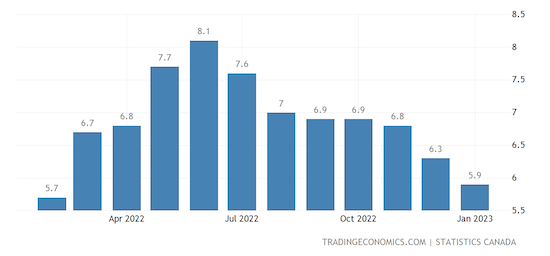

- Canada’s annual inflation rate fell to 5.9% in January, lower than markets predicted.

- The EU is closing in on approving its 10th sanctions package against Russia.

Some sources linked are subscription services.