MH Daily Bulletin: February 16

News relevant to the plastics industry:

At M. Holland

- At M. Holland, we work closely with customers to understand their goals and challenges and find the right solutions. Click here to read more about our recent collaboration with Eaton, an international power management company, to increase the adoption of additive manufacturing and easily scale production across its locations worldwide.

- Last week, Plastics News featured business insight from M. Holland’s market experts, including predictions for 2023. Read the full Plastics News article here.

Supply

- Oil was flat Wednesday on worries that rising interest rates will slow the U.S. economy and cut fuel demand.

- In mid-morning trading today, WTI futures were up 0.2% at $78.72/bbl, Brent was up 0.1% at $85.45/bbl, and U.S. natural gas was up 0.5% at $2.48/MMBtu.

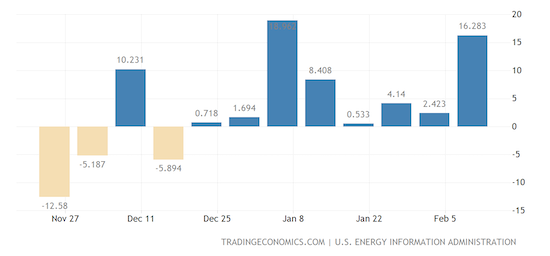

- U.S. crude stockpiles jumped by 16.3 million barrels last week to a total of 471.4 million barrels, their highest since June 2021.

- Global oil demand is set to increase by 2 million bpd this year, led by growth in Chinese consumption, the International Energy Agency said.

- Marathon Oil handily beat quarterly profit targets, boosted by higher crude prices due to the war in Ukraine.

- Spanish authorities barred a tanker from unloading because they said it violated European sanctions on Russia.

- Egypt’s Suez Canal Authority will increase fees for crude oil and petroleum product tankers starting in April.

- India reduced its windfall tax on crude and certain fuel products.

- Glencore will pay $7.1 billion to investors after high oil and coal prices last year helped adjusted earnings grow 60% to $34.1 billion, a record.

- Pemex, Mexico’s state owned petroleum company and the world’s most leveraged producer with $105 billion in debt, will attempt to pay down its debts after finance markets imposed punishing rates on a bond issue in January.

- Barclays will tighten lending criteria for coal power and stop financing oil sands exploration and production, the British bank announced.

- Nova Chemicals introduced a new business line – Nova Circular Solutions – and branding – Syndigo – for its sustainable products portfolio.

- Exxon Mobil is partnering with Honeywell to capture CO2 at a proposed hydrogen production facility in Texas, set to start operating by 2028.

Supply Chain

- The Port of Oakland is planning infrastructure investments and better data intelligence to lure back business after volume in 2022 stood 200,000 TEUs below pre-pandemic levels.

- Boeing’s finance chief says the plane-maker continues to face parts shortages due to an unstable supply chain.

- Amazon warned distributors in Europe that it will stop ordering from them next year in favor of buying products directly from brands, a bid to stem losses by cutting out some middlemen.

- Walmart is shuttering two stores in Arkansas and Illinois that offer only pickup and delivery service, marking the end of a decade-long e-commerce experiment.

- Semiconductor supplier Rinchem is building a new chemical warehouse near Phoenix.

- Less-than-truckload carrier Saia has opened three new terminals this month.

- Fertilizer companies including Nutrien, Mosaic and CF Industries are expected to take a sales hit in the fourth quarter as farmers cut back on purchases to offset high energy costs.

- Steelmaker Ternium is considering building a new $2.2 billion steel production plant near its current Pesqueria site in northern Mexico.

- South Korean liner HMM ordered nine methanol-fueled container ships as part of a push to go carbon neutral.

- In the latest news from the auto industry:

- The White House issued long-awaited rules for the national electric-vehicle charger network that requires chargers to be built in the U.S., with 55% of their content coming from U.S.-made components by 2024.

- Ford will extend a halt on production of its F-150 Lightning through at least the end of next week as it investigates a battery issue.

- Tesla will suspend some China production until the end of February as it upgrades its facilities to make a refreshed version of the Model 3.

- Tesla will open part of its U.S. charging network to electric vehicles (EVs) made by rivals as part of a $7.5 billion federal program to expand the use of EVs and cut carbon emissions.

- Auto supplier Magna International will invest over $470 million to expand operations in Ontario, Canada.

