MH Daily Bulletin: February 10

News relevant to the plastics industry:

At M. Holland

- This week, Plastics News featured business insight from M. Holland’s market experts, including predictions for 2023. Read the full Plastics News article here.

Supply

- Oil fell half-a-percent Thursday on news of a continued rise in U.S. crude stocks last week.

- Early today, Russia announced it is cutting oil production by 500,00 bpd in response to Western price caps, sending global prices higher.

- In mid-morning trading today, WTI futures were up 1.7% at $79.36/bbl, Brent was up 1.9% at $86.08/bbl, and U.S. natural gas was up 1.2% at $2.46/MMBtu.

- Crude production in the Permian Basin surged 12% in January as Plains All American Pipeline predicted its output in the shale field will be up 500,000 bpd this year.

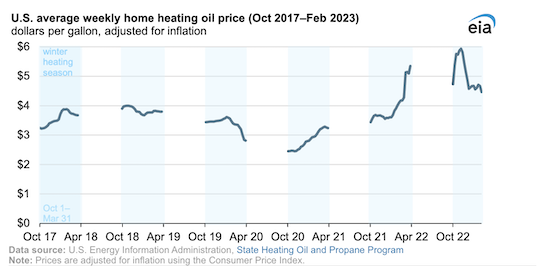

- Unusually warm weather led to a sharp drop in U.S. residential heating oil prices in recent weeks:

- As part of a wider corporate reorganization, Exxon Mobil announced plans to create a global trading division to compete more aggressively with the likes of BP and Shell.

- Key oil operations in Turkey are unlikely to restart for another week due to damage from major earthquakes.

- China’s state-owned oil majors could significantly increase the nation’s imports of Russian crude this year.

- Algeria was Spain’s largest natural gas supplier in January, providing 25% of the nation’s demand.

- TotalEnergies is pausing plans to take a 25% stake in embattled Adani Group’s $50 billion hydrogen project in India.

Supply Chain

- The death toll from earthquakes in Turkey and Syria rose above 22,000.

- Top U.S. officials are renewing pressure on railroad executives to extend paid sick leave for workers and avoid potential labor action. CSX reached an agreement on the issue with two of its unions this week.

- U.S. container imports dipped below pre-pandemic levels in January to just over 2 million TEUs, about 16.1% lower than the same time a year ago.

- Global air cargo traffic fell 15.3% in December, leaving the business down 8% for the full year.

- Less-than-truckload carrier XPO lost $94 million in its first quarter since spinning off freight brokerage RXO.

- Freighter operators for Amazon expect the company to cut the number of planes in its fleet.

- Shopify is stepping up its logistics and fulfillment services as it expands efforts to help merchants compete with Amazon.

- Spice company McCormick plans to cut its supply chain workforce by 10% this year.

- The U.S. administration will release over $660 million in infrastructure funding this year for port improvement projects across the nation.

- In the latest news from the auto industry:

- Tesla’s China-made car deliveries surged 18.4% in January after it cut prices for most models.

- Volvo saw profit fall last quarter as higher component costs outweighed steady demand.

- Nissan experienced a 155% jump in quarterly operating profit, boosted by a weaker yen and cost management measures.

- GM reached a long-term semiconductor supply deal with U.S. chipmaker GlobalFoundries.

- Volvo is in advanced talks with big mining companies concerning potential stakes in lithium mining or processing operations.

- Revenues at South Korea’s three big battery companies are soaring on strong electric-vehicle demand.

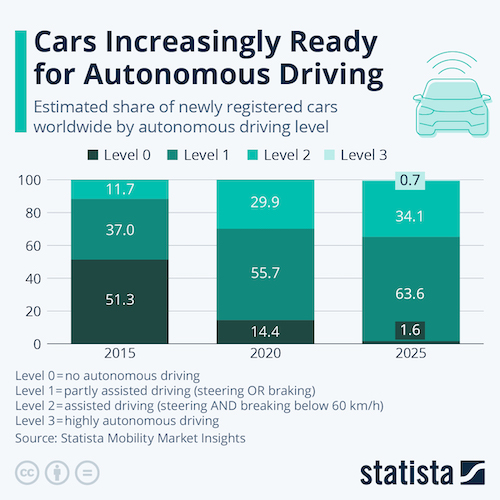

- Knight-Swift Transportation took delivery of its first autonomous truck from startup Embark Trucks.

