MH Daily Bulletin: February 21

News relevant to the plastics industry:

At M. Holland

- At M. Holland, we work closely with customers to understand their goals and challenges and find the right solutions. Click here to read more about our recent collaboration with Eaton, an international power management company, to increase the adoption of additive manufacturing and easily scale production across its locations worldwide.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil rose 1% Monday, buoyed by optimism over Chinese demand.

- In mid-morning trading today, WTI futures were off marginally at $76.33/bbl, Brent was down 1.2% at $83.07/bbl, and U.S. natural gas was down 6.7% at $2.12/MMBtu.

- U.S. gasoline prices have held steady around $3.37 per gallon for the past month despite regional jumps in the West.

- Crude imports in India, the world’s third largest importer, hit a six-month high in January.

- Large-scale solar and wind projects in China are coming under pressure due to competition for land space and access to the nation’s power grid.

- Russian seaborne crude exports surged by 26% to 3.6 million bpd last week, the highest level in a month. Shipments to China jumped to record levels.

- Germany says it will do most of the work this year to prepare its power market for greater reliance on renewable supplies by the end of the decade.

- Tight production capacity for LNG could lead to shortages next winter, the International Energy Agency warned.

- Australia’s top fuel supplier posted bumper fourth-quarter profits.

- At their meeting yesterday, EU foreign ministers failed to agree on a plan to phase out fossil fuels, with the role of nuclear energy during the transition among the sticking points.

- Dow Chemical and luxury brands company LVMH announced plans to collaborate to accelerate the use of sustainable packaging in LVMH’s cosmetic and perfume products.

Supply Chain

- A 6.3-magnitude earthquake struck southern Turkey on Monday, further damaging buildings two weeks after the country’s worst earthquake in modern history.

- A major winter storm will stretch coast-to-coast in the U.S. this week, exposing millions to dangerously icy conditions.

- Fears are rising that Italy could be facing another severe drought after dry winter weather has left the Alps with half their normal snowfall and canals in Venice are too low in some areas for boats to pass.

- India invoked an emergency rule to force coal power plants to operate at full capacity, a bid to avoid blackouts amid surging electricity demand.

- A.P. Moller-Maersk agreed to sell its two logistics sites in Russia, marking the near end of its business activities in the country.

- Union Pacific reached a deal with two unions to provide paid sick leave, the latest in a sweeping change to benefits offered in the rail industry.

- With average freight rates on Asia-U.S. West Coast routes down 70% since April, major retailers are expecting to achieve big cost savings during annual contract negotiations later this month.

- Several of Pakistan’s biggest companies halted operations in recent months after running out of raw materials or foreign exchange.

- Miner BHP Group saw a 32% drop in profits in its fiscal first half but forecast a positive demand outlook on strengthening activity in China.

- Texas Instruments plans to invest $11 billion to expand its semiconductor wafer plant in Utah.

- In the latest news from the auto industry:

- The U.S. has overtaken Germany to become the world’s second-largest market for electric vehicles, with sales expected to surge in 2023.

- A first-ever U.S. tax credit on used electric vehicles is significantly boosting the secondhand market.

- Mexico’s president warned of water shortages in Nuevo Leon, the state considered a frontrunner to land a major investment from Tesla.

- Uber will introduce electric vehicles for ride-sharing in India, its first move to adopt clean cars in the country.

- India’s Ola Electric Mobility is planning a massive electric-vehicle production hub in the southern state of Tamil Nadu.

- Chinese battery-maker CATL is offering discounts to some domestic automakers, reflecting a downturn in lithium prices, according to reports.

Domestic Markets

- Household debt in 2022 rose to its highest level since 2008, with the average household owing $142,860.

- A string of strong U.S. economic data released last week has more analysts expecting interest rates to land higher than initially expected.

- Monthly voluntary job quits were up 20% last year compared to pre-pandemic levels, new data shows.

- Fundraising by venture-capital firms hit a nine-year low last quarter as macroeconomic pressures weighed on major investors.

- Loan defaults by office landlords are rising, suggesting that remote and hybrid work have permanently altered the market.

- Ninety-seven percent of companies with outstanding speculative-rated bonds have missed their long-term earnings forecasts, creating risks of defaults in the high-yield bond market.

- Existing home sales fell 0.7% in January, the 12th consecutive monthly decline, to the lowest since October 2010.

- Walmart beat estimates for both earnings and profits in the fourth quarter and issued “a pretty cautious outlook on the rest of the year” due to “very pressured consumers.”

- Home Depot reported better-than-expected profits in its fourth quarter but missed on the top line and projected muted results in 2023. The retailer will spend $1 billion to raise wages for its hourly workers as it competes for employees in a tight labor market.

- Starbucks, whose baristas have struggled to keep up with demand for online orders since the pandemic, filed a patent for a machine to quickly make highly customized drinks.

International Markets

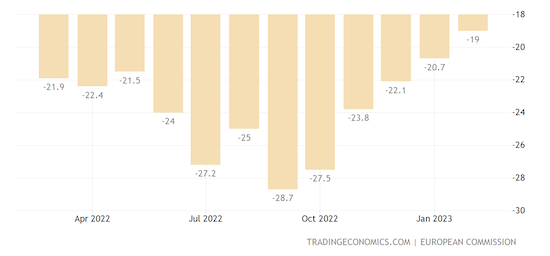

- Euro zone consumer sentiment rose to -19 in February, the highest level in a year.

- German central bankers say the nation’s economy is poised to shrink slightly this year even as the energy crisis and manufacturing bottlenecks ease.

- The Purchasing Managers Index in the U.K. unexpectedly jumped into expansion territory this month, rising to 53.0, as the country appears to be dodging recession.

- The expected surge from pent-up consumer demand in China after it lifted its COVID-19 restrictions has been slow to materialize, with retail sales down 2.6% in December and muted spending during the Lunar New Year holiday.

- China’s property market is still struggling after many state-owned companies failed to step in and take over private development projects despite requests from the government last year.

- Taiwan’s export orders contracted for the fifth month in a row in January, a sign of conditions in global tech markets.

- Telecoms gear-maker Ericsson plans to cut 1,400 jobs in Sweden as it contends with a slowdown in some markets.

- A slow decline in commodity food costs has done little to remedy inflation on grocery store shelves around the world, analysts say.

- Tens of thousands of British junior doctors plan to strike in March, adding to a series of walkouts putting pressure on the nation’s already strained healthcare system.

- A majority of U.K. companies participating in a six-month trial of a four-day workweek say they will stick with it after seeing a sharp drop in turnover and absenteeism with no apparent drop in productivity.

- The price for carbon permits on the EU carbon market hit a record 100 euros.

- Concluding that it “cannot recycle our way out of this plastic pollution crisis,” PepsiCo plans to double its use of reusable beverage containers by 2030.

Some sources linked are subscription services.