- Ford, struggling under an $8 billion cost disadvantage compared with major competitors, plans to cost-cut its way to 8% margins on its next-generation electric vehicles due at mid-decade.

- GM signed an exclusive supplier agreement with U.S. chipmaker GlobalFoundries.

- Global demand for lithium batteries is expected to surge more than fivefold by the end of the decade.

Domestic Markets

- Producer prices jumped 0.7% in January from the prior month, though annual inflation eased to 6% from 6.5% in December. Economists were expecting a 0.4% month over month increase and a year over year inflation rate of 5.4%.

- First-time unemployment claims unexpectedly fell last week by 1,000 to 194,000, the fifth straight week below 200,000. Economists had expected 200,000.

- The U.S. could run out of money to pay all of its bills on time sometime between July and September, adding urgency to a lawmaker clash on raising the nation’s debt ceiling.

- Traders see about a 50-50 chance of a quarter-point interest-rate hike in June following expected increases of the same magnitude at its next scheduled meetings in March and May, with interest rates peaking around 5.3% in July.

- Production at U.S. factories rebounded by 1% last month.

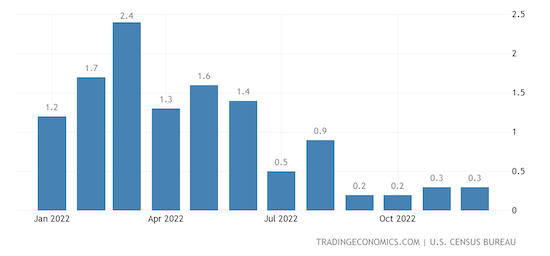

- U.S. business inventories rose a moderate 0.3% in December as companies carefully navigated slowing demand.

- The New York Fed saw its barometer of regional manufacturing activity contract for a third month in February but at a much slower pace than in previous months.

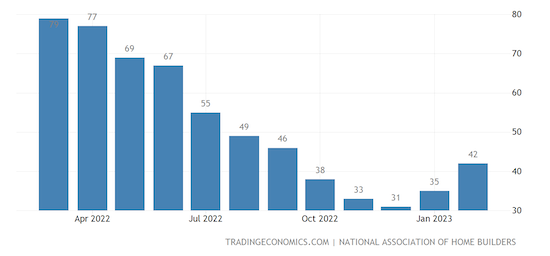

- Confidence among single-family homebuilders improved for a second month in February with one of its largest gains in nearly a decade, according to an index from the National Association of Home Builders.

- Discount retailer Tuesday Morning filed for bankruptcy for a second time in less than three years.

- AIG, one of the world’s biggest insurers, posted a 92% decline in quarterly profit due to volatile markets and impacts from severe winter weather.

- Cisco Systems raised its outlook for the year after posting a better-than-expected 7% gain in quarterly revenue.

- The U.S. Justice Department is reportedly ramping up efforts in a years-long antitrust complaint against Apple.

- Fidelity Investments plans to onboard 4,000 new employees by midyear even as rival asset managers slash staffing levels.

- KPMG announced plans to cut 2% of its U.S. workforce, becoming the first of the world’s four major accountancy firms to slash jobs.

- Kraft Heinz will pause further price hikes for its quick meals and condiments after quarterly sales rose 10% to $7.38 billion.

International Markets

- India might consider lowering taxes on food and fuel to tamp down persistent inflation.

- European air travel could see “massive” disruption at the end of the week amid strikes planned for seven German airports.

- An IT failure at Lufthansa stranded thousands of air travelers in Germany Wednesday.

- Business is booming for aircraft leasing companies as international passenger traffic in December recovered to 77% of pre-pandemic levels.

- Airbus is raising production of its widebody jets, heating up its rivalry with Boeing as the two global giants seek to take advantage of a surge in international travel.

- The wait time for Mexicans seeking tourist visas to the U.S. is averaging 450 days.

- Mexican airline Aeromar announced the “definitive end” of operations this week after the heavily indebted airline failed to reach agreements with investors.

- Sales at French luxury group Kering fell 7% last quarter, dragged down by a slump in revenue at its biggest brand, Gucci.

- Walmart’s Mexico unit saw net profit rise 12% last quarter as it opened 69 new stores in the country.

- Canadian e-commerce firm Shopify forecast slowing revenue growth for the current quarter, signaling economic challenges are weighing on its merchants’ online businesses.

- Avian flu has reached new corners of the globe while becoming endemic for the first time in some wild birds that transmit the virus to poultry, researchers say.

Some sources linked are subscription services.