MH Daily Bulletin: February 17

News relevant to the plastics industry:

At M. Holland

- At M. Holland, we work closely with customers to understand their goals and challenges and find the right solutions. Click here to read more about our recent collaboration with Eaton, an international power management company, to increase the adoption of additive manufacturing and easily scale production across its locations worldwide.

- Market Expertise: M. Holland offers a host of resources to clients, prospects and suppliers across nine strategic markets.

Supply

- Oil fell slightly Thursday as the market weighed mixed U.S. economic signals and prospects for demand recovery in China.

- Energy futures tumbled in mid-morning trading on fears of extended Federal Reserve interest-rate hikes, with WTI futures down 3.9% at $75.45/bbl, Brent off 3.5% at $82.20/bbl, and U.S. natural gas down 4.9% at $2.27/MMBtu.

- Natural gas prices in Europe have plunged about 80% since last summer’s peaks, new data shows.

- Adjusted for inflation, U.S. natural gas prices are at a 30-year low, according to analysts.

- At least three proposed U.S. LNG export plants have likely found enough customers to earn bank financing this year, which would make the country the world’s largest LNG exporter for years to come.

- BP will buy truck fueling provider TravelCenters of America for about $1.3 billion, as the British energy giant seeks to expand its retail network.

- Saudi Arabia signaled that OPEC’s current deal to cut oil production targets by 2 million bpd would be locked in until the end of the year.

- India’s fuel demand rebounded strongly in the first half of February.

- Profits tripled last year for British Gas owner Centrica to a record 3.3 billion pounds.

- Spain’s Repsol saw fourth-quarter adjusted profit more than double from the same time last year to $2.15 billion.

- A sustainability group backed by the G20 industrialized nations approved “global baseline” rules for firms disclosing how climate change affects their business.

- BP plans to hire over 100 employees in its offshore wind division.

- China is set to install a record 95-120 GW of solar power this year as equipment costs fall and it pushes ahead with massive inland renewables plans.

Supply Chain

- The Pacific Ocean will shift to a more neutral pattern of surface temperatures and wind strength for the next several months as the weather phenomenon of La Niña ends.

- A Norfolk Southern train derailed Thursday west of Detroit, Michigan, as cleanup continues of a derailment that spilled hazardous chemicals in a small Ohio town.

- Uber Freight’s chief economist predicted the recent spot market recession in the freight industry will expand to a full industry recession to cover all modes of cargo transportation.

- Fort Lee, New Jersey, was named the worst trucking bottleneck in the U.S. for the fifth year in a row.

- Container ship owner Danaos saw net income decline 8% in the fourth quarter.

- The ocean container leasing market is showing signs of cooling.

- MSC signed a deal with DB Schenker to reduce carbon emissions by using second-generation biofuels.

- A Chinese state-backed trade group warns that tightening U.S. restrictions on chip technology pose a threat to free trade.

- Chinese chipmakers are delaying expansion plans due to U.S. export bans on chip technology.

- A major Coca-Cola bottler says glass costs will potentially rise by low double digits this year as shortages persist.

- Airbus slowed its production ramp-up of key narrowbody models amid supply disruptions.

- Air leasing activity is falling behind schedule due to aircraft delivery delays, Air Lease Corp says.

- In the latest news from the auto industry:

- Tesla is recalling over 360,000 vehicles equipped with its high-profile driver assistance feature in response to rising U.S. regulatory pressure.

- China is expected to heavily scrutinize Ford’s recent agreement with CATL to ensure the Chinese battery giant’s core technology isn’t handed over to the U.S. carmaker.

- Volkswagen will raise prices for all gas-powered models by an average of 4.4% starting next week due to rising costs.

- Dray trucks are expected to lead the trucking industry’s transition to electric vehicles.

- Renault declared a dividend for the first time in four years as its ongoing revamp starts to bear fruit with improving margins and earnings.

- Mercedes-Benz plans to buy back up to $4.28 billion of its shares over two years starting in March.

- The U.S. and Europe are looking to form a group that would cooperate on procuring minerals used in clean-energy technologies such as electric-vehicle batteries.