Domestic Markets

- Over 1 million jobs were added in the U.S. last quarter, with the largest growth in healthcare, education, and leisure and hospitality.

- New White House wage figures suggest labor-cost pressures are easing in key parts of the economy.

- Prices for online goods in the U.S. fell 1% in January from a year earlier, the fifth consecutive monthly drop.

- Yahoo announced plans to lay off about 1,000 positions this week, or 20% of its workforce, as it overhauls its tech advertising unit.

- Unilever plans to continue raising prices for its detergents, soaps and packaged food to offset rising input costs until the second half of 2023.

- The U.S. housing market slowdown has been much more pronounced in expensive markets and areas where prices surged the most during the pandemic boom, especially the West.

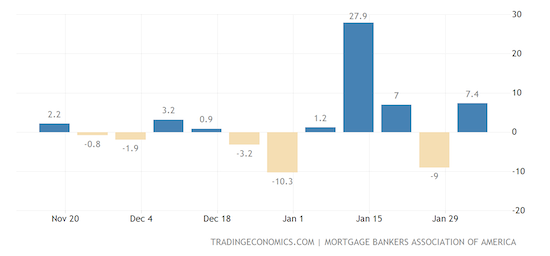

- Mortgage rates rose at the start of February for the first time in a month, averaging 6.12%. The data aligns with a surge in mortgage applications last week:

- In the latest news from quarterly earnings season:

- High-end clothing makers including Tapestry, owner of Coach, and Ralph Lauren saw stronger-than-expected quarterly results.

- Kellogg saw net sales rise 12% to $3.83 billion, helped by robust cereal demand and price hikes.

- AstraZeneca’s revenues are coming under pressure as COVID-19 vaccine sales decline.

- L’Oreal posted 8.1% sales growth, slightly slower than the previous quarter, amid steady demand in the U.S. and Europe.

- Mexican bottler Arca Continental reported a 24.2% increase in net profit from a year earlier, largely the result of price hikes.

- Bombardier forecast a surge in jet deliveries this year on strong demand for corporate flying.

- Online travel booking company Expedia missed Wall Street projections on a spike in cancellations related to bad weather near the end of the quarter.

- Shares of Lyft plunged Thursday after the ride-hailing firm posted an unexpected quarterly loss and projected first-quarter revenue would miss targets.

- Nippon Steel, Japan’s top steelmaker, plans to pay a record-high dividend following a strong profit gain last year.

- U.S. beer shipments in December were off 14.1% compared with December 2021 and 19.4% from December 2020 as consumers responded to recent price hikes.

International Markets

- The White House is poised to introduce new restrictions on U.S. companies funding the development of advanced computing tech in China, according to reports.

- Unilever predicts China will see a “consumption boom” as lockdowns ease, boosted by some $2 trillion in excess savings built up during the pandemic.

- The U.K. avoided a technical recession, marked by two consecutive quarters of contraction, as the economy showed zero growth in the fourth quarter after shrinking 0.2% in the prior quarter.

- Annual inflation in Germany rose to 8.7% in January from a four-month low in December.

- Mexican consumer prices rose 7.91% in January from a year earlier, slightly above forecasts. The nation’s central bank hiked interest rates by 50 basis points to around 11% Thursday.

- Real wages in Japan rose in December for the first time in nine months.

- South Africa declared a state of emergency as crippling power shortages threaten the nation’s industries and social fabric.

- Global commercial real estate prices fell for the first time in 14 years last quarter.

- Russia’s current account surplus shrank almost 60% in January amid a sharp drop in export volumes.

Some sources linked are subscription services.