MH Daily Bulletin: February 20

News relevant to the plastics industry:

At M. Holland

- At M. Holland, we work closely with customers to understand their goals and challenges and find the right solutions. Click here to read more about our recent collaboration with Eaton, an international power management company, to increase the adoption of additive manufacturing and easily scale production across its locations worldwide.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell 2.5% Friday, capping a substantial weekly decline on worries that the U.S. will hike interest rates more than expected.

- In mid-morning trading today, WTI futures were up 0.9% at $77.03/bbl, Brent was up 1.1% at $83.95/bbl, and U.S. natural gas was down 0.2% at $2.27/MMBtu.

- Global oil demand hit a record high of 1.3 million bpd in December.

- Active U.S. drilling rigs fell by one last week to a total of 760, according to Baker Hughes.

- U.S. crude shipments to Europe were 70% higher in 2022 from the prior year and are expected to continue growing.

- The U.S. is on track to import about 3 million barrels of crude from Venezuela this month.

- China’s reopening is expected to raise its crude imports to a record-high nearing 11.8 million bpd this year, industry experts say. The nation overtook the U.S. in 2022 as the world’s largest refiner.

- European natural gas prices fell to an 18-month low last week amid mild weather and large inventories.

- Bailed-out German gas company Uniper expects profits to recover this year following a record $20.3 billion net loss in 2022.

- Over $2 billion has been poured into procurement of ships for a “shadow fleet” to carry Russian fuel around Western sanctions, experts say.

- Some environmental groups are questioning the impact of planned offshore wind farms on the U.S. Atlantic coast following a string of large-whale deaths.

- Global spending on fossil-fuel subsidies surpassed $1 trillion last year, according to the International Energy Agency.

- India’s biggest natural gas supplier is looking at acquiring a large stake in at least one planned U.S. LNG export project.

- Rolling blackouts in Cuba will last until May as the country’s aging oil-fired power plants deteriorate.

- The Philippines is the world’s biggest source of plastic ocean waste, with India a distant second.

Supply Chain

- Lufthansa suspended cargo bookings through Frankfurt and Munich last week following a digital systems outage.

- U.S. intermodal volumes fell 10.2% last week from the same time a year ago, according to the Association of American Railroads.

- The ports of Los Angeles and Long Beach handled 635,424 TEUs in January, down 22% from last year and 12% from pre-pandemic levels.

- The Georgia Ports Authority is cutting hours at the Port of Savannah as an import surge subsides.

- More than one-fifth of U.S. warehouse operators have invested in automation to help address labor shortages during the pandemic, but efforts to achieve full automation have stalled due to limitations on robotic technology.

- Scorpio Tankers swung to a $264.4 million net profit in the fourth quarter.

- Freight broker Convoy is closing its Atlanta office and laying off workers as part of a restructuring.

- Coyote Logistics, wholly owned by UPS, became the latest freight company to downsize in response to weak demand, announcing it will cut 200 jobs.

- Top producer India has suspended sugar exports due to growing domestic shortages.

- Brazilian plane-maker Embraer fell short of full-year delivery targets in 2022 due largely to supply-chain constraints.

- In the latest news from the auto industry:

- Russia may reduce sales of nickel and palladium to the U.S. in an escalating trade dispute over tariffs on Russian aluminum.

- Tesla is considering a takeover of Canadian battery-metals miner Sigma Lithium, according to reports.

- Mercedes-Benz is looking to sell more cars directly to consumers this year.

- Mercedes-Benz and Volkswagen are pushing the German government to assist in scaling up the nation’s electric-vehicle charging network.

- Vietnamese electric-vehicle maker VinFast says it received approval to start constructing a plant in North Carolina.

- U.S. Foods put its first five electric semi-trucks into operation at its distribution center in La Mirada, California.

- Spending on new cars in Russia fell by more than 50% last year as a result of Western sanctions.

- Top U.S. auto retailer AutoNation posted better-than-expected quarterly profit as the industry starts to show signs of a gradual recovery from pandemic supply-chain issues.

- Renault expects to carve out its combustion-engine unit by this summer.

- High-end automakers are looking at ways to create authentic electric-motor noises in a bid to accommodate consumer preferences for loud combustion engines.

Domestic Markets

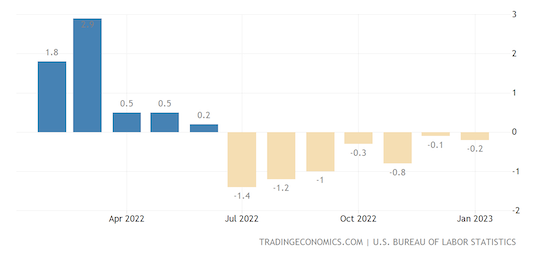

- U.S. import prices dropped for a seventh month in January, led by a decline in costs for energy products.

- Two Federal Reserve officials bolstered expectations for a longer run of U.S. interest-rate hikes this year.

- Over 9% of subprime auto loans were past due at the end of 2022, the highest level in over a decade.

- Michigan is becoming a technology hub as automakers divert tech investments from Silicon Valley to closer to home.

- The price of eggs rose 8.5% in January compared with the month before.

- Shares of publicly listed travel companies are surging amid signs for another bustling year of travel.

- Deere & Co. raised its annual profit forecast after beating quarterly estimates, led by an increase in spending from construction customers.

- U.S. initial public offerings hit a 15-month high last week, signaling expectations of a more stable market.

International Markets

- The death toll from recent earthquakes in Turkey and Syria topped 46,000.

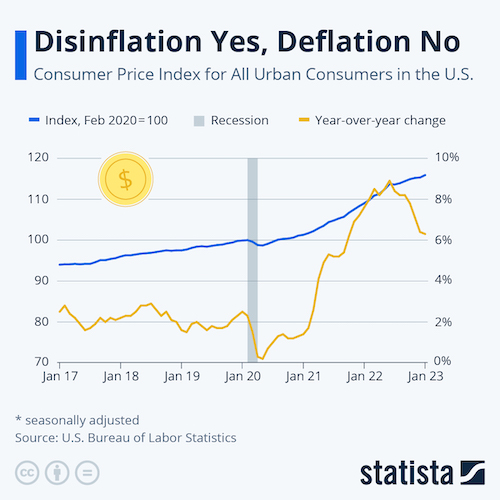

- Workers in advanced economies had less purchasing power last year than in 2019 as inflation continued to rise faster than wages.

- German producer prices rose a higher-than-expected 17.8% year over year in January, although the pace of gains declined for the fourth month in a row.

- Russia’s invasion of Ukraine will have cost the German economy $171 billion, or 4% of its GDP, in lost value creation by the end of the year, analysts say.

- Economists expect Japanese inflation will have hit a 41-year high in January.

- British consumers unexpectedly boosted spending in January despite an overall weak economic picture.

- Russian inflation is surging on a recent drop in the value of the ruble.

- Chinese computer-maker Lenovo reported a 24% revenue decline last quarter, its steepest drop in 14 years.

- Sales of luxury goods maker Hermes rose 22.9% last quarter on a rebound in Chinese demand.

- Global air travel demand is expected to recover to pre-pandemic levels on most routes this year.

- Friday’s strike at seven German airports impacted nearly 300,000 travelers.

Some sources linked are subscription services.