- Lithium giant Albemarle expects China’s electric-vehicle market to grow 40% this year, boosting demand for the battery metal in the world’s largest auto market.

Domestic Markets

- Corporate America’s fourth-quarter earnings are down 2.3% from the previous period, the first decline since 2020.

- U.S. credit card balances have reached a record high nearing $1 trillion, while delinquency rates recently surpassed pre-pandemic norms.

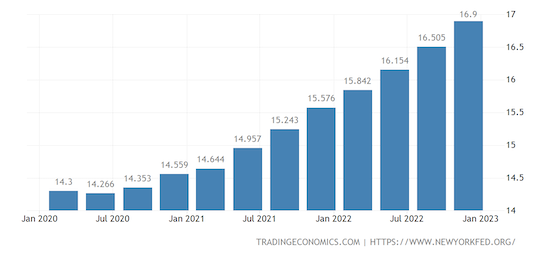

- U.S. household debt jumped to a record $16.90 trillion from October through December last year, the largest quarterly increase in two decades.

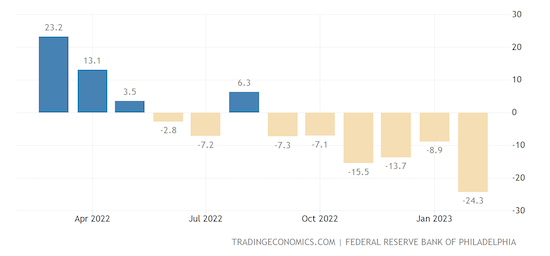

- Manufacturing activity in the mid-Atlantic region dropped off sharply and unexpectedly in February, with the Philadelphia Fed’s monthly index falling from -8.9 to -24.3.

- China slapped fresh sanctions on the U.S.’s two largest defense contractors, Lockheed Martin and Raytheon Technologies.

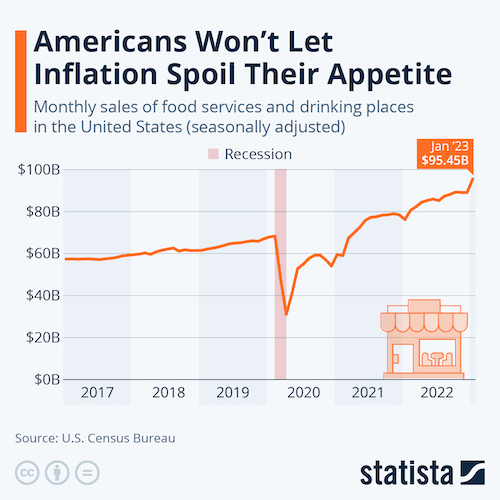

- DoorDash’s revenue rose 40% last quarter as consumers spent more on deliveries of food and household essentials.

- WeWork forecast lower-than-expected revenue for the current quarter, signaling that its business of providing flexible workspace is feeling the heat of mass tech layoffs.

- Hasbro beat quarterly estimates but forecast gloomy 2023 sales and profits due to lower demand and a $300 million hit to revenue from a stronger dollar.

- The cost of pet food and pet products have surged by double-digit percentages over the past year.

- Bank of America is planning to cut jobs in its investment banking business.

- Boeing is merging its aircraft financing arm into its commercial airplanes business unit as part of a push to simplify its corporate structure.

- U.S. single-family homebuilding fell by 4.3% in January and 27.3% from the same time last year, down to a 31-month low.

International Markets

- Thousands went on strike in France Thursday in continued protest of the government’s pension reforms.

- Spain’s exports grew by 23% last year to a record $416.59 billion.

- Brazil’s economic activity rose by 2.9% last year, boosted by the services sector, defying earlier predictions of milder growth.

- Mexican officials say the nation’s monetary tightening cycle is nearing an end with probable terminal rates somewhere around 11.25% to 11.75%.

- Nestle, the world’s biggest food group, will lift prices again this year after more costly ingredients led to a profit miss in 2022.

- Lufthansa canceled over 1,300 flights Friday, including all flights in Frankfurt and Munich, as a result of strike action. The airline plans to cancel an additional 34,000 flights this summer.

Some sources linked are subscription services.