MH Daily Bulletin: February 7

News relevant to the plastics industry:

At M. Holland

- M. Holland will be exhibiting at MD&M West in Anaheim on Feb. 7-9. Stop by Booth #4115 to meet our Healthcare team and discuss how M. Holland’s line of medical-grade resins can help you develop safe and effective medical products and packaging.

Supply

- Oil rose half-a-percent Monday, buoyed by supply concerns.

- In mid-morning trading today, WTI futures were up 3.7% at $76.86/bbl and Brent was up 3.2% at $83.54/bbl.

- U.S. natural gas is hovering near a 25-month low of $2.50/MMBtu, with mid-morning futures up 3.4% at $2.54/MMBtu.

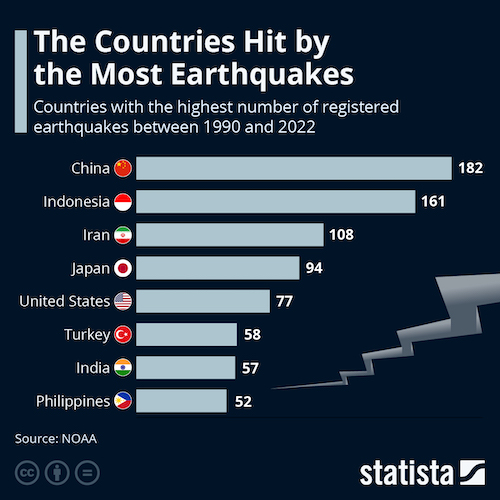

- A series of major earthquakes yesterday caused severe damage to Turkey’s energy infrastructure.

- U.S. gasoline prices fell for the first time in 2023 last week, down to an average of $3.44 per gallon.

- A national strike over pension reforms in France disrupted power supplies, petroleum operations and ports today.

- California is asking federal energy regulators to investigate recent natural-gas price hikes.

- Saudi Arabia surprised markets Monday by raising the selling price of its flagship crude to buyers in Asia, the first hike in six months.

- BP reported record earnings of $27.7 billion for 2022, more than twice its profits the prior year. The company said it is dialing back its aggressive push to renewable energy and will shift more resources to fossil fuel supply in response “to what society wants.”

- India’s largest gas importer is seeking long-term contracts that would more than double imports of LNG as the country looks to diversify its coal-dependent electricity sourcing.

- More news related to the war in Ukraine:

- Russia diverted most of its fuel oil exports to Asia and the Middle East even before Europe’s newest embargo took effect Sunday.

- Russia’s budget revenues plummeted 35% in January, the result of a steep drop in oil and gas sales despite rising seaborne crude exports.

- Linde, the world’s largest industrial gas company, plans to invest $1.8 billion to supply clean hydrogen to a blue ammonia plant in Texas, spurred by last year’s Inflation Reduction Act.

- Goldman Sachs launched a biomethane business in Europe with plans to invest $1 billion over the next four years.

- Denmark distributed its first licenses to capture and store carbon in the North Sea this week.

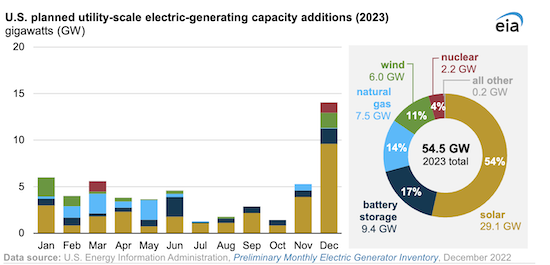

- More than half of this year’s added U.S. renewables capacity will be solar (54%), followed by battery storage (17%):

Supply Chain

- The death toll from earthquakes in Turkey and Syria rose to more than 5,000, prompting a massive international rescue operation.

- South Africa’s electricity crisis is probably costing its economy as much as $51 million per day, according to the central bank.

- Global airfreight demand fell 8% in January while capacity expanded 11%.

- The Baltic Dry Index measuring dry-bulk shipping rates fell to its lowest level since June 2020.

- A flood of new capacity could push the container shipping sector into rate wars, an Evergreen Marine executive said.

- California’s Port of Hueneme plans to develop 250 acres of farmland for cargo handling under a 10-year plan.

- New orders for rail cars fell by more than half from the third to the fourth quarter of 2022.

- A key index of freight demand is down 2% week over week and 17.5% year over year as consumers slow discretionary spending due to high inflation and credit card rates.

- Orders for Class 8 trucks were down year over year in January for the first time since August, but truck makers say pent-up demand from the pandemic still overhangs the market and they remain optimistic about the remainder of the year.

- Mississippi-based trucker Jones Logistics acquired Tennessee-based Nationwide Express.

- Gap will offer warehousing and distribution services to small and midsize brands under an agreement with UPS subsidiary Ware2Go.

- FedEx scrapped its same-day delivery service in large U.S. metros, part of broader efforts to cut costs.

- In the latest news from the auto industry:

- Companies and the U.S. government are shelling out billions of dollars to build a supply chain for electric-vehicle batteries in North America.

- Vietnamese electric-vehicle-maker Vinfast is cutting its U.S. workforce amid a continued delay of its first car shipments.

- Shares of Faraday Future surged Monday after the luxury electric-vehicle startup said it raised enough funds to produce its first model in March.

- Cummins says revenue could grow up to 17% this year amid strong demand for its engines used in trucks and other heavy vehicles.

- Workers at the U.K.’s Royal Mail will stage another strike Feb. 16.

- Shenzhen-based Apple contract manufacturer Luxshare plans to expand beyond consumer electronics.

- In a tax dispute with the Panamanian government, First Quantum Minerals suspended loading at a major port in Panama, suspending exports of the Canadian firm’s copper concentrates.

- The U.S. is considering a 200% import tariff on Russian-made aluminum, officials said.

Domestic Markets

- Goldman Sachs lowered its U.S. recession odds from 35% to 25% within the next 12 months, citing strength in the labor market.

- Americans have spent about 35% of the extra savings they accumulated during the pandemic.

- In the latest news from quarterly earnings season:

- Budget carrier Spirit Airlines saw operating revenue rise 41%, fueled by a strong rebound in travel.

- Tyson Foods missed quarterly projections following an 8.5% average price decline for its beef products.

- Sales are slowing sharply for pharmaceutical companies that made windfalls on COVID-19 medicines the past two years.

- Bed Bath & Beyond plans to raise over $1 billion by selling stock in a last-ditch effort to save itself from bankruptcy.

- Amazon plans to close some Fresh supermarkets and Go convenience stores in a push to cut costs.

- Many airlines will not be able to meet looming U.S. deadlines for retrofitting airplane components to safeguard against interference from 5G technology, a trade body said.

- U.S. farmers are planning a major boost to corn planting this year as a result of falling fertilizer prices.

International Markets

- The International Monetary Fund slashed its medium-term growth forecast for China.

- Investor morale in the euro zone improved for the fourth month in a row in February, reaching the highest level in almost a year.

- Britain’s construction sector had its worst month in almost three years in January.

- Canadian economic activity expanded at the sharpest pace in eight months in January, according to a purchasing managers’ index.

- Private U.S. firms have committed over $4.2 billion of investments in northern Central America, the U.S. administration says.

- Global airline traffic recovered to 68.5% of pre-pandemic levels last year.

Some sources linked are subscription